timsa

BABA’s Reversal May Already Be Here

We previously covered Alibaba Group Holding Limited (NYSE:NYSE:BABA) in April 2024, discussing the stock’s underperformance despite the massive share repurchases/ dividend payouts, with the ongoing restructuring yet to produce any results as well.

Despite so, we had reiterated our Buy rating, since the company continued to generate robust Free Cash Flow with its stock valuations overly discounted, with it offering patient investors with an excellent upside potential over the next few years.

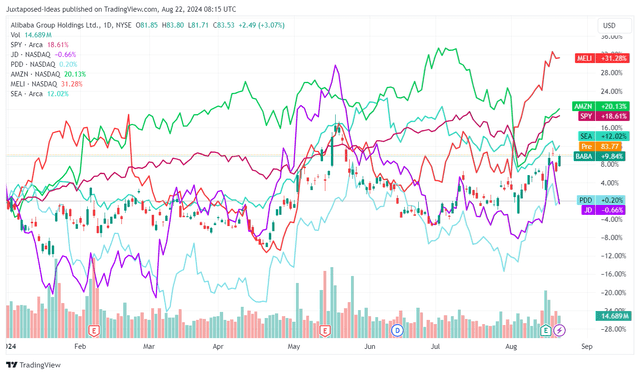

BABA YTD Stock Price

Since then, BABA has had a promising +17.4% recovery, compared to the wider market at +9.1%.

While these numbers remain well behind its global diversified e-commerce/ logistics/ fintech peers, such as Mercado Libre (MELI) and Amazon (AMZN), it appears that bullish support has started to materialize surrounding BABA’s prospects, potentially reversing the massive stock losses since the October 2020 peak.

This is despite BABA’s mixed FQ1’25 performance with total revenues of $33.47B (+8.9% QoQ/ +3.6% YoY) and adj EPS of $2.26 (+61.4% QoQ/ -5.8% YoY), with part of the growth headwinds attributed to Taobao and Tmall Group.

To remind readers, Taobao and Tmall Group is the company’s top-line driver commanding 46.2% of its overall revenues (-1.3 points YoY) in FY2024, while subsidizing the losses observed in its Alibaba International Digital Commerce Group, Local Services Group, and Digital Media and Entertainment Group.

However, with the e-commerce landscape increasingly competitive domestically/ globally, attributed to the rising new start ups such as the privately owned SHEIN and Temu launched by PDD Holdings (PDD), it is unsurprising that BABA’s Taobao and Tmall Group has reported impacted FQ1’25 sales of $15.6B (+20.8% QoQ/ -1.5% YoY) and FY2024 (CY2023) sales of $60.23B (+5% YoY).

This is compared to SHEIN, which supposedly reported 2023 sales of $32.5B (+43.1% YoY) and Temu at $15.1B (+5206.8% YoY).

Even so, readers must note that the minimal topline growth observed in BABA’s Taobao and Tmall Group is likely attributed to the management unwillingness to cut into profit margins.

This is compared to Temu, which reportedly “makes a loss of around 30-35 percent on each US order, and an average of 40 percent on orders globally” by late 2023, with PDD yet to break down Temu’s top/ bottom line performances – in a direct contrast to SHEIN’s “more than doubled profits to more than $2B.”

As a result, while BABA’s Taobao and Tmall Group top-line growth has suffered from the intensifying competition, we believe that the management’s strategic choice to maintain a relatively stable EBITA margins of 43% (+1.7 points QoQ/ +0.1 YoY) has been prudent indeed.

At the same time, the management has reported growing 88VIP members to over 42M (+7M QoQ/ +12M from FQ2’24 levels of 30M) – with the “steady growth in GMV and order volume driven by a notable increase in purchase frequency” implying the inherent stickiness of its e-commerce platform.

Moving on, while BABA’s Cloud Intelligence unit has reported FQ1’25 revenue growth to $3.65B (+3.1% QoQ/ +5.4% YoY), it is apparent that the company has yet to fully monetize the generative AI boom as observed with its global peers, such as AMZN’s AWS, Google’s Cloud (GOOG), and Microsoft’s Azure (MSFT).

On the other hand, BABA’s cloud segment continues to report a stable global cloud services market share at 4% (inline QoQ/ YoY), with it also increasingly profitable at EBITA margin of 8.8% (+3.3 points QoQ/ +7.3 YoY) by the latest quarter.

These efforts well balance the narrowing losses observed in BABA’s other segments, as the management looks to continue investing in its R&D and AI capabilities to drive “improvement in its loss-making businesses” and deliver “double-digit growth in the second half of the fiscal year with gradual acceleration thereafter.”

Most importantly, with the ongoing restructuring efforts already showing promising early results, we believe that it remains well positioned to generate rich Free Cash Flow moving forward, as observed in the FQ1’25 numbers of $2.39B (+12.7% QoQ/ -55.6% YoY) despite the intensified AI-related capex.

Lastly, with BABA still reporting an extremely rich balance sheet with $84.44B in cash/ equivalents (-1.2% QoQ/ +4.7% YoY), we believe that it remains well positioned to invest in its growth opportunities across the e-commerce and cloud market, with the near-term pressure on its cash flows likely to be temporal.

So, Is BABA Stock A Buy, Sell, or Hold?

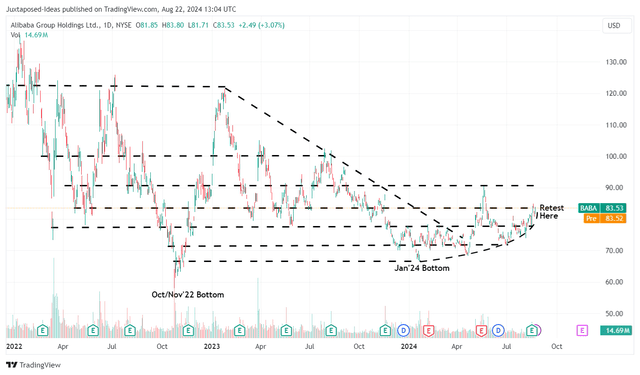

BABA 2Y Stock Price

For now, BABA has been consistently charting higher highs and higher lows since the January 2024 bottom, with it signaling a potential reversal in market sentiments surrounding its prospects.

For context, we had offered a fair value estimate of $76.90 in our last article, based on the LTM adj EPS of $8.73 ending FQ3’24 and the FWD P/E valuations of 8.82x.

Based on the LTM adj EPS of $8.47 ending FQ1’25 and the market’s moderately raised FWD P/E valuations of 9.15, it appears that sentiments surrounding BABA’s prospects have moderately lifted, with the stock trading higher than our updated fair value estimate of $77.50.

Assuming that the bulls continue to defend its recovery, we may see the stock being upgraded to our bull-case long-term price target of $151.10, based on the sector median FWD P/E of 15.30x and the consensus FY2026 adj EPS estimates of $9.88 – with it offering opportunistic investors with a great upside potential of +80.8%.

BABA’s shareholder returns have been more than excellent as well, with $30.52B poured into share repurchases and -6.7% of its float retired over the last twelve months, or -8.2% since FY2019.

This is on top of the annual dividend of $1.00 per share and the one-time payout of $0.66 per share, with it allowing long-term shareholders to DRIP and accumulate additional shares on a regular basis.

As a result of the still attractive risk/ reward ratio at current levels and the promising results observed in its bread-and-butter segments (e-commerce and cloud), we are reiterating our Buy rating for the BABA stock, though with numerous caveats.

Risk Warning

One, the US Presidential campaign is likely to trigger further volatility in the US China trade relations, with higher tariffs of up to 60% more likely than not, no matter who wins the elections in November 2024.

While BABA is unlikely to be drastically affected by the higher tariffs, it goes without saying that a heightened tension between the two countries is likely to trigger further pessimism in Chinese ADRs, with it potentially reversing much of the stock’s recent gains.

Two, with BABA’s prospects mostly linked to Taobao/ Tmall Group and the segment’s top-line growth appearing to be stagnant, we may see the stock potentially underperform against its peers, with JD.com reporting robust QoQ/ YoY retail sales growth along with PDD’s Temu and the privately owned SHEIN.

As a result of the ongoing geopolitical and growth headwinds, we believe that those whom add BABA here must also be very patient, since its reversal from the ongoing restructuring is likely to be prolonged.