artplus/iStock by way of Getty Photographs

Expensive Companions

Alluvial Fund returned 3.2% within the fourth quarter, bringing our return to fifteen.1% for the total yr.

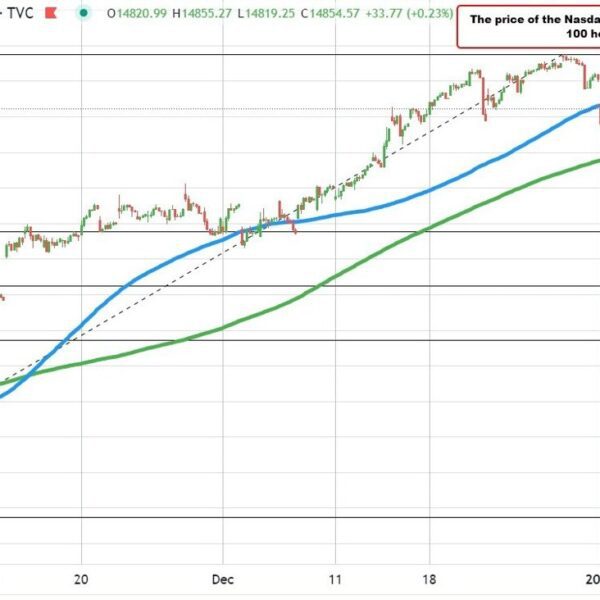

What a market turnaround this quarter noticed. Spurred by a change in tone from the Federal Reserve, small-cap shares snapped out of their doldrums and roared 22% increased in November and December. What had been one other depressing yr for small-cap and micro-cap shares became a great one. Our portfolio tends to lag when markets make huge strikes in both course and this quarter was no exception. Nonetheless, as a result of the fund had been monitoring nicely forward of benchmarks by October, we ended up with a passable end result this yr, forward of the micro-cap index and simply behind small-caps.

TABLE I: Alluvial Fund LP Returns (%) as of December 31, 2023

|

2023 |

2022 |

2021 |

2020 |

2019 |

Cumul. |

Annual. |

|

|

Alluvial Fund LP NET |

15.1 |

-14.9 |

31.0 |

28.4 |

18.4 |

130.1 |

12.6 |

|

Russell MicroCap TR |

9.3 |

-22.0 |

19.3 |

21.0 |

22.4 |

48.3 |

5.8 |

|

Russell 2000 TR |

16.9 |

-20.4 |

14.8 |

20.0 |

25.7 |

63.8 |

7.3 |

|

MSCI World Sm+MicroCap NR |

15.1 |

-19.1 |

15.8 |

16.5 |

25.7 |

66.8 |

7.6 |

|

Partnership started operations 01/01/2017 |

I take advantage of these letters to replace you on developments within the portfolio, trying to eschew fluff and keep away from pontificating on the financial tendencies of the day. I hope when all is claimed and accomplished, I’ll have largely resisted the temptation to touch upon subjects the place I’ve no particular experience or understanding. So, I’ll confine my observations to this: the return of significant rates of interest had a sobering impact on traders in 2023. With money and high-quality bonds as soon as once more providing an affordable return, the attract of speculative cash-burning corporations was diminished. The on line casino grew quieter and this was a great factor. Nevertheless, now that the Federal Reserve seems to be completed with its aggressive collection of fee hikes, the on line casino seems to be livening up as soon as extra. Let the gamers play. If folks need to return to paying >10x revenues for software program corporations of doubtful high quality, I want them luck. Alluvial will stick to purchasing shares in money producing corporations at giant reductions to a conservative estimate of honest worth.

Within the quarter, we invested in a extremely engaging spin-off safety: Internet Lease Workplace Properties (NLOP). The phrase “office” is sufficient to give many traders chills, and that’s why the chance existed within the first place and continues to exist. Thankfully, the overwhelming pessimism allowed us to construct a big place at a really engaging value.

It’s no secret that places of work as an asset class are underneath stress. Work-from-home insurance policies are placing downward stress on rents and occupancy, with many corporations choosing much less house as leases expire. Some REITs, desirous to keep away from the stigma of workplace possession, have chosen to get rid of their workplace properties nevertheless they will. REIT W.P. Carey (WPC) elected to spin off a hodgepodge of workplace belongings as Internet Lease Workplace Properties. The spin-off was tiny, taxable, and stuffed filled with belongings about as fashionable because the flu, so it’s no shock it landed with a thud. Shares of NLOP traded as little as $11 within the first days of buying and selling. We started accumulating shares round $13 and continued to purchase as they rose into the higher teenagers. Even now, as shares hover round $24, I proceed to imagine NLOP stays very a lot undervalued.

After I referred to as NLOP a “hodgepodge of office assets”, I meant it. The REIT owns all the pieces from high quality buildings on 10-15+ yr leases to marginal properties on short-term leases that should quickly be repositioned or redeveloped. Geographic and trade diversification is nice, with no publicity to probably the most challenged workplace markets. At $24, NLOP trades at $103 per sq. foot of leasable house, a big low cost to a extremely conservative estimate of market worth.

TABLE II: High Ten Holdings, 12/31/23 (%)

|

Internet Lease Workplace Properties (NLOP) |

7.3 |

|

P10 Inc. (PX) |

6.9 |

|

Fitlife Manufacturers Inc. (FTLF) |

5.8 |

|

ECIP Financial institution Basket |

5.0 |

|

Unidata S.p.A. |

5.0 |

|

Crawford United Corp. (OTCPK:CRAWA) |

4.5 |

|

Logistec Corp. (OTCPK:LTKBF) |

4.3 |

|

Rand Worldwide Inc. (OTCPK:RWWI) |

3.9 |

|

Seneca Meals Corp. (SENEA) |

3.8 |

|

OTCPK:EACO Corp. |

3.5 |

|

Whole, High Ten |

50.0% |

This low cost makes for a doubtlessly fascinating funding, however my favourite a part of the story right here is the built-in catalyst: NLOP was designed to liquidate from the get-go. This REIT is just too small to draw a big base of traders and its property holdings are too scattershot to pursue a coherent technique. The registration doc places it plainly, stating that Internet Lease Workplace Properties would “…seek to maximize shareholder value through dispositions of high-quality office properties…”

The liquidation course of is off to a great begin. In late December, the corporate bought off 4 of its preliminary 59 properties, and at excellent costs. Two properties with stable, long-term leases have been bought at a median of $170 per sq. foot whereas two properties with expiring leases bought for $87 per sq. foot.

NLOP utilized the proceeds of the property gross sales towards its debt, which I have to level out is each high-cost and substantial. The excellent news is that this debt can be diminished quickly from a mixture of strong money movement from the property portfolio and continued asset gross sales. Debt discount will permit an increasing number of money movement to accrete to shareholders. With so many alternative belongings and an workplace market in flux, its greatest to be conservative on NLOP’s valuation, however I’m very comfy utilizing a determine of $130 per sq. foot to worth the corporate’s 8.4 million sq. ft of leasable house. Internet of debt, that comes out to round $38 per share. I see upside to this valuation if NLOP can proceed promoting its well-leased properties at $170/sq. foot or increased, and its “fixer-uppers” at $75/sq. foot or higher. I’m completely satisfied to carry our NLOP shares till we obtain a value a lot nearer to liquidation worth.

I ought to be aware that our funding in Internet Lease Workplace Properties could also be unstable. Shares might bounce round significantly on adjustments in financial sentiment, the course of rates of interest, and investor enthusiasm (or the shortage thereof) across the workplace market. I think about the numerous upside potential nicely definitely worth the volatility.

I stay obsessed with one other giant holding of ours, FitLife Manufacturers. Final I reported, FitLife had simply closed on its acquisition of the belongings of MusclePharm (OTC:MSLPQ), a as soon as high-flying train dietary supplements model that been mismanaged into chapter 11. The potential synergies for FitLife and MusclePharm have been apparent, with FitLife ready to make use of its current manufacturing relationships to create the product after which leverage its sturdy on-line channels to supply the product to clients. One in every of FitLife’s first duties is to persuade on-line retailers that beforehand stocked MusclePharm merchandise to take action once more. Whereas FitLife has but to report fourth quarter outcomes, it seems progress is being made. Retailer iHerb.com, as soon as a major vendor, now signifies MusclePharm merchandise are “coming soon.” FitLife shares have carried out nicely. The market is giving the corporate credit score for its successes in buying selection belongings out of chapter and optimizing them. I don’t assume the corporate is anyplace near operating out of alternatives.

Crawford United gave us some excellent news, authorizing a buyback of as much as 300,000 shares, or 8.5% of the full excellent. Shares carried out nicely in 2023 because the earlier yr’s motivated vendor give up flooding the market with shares. Nonetheless, Crawford United trades at solely round 8x earnings regardless of a powerful earnings trajectory and the bottom debt in a number of quarters. Following the buyback authorization, shares jumped from the excessive $20s into the low $30s. Generally all it takes to catalyze a response in a inventory is administration speaking to the market that it thinks shares are low cost and it’s prepared to do one thing about it. It truly is that easy. Simply after yearend, Crawford United introduced its first acquisition shortly, paying $7 million to purchase Heany Industries, a 92-year-old supplier of business coatings and ceramics, primarily to the aerospace trade. Relying on how Crawford selected to finance the deal and the earnings a number of they paid, I believe the acquisition might improve money earnings by 25 cents per share.

One other current addition to our portfolio is MRC World, a distributor to grease & gasoline drillers, pure gasoline utilities, and different industries—assume fittings, valves, pipes, and the like. MRC is an “ok” enterprise—neither fantastic nor horrible, however merely boring and worthwhile. It’s uncovered to the ups and downs of the oil & gasoline market, but it surely has made strides to diversify its enterprise into different, much less cyclical markets. Most significantly, MRC has an unimpressive monitor file as a public firm and a few sad homeowners, and for these causes I imagine the corporate can be bought.

MRC World’s historical past stretches again to its founding in 1921, as McJunkin Provide Firm. The corporate would get pleasure from a number of many years of prosperity, culminating in a big funding from Goldman Sachs in 2006. Following a collection of mergers and acquisitions, Goldman renamed the corporate “MRC Global”, took it public in 2012, after which bought its remaining MRC shares the next yr. This exit was well-timed, as MRC shares quickly started an extended decline, pushed by a mixture of inopportune investments and extra monetary leverage. In 2015, urgently needing capital, the corporate turned to revered dealmaker Henry Cornell, a Goldman alum who was instrumental in MRC’s creation. Cornell Capital put up $363 million to purchase convertible most popular inventory and MRC used the contemporary capital to pay down debt and restore its firepower for added acquisitions.

TABLE III: World Allocation, 12/31/23 (%)

|

United States |

68.4 |

|

Eurozone |

10.7 |

|

Canada |

10.6 |

|

Poland |

7.1 |

|

Denmark |

1.9 |

|

Different |

1.3 |

|

Whole |

100% |

Cornell in all probability anticipated to earn a great money yield for a number of years, then convert the popular shares and promote as MRC’s earnings recovered and its valuation grew, however the rebound by no means actually got here. Following the funding, MRC’s working earnings reached solely round 1/3 of 2013 ranges earlier than one other spherical of write-offs and losses in 2020 as COVID prompted power demand to plummet. Latest outcomes have been higher—the corporate has constructed a great line of enterprise supplying gasoline utilities and industrials, and debt has been paid down considerably—however MRC has been a disappointment for Cornell Capital.

Turning to the current, MRC has a time period mortgage that comes due in September 2024. The corporate needs to refinance the mortgage, however Cornell Capital, which clearly needs out of this underwhelming funding, has blocked its efforts so far, submitting a lawsuit claiming MRC should search Cornell’s consent on the phrases of the brand new debt. MRC expects to have the ability to repay the time period mortgage by drawing on its asset-backed line of credit score, however this can be a lower than superb resolution. Enter activist Engine Capital, proprietor of 4% of MRC World shares. Engine Capital has referred to as for MRC World to hunt a sale, arguing it’s the easiest way to money out Cornell Capital and obtain a passable end result for all shareholders. In Engine’s view, MRC’s expressed technique of continued mergers and acquisitions is unfeasible given the dangers of ongoing litigation with Cornell Capital and MRC’s excessive value of capital. I wholeheartedly agree. On October 30, Bloomberg reported that MRC World is working with monetary advisors to discover a sale. If MRC World is bought, I imagine it might fetch a value within the mid-to-high teenagers.

To recap: MRC’s greatest capital supplier is sad; an activist is sad; long-term shareholders possible are too, having misplaced half their funding for the reason that IPO; and administration can’t be having a lot enjoyable both with the headache of litigation and the looming time period mortgage maturity. One thing has to offer, and I imagine will probably be MRC World’s existence as an unbiased public firm.

We proceed to carry our investments in varied banks, the most important being United Bancorporation of Alabama (OTCQX:UBAB) and BankFirst Capital Company (OTCQX:BFCC). Each are recipients of low cost everlasting capital from the US Treasury, and each have been strongly worthwhile in 2023 regardless of the difficult backdrop of quickly growing rates of interest and deposit prices. Every financial institution trades at a mid-single digit a number of of earnings, and every is poised to extend these earnings in 2024. The 2 banks are pursuing totally different methods with BankFirst centered on progress by acquisition and United Bancorporation of Alabama centered on worthwhile area of interest lending and companies, however each are low cost and well-run establishments. I believe an uplisting to the NASDAQ is within the playing cards for every inside a number of years.

The fund additionally owns quite a lot of group banks with extraordinarily illiquid shares, a few of them traded on the skilled market. These banks are among the many most cost-effective securities I can discover, with many buying and selling at some mixture of price-to-earnings multiples underneath 5, lower than 60% of tangible e-book worth, or sustainable double-digit dividend yields.

TABLE IV: Sector Breakdown, 12/31/23 (%)

|

Financials |

17.7 |

|

Industrials |

15.2 |

|

Data Expertise |

15.1 |

|

Shopper Staples |

12.0 |

|

Communications |

9.7 |

|

Actual Property |

9.5 |

|

Shopper Discretionary |

9.1 |

|

Supplies |

6.9 |

|

Power |

4.0 |

|

Well being Care |

0.9 |

|

Utilities |

0.0 |

|

Whole |

100% |

A few of these shares might go nowhere for fairly a while, however I see worth in proudly owning them so long as the underlying banks produce cheap returns on fairness and keep excessive lending requirements. So long as tangible e-book worth per share grows at a wholesome tempo, shareholders will earn a pleasant return when these banks are acquired or their shares change into extra liquid because the financial institution grows.

It’s unusual to assume that simply six or so months in the past, many have been predicting calamity for the banking sector primarily based on the high-profile failures of some regional establishments. In line with the doomsayers, deposits would both flee or change into unmanageably costly, financial institution mortgage books have been homes of playing cards, and rising securities losses would obliterate any remaining fairness. And as standard, when “everyone knows” {that a} sector is teetering on the precipice of monetary oblivion, that’s the time to purchase with each fingers. In fact, it’s simple to say so with the advantage of hindsight. Alluvial did add to our financial institution holdings as valuations hit their low factors final yr, however I want I had purchased much more.

OTCPK:LICT Company is a long-time Alluvial Fund holding. Shares have moved up and down in recent times, however largely sideways. LICT continues to make strikes, spinning off its Michigan operations, buying a Utah telecom, and repurchasing 8.6% of shares excellent during the last three years, however the inventory simply received’t head increased and keep there. I believe that is the yr that adjustments. Starting this yr, LICT has a serious improve in annual federal subsidies heading its approach: over $13 million yearly for 15 years, or $762 per LICT share. This can lead to a serious revenue uplift. Subsidies included, LICT would be the most cost-effective public telecom in america, buying and selling at solely 4.5x 2024 EBITDA. Cheap, if not just a little costly for a conventional wireline-heavy telecom, however far too low cost for a contemporary, operation that derives most of its income and earnings from broadband companies.

Seneca Meals has been energetic. Shares dipped after quarterly outcomes however have since recovered. In November, the corporate acquired the Inexperienced Large canned greens enterprise from B&G Meals.

Seneca was already energetic in co-manufacturing product for B&G, so this acquisition ought to lead to elevated gross revenue for Seneca with little incremental funding or expenditure. In addition to the B&G Meals belongings, Seneca Meals has been very energetic in repurchasing its personal shares, decreasing the amount excellent by practically 6% from July by October. I count on to see extra repurchase exercise when the corporate stories in February. Shopping for again shares whereas they commerce at a mid-single digit a number of of earnings is a superb use of capital.

The Logistec Company buyout closed in early January, permitting us to comprehend a pleasant acquire on that particular scenario.

Our remaining Canadian holdings are Hammond Manufacturing (HMM.A:CA) and Supremex Inc. (OTCPK:SUMXF), two modestly-valued producers. Because the mighty American inventory market hits information highs, I believe already uncared for markets like Canada’s might provide much more mis-priced securities. Fertile grounds for locating alternatives for those who don’t thoughts under-performing within the brief run. The fund is at present about 70% allotted towards US holdings, a determine I think about barely above the long-term goal. Although I imagine many international markets are cheaper than US markets, I hold operating throughout US particular conditions simply too good to disregard. The has prompted the breakdown between our US and worldwide holdings to swing towards the US. I count on the pendulum to swing again a bit in 2024.

With our seventh yr of operations within the books, I need to thanks as soon as once more for investing in Alluvial Fund. I began Alluvial in hopes of spotlighting the alternatives out there’s dustier corners, and to this point, it’s working. Markets look quite a bit totally different than when Alluvial Fund launched in 2017 and much more totally different than once I started managing capital a decade in the past. There are fewer good high quality OTC-traded corporations, and fewer small public corporations usually. The limitations to researching and investing in international corporations are decrease. It appears these adjustments ought to lead to fewer alternatives out there segments the place Alluvial focuses, however in some way there may be by no means a scarcity of uncared for, misunderstood securities right here and there across the globe.

Because of a great begin to the yr and a few new capital from restricted companions, Alluvial Fund is at an all-time excessive each when it comes to complete returns to LPs and belongings underneath administration. I’ll attempt with all my may to ship a great yr—a great yr for all of us, because the entirety of my cash is invested in Alluvial Fund. I hope you might be nicely, and I stay up for reporting to you once more a number of months from now. Within the meantime, please don’t hesitate to succeed in out with questions or feedback in regards to the portfolio, or simply to catch up. I welcome your calls and e-mails.

Greatest Regards,

Dave Waters, CFA, Alluvial Capital Administration, LLC

| Disclosures

Funding in Alluvial Fund are topic to danger, together with the chance of everlasting loss. Alluvial Fund’s technique might expertise higher volatility and drawdowns than market indexes. An funding in Alluvial Fund will not be supposed to be a whole funding program and isn’t supposed for shortterm funding. Earlier than investing, potential restricted companions ought to rigorously consider their monetary scenario and their means to tolerate volatility. Alluvial Capital Administration, LLC believes the figures, calculations and statistics included on this letter to be appropriate however supplies no guarantee towards errors in calculation or transcription. Alluvial Capital Administration, LLC is a Registered Funding Advisor. This communication doesn’t represent a suggestion to purchase, promote, or maintain any funding securities. Efficiency Notes Internet efficiency figures are for a typical restricted companion underneath the usual charge association. Returns for companions’ capital accounts might range relying on particular person charge preparations. Alluvial Fund, LP has a fiscal yr finish of December 31, 2023 and is topic to an annual audit by Cohen & Firm. Efficiency figures for year-to-date durations are calculated by NAV Consulting, Inc. Yr-to-date figures are unaudited and are topic to alter. Gross efficiency figures are reported web of all partnership bills. Internet efficiency figures for Alluvial Fund, LP are reported web of all partnership bills, administration charges, and efficiency incentive charges. Contact Alluvial welcomes inquiries from purchasers and potential purchasers. Please go to our web site at Alluvial Capital Management, LLC, or contact Dave Waters at [email protected] or (412) 368-2321. |

Editor’s Notice: The abstract bullets for this text have been chosen by Searching for Alpha editors.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.