Pgiam/iStock via Getty Images

Dear readers/followers,

In this article, I’ll update my thesis on the Swedish company Alfa Laval (OTCPK:ALFVF) (OTCPK:ALFVY). This is a Swedish business I have been reviewing and investing in for several years. In my latest article, I made a case for why I believe the upside to be sub-par going forward. The company has outperformed my expectations for the time being, and since my latest article, which you can find here, the business is up by over 16%, which is a decent outperformance compared to the S&P500 up around 8%.

In this article, I’ll review 2Q24, the latest quarterly report we have to go on, and also show you why I don’t consider this necessarily indicative of the future of this company. The change we’ve seen here, I argue, is not based on significant earnings growth, or earnings growth potential, but rather continued premiumization of a company that does deserve premia, but shouldn’t be considered as premium as this.

Let me show you why my stance is that Alfa Laval will actually underperform for the next 1-3 years, and why I have mostly sold what I own in the business, and I am waiting for a better time to re-enter the investment.

Alfa Laval – The upside here is limited to a somewhat worrying extent

Let me start out by clearly stating that I am far from the only one who views Alfa Laval as immensely overvalued here. My price targets, which I will show you later, might seem conservative, but I assure you that many analysts and analyst houses work with PTs in the 330-360 range for this business. This does not mean it’s the “right” target or right expectations, but there are very explainable reasons as to why we have such expectations for this company.

Alfa Laval’s business strategy focuses on the specialization in the company’s field, namely process engineering. As I’ve said before, it’s a leader in heat transfer, separation, and fluids/handling. It’s very apt in these fields, and given the importance of these fields for the global industrial sector, the company’s premiumization certainly makes sense. Since early 2019, the company has moved from 200 to double that share price, which has reduced the yield significantly.

What the company researches/develops, manufactures, and sells are highly engineered products for very specialized fields. It works at a 2-3% R&D to revenue, which is low but still good enough for it to retain its market leadership. What bulls for the company typically speak of when they consider the company having an upside is the appeal of the renewable transition, which many believe represents a structural growth opportunity for Alfa. The company also quite recently included Desmet in its operations, which has added expertise in fluids like edible oils and biofuels – which is again serving this renewable sector in part, and why many believe in an upside here.

At the same time, it’s working on an impressive restructuring program. That’s what we’ll look at here in 2Q24.

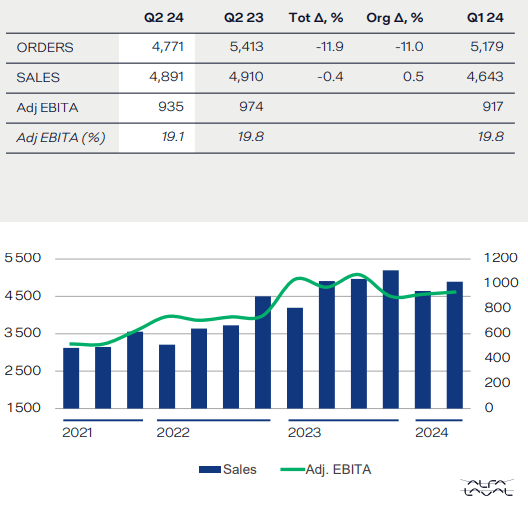

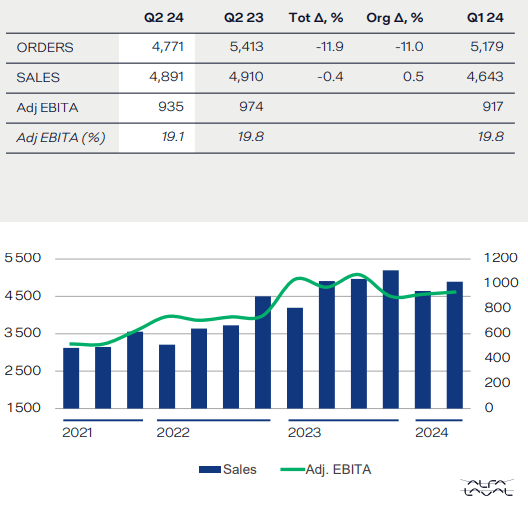

And for the quarter, it needs to be said that the company is at the very least growing impressively. This is what has enabled the company’s valuation to grow as well. Order intake is up 3%, EBITDA is up 23%, and net sales are up 10%. All really quite superb trends. Profitability in the energy sub-segment is good due to high demand in servicing, which makes up for (and more) the weakness in HVAC, which has been seeing pressure for some time given a very soft construction market in the company’s sector. Customers are focusing on energy efficiency – and this makes Energy as a sector the lowest-performing segment here at this time.

Alfa Laval IR (Alfa Laval IR)

Don’t get me wrong. Order weakness was apparent in Food & Water as well, with a negative-near-double-digit order decline, but with a decent demand improvement. Interesting to note here is that biofuels are increasingly attractive despite their volatility. This goes hand in hand with my investment plans, where I currently push a lot of money to work in Biofuel-adjacent or focused, such as Neste or UPM-Kymmene Oyj (OTCPK:UPMKF).

It’s inarguable for me that this is a wide-moat company. The quality is also not discussable – it’s high. That’s why I’m happy to own Alfa Laval at a wide range of prices, and I’m not too quick to sell it when I do have it. But at this time, I don’t believe there to be a good argument to either own it or buy it – more on that in a short while.

The marine segment was the star of the show during 2Q24. The company saw 30% order growth, 23% sales growth, and a doubling of the company’s segment EBITDA. There’s a continued high demand for pumping systems, and ship contracting is at a good level, and the profitability here is very solid, with good margins.

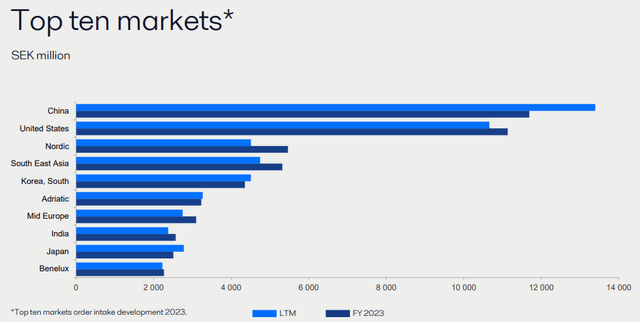

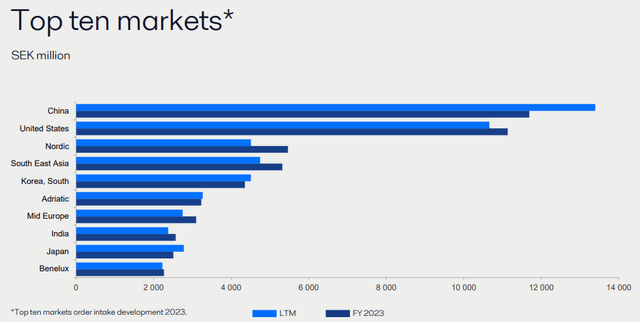

The service segment remains a very solid play here as well – with increasing service orders, not in excess of the last quarter which saw an absolute record, but in comparison to YoY and most 2023 periods. Order geographies remain spread out, but with a current weight towards seeing growth in Southern Europe and APAC as opposed to Africa/Middle East, and NA. SA is up as well, but other regions are currently mostly down.

The company also, which I consider to be one of its non-trivial risk factors, remains with a very high exposure to China, which by far makes a downturn in China very serious for Alfa Laval. It’s a core reason why I as an investor, I do not fully understand how people seem to be able to take this so lightly.

Alfa Laval IR (Alfa Laval IR)

The company is still getting plenty of orders, though impacted by FX at this time, and sports a very solid and impressive backlog for its operations and projects. Even weak segments are seeing strong backlogs here. Company sales also remain very solid, and while 2Qxx tends to be a strong annual segment, the company’s performance is definitely worth highlighting here. YTD, Alfa Laval has met its growth targets, as sales are up 8.1%. Adjusted EBITDA margins are also increasing, with good numbers there as well. The company’s overall debt position is compelling, with maturities well spread out and low leverage. Debt/EBITDA is less than 1x, and this is down from the last year’s 1.6x. So the company is growing, and reducing debt. All of these things are positive – and the company’s funding rate at 2.43% per annum is definitely worth glowing neon letters and numbers here.

But the problem remains the company’s inflated valuation and its high dependence on the Chinese market for both growth and maintaining that level. That is what I do not like.

Alfa Lava’s Upside is marred by inflated valuation and potential downside in case of China’s weakness

Alfa Laval traditionally trades at something like a 22-23x P/E, and now trades at around 26x, coming down from 27-28x a few months back. The yield is down to a 1.62%, EPS yield of less than 4% with a BBB+ credit rating.

Even if we assume that the company’s forecasts, including an 11-12% EPS growth, we’d still only be getting around 10% annualized if the company manages this – and the company has a 25% forecast accuracy failure on a negative basis with a 10% margin of error (Source: FAST Graphs paywalled link). In short, not really enough.

Also, there’s another major risk – and that is the company’s average valuations. Over a 20-year basis, which I argue to be more indicative than the short-term trend, Alfa Laval only manages an 18-19.5x P/E. This would imply a downside of annualized RoR at the 0.49% level at 19.6x, and negative below that, negative 1-2% at 18x P/E. And that is, again, with an expected EPS growth rate of 5-12% per year.

So in the end, it all comes down to the valuation you apply for this business and how high we expect it, or do not expect it, to go.

Even assuming premium targets here, the company has a very clear potential for underperformance.

Unlike the more premium-oriented analysts, I give Alfa Laval an EBITDA growth rate target of 5-6%. I believe this to be high, for the next 10 years each year, as well as an annual sales growth of 5-6% rather than more and a ROCE of 18-19%, possibly as high as 20%. The company’s cost of capital is estimated at 8.8-9%, and I expect an upside both from renewables and the company’s M&A. The problem is that even with all of that included, anything above 350 SEK/share is too much for this business. That is why my last PT was 335/share, and I’m only raising it to 340 SEK to account for the better-than-expected results we saw this quarter. The company is cyclical, a fact that seems to have escaped many analysts. How is it cyclical? It’s directly exposed to marine transport and oil & gas at 35%+ of its sales. All of these industries have very volatile CapEx cycles. In addition, China. These two things in conjunction don’t “work” for me with this company and a higher target, and that’s why remain conservative here and don’t expect much from here on out.

The relevant ADR for Alfa Laval is ALFVY, which is a 1:1 ORD ADR, coming to a current of $45/share. I currently give this ADR a price target, translated from my native price target, of $33/share.

Thesis

- The company is a fundamentally appealing industrial out of Sweden that, to my mind, is a must-own in a conservative dividend stock. My previous rotation has been based on both writing medium-dated covered calls, adding 3-5% to my annualized yield, and straight selling of the common equity.

- The valuation has made the yield less than 1.7%, and the upside is around 2-3% even with the dividend growth included, and that’s assuming we don’t get a cyclical downturn – which I believe given group exposures might be possible.

- I give the company a “HOLD” here, but I am increasing my conservative price target to a level of 340 SEK/share to account for the quality and upside potential I see in the business. That being said, if the company were to drop below 345, I would still look at what else is available on the market prior to investing. The price target for the ADR at this time is $33/share, this includes FX.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

At the current valuation, the stock lacks meaningful upside to justify a good valuation. For this, I give the company a rating of “HOLD”, and remove one criterion since my last article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.