ANZ provides insights into the outlook for the USD and GBP in the upcoming week, focusing on the impact of recent macroeconomic data and positioning trends.

Key Points:

-

USD Outlook:

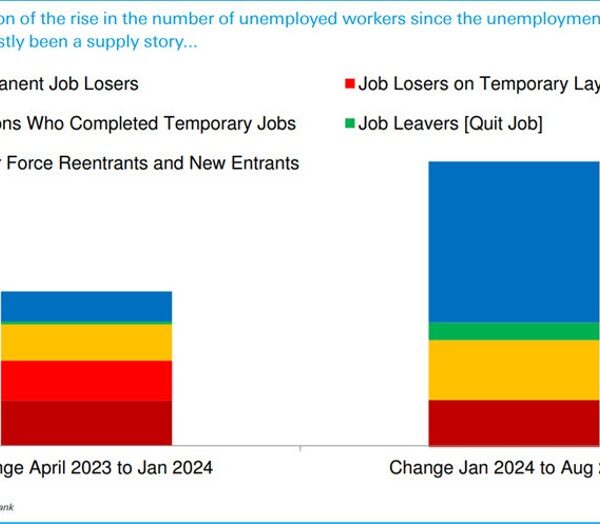

- Macroeconomic Stability: Despite market reactions suggesting otherwise, ANZ believes the US macroeconomic backdrop is not as dire. The labor market is easing but trending towards normalization rather than a recession.

- ISM Services Employment: The ISM services employment index for July hit a 10-month high at 51.1, indicating resilience in the labor market.

- Weather Impact on Payrolls: July’s household survey showed a larger-than-normal number of workers impacted by bad weather. The San Francisco Fed’s weather-adjusted payroll figure was 150k, better than the reported 114k.

- GDP Growth: The Atlanta Fed’s GDPNow estimate has risen to nearly 3%, up from a low near 1.5% earlier this year, suggesting fears of a US slowdown may be overblown.

- CPI as a Key Risk Event: ANZ highlights Wednesday’s CPI as a crucial risk event, with Bloomberg’s nowcast pointing to a consensus CPI of around 3% y/y. While CPI is usually neutral-to-negative for the USD, in the current climate, an in-line print could support a USD recovery by confirming the likelihood of a soft landing.

- Impact on CHF and JPY: ANZ expects that as US yields recover and expectations normalize, the CHF and JPY—currencies that have rallied on haven demand—are likely to lose much of their recent gains against the USD.

-

GBP Outlook:

- Positioning Unwind: The ongoing unwind of long GBP positions is limiting GBP/USD appreciation despite a recovery in risk sentiment.

- Short-Term Neutral Stance: ANZ has closed out short GBP trade recommendations and is currently neutral on GBP in the near term. They anticipate the unwind in long positions to be ending, which could stabilize GBP/USD.

- Longer-Term Positive View: Over a longer horizon, ANZ remains cautiously optimistic about GBP. The UK economy has shown resilience with gains in both services and manufacturing PMIs, and overall economic momentum remains steady.

- Gradual BoE Easing: Sticky services CPI suggests the Bank of England’s easing cycle will be gradual, with the next rate cut expected in Q4. ANZ sees limited downside for GBP in the near term and expects the currency to stabilize as positioning normalizes.

Conclusion:

ANZ anticipates a potential recovery in the USD if upcoming data, particularly the CPI, aligns with expectations, which could also curtail recent CHF and JPY gains. For GBP, while there is some short-term uncertainty due to the positioning unwind, ANZ maintains a neutral near-term view and sees the longer-term outlook as more positive, with the BoE’s gradual easing cycle providing support.

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here.