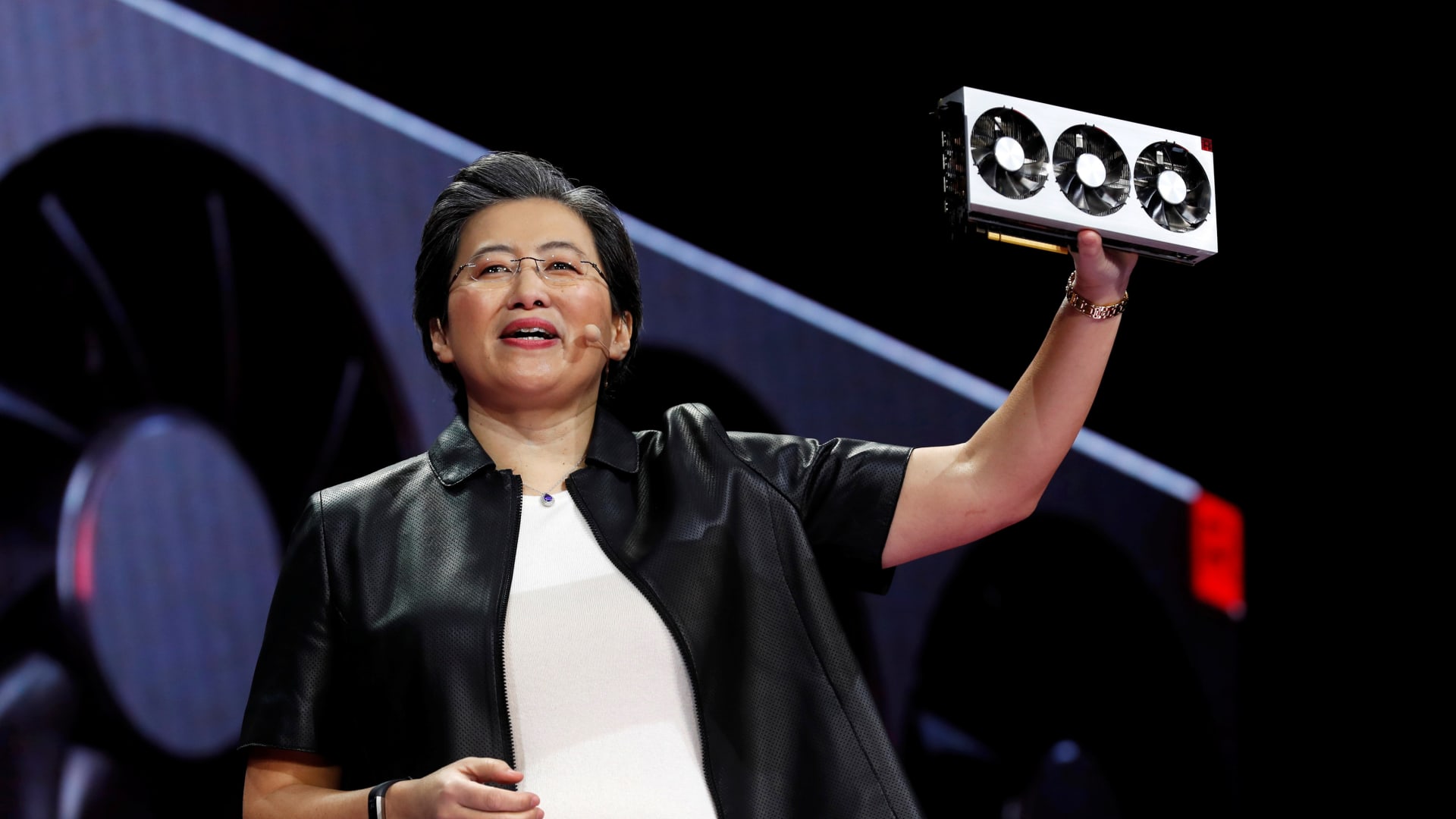

Lisa Su, president and CEO of AMD, talks in regards to the AMD EPYC processor throughout a keynote tackle on the 2019 CES in Las Vegas, Nevada, U.S., January 9, 2019.

Steve Marcus | Reuters

Advanced Micro Devices reported first-quarter earnings and sales on Tuesday that have been barely forward of Wall Road expectations, and supplied an in-line forecast for the present quarter.

Shares dropped 7% in prolonged buying and selling.

Here is the way it did versus LSEG consensus expectations for the quarter resulted in March:

- Earnings per share: 62 cents adjusted versus 61 cents anticipated

- Income: $5.47 billion vs. $5.46 billion anticipated.

AMD stated it expects about $5.7 billion in gross sales within the present quarter, in keeping with Wall Road estimates of the identical approximate complete. That might characterize about 6% annual development.

The corporate reported web revenue of $123 million, or 7 cents per share, versus a web lack of $139 million, or 9 cents per share, throughout the year-earlier interval. Income was up about 2% from a 12 months earlier.

AMD shares have risen 14% in 2024, so regardless of assembly forecast estimates and signaling development in AI chip gross sales, Tuesday’s outcomes weren’t sufficient to forestall the inventory from sliding.

The chipmaker stated its carefully watched Information Heart section grew 80% year-over-year to $2.3 billion because of gross sales of its MI300 sequence AI chips, which compete with Nvidia’s graphics processing items.

CEO Lisa Su stated Microsoft, Meta, and Oracle use AMD’s MI300X. AMD stated it had bought over $1 billion of the chips because it launched within the fourth quarter of 2023.

AMD expects $4 billion in 2024 AI chip gross sales, up from a $3.5 billion forecast in January. For comparability, Nvidia, the largest vendor of AI server chips, reported $18.4 billion in gross sales — principally AI chips — in its knowledge middle section alone for the January quarter, the newest for which monetary outcomes can be found.

Su instructed traders on Tuesday that the corporate was engaged on new AI chips and successors to the present technology. “We’re getting much closer to our top AI customers. They’re actually giving us significant feedback on the road map,” Su stated.

AMD additionally makes central processors which might be usually paired with superior AI chips in servers. Su instructed analysts on a name that the corporate believed it had taken market share within the server CPU section — probably from Intel. Su stated that AMD sees “signs of improving demand” for its CPUs as a result of AI server growth.

AMD’s weakest division was its gaming section, which was down 48% 12 months over 12 months to $922 million, which the corporate stated was on account of decrease chip gross sales for recreation consoles and PCs. AMD makes chips for Sony’s PlayStation 5, for instance. AMD’s gaming gross sales trailed a StreetAccount estimate of $969 million.

AMD’s authentic enterprise, processors for chips and PCs, is reported as shopper section income. AMD reported $1.4 billion in first-quarter gross sales, an 85% annual improve, suggesting that final 12 months’s PC stoop is over. AMD’s PC processors can run synthetic intelligence packages domestically, which might enable it to energy so-called “AI PCs” that many business individuals are banking on to drive new laptop computer and desktop gross sales.

The corporate’s embedded section, made up of merchandise acquired as a part of the Xilinx acquisition in 2022, reported falling gross sales, dropping 46% 12 months over 12 months to $846 million, lagging Wall Road expectations of $942 million.