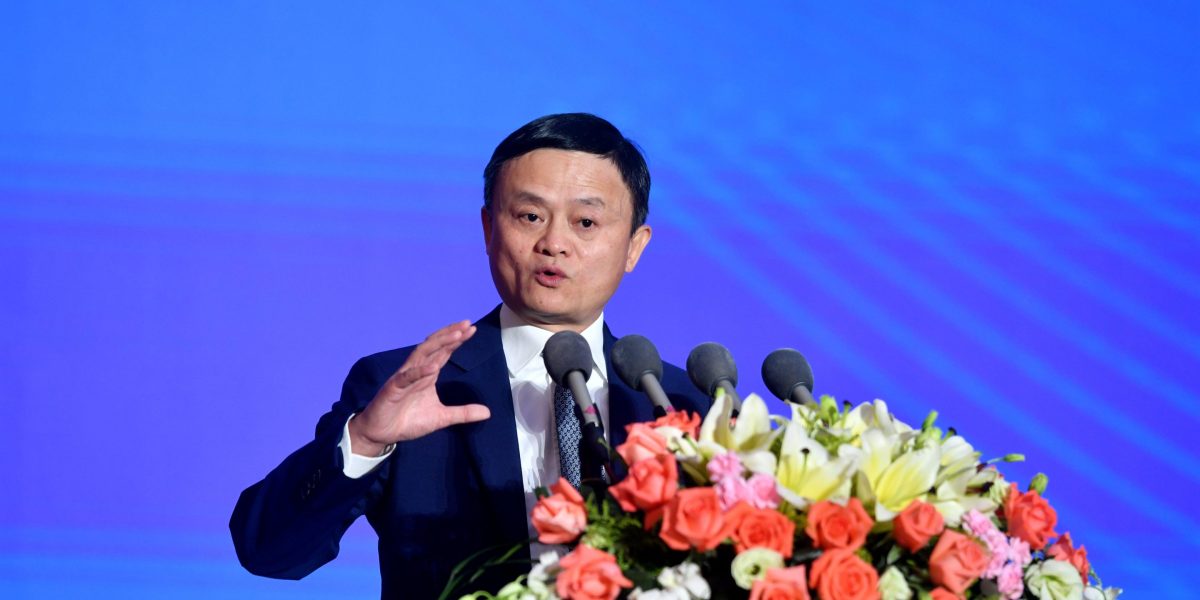

Alibaba, the beleaguered Chinese language e-commerce big, is getting a lift from its billionaire co-founders. The tech big is going through consumption worries in its home market, intense competitors from e-commerce upstarts, and fallout from geopolitical friction between Washington and Beijing, sending its shares down by 40% over the previous yr. However studies that co-founders Jack Ma and Joe Tsai ploughed $200 million into the corporate’s shares are cheering traders, including $13 billion to Alibaba’s worth in Tuesday buying and selling.

The once-outspoken billionaire Ma bought $50 million value of shares within the final quarter, The New York Times studies. An entity linked to Tsai additionally bought practically two million Alibaba depository shares value about $152 million, according to a regulatory submitting on Tuesday. Depository shares are shares of international firms held by U.S. depository banks and traded on the U.S. exchanges.

Alibaba’s inventory within the U.S. closed round 7.9% larger in Tuesday buying and selling, elevating the e-commerce big’s market worth to $188.3 billion, representing a soar of round $13.7 billion from the day prior to this. The corporate’s Hong Kong traded shares are up 7.2% in comparison with the day prior to this’s shut. (Hong Kong’s Cling Seng Index rose by 3.6%)

Alibaba’s co-founders are actually the corporate’s largest shareholders, pulling forward of Japanese funding holding firm Softbank, in keeping with the South China Morning Post. (Alibaba owns the SCMP).

Ma and Tsai’s share purchases are a “show of confidence” in Alibaba, says Ray Wang, principal analyst at Silicon Valley-based analysis agency Constellation R, however he doesn’t anticipate Ma to take a extra lively function within the firm’s operations. Ma stepped down as Alibaba’s chairman in Sep. 2019; Tsai took over as the corporate’s chairman in late 2023.

Ma has largely disappeared from the general public eye since his run-in with Beijing in 2020, when his criticism of Beijing regulators helped torpedo the IPO of Ant Group, Alibaba’s fintech affiliate. However Alibaba’s founder is reemerging as the corporate faces a brand new e-commerce challenger: PDD Holdings, proprietor of the procuring platforms Pinduoduo and Temu.

PDD’s progress has outpaced Alibaba’s, with Pinduoduo and Temu’s enterprise fashions interesting to a extra cost-conscious shopper. PDD’s income for the quarter ending Sept. 30 elevated 94% year-on-year, in comparison with a 9% soar at Alibaba. PDD’s shares have surged 78% over the previous six months in comparison with a 23% decline for Alibaba.

Ma took to an inner dialogue discussion board in late November to name on Alibaba to “correct its course” in a message that additionally acknowledged PDD’s success.

Alibaba has additionally grow to be a sufferer of U.S.-China tensions. Final yr, the e-commerce firm shelved its plan to spin off its cloud computing unit as an unbiased firm, blaming U.S. export controls on chips. U.S. restrictions on high-end semiconductors is making it tough for Chinese language firms like Alibaba and Tencent to get the superior chips wanted for information facilities and AI functions.