udra

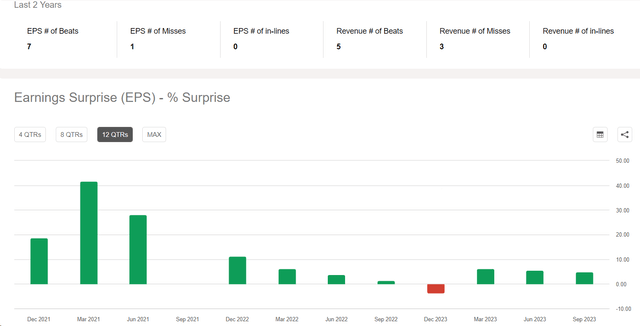

This isn’t the primary yr I have been writing about Apple Inc. (NASDAQ:AAPL) inventory right here on In search of Alpha and my timing was utterly fallacious, though it nonetheless appears completely logical to me immediately: inflated multiples towards a backdrop of declining working progress and the emergence of latest CapEx (the partial relocation of manufacturing from China), ought to have led to a big drop in AAPL’s share worth. That did not occur – to my shock, the quickest financial tightening in Fed historical past hasn’t had time to influence shopper demand, permitting Apple and different tech firms to simply outperform analyst expectations in latest quarters:

The inventory has considerably outperformed the S&P 500 Index (SPX) (SP500) (SPY) since my final ‘Promote’ score, however I stay skeptical that AAPL’s present rally is sustainable.

Why Do I Suppose So?

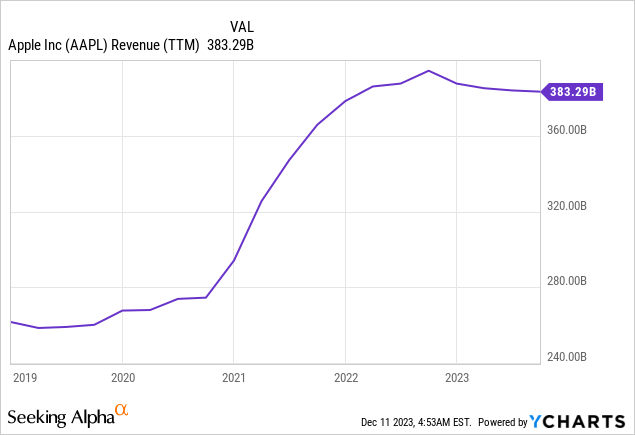

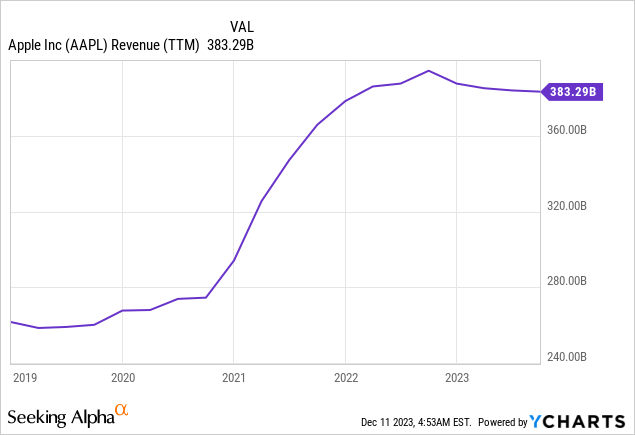

Apple’s fiscal Q4 FY2023 performance displays a nuanced monetary panorama. Income stood at $89.5 billion, a marginal 1% dip YoY however a notable 9% uptick from the previous quarter, exceeding the anticipated $89.3 billion. AAPL prolonged a four-quarter streak of annual income contraction, with the preliminary decline noticed in 1Q FY2023.

GAAP earnings per diluted share demonstrated a sturdy 14% YoY surge, reaching $1.46, surpassing the consensus estimate of $1.39.

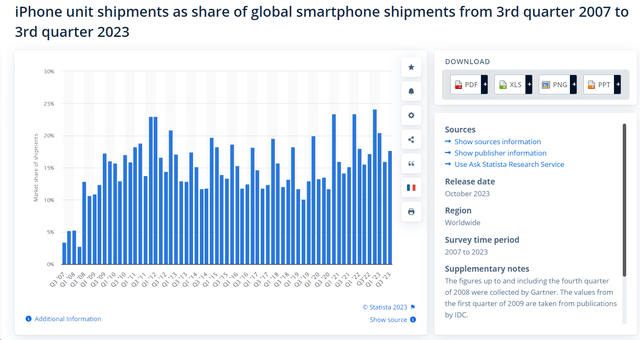

The iPhone phase exhibited resilience, producing $43.8 billion in income, marking a brand new excessive for September-quarters. Transport ~53.6 million models in fiscal This fall, Apple’s market share expanded to 17.7% within the international smartphone area, up from 17.2% the earlier yr. Strategic maneuvers, together with broadening the hole between iPhone 15 fashions, contributed to this success.

Product income, constituting 75% of the full, totaled $67.2 billion, showcasing a 5% YoY drop in GAAP however an 11% sequential surge. Concurrently, Providers reached a pinnacle at $22.3 billion, constituting 25% of the full and reflecting a sturdy 16% YoY improve. Apple’s energetic put in base set a brand new file, fostering progress within the providers sector. Rising markets, experiencing double-digit proportion progress in native currencies, performed a pivotal position in income resilience, in response to the company’s earnings call.

The Mac phase, nonetheless, confronted headwinds, witnessing a 34% YoY drop in GAAP income to $7.6 billion, amid a worldwide downturn in PC demand. Mac’s market share slid from 12.7% to 10.6% in calendar Q3 2023. In distinction, iPad income reached $6.4 billion, marking a ten% YoY contraction however an 11% sequential growth. Income from Wearables, Residence, and Equipment amounted to $9.3 billion, demonstrating a 3% YoY decline.

As of fiscal 2023’s conclusion, money and short- and long-term investments stood at $162.1 billion, reflecting a lower from $169.1 billion in fiscal 2022 and $196.3 billion in fiscal 2021. Conversely, debt diminished to $114.4 billion in fiscal 2023, down from $120.1 billion in fiscal 2022. Notably, Apple’s fiscal 2023 money circulate from operations reached $110.5 billion, showcasing sustained monetary prowess.

CEO Tim Prepare dinner emphasised Apple’s international outreach, citing file income in India and strong gross sales in varied international locations. On a web foundation for the December quarter, Apple expects income to be little modified year-over-year, regardless of fiscal 1Q FY2023 being a 14-week quarter and 1Q FY2024 being a 13-week quarter.

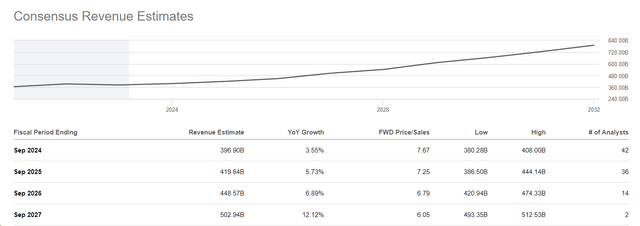

To date this yr and final yr, Apple has had no issues with demand, but it surely appears to me that the slowdown in gross sales progress will more than likely carry over to subsequent yr – this could go towards analysts’ consensus expectations:

Regardless of inflation moderating and the Federal Reserve signaling a pause, financial progress is cooling. According to Saira Malik [Naveen CIO], the latest jobs knowledge, that includes a lower-than-expected unemployment fee of three.7% and constructive non-farm payrolls at 199,000 in November, helps a cautiously optimistic view. Nonetheless, Malik expresses issues concerning the shopper in 2024, noting rising auto and bank card delinquencies, a pullback in restaurant spending, and a possible influence on the economic system pushed by shopper habits.

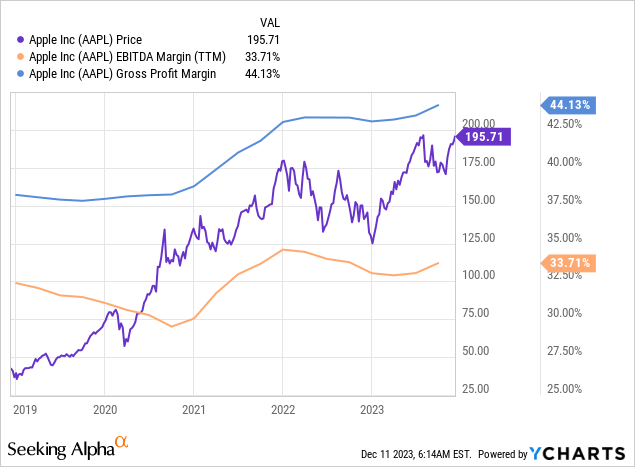

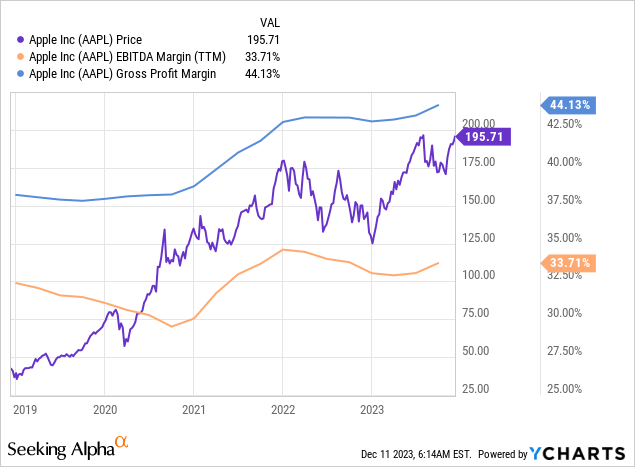

To be sincere, I do not see any catalysts for a rise in demand for digital items in 2024 both. Apple will more than likely be in a interval of margin contraction once more regardless of the decline in inflation – traditionally this results in a decline within the firm’s shares except there’s virtually free cash and unprecedentedly beneficiant stimulus measures like within the post-COVID interval, which is unlikely to be the case anymore.

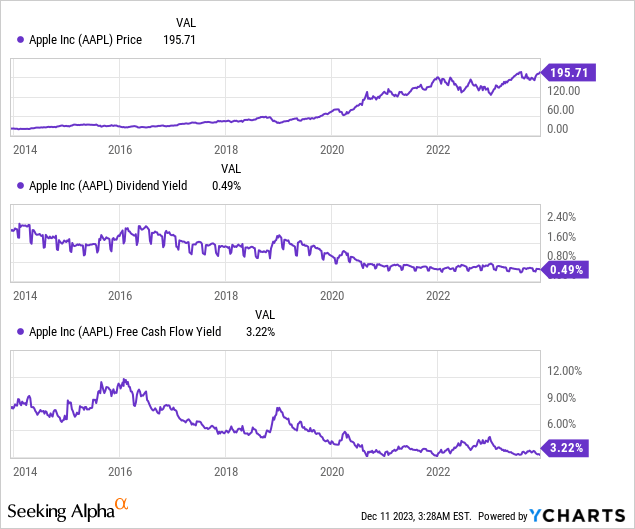

Regardless of an anticipated 8% dividend hike, Apple raised its quarterly dividend by 4% to $0.24 per share in April 2023, contributing to its ongoing dividend progress trajectory.

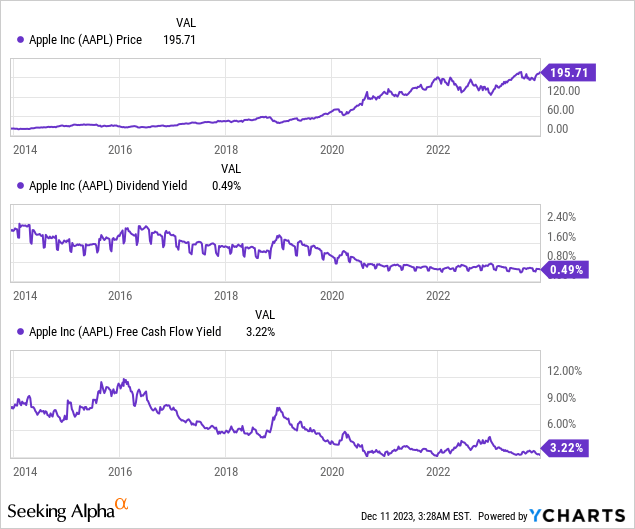

Nonetheless, Apple’s most vital instrument for shareholder returns continues to be buybacks, which the corporate carried out within the fourth quarter of the 2023 monetary yr within the quantity of $15.5 billion. Nonetheless, towards the backdrop of the continued decline in gross sales, these buybacks will now not be efficient, because the “total shareholder return of 2.5% (which I calculated by dividing the sum of dividends and buybacks for one year by market capitalization) looks too modest from the point of view of the company’s “weight”. The FCF yield says the same thing – AAPL is too expensive a company for the return it can offer investors.

Please word – I am not even speaking about P/E, EV/EBITDA, or P/S, which of course look very high in the case of AAPL stock. It’s just that investors are trying to justify the high valuation multiples by saying that the buybacks are saving the day, but I want you to see clearly that that’s not entirely true.

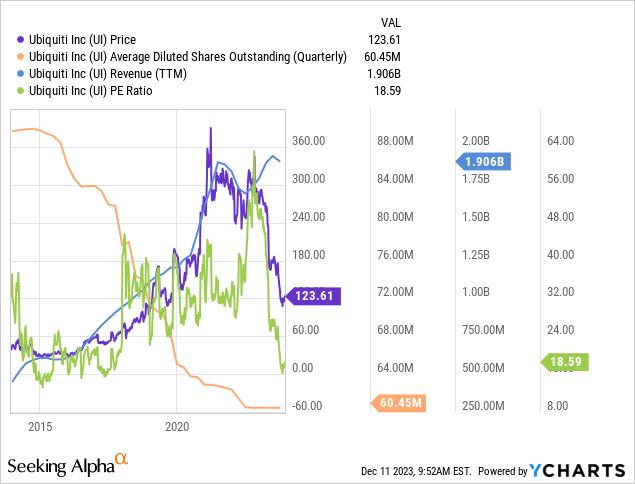

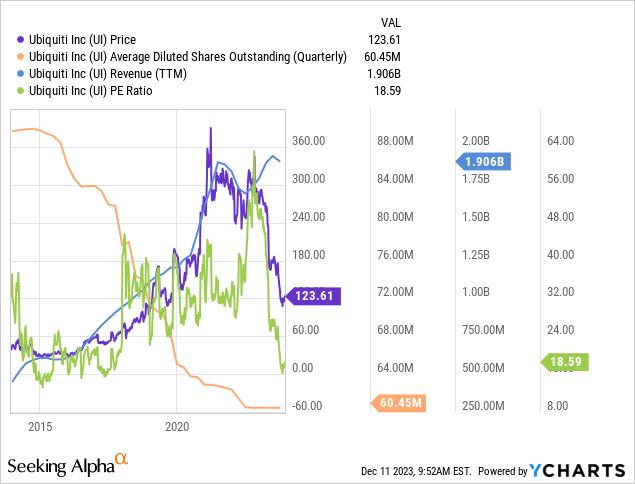

There are many examples of stock buybacks not saving the market, but for some reason, the first one that comes to mind is Ubiquiti Inc (UI). I’m not comparing AAPL and UI operationally at all, but rather using UI as an example of how the company’s valuation is contracting rapidly due to shrinking margins despite increasing sales and ongoing buybacks.

The Verdict

AAPL’s margins already look near all-time highs in a historical context, while the slowdown in demand that should have occurred in the second half of 2023 due to a decline in excess ‘COVID savings’ and as a result of tight monetary policy is still to come, in my view. But the market is pricing things in as if all these negative developments won’t happen at all, which sounds illogical (at least to me).

Apple is a great company that has earned its place as the most valuable company in corporate America (and the world as a whole). But everything has a price. AAPL stock doesn’t just look expensive from a traditional valuation metrics perspective, which could be explained by the high shareholder yield (buybacks + dividends). The stock is also overvalued in terms of the overall return that investors receive if they buy AAPL at the current price levels because instead of 2.5%, you can still get around twice that from treasury bonds today.

There are upside risks to my thesis, because if demand remains at the same level as today, Apple could more easily weather a difficult time for itself, and analysts’ expectations for FY2024 and beyond may even prove too pessimistic in their current form.

Nevertheless, I still see more risks than benefits for Apple’s share price in the medium term, even though I like the company as a long-term investment.

I confirm my previous rating of “Promote”.

Thanks for studying!