Daria Nipot

My thesis

Amazon (NASDAQ:AMZN) (NEOE:AMZN:CA) is an absolutely unique company, as it managed to become an undisputable global leader in two industries that are considered to be vital megatrends of the last few decades: e-commerce and cloud infrastructure. Both industries are still growing rapidly, and the environment looks quite favorable. Having a massive e-commerce ecosystem involving millions of users and vendors also positions AMZN well to capitalize on another thriving industry, digital advertising. The company’s profitability profile is improving notably, and its fortress balance sheet means that it is likely to have enough financial resources to fuel all its ambitious ventures. The stock looks extremely attractively valued for a powerhouse like Amazon, and the stock is certainly a Strong Buy at this share price.

AMZN stock analysis

The remarkable fact is that despite its hyper-scale with $604 billion TTM revenue, Amazon continues demonstrating double-digit revenue growth. The company remains on this growth path, which we saw from the recent Q2 earnings report shared on August 1.

Seeking Alpha

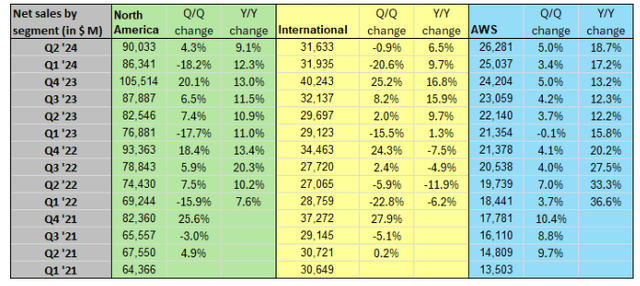

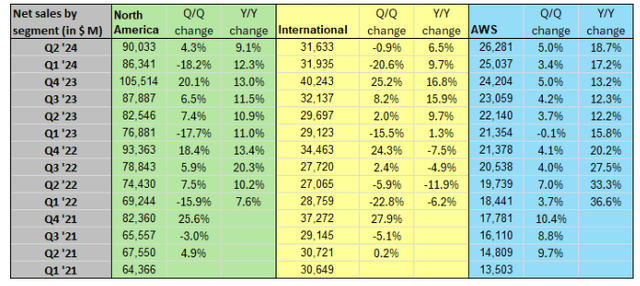

Consolidated revenue grew by 10% on a YoY basis with all three segments demonstrating growth, a strong positive indicator for any business. Amazon Web Services (AWS) is the company’s most rapidly growing and most profitable business. AWS and North America e-commerce segments were the major revenue growth drivers in Q2.

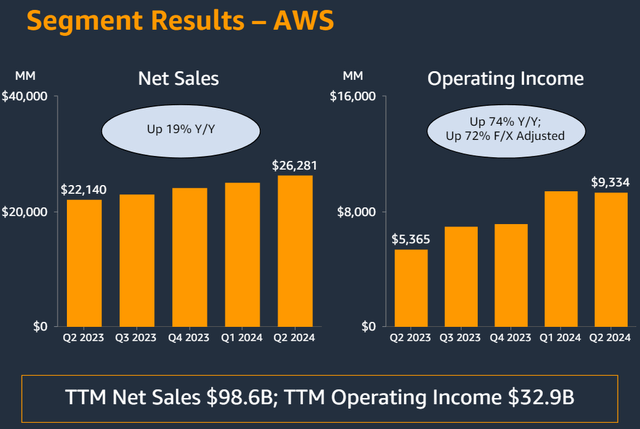

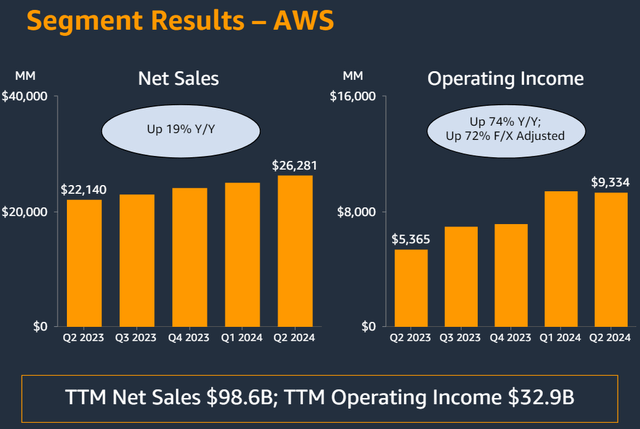

Let me start with the company’s major profit growth driver, AWS. The above table demonstrates that revenue growth of AWS has accelerated again in Q2, which is a really favorable dynamic. Another good point to me is that AWS’s revenue growth without any seasonality, as Q2 is the fifth straight quarter when the company delivered sequential revenue growth. The below slide suggests that the operating income of this segment grows faster than revenue, meaning that AWS boasts robust operating leverage, and we can expect higher profitability if revenue continues to grow that rapidly.

AMZN’s Q2 earnings slides

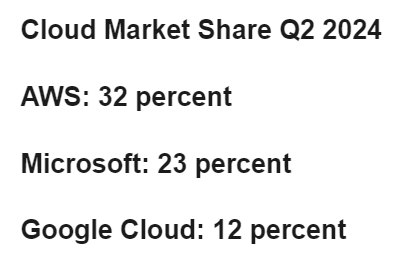

From the bigger picture perspective, it is crucial to mention that AWS is the global leader in cloud infrastructure with a 32% market share in Q2 2024. Microsoft (MSFT) and Google (GOOGL) are the closest competitors of AWS, with a 23% and 12% global market share, respectively. Amazon has been leading in the industry for several years thanks to its aggressive investments in growth. For example, the company invested around $400 billion in R&D over the last decade. Amazon does not disaggregate its R&D spending by segments, but I believe that a notable portion of this budget was allocated to AWS. With such a commitment to invest in R&D, and Amazon’s strong balance sheet, I believe that the company has strong potential to maintain its leadership in cloud further. The cloud computing market is a thriving industry, expected to deliver an 17.8% CAGR by 2032, which is a strong bullish catalyst for Amazon as the industry’s leader.

CRN

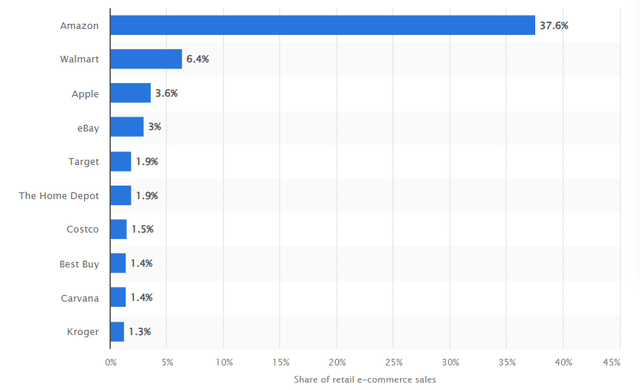

If there is a competition in cloud from giants like Microsoft and Google, in the e-commerce industry there are no rivals which are even close to Amazon’s scale. According to Statista, Amazon’s market share in the U.S. e-commerce is 37.6%, which is massive. Walmart’s (WMT) market share is 6.4%, and WMT is the second-largest players in the U.S. online shopping industry.

I think that Amazon’s moat in e-commerce is unbeatable because the business itself is like a snowball, where the larger the scale, the easier it is to attract new merchants and new customers. Moreover, Amazon strives to be innovative in e-commerce as well by pioneering various features like delivery by electric vans and drones or offering its Amazon Prime subscription. I call Amazon the global e-commerce leader because it is also the leading marketplace across the largest European economies as well. North American e-commerce is also a thriving industry that is expected to show a 10.2% CAGR by 2032. As an undisputable leader, it is extremely likely that Amazon will be able to absorb favorable industry trends.

Despite Alibaba’s (BABA) status as the largest e-commerce player in the world from the perspective of the gross merchandise value (GMV), I am not bringing BABA to the discussion because its footprint in Europe and North America is not that significant compared to Amazon.

Statista

Having the status of the largest North American and European e-commerce player also helps Amazon in building other businesses generating billions in revenues. The company generated almost $25 billion in revenue from advertising services, which is around 20% higher YoY. With an ecosystem involving over 310 million active users, Amazon accumulates vast amounts of data about users’ preferences. This likely helps to maximize the value for customers of the company’s advertising business.

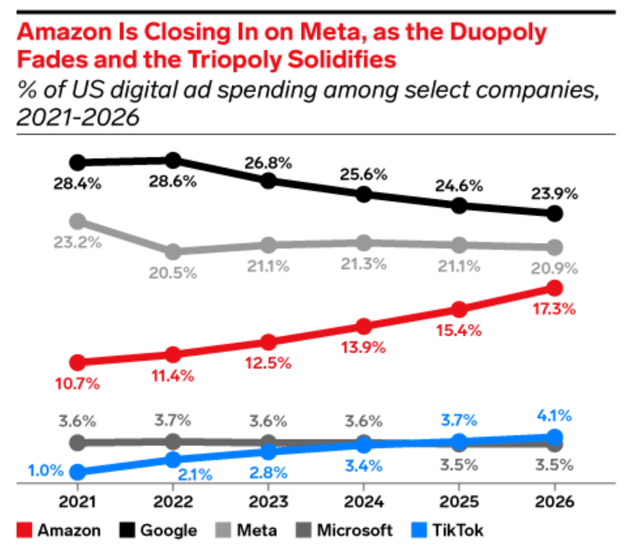

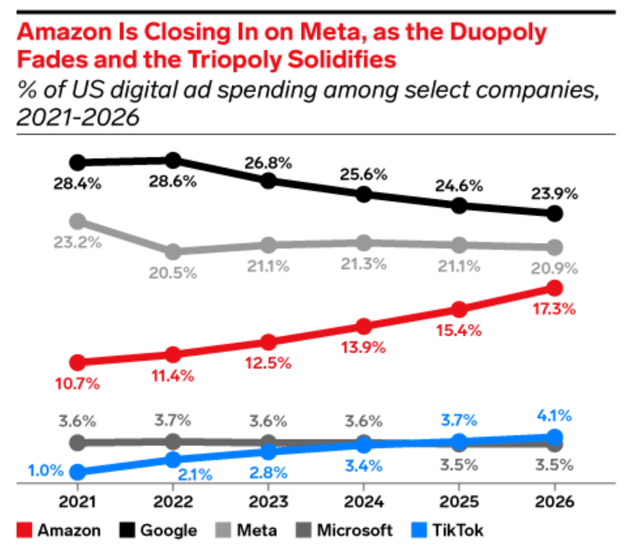

The below chart shows that Amazon is aggressively gaining market share at the expense of the industry leaders and is expected to significantly narrow the gap with Google and Meta (META) by 2026. Digital advertising is another thriving industry where Amazon’s footprint is already strong. The industry is expected to deliver a 14% CAGR by 2030.

eMarketer

Amazon is a true business powerhouse, as it undisputedly leads in two massive and thriving industries. Moreover, it has the potential to become the leading player in another promising industry, digital advertising. Amazon is an excellent business and I think that the stock is any investor must have.

Intrinsic value calculation

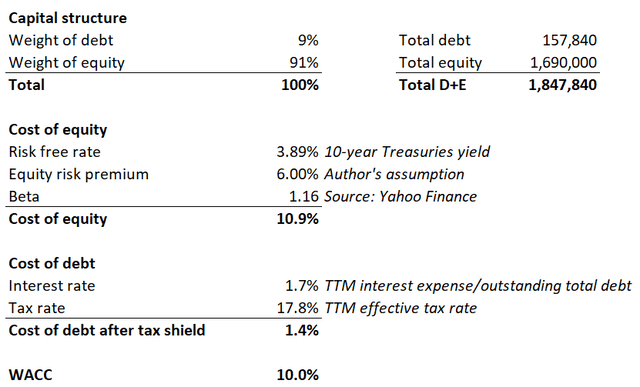

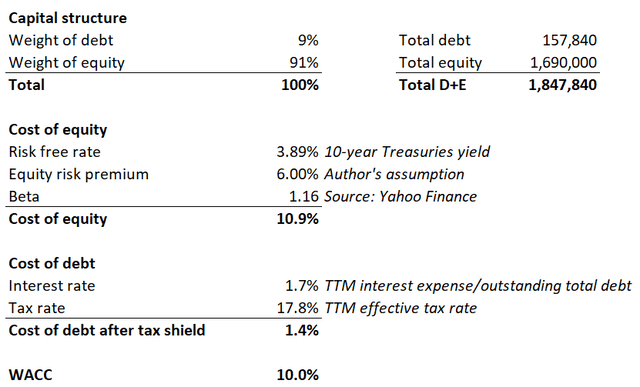

The discount rate is a vital assumption for the discounted cash flow (DCF) model. Therefore, I start with calculating the weighted average cost of capital (WACC) using the capital-asset pricing model (CAPM). Below working outlines my WACC calculations. AMZN’s WACC is 10%.

DT Invest

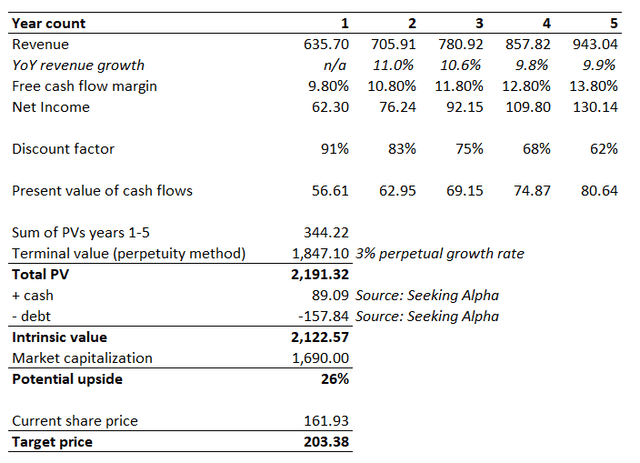

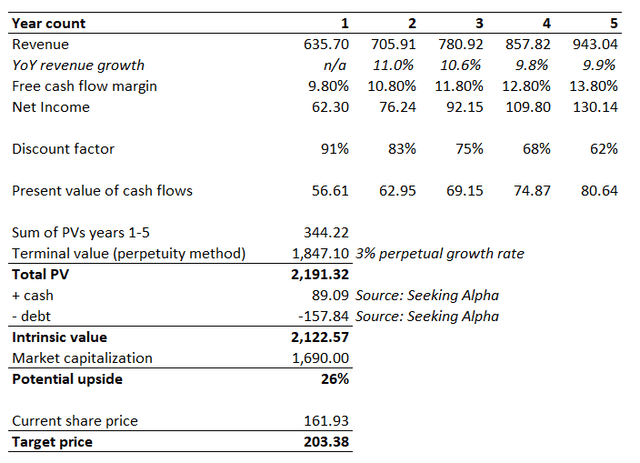

Consensus estimates appear conservative, as they observe around a 10% revenue CAGR for the next five years. A 9.8% TTM levered FCF margin is solid, but looks like having further room to expand together with revenue growth. Moreover, the TTM levered FCF margin is around two times higher than Amazon’s last five years’ average, meaning that there is a clear expansion trend. Therefore, I incorporate a 100 basis points yearly FCF expansion. The perpetual growth rate is very conservative at 3%.

DT Invest

After adding cash and deducting total debt out of the total present value of future cash flows gives AMZN’s intrinsic value at $2.1 trillion, 26% higher compared to the market capitalization. I think that the valuation is extremely attractive for a leading and innovative company like AMZN. With a 26% potential upside, the target price recommended by DT Invest is $203.

What can go wrong with my thesis?

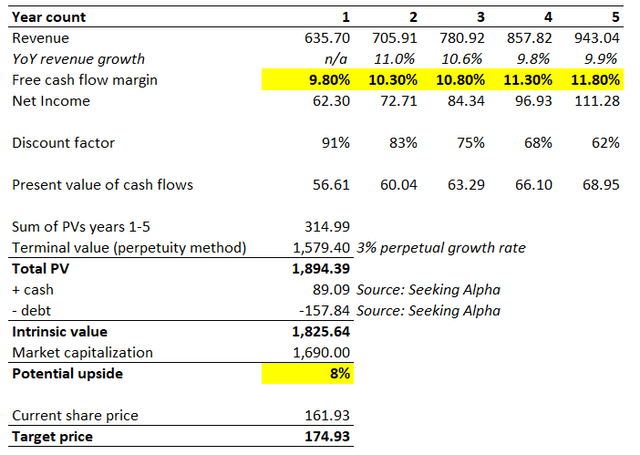

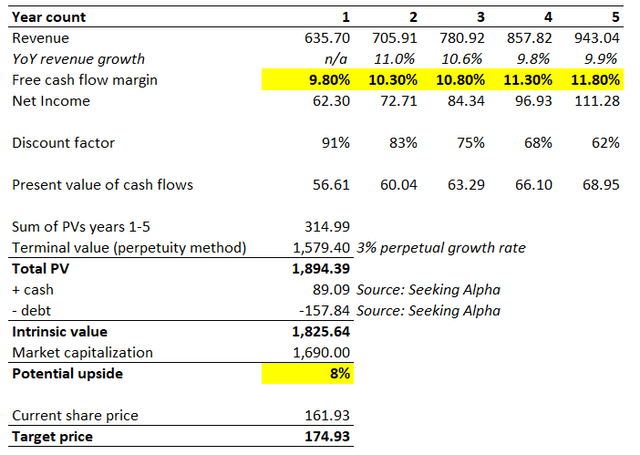

While incorporating a 10% revenue CAGR for the next five years looks sound compared to historical growth trends, the FCF expansion rate that I used might be too aggressive. In case I implement a 50 basis points yearly expansion of FCF margin, AMZN’s intrinsic value deteriorates notably. With more conservative assumptions around the FCF margin, the upside potential does not look that compelling. Though, the stock is still undervalued even with much more conservative profitability profile assumptions.

DT Invest

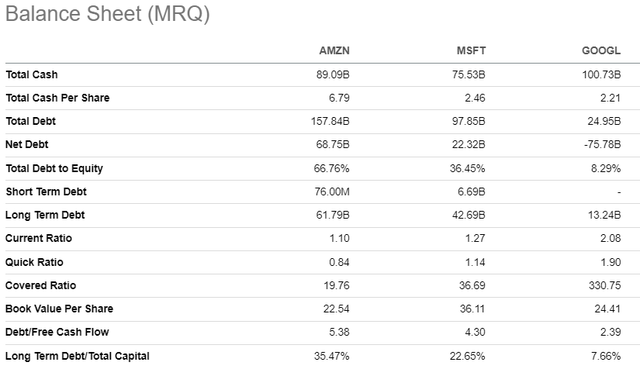

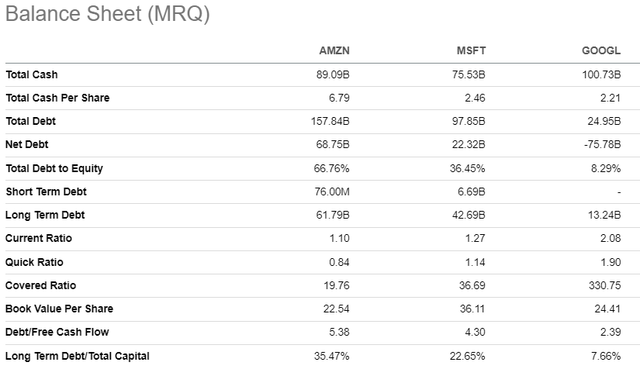

The competition in the cloud infrastructure industry is fierce, as Amazon directly competes with companies that are larger in terms of the market cap. Microsoft’s market cap is $3 trillion, while Google’s market cap is around $2 trillion. As mentioned earlier, Amazon holds the largest market share in cloud, but that is not a guarantee that its leadership will last forever. Moreover, Amazon’s big rivals in cloud appear to be more financially flexible, as their balance sheets look stronger. I believe that Amazon’s financial position is in excellent shape, but Microsoft and especially Google boast stronger balance sheets. This means that, in theory, Amazon’s competitors have more capacity to invest in innovation and growth of their cloud businesses. Of course, there is no direct correlation between the amounts invested in R&D and a company’s market share, but it is crucial to acknowledge that the competition risk is elevated.

Seeking Alpha

Summary

AMZN dominates in two thriving industries, and its strategy of heavy reliance on innovation and differentiation will likely help it preserve its leadership. Capital allocation is exceptional as the balance sheet is robust even after significantly ramping up R&D and CAPEX spending in recent years. A 26% discount to AMZN’s intrinsic value for the company that dominates in its core businesses is nothing but a gift, in my opinion.