DNY59

The semiconductor business is inherently cyclical, driven by economic cycles. There are steep plunges during contraction, followed by very attractive returns during expansions if one chooses quality over discount (read: Intel).

As I am all about total returns and hunting alpha, Advanced Micro Devices, Inc. (NASDAQ:AMD) is one of the quality companies I am loading up on during weakness, expecting double-digit annual returns long term.

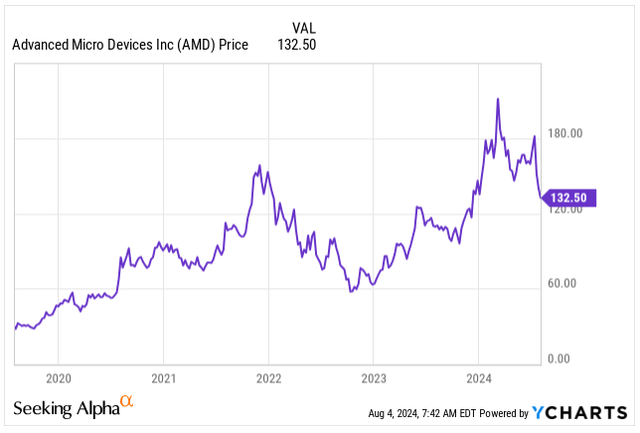

One of the many reasons I am taking such an ultra-bullish stance on AMD’s shares is the recent overall market pullback, which caused AMD’s unjustified stock-price plunge, wiping out over $100B valuation.

The stock is now trading at FY24 P/E of 37.9x, which is too low for a company expected to grow its bottom line by 31% this year, with further acceleration in the subsequent years.

AMD’s FY24 PEG ratio is now at 1.23, far too low for a company that is winning in each of its business segments.

Business Overview

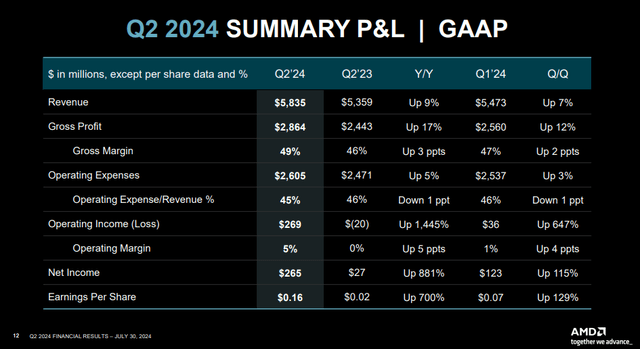

Let’s examine AMD’s Q2 earnings report to understand its qualities and superiority better.

In Q2, the company’s revenue was $5.86B, up 9%, beating analysts’ expectations by $120M. This growth was fueled by major growth in the Data Center segment.

The EPS came at $0.69, up 7x YoY, significantly boosted by a Gross Margin expansion of three points from the prior year. Even though the bottom-line beat analysts’ expectations, it was more muted by only $0.01.

The Q2 earnings marked a reversal of AMD’s lackluster performance in the previous quarters, helped by strong revenue and earnings growth driven by the record Data Center segment, following its successful release of MI300 AI accelerators earlier this year.

Even better, following in the footsteps of its main AI-chips rival, Nvidia (NVDA), AMD is seeing strong momentum and growth in H2 and is poised to deliver a solid full-year thanks to demand for Instinct, EPYC, and Ryzen processors.

To reflect on CEO Dr. Lisa Su’s words from the earnings call, I am increasingly bullish on AMD’s prospects in the ever-expanding AI market as second in line to benefit following Nvidia’s success.

The rapid advances in generative AI are driving demand for more compute in every market, creating significant growth opportunities as we deliver leadership AI solutions across our business.

Even as many investors argue that the AI investment narrative is focused around mega-cap stocks such as Microsoft (MSFT), Meta (META), and Google (GOOGL) pouring billions of dollars into building best-in-class Gen AI data center infrastructure, the tailwinds have the potential to widen to smaller enterprises and governments, bringing new demand and diversifying the exposure of the primary AI-chip beneficiaries.

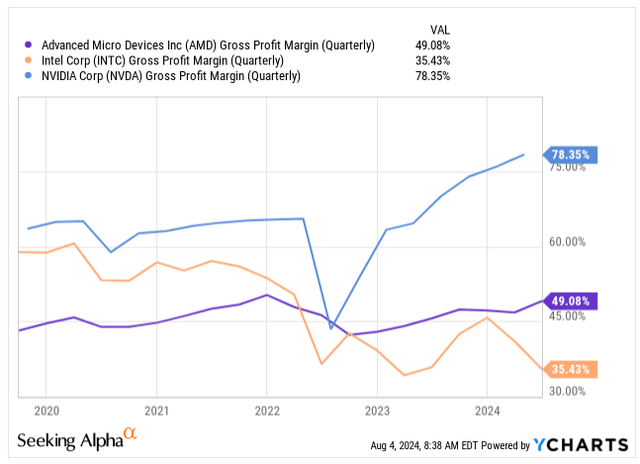

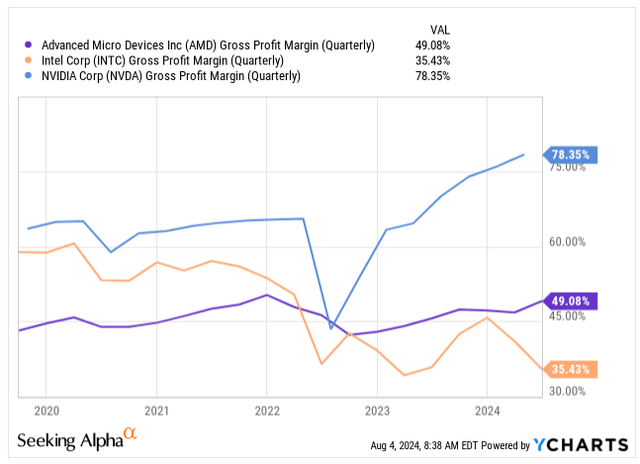

More importantly, the conversion of the revenue to earnings is crucial here. Despite Nvidia’s market-leading profitability, thanks to its engineering edge as part of its first-mover advantage, pushing its Gross Margin to 78%, AMD still sees a strong pricing power with its AI chips, boosting its Gross Margins, now at 49%.

Gross Profit Margin (Seeking Alpha)

Looking at the Q2 business segment revenue breakdown:

- Data Center: $2.83 billion, up 115% YoY

- Client Unit: $1.49 billion, up 49% YoY

- Gaming: $0.65 billion, down 59% YoY

- Embedded: $0.86 billion, down 41% YoY

Even as we are seeing pockets of weakness, mostly in the segments, being economically influenced by slower PC-upgrade cycles, data center growth is becoming AMD’s key investment narrative.

Yet, not all companies are benefiting in a linear fashion from the demand explosion, notably Intel (INTC), which failed to deliver the right product category. Its Data Center and AI business unit (DCAI) reported negative -3% revenue growth in Q2 with an Operating Margin of less than 10%, compared to AMD’s 26%.

We do not yet have the Q2 numbers of Nvidia, the key beneficiary of the AI CAPEX super-cycle, expected to report its earnings in August, nonetheless expecting meaningful double-digit YoY growth while maintaining the profit margins elevated is the base case.

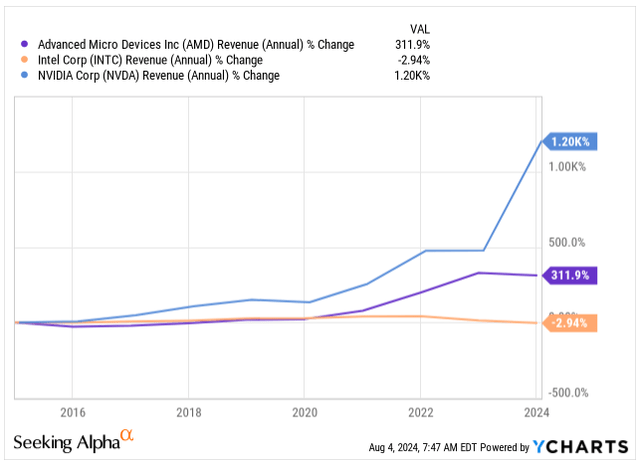

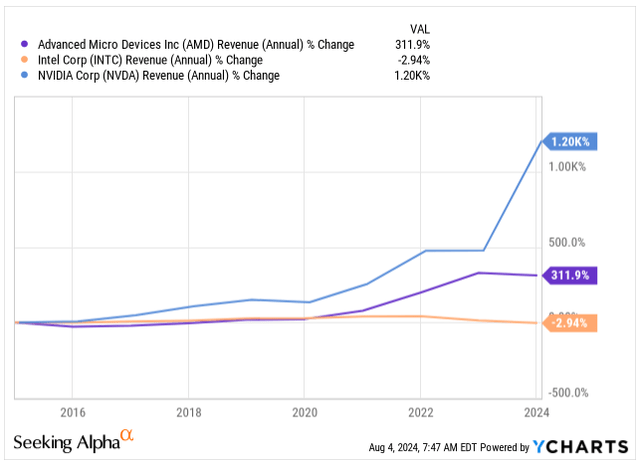

Below, you can see the revenue growth over the past decade. Innovative companies that planted seeds years ago are now reaping the rewards, compared to Intel, which failed to capitalize on the CAPEX supercycle.

Revenue Growth (Seeking Alpha)

That’s why investing in quality is critical to unlocking market-beating returns, even if quality comes at a premium price.

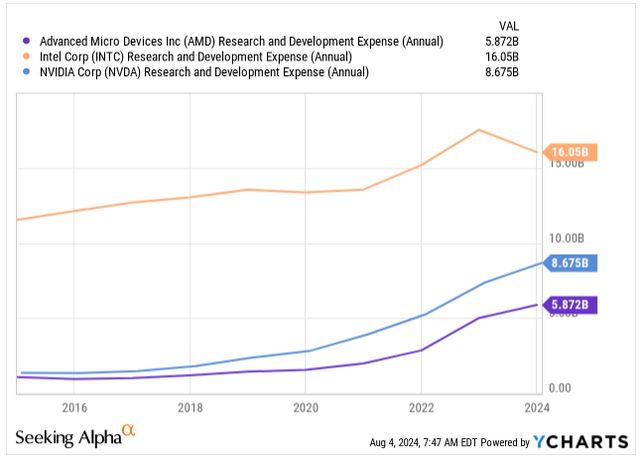

To put the numbers into perspective, looking at the R&D Expense, Intel actually spends $16B annually at today’s run rate.

In comparison, AMD’s R&D budget is 2.75x, and Nvidia’s is 1.85x smaller than Intel’s. Yet, both companies’ revenue growth has outperformed, capturing market share and establishing strong positions in new product categories.

In my last coverage, I built the case around Nvidia retaining its market leadership for the Gen AI GPUs, estimated at around 98%. With Nvidia’s first mover advantage, which positions them one product-cycle release ahead of AMD with their Blackwell coming in 2025, I expect this to remain the case for the remainder of 2024 and well into 2025 as the businesses with excess cash can pick the best-in-class offerings, even as Blackwell chips are expected to cost around $70,000 each with 72-GPU configuration to sell around $3M.

AMD’s position is more delicate and while the mega-cap companies are buying their MI300 chips as well to diversify away from Nvidia partially, I expect AMD’s chips to better sell to smaller enterprises and potentially governments outside of the US as their MI300 chips are priced at more feasible $20,000 per unit, with lagging energy-efficiency behind Blackwell, but competitive computing output.

As the technological leaps from one generation of AI-chip to another are major, both AMD and Nvidia are working with very aggressive 1-year product cycle releases, with AMD’s product pipeline already announced:

- 2024: MI300 & MI325X

- 2025: MI350

- 2026: MI400

To help expand its footprint also outside of the US, AMD has announced a deal with Silo AI, the largest private AI lab in Europe, costing $665M. The goal is to diversify a portfolio and build custom platforms, models, and AI solutions for cloud enterprise, embedded, and endpoint computing markets.

Let’s not mistake and look at AMD’s business as a one-trick pony. AMD is, in fact, the second-largest company developing and selling advanced CPUs, with a 36% market share behind Intel’s 62%. However, the gap has been continuously shrinking due to AMD’s smaller node sizes, giving its products an edge in speed and performance.

AMD’s chips, which are now manufactured by Taiwan Semiconductor Manufacturing Company Limited (TSM), are at a 4-nanometer scale ahead of Intel’s larger 5-nanometer chips.

Valuation

If you are a value-oriented investor, perhaps AMD’s premium valuation might not be the right cup of tea for you, as the company is trading at a Blended P/E of 42.3x

Certainly, that’s an expensive valuation by any conventional standards, but again, referring to my investment case from my previous coverage, the landscape for semi-businesses benefiting from the AI CAPEX supercycle has changed as companies develop new product categories, the next growth driver.

Even as the legacy business connected to PC upgrade cycles, legacy data centers, and gaming suffers, AMD and Nvidia are showing remarkable growth fueled by the demand for their Gen AI chips, which are here to stay.

That’s one reason historical valuation and growth do not fully tell the story (even as AMD is trading below its 20-year average P/E of 44x). Instead, looking into the future might be a better way to assess valuation.

AMD’s EPS growth is expected to accelerate, driven by the aggressive 1-year product cycle releases and ramp-up of production of its data center GPUs, all along improving profitability:

- 2024: EPS of $3.48E, YoY growth of 31%

- 2025: EPS of $5.40E, YoY growth of 55%

- 2026: EPS of $7.39E, YoY growth of 37%.

Thanks to the strong bottom-line growth if we look at AMD’s forward P/E valuation, the stock is not expensive after all:

- Forward P/E 2024 Earnings: 38x

- Forward P/E 2025 Earnings: 24x

- Forward P/E 2026 Earnings: 18x.

The best way to gauge AMD’s valuation is to look at its closest competitor, Nvidia. Although Nvidia is currently more expensive on the forward P/E basis, one has to consider that its products are more sought-after.

- Forward P/E 2024 Earnings: 40x

- Forward P/E 2025 Earnings: 30x

- Forward P/E 2026 Earnings: 26x.

No matter how we look at it, AMD’s shares are trading at a discount relative to their growth potential.

Of course, the risk is that the FactSet estimates might not materialize if Gen AI investments slow or if more competition comes with industry-leading products at more competitive prices, pressuring both the demand and profit sides of the equation.

Following the 8.3% price slide after the strong Q2 earnings, I see AMD as a potentially good investment that can achieve an ROR of 15%-25% annually as growth materializes and valuation contracts.

Naturally, if negative market sentiment persists, the stock may drop even further, but I have already doubled down on my existing position, and I intend to add further to any unjustified weakness as long as the fundamentals of my investment thesis do not change.

Takeaway

AMD, alongside Nvidia and Broadcom, is among the best investments money can buy to play the AI investment theme.

AMD reported strong Q2 earnings, doubling its data center revenue from a year ago, thanks to its sought-after MI300 accelerator, competing against Nvidia’s H100 chips.

AMD has announced a one-year product cycle to build market share, with MI325x expected to be released later this year.

AMD’s products are showing strong pricing power, with profitability rising across the board. As the Gen AI theme plays out, this position positions the company well to reward shareholders over the next few years.