Prime Bloomberg’s ETF analyst James Seyffart has voiced his concern amid ongoing hypothesis concerning an enormous capital influx if a Spot Bitcoin Alternate-traded fund (ETF) is permitted.

Bloomberg Analyst On Bitcoin Spot ETF Influx

There may be rising optimism that america Securities and Alternate Fee (SEC) will quickly permit spot Bitcoin exchange-traded funds (ETFs). Together with the anticipation, is the projection that if a Bitcoin ETF is permitted, it would see an influx of as much as a whopping $100 billion.

Resulting from this, James Seyffart has publicly warned merchants in opposition to holding these sorts of expectations. In response to the analyst, he believes that the projection is an overestimation of demand. He then highlighted that it would take years to file an enormous quantity of this type.

Seyffart asserted that it’s “extreme” to foretell such influx into the market, notably in mild of the truth that Gold has been available on the market for some time. He additional identified that regardless of gold being round within the US since 2004, the asset’s worth within the nation is sitting at $95 billion.

The Bloomberg analyst’s warning got here in response to the highest mathematician Fred Kruger’s X (previously Twitter) publish a few potential $100 billion influx into Bitcoin. Within the X publish, Krueger recounted how Bitcoin reached its all-time excessive (ATH) of over $69,000 in 2021, because of a $10 billion influx.

Moreover, he asserted that with BTC getting a $100 billion influx, the value of the crypto asset would possibly improve by 10 occasions. He then made a tough calculation that if BTC is at $50,000, the $100 billion influx with that value will amass to 2 million BTC.

Nonetheless, he famous that this can be a small provide, subsequently the value has to extend to match the digital asset’s demand. He additional identified that getting these 2 million BTC can be tough as high holders of the asset are unwilling to promote theirs.

A number of ETF Candidates Meet With The SEC

A latest report reveals that a number of ETF candidates have had conferences with the US regulator recently. Bloomberg’s ETF analyst James Seyffart has highlighted that about 4 distinct issuers have met with the SEC about their BTC submitting up to now few days.

In response to the analyst, Blackrock met with the regulatory watchdog for the third time in a number of weeks. In the meantime, different issuers resembling Grayscale, Constancy, and Franklin every met with the SEC final week.

Moreover, Seyffart highlighted that each the Division of Buying and selling and Markets and the Division of Company Finance attended every of those conferences. He additionally added that these two divisions can be answerable for deciding if and when the 19b-4’s & S-1’s could be permitted or denied.

Nonetheless, by January 15, 2024, the US regulator is anticipated to determine on Blackrock’s utility.

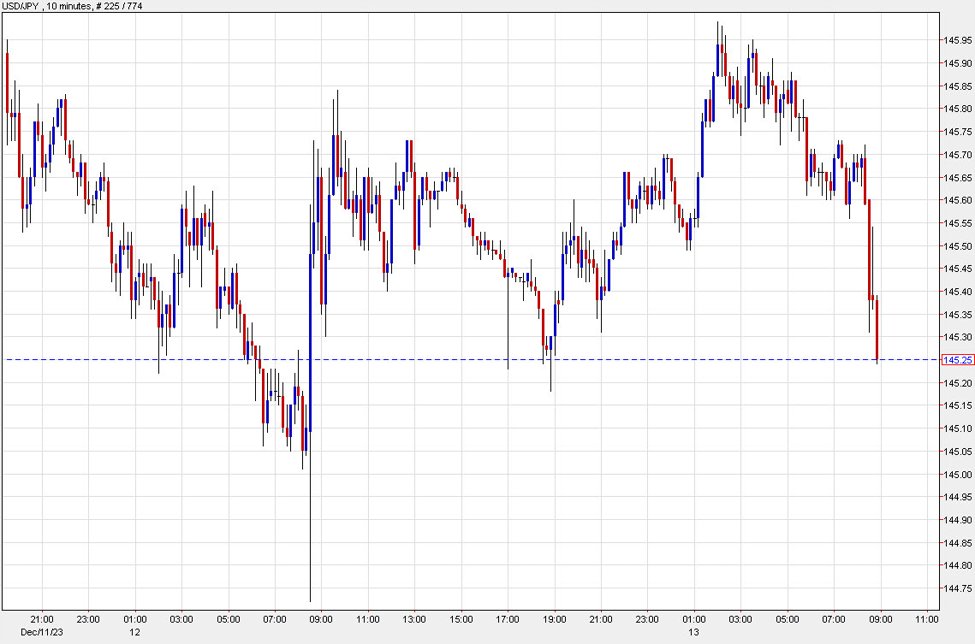

Featured picture from iStock, chart by Tradingview.com