Editor’s note: Seeking Alpha is proud to welcome Beau Marshall as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Tippapatt

At its current valuation in the $50-$60 range, I believe AMN Healthcare Services (NYSE:AMN), a nationwide temporary healthcare staffing company, could be a buy for a long-term investor. The company is currently suffering from a post-pandemic correction in the travel nursing industry, but it has secular drivers behind it, including industry consolidation, platformization through its app and potential margin expansion from its growing software business. If the company can reclaim the strong performance it showed before the pandemic, it will likely offer market-beating returns over the next decade. In the near term, investors should be wary that we may not have reached the bottom of the travel nurse contraction, but recent insider buying activity suggests management doesn’t expect a further precipitous drop.

The company is on quite a comedown from the pandemic boom in travel nursing. Having reached an all-time closing high of $127.04 on 1 November 2022, it has been trading below $60 recently. There is no mystery as to why: AMN’s revenue in 2022 was $5.2bn compared with the trailing twelve-month figure of $3.5bn, and diluted EPS has gone from $9.90 in 2022, to $3.76 ttm. But on a longer-term horizon, the business has performed impressively. Between 2013 and 2023, the company grew revenue, EPS and free cash flow at an annual rate well above 10%, and over that period, the median return on invested capital was 15%. This is clearly a well-run business historically.

Can the company resume this impressive performance once the post-pandemic reset in its core market finally comes to an end? How far away is the bottom, and is there a chance of further earnings and multiple compression before things turn around? And, if we have a positive long-term outlook for the company, is the current valuation enticing enough to promise market beating returns?

AMN Long-term Outlook

The main long-term tailwind for the healthcare staffing market as a whole is the aging population and the increasing amount of money spent on healthcare. In this study, 47 of the 158 fastest growing staffing companies report travel nursing as their main vertical, second only to IT with 59. Another report cites “the rising global population, along with the growing prevalence of chronic diseases” as tailwinds for the global healthcare staffing market and estimates that it will grow at a rate of 7.6% a year between now and 2030. That growth rate is decent for an industry, likely doubling GDP growth, but we would need AMN to sustain a higher revenue growth rate to continue past performance.

Driver 1: Continued Acquisitions

One way in which the company could do this is through acquisition. This is one of the reasons AMN has achieved its past growth rates. By my count, in the past 10 years AMN has acquired companies at a total cost of more than $1.5bn, which is a lot, given their current market cap is around $2bn. Their good return on invested capital over this period (around 15%) suggests that their acquisitions have largely been successful. Can AMN maintain this judicious capital allocation?

The fact that they have a new CEO at the helm might lead us to be skeptical. In 2023, Susan Salka retired after 17 years in charge of AMN. Her replacement, Cary Grace, doesn’t seem to have much direct experience in the healthcare staffing industry, but one interesting piece of information I picked up from one profile is that she used to oversee the integration of acquisitions at Aon, which ought to be critical in her new role. It’s difficult to get much more of a sense of how she thinks about acquisitions, and unfortunately, analysts on recent earnings calls have not been questioning her on this topic. However, the AMN acquisition strategy as a whole is laid out in their most recent investor presentation and checks many of the boxes one would want to see.

There should be more acquisition opportunities. The healthcare staffing market remains fragmented, but there is a trend towards consolidation which could benefit AMN, as this passage from a 2023 industry report suggests:

“The five largest healthcare staffing firms accounted for 37% of the market share and the 10 largest accounted for 52%. This represents an increase from the 33% and 48% levels observed in 2008 when SIA started tracking these metrics. Since 2013, we have seen a steady increase in market share among these firms, eventually reaching a peak in 2019. This growth stems from both business expansion and acquisitions, and highlights a degree of market consolidation that mimics long-term trends of consolidation among healthcare providers.”

Driver 2: Platformization

Another trend mentioned in the same report that is likely to benefit the larger players is the move towards platforms. Instead of having recruiters match individual healthcare professionals to hospitals that need temporary staff, “the platform model offers clients a modern, self-service experience with minimal human mediation”. AMN provides this through their AMN Passport App, which had 225,000 registered users as of January 2024, per the 2023 Annual report. According to this report, between 2021 and 2023 “the share of the US healthcare staffing sector attributed to platforms has nearly tripled to 28% from 10%”.

This “platformization” can benefit the larger players in two ways: firstly, network effects mean that the larger platforms with more “buyers” and “sellers” will likely offer a larger number and wider range of choices for each side; secondly, if more of the process can be automated, the platforms may be able to deliver services at a lower cost given the labor savings relative to small firms. It’s effectively the difference between a travel booking website and a travel agent – though I don’t expect the distinction in this case to be so dramatic.

Driver 3: Margin Accretion

AMN reports three segments: Nurse and allied solutions, Physician and leadership solutions and Technology and workforce solutions. The third segment includes the following products:

-

Language interpretation – software which facilitates video/audio calls between staff and patients who do not speak the same language and a remote third-party interpreter who is a healthcare professional

-

Vendor Management System: software which allows the user to track and efficiently organize their staffing process

The data in the table below are taken from the 2020 and 2023 annual reports. The technology and workforce solutions segment accounted for 4% of revenue when the company first reported it in 2018. In 2023, it accounted for 13%. Crucially, it is not only growing faster than the other segments, but its operating margins are much higher, normally around 45% while the other segments tend to hover just under 15%. Assuming this trend continues – and from their investor presentation it seems the company is angling for it – we could see AMN’s margins move higher over the coming years.

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | ||

|

Nurse and allied solutions |

|||||||

| Revenue | 1,431,018 | 1,562,588 | 1,699,311 | 2,990,103 | 3,982,453 | 2,624,509 | |

| Operating Profit | 201,866 | 219,862 | 232,005 | 461,311 | 576,226 | 362,158 | |

| % of revenue | 67.0% | 70.3% | 71.0% | 75.0% | 76.0% | 69.3% | |

| Operating Margin | 14.1% | 14.1% | 13.7% | 15.4% | 14.5% | 13.8% | |

|

Physician and leadership solutions |

|||||||

| Revenue | 617,488 | 562,762 | 466,622 | 594,243 | 697,946 | 669,701 | |

| Operating Profit | 86,077 | 71,378 | 62,342 | 81,439 | 92,331 | 94,966 | |

| % of revenue | 28.9% | 25.3% | 19.5% | 14.9% | 13.3% | 17.7% | |

| Operating Margin | 13.9% | 12.7% | 13.4% | 13.7% | 13.2% | 14.2% | |

|

Technology and workforce solutions |

|||||||

| Revenue | 87,568 | 96,757 | 227,781 | 399,889 | 562,843 | 495,044 | |

| Operating Profit | 41,373 | 23,899 | 93,212 | 187,578 | 299,390 | 214,736 | |

| % of revenue | 4.1% | 4.4% | 9.5% | 10.0% | 10.7% | 13.1% | |

| Operating Margin | 47.2% | 24.7% | 40.9% | 46.9% | 53.2% | 43.4% | |

Where Is The Bottom?

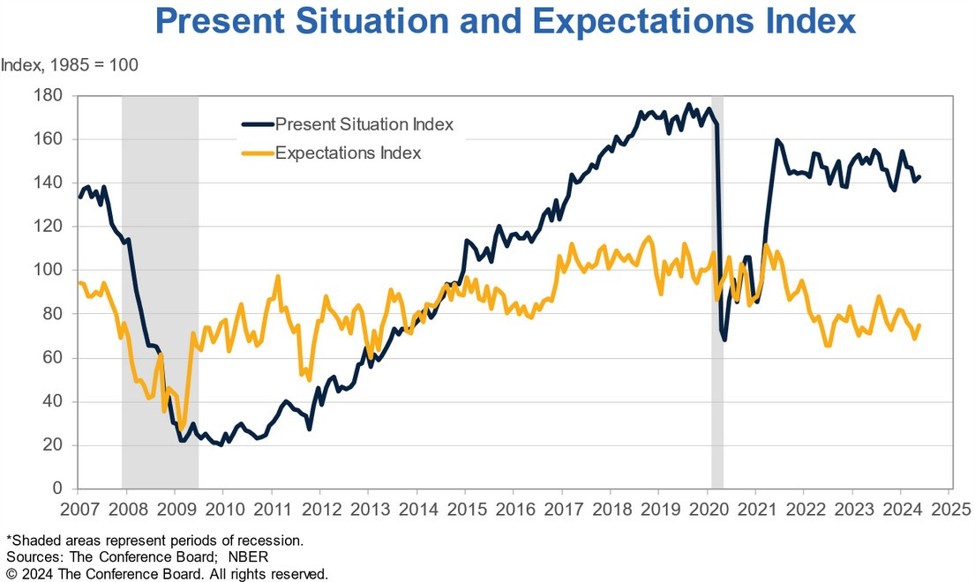

So much for the long-term growth prospects, but what about the near term? If we buy AMN today, are we risking a further precipitous drop before the stock and the business finally turn around? This is incredibly difficult to predict, but the short answer is yes. There are good reasons to believe that the bottom is not yet in for the temporary healthcare staffing market.

Firstly, management continues to sound downbeat about the near-term prospects for the nurse and allied segment (which is about 70% of revenue). On the Q1 earnings call, they said they expect a sequential decline between Q1 and Q2, and another sequential decline Q2 to Q3. Therefore, it looks like the very earliest we could expect a bottom is Q4 of this year. The CEO did indicate that they believe some of their largest clients have now returned to the pre-Covid equilibrium in terms of permanent vs temporary staff, which might signal the start of the recovery, but she also noted that smaller clients were a couple of quarters behind on this trend.

Secondly, also on the Q1 earnings call, management reduced their planned CapEx for this year by 20%, which suggests worries about profitability. I am not overly concerned about this – a figure of 20% doesn’t suggest panic, perhaps just an attempt to provide a bit more of a buffer – but it certainly doesn’t suggest that management expects things to turn around pronto.

Third, the analysts expect further revenue and earnings declines. The following are the average analyst estimates as of May 28 according to Seeking Alpha:

|

Revenue |

EPS |

|

|

2023 Actual |

3.79bn |

$5.36 |

|

2024 Est. |

2.98bn |

$3.46 |

|

2025 Est. |

3.01bn |

$3.96 |

As always, we should take the analyst estimates with a pinch of salt, but it is worth considering that maybe they know something we don’t.

To balance this out, we have a strong bullish signal: between 27 February and 6 March, directors of the company, including the CEO and CFO bought nearly 35,000 shares at market prices (around $57 at the time) for a total value of nearly $2m. The CEO accounted for about half of that. Although this is not a significant amount compared to the market cap, given that Cary Grace received a cash salary of just over $1m in 2023, and Jeffrey Knudson, the CFO received $630,000 cash salary, it is likely a significant amount of money to the people concerned. I doubt they would take this opportunity to buy big if they thought there was a likelihood of a further slide.

The risk/reward from here

Given what I discussed about the long-term prospects of the company, where could AMN be in 10 years’ time? And if we believe the prediction, what should we pay for it today?

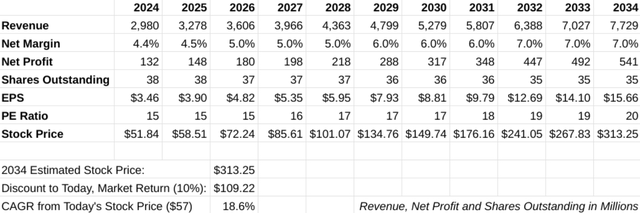

I have made the following assumptions for my valuation of AMN:

-

Revenue: I have taken the analysts’ expectations of revenue for 2024 ($2.98bn according to Seeking Alpha) and applied a growth rate of 10% per year, less than that achieved by the company in the preceding 10 years.

-

Net Margin: I assume net margin improves slightly from the median of the last ten years (5.6%) owing to a greater proportion of revenue from the higher margin technology and workforce solutions segment, as well as the growth of the platform which would automate more processes. My estimate is below the net margins attained in the boom years of 2021 and 2022.

-

Shares Outstanding: these have decreased by around 2% per year over the last ten years, but all of this decrease has come in the past 2 years. Share repurchase doesn’t seem to be the priority for now, but it is on the company’s radar, and they have $227m left in the authorization. So I assume the number of shares outstanding glides down about 1% a year from 39m now to 35m by 2034.

-

P/E Multiple: historically, AMN has traded at a P/E of around 20. This seems reasonable for a company growing about 10% a year.

I believe these assumptions are reasonable, as long as you believe that AMN can execute its strategy over the next 10 years. From today’s price in the mid-fifties, the 2034 estimate would represent roughly an 18% CAGR, most likely a market-beating return. If we assume instead a 10% discount rate, i.e. market matching, fair value would be around $108, which would give a margin of safety approaching 50%.

One final risk to mention – the company is carrying some long-term debt, around $1.3bn of it. About a third is a floating-rate revolving credit facility, which should be okay at this point in the cycle, as interest rates are unlikely to rise precipitously from here. The rest is in fixed-rate notes maturing in 2027 and 2029. The CFO said on the Q4 2023 conference call that the company is focusing on paying down debt with its near-term free cash flow, and the company’s net leverage ratio is within its stated target range of 2-2.5x. Therefore, although I would prefer a pristine balance sheet, I don’t think the debt load is likely to become a problem, unless the company sees a prolonged period of negative free cash flow – something which nobody is predicting as of now.

Conclusion

This business has performed well over the last 10 years, post-pandemic hangover notwithstanding, and there are good reasons to believe that it can continue to grow and expand margins over the next 10 years. On the other hand, investors should be wary that the stock may have further to fall, and the more risk-averse may choose to wait until they see evidence that the business is turning around before jumping in. The stock will turn around before the business does, so these investors will likely miss some of the upside, but there should still be plenty of room to run if the long-term story plays out.

Those with a greater risk tolerance may take heart from the fact that the CEO and CFO have bought in at these levels. Perhaps a reasonable strategy would be for investors to start with a small position and increase it as they gain more confidence. AMN deserves consideration for long-term investors who are looking to pick up a good company at an attractive price – especially those who believe the company falls within their circle of competence.