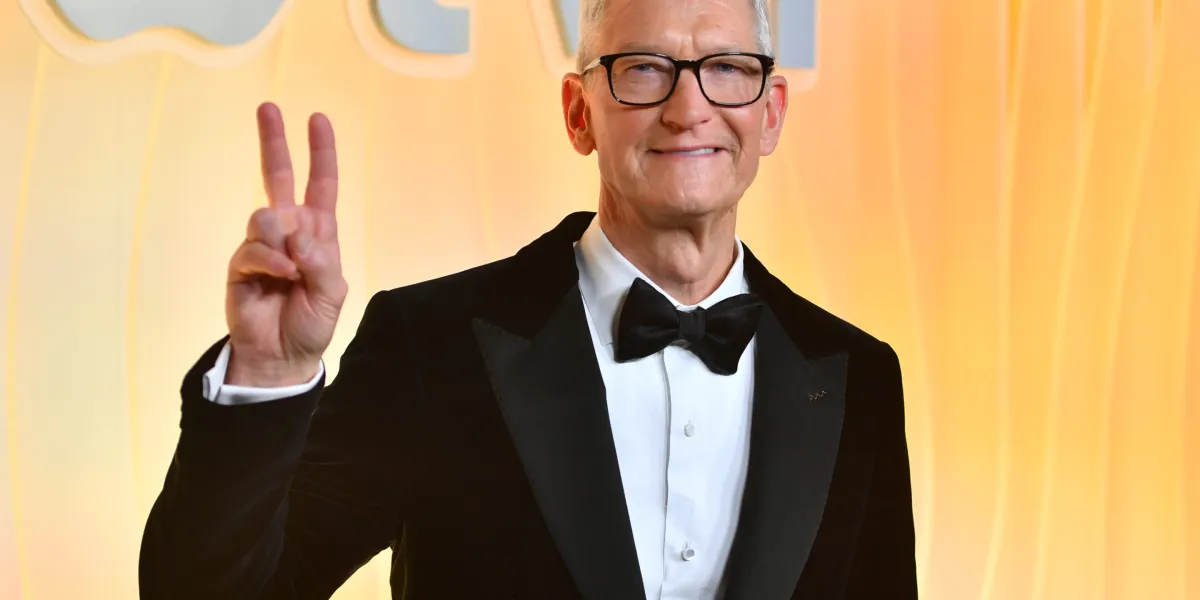

While Americans are monitoring their grocery budgets and delaying major life purchases, their employers are being awarded record-breaking salaries. Some of the highest-paid CEOs can watch the annual wage of a U.S. worker hit their bank accounts over the span of just hours. Take Apple’s Tim Cook, for example, he outearns the average American in less than a day’s work.

Apple, now a $4.1 trillion technology behemoth, has come a long way since its public debut 45 years ago. Under Cook’s leadership, it has become the second most valuable company on the planet—and his compensation reflects it.

Cook’s annual compensation grew to $74.6 million in 2024, an 18% increase from $63.2 million the year before. His eye-watering honeypot is comprised of $58.1 million in stock awards, $12 million in non-equity incentive plan pay, and $1.5 million in other compensation.

And even though he’s one of the highest-paid chief executives in the world today, his current paycheck is a far cry from what he once earned. In 2022, Cook received nearly $100 million, largely due to stock awards, but his pay dropped the next year following backlash from Apple staffers and shareholders.

And when compared to the paycheck of everyday Americans, the difference is severe. With his $74.6 million package, it only takes around seven hours for Cook to outearn the typical U.S. worker—who takes home just $62,088 a year, according to 2025 first quarter wage data from the BLS.

Within the 30 minutes it takes most people to commute to the office, Cook is already $4,256 richer—more than what most Americans have set aside as emergency savings.

While it may take decades for Americans to save for a home, the Apple CEO can afford it after just one weekend. It only takes 2.15 days for Cook to pool up $439,000 in earnings, the median price of a U.S. home, according to a new CEO salary tool from Resume.io.

Even buying his own company’s products—which are luxuries for most, priced in the thousands—barely registers as an expense. In just over 21 minutes, Cook has made enough to buy a $3,000 MacBook Pro; and in less than eight minutes, he can score an $1,100 iPhone Pro 17.

America’s highest-paid CEOs—and how Cook compares

Cook is one of the highest paid CEOs in the U.S. but he’s not the only one making headlines for his extreme paycheck.

Tesla leader and world’s richest person Elon Musk just secured a $1 trillion pay package following a heated back-and-forth with advisory firms imploring shareholders to reject the outlandish compensation. It was an unprecedented approval that spurred criticism on the growing wealth divide between the world’s have and have-nots.

Musk is just one of many CEOs with a spotlight on their bank accounts. In 2024 the highest-paid CEO leading a large, billion-dollar public U.S. company was Rick Smith. The chief executive of $45.5 billion defense-tech company Axon took home $164.5 million, according to an analysis from executive compensation consulting firm Equilar.

Smith’s followed by Jim Anderson, the CEO of Coherent, who raked in $101.5 million last year. Meanwhile, Starbucks’ Brian Niccolmade $95.8 million, GE Aerospace’s Larry Culp took home $87.4 million, and Ares Management’s Michael Arougheti followed in fifth with $85.4 million. On that list, Cook was the seventh highest-paid CEO, right below Microsoft leader Satya Nadella boasting $79.1 million.

There are, of course, other CEOs steering private companies (that don’t need to disclose their CEO’s salaries) who are bringing home eight-figure salaries too. And aside from direct compensation, it’s not uncommon for leaders to enjoy billion-dollar gains from their investments.

In October, LVMH CEO Bernard Arnaultsaw his wealth skyrocket $19 billion overnight following the business’ breakout earnings report. And the month before, then-Oracle chief executive Safra Catz’s wealth jumped by over $400 million to $3.4 billion in just six hours thanks to the tech company’s breakout year, according toForbes.

America’s widening income inequality

The U.S. is home to the most billionaires in the world, and the country’s changing wealth dynamics are not lost on those living paycheck-to-paycheck. The after-tax wages of Americans in the lowest-income group grew just 1.3% year-over-year this July, down from 1.6% in the month before, according to the Bank of America Institute.

Meanwhile, higher-income wages swelled to 3.2% during the same period—the third consecutive monthly increase. This change marks the widest wealth divide between lower- and upper-income households in four years.

“In some sense, we had an improvement in lower-income wage growth since the pandemic, and now that’s gone into reverse,” David Tinsley, senior economist for the Bank of America Institute, told Fortune this August. “There was a narrowing of wealth inequality, and now it’s widening.”

Even the Americans making enough to be considered “rich” are delaying major life purchases.

About 47% of six-figure earners are setting back their dream vacations and travel, 31% are stalling on home renovations, and 26% are delaying buying or leasing a new car, according to a 2025 report from Clarify Capital.

Achieving the American Dream of owning a home with a white-picket fence is on pause for now, too; about 17% are delaying buying a house, and 6% are even delaying getting married.