Lya_Cattel/E+ via Getty Images

Synopsis

Amcor plc (NYSE:AMCR) is a global leader in the manufacturing and developing of responsible packaging products. They have a strong commitment towards sustainability. In 2018, they became the first packaging firm to pledge that all of their packaging would be recyclable, compostable, and reusable by 2025. Through the first half of the year, they have been experiencing weaker volume arising from destocking and weaker market demand. Additionally, the EU’s advancing regulations on plastics could potentially pose a significant challenge to the packaging industry, as they impose stringent regulations and criteria for product packaging. Given the mixed outlook, I am recommending a hold rating for AMCR.

Historical Financial Analysis

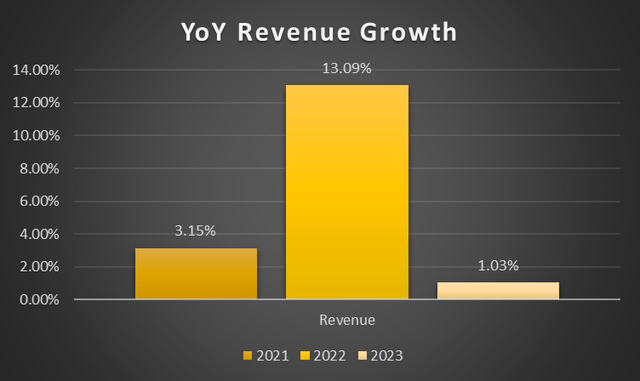

AMCR’s year-over-year revenue growth has fluctuated over the past few years, with the strongest growth of 13.09% in FY2022. In FY2022, net sales have increased by $1.683 billion, or 13.09%. This includes the price increase of ~$1.530 billion, passing down higher raw material costs. For FY2023, net sales were slightly up by 1% as a result of unfavourable currency impact and a price increase of ~$775 million. Volume has fallen 3% lower as compared to FY2022. In North America, volumes were greater in healthcare, pet care, home, and personal care categories. It is offset by lower volumes in packaging for condiments, meat, and ready meals. Europe has also seen low single digit growth, offset by weaker volumes in coffee, home, and personal care segments. Stronger volumes in the pet care and pharmaceutical segments partially offset this.

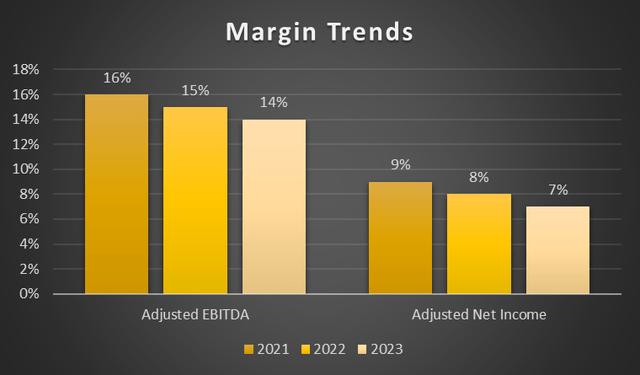

Moving onto its profitability margins, they have been declining but modestly. FY2023’s adjusted EBITDA margin is down slightly to 14% from 15% in FY2022, while its adjusted net income margin is down to 7% from 8% in FY2022. GAAP’s net income would include a $215 million gain from selling its business in Russia. The reason behind the margin contraction in FY2023 was due to inflation and increasing raw material costs.

Third Quarter 2024 Earnings Analysis

In 3Q24, volume and net sales have fallen. Net sales fell 7% year over year, with a 6.8% decline in flexible packaging and a 7.6% decline in rigid packaging. On a comparable constant currency base, net sales are 6% lower year-over-year. Destocking in the healthcare segment and the North American beverage segment are the reasons for the weakness in volume. Management has pointed out that weaker performance is due to destocking and weak consumer demand.

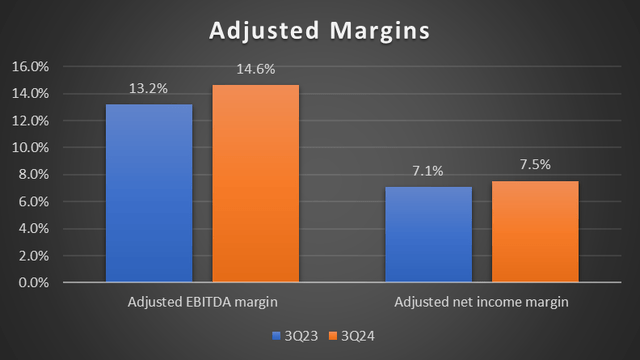

Moving onto adjusted margins, both its adjusted EBITDA margin and adjusted net income margin expanded year-over-year. AMCR’s adjusted EBITDA margin expanded from 13.2% to 14.6% while its adjusted net income margin increased from 7.1% to 7.5%. The reason behind the expansion was attributed to restructuring initiatives’ benefits and cost performance, which improved AMCR’s operating leverage.

On the other hand, net income is up by 5.6% year over year. Management has reaffirmed their guidance range for adjusted free cash flow of $850 million to $950 million for FY2024. They have also raised their adjusted EPS guidance from $0.67 – $0.71 to $0.685 – $0.71, expecting further momentum for the upcoming quarter.

Business Overview

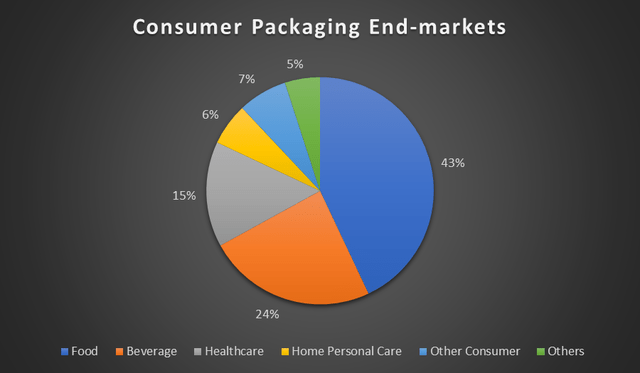

AMCR is a global leader in the packaging industry for food, beverages, healthcare, personal care, and many others. With two reportable segments under Flexibles and Rigid Packaging segments. Flexibles accounts for ~76% of FY2023 net revenue, while Rigid Packaging segment accounts for the remaining ~24%. AMCR is considerably one of the largest producers of plastics, aluminium and fibre-based flexible packaging. With multiple consumer packaging end-markets ranging from food and beverages to healthcare and home personal care, AMCR’s sales are significantly diverse.

Destocking Eases but Continues to Linger in Healthcare Industry

In AMCR’s flexible segment, it would have been positive this quarter if not for its healthcare product performance. The key reason for its weakness lies mainly in destocking in the healthcare end-market, which has been lingering from 2Q24 to 3Q24. Similar to its previous quarter, overall healthcare volumes were down double-digits. The destocking persists in North America and Europe, resulting in weaker demand for healthcare products. Management is expecting this temporary headwind to extend into 1Q25 before its healthcare segment volume starts stabilising.

Packaging Regulation in the EU

With the European Parliament advancing on the Packaging and Packaging Waste Regulation [PPWR], AMCR has shown support of such changes to the regulation. The regulatory framework aims to decrease the amount of packaging and limit specific types. Suppliers would need to comply with strict requirements so that packaging is minimised and recyclable. This could pose a significant challenge for AMCR, as new regulations often necessitate strict disclosures and practices, potentially leading to higher costs and affecting the European packaging industry. Various packaging would be required to meet certain criteria, such as recyclability, use of recycled content, and others.

However, the management appears to be welcoming these requirements, as they have ongoing initiatives in place to ensure the sustainability of packaging. They have reiterated their commitment to make 100% of its product portfolio recyclable, reusable, or compostable by 2025. By 2030, they have planned to achieve 30% use of recycled content. It is an opportunity for AMCR to reinforce and lead the industry on sustainability.

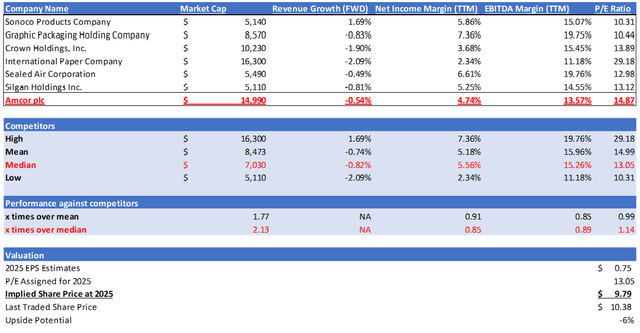

Relative Valuation Model

In my relative valuation model, I will be comparing AMCR with a list of peers in the highly competitive packaging industry, as shown above, in terms of its growth outlook and profitability margins. Starting with growth outlook, AMCR has a forward revenue growth rate of -0.54%, which outperforms its peers’ median of -0.82%. Overall, the packaging industry’s outlook appears to be weak, with most of its peers indicating a negative forward revenue growth rate. For context, AMCR is experiencing weaker consumer demand and persistent destocking.

AMCR’s profitability margin slightly underperformed its peers’ median in terms of net income margin TTM and EBITDA margin TTM. AMCR reported a net income margin TTM of 4.74% and an EBITDA margin TTM of 13.57%, which are 0.85x and 0.89x of the peers’ median, respectively.

AMCR’s forward non-GAAP P/E ratio is currently trading at 14.87x, which is higher than the peers’ median of 13.05x. For context, it is trading below its 5-year average of 17.49x. Given its mixed performance against its peers, I argue it’s fair for AMCR to be trading at its peers’ median of 13.05x rather than higher.

For 2024, the market revenue estimate for AMCR is $13.75 billion, while EPS is $0.70. For 2025, the revenue estimate is $14.31 billion, while EPS is $0.75. Given the management guidance for FY2024 as well as my forward-looking analysis as discussed, they support the market’s estimate. Therefore, by applying my 2025 target P/E for AMCR to its 2025 EPS estimate, my 2025 target share price is $9.79.

Risks & Conclusions

I would give AMCR a hold rating for the time being, as they have underperformed slightly against their peers. Weaker volume as a result of destocking and weaker consumer demand would be a temporary headwind for now. AMCR has reaffirmed their commitment to sustainability and ESG practices by actively participating in various initiatives to ensure sustainability in packaging. With increased scrutiny and regulations on the packaging industry, AMCR would be well-prepared and have the potential to be the industry leader on sustainability in the long run.