NurPhoto/NurPhoto by way of Getty Pictures

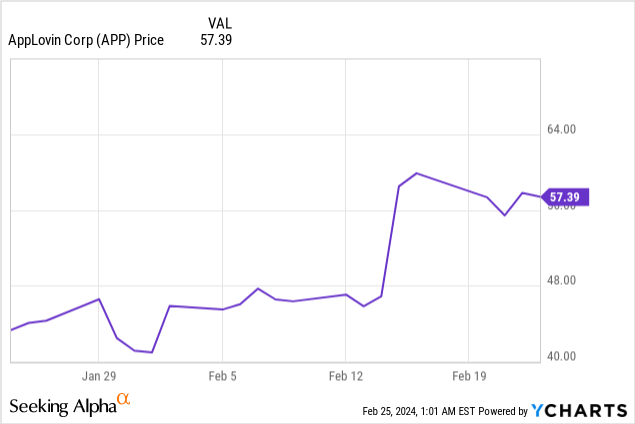

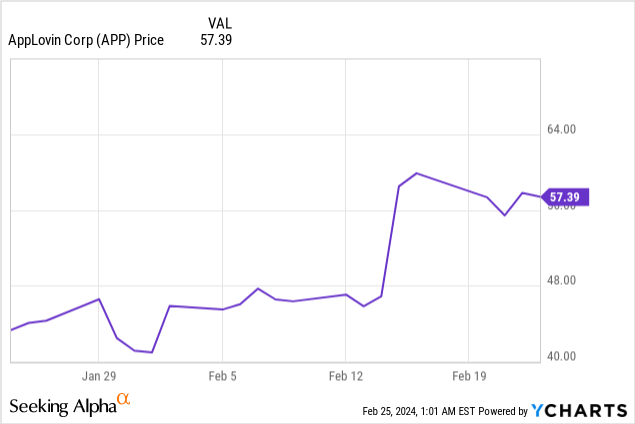

Investor sentiment in direction of AppLovin Company (APP) seems constructive after it reported fourth-quarter 2023 earnings on February 14, 2024, after the bell. Income was $25.23 million greater than analysts’ consensus expectations, and earnings beat expectations by $0.14. Moreover, the corporate’s free money movement (FCF) jumped considerably greater in 2023. The inventory rose 25% after reporting earnings, including to beneficial properties made earlier this 12 months and its 278% rise in 2023. Even after the inventory’s latest surge, the market could also be undervaluing the inventory in my opinion, and there might be extra potential upside.

AppLovin operates within the cellular app monetization area and efficiently leverages synthetic intelligence (AI), a rising theme attracting investor curiosity. This text will talk about what AppLovin does, the way it monetizes AI, its latest earnings report, a case for why the market could undervalue the inventory, a number of dangers, and why it could be a purchase for aggressive development traders even after its improbable rise.

What the corporate does

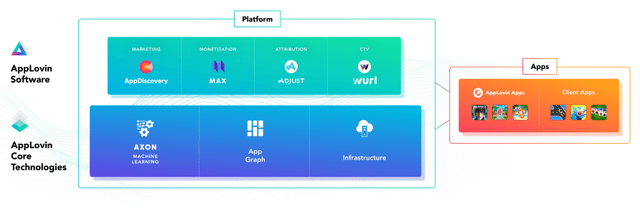

AppLovin supplies instruments and helps cellular app builders, particularly sport builders, get their apps found by customers, and it monetizes these apps for patrons primarily by promoting. AppLovin generates earnings primarily by appearing as a supply-side platform (SSP), representing publishers in programmatic advert auctions. The next picture visually represents the providers it provides builders (sport publishers).

AppLovin’s Core Applied sciences underlie and energy the software program and include the next:

- The Axon machine-learning or AI advice engine.

- The corporate’s proprietary App Graph.

- An elastic cloud infrastructure.

Core Applied sciences collects nameless information from tens of millions of units about what apps individuals use, when, and the way they work together with them. It catalogs and shops that info in a large map of cellular app utilization referred to as the App Graph. Each day, the App graph collects tens of millions of latest interactions. Axon acts like a super-intelligent librarian who finds the knowledge it wants on the App Graph and makes use of AI algorithms to grasp every consumer’s preferences and pursuits. Based mostly on this understanding, AXON picks essentially the most related promoting content material to indicate that consumer. AppLovin lately launched Axon 2.0, an improved model of the unique Axon.

The infrastructure is the “backbone” connecting the entire system. AppLovin’s infrastructure consists of a cloud computing system that may routinely spin up or wind down the computing sources wanted in response to adjustments within the large quantity of knowledge the system must course of. The a part of the platform on the above picture referred to as AppLovin’s Software program is a set of instruments that lies on prime of the cloud infrastructure that helps app builders promote and monetize their apps. These instruments embrace the next:

- AppDiscovery: This program is AppLovin’s advert community. It matches the forms of customers that advertisers search with customers on a writer’s app by a real-time advert public sale at huge scale and microsecond-level speeds. AppDiscovery makes use of the platform’s AXON machine-learning advice engine with predictive algorithms to assist builders match their apps to customers who usually tend to obtain them.

- Modify: AppLovin’s analytics platform helps cellular app entrepreneurs develop their companies by offering clever software program with automation for measuring and bettering promoting campaigns whereas protecting consumer information secure. Moreover, if a developer ever wants assist, the corporate has a world buyer assist workforce that’s responsive.

- MAX: The platform’s in-app programmatic advert bidding software program helps app builders (publishers) make more cash from their promoting stock by operating a real-time aggressive public sale that pulls extra competitors and better returns for publishers. Many builders that combine MAX have gained a measurable improve of their common income per every day energetic consumer over conventional monetization strategies. Plus, they will save a lot time by automating handbook monetization work by its superior characteristic set.

- Wurl: AppLovin acquired connected TV (CTV) platform Wurl in April 2022, which primarily distributes streaming video for content material firms and supplies instruments to maximise promoting income and entice customers. This platform is a comparatively new a part of the enterprise that administration believes has the potential to turn out to be a significant contributor to annual earnings.

- Array: This new product does not seem on the above picture as a result of administration began Array in Could 2023, after it produced the picture within the 2022 10-Okay launched in February 2023. Array is a collection of options for smartphone OEMs and telecom carriers to assist them monetize their app ecosystems on cellular units. This initiative could be very early, with Chinese language smartphone producer Oppo, the one firm with a press announcement stating that it makes use of AppLovin’s cellular app advice engine. Array is one other product that administration believes has the potential to turn out to be a significant contributor to annual income.

Up till lately, primarily gaming builders used the corporate’s platform. Nonetheless, now it plans on ramping up the identical providers for non-gaming apps. The non-gaming enterprise could take a while to develop, as non-gaming app builders must familiarize themselves with AppLovin.

Final, AppLovin owns Lion Studios, which manages a portfolio of over 350 free-to-play cellular video games throughout 5 genres. These gaming apps embody a mixture of AppLovin-owned and accomplice studios-developed video games and make the most of the AppLovin Software program Platform to market and monetize these apps. Earlier within the firm’s historical past, its Apps and the Software program Platform had a symbiotic relationship, the place the Software program Platform gave the Apps an financial benefit, and Lion Studios utilizing the Software program Platform helped the platform attain scale by 2022, in keeping with administration. AppLovin administration now believes the Software program Platform enterprise can stand independently and has contemplated divesting its App enterprise. It has already spun out one small indie app developer named Redemption Video games in March 2023. Administration states within the firm’s 2022 10-K:

Early in 2022, given the size reached by our Software program Platform options, particularly AppDiscovery and MAX, we decided we now not required entry to a first-party portfolio of Apps and due to this fact commenced a strategic evaluation of our Apps. We’re persevering with the optimization of our Apps portfolio and its value construction, specializing in find out how to greatest optimize every of these asset’s contribution to our total monetary efficiency. This evaluation has resulted within the divestiture or closure of sure studios, a discount of headcount, restructuring of earn out preparations, and different adjustments to our Apps portfolio, similar to restructuring of sure property or selecting to make adjustments to optimize the price construction of sure Apps quite than investing in income development.

Supply: AppLovin 2022 10-Okay

AppLovin has stored lots of its first-party gaming Apps because the finish of the fourth quarter of 2023. Administration will handle its App portfolio to supply a revenue as a substitute of promoting off all of the video games at current. Nonetheless, the corporate could restructure or promote the App property sooner or later. Buyers ought to preserve shut tabs on firm information releases for additional developments.

Administration believes its latest income development spurt because the center of final 12 months is because of the introduction of its Axon 2.0 AI engine within the second quarter of 2023, which has boosted income development. CEO Adam Foroughi stated on the corporate’s second quarter 2023 earnings name:

We would attribute the development in our platform actually 100% from the developments in our core expertise [Axon 2.0]. The improve made our platform much more correct for advertisers and permits us to actually monetize extra of a breadth of advertisers. So having the ability to do each issues enabled us to actually develop our enterprise on the again half of the quarter as we rolled out this expertise.

Supply: AppLovin Second Quarter 2023 Earnings Name Transcript.

AppLovin makes use of Axon 2.0 AI expertise in its advert community AppDiscovery and its advert bidding software program Max. Utilizing AI in programmatic promoting is at the moment among the many greatest methods to monetize AI expertise. The corporate’s latest monetary efficiency, mixed with AI being excessive on the checklist of investing themes in 2024, has attracted investor curiosity within the inventory. Let us take a look at the corporate’s newest quarter.

Fourth quarter 2023 earnings report

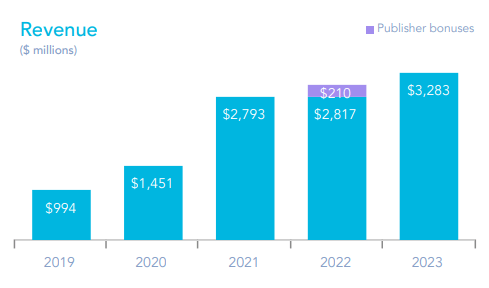

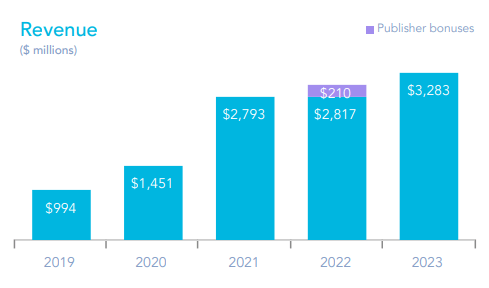

AppLovin produced complete income for the total 12 months 2023 of $3.3 billion, up 17% year-over-year.

AppLovin Fourth Quarter 2023 Shareholders Letter

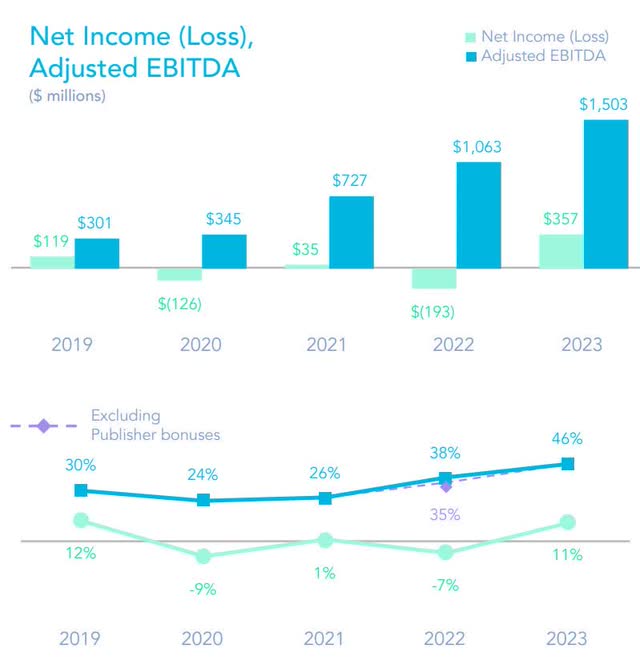

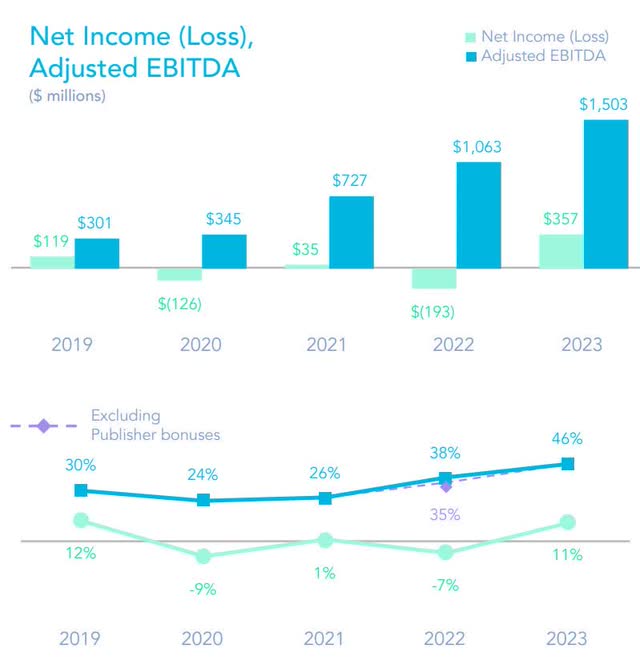

The corporate’s complete consolidated adjusted EBITDA was $476 million, up 83% year-over-year, with an Adjusted EBITDA margin of fifty%. AppLovin doubtless emphasizes EBITDA as a result of it is nonetheless a younger firm. EBITDA eliminates the impression of non-operating bills like taxes and curiosity on debt, permitting traders to deal with the corporate’s core profitability and future earnings potential. Over the past a number of years, the corporate hasn’t been persistently worthwhile on the web earnings line. Nonetheless, it did generate a web earnings of $357 million in 2023, with a web margin of 11% in comparison with a web lack of $193 million and a web margin of -7% in 2022. The chart beneath exhibits how the adjusted EBITDA margin has elevated by 1600 foundation factors over the previous 5 years, a constructive pattern.

AppLovin Fourth Quarter 2023 Shareholders Letter

The star of the present and the principle purpose that AppLovin maintained strong total income development and profitability in 2023 was the corporate’s Software program Platform phase. Proper originally of the fourth quarter 2023 earnings name, Chief Govt Officer (CEO) Adam Foroughi stated the following:

After a difficult 2022, characterised by stagnant development, we refocused on rising our current enterprise and investing in new initiatives. I’m immensely happy with our workforce’s dedication and laborious work, which has resulted in our software program platform income rising by 76% in 2023. Regardless of a challenged financial panorama and cellular gaming sector, we’ve got continued to develop. It is a clear testomony to the energy and potential of the updates we’ve got made to our AI promoting engine, AXON.

Supply: AppLovin Fourth Quarter 2023 Earnings Name Transcript.

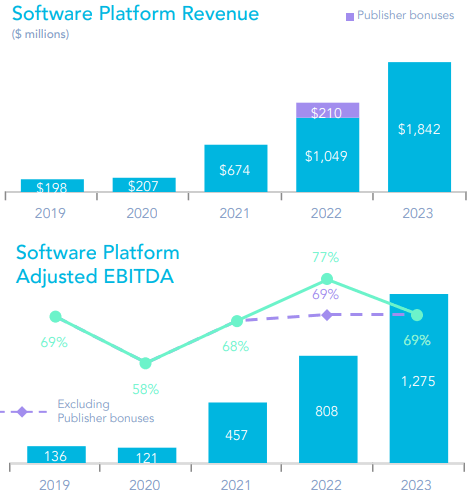

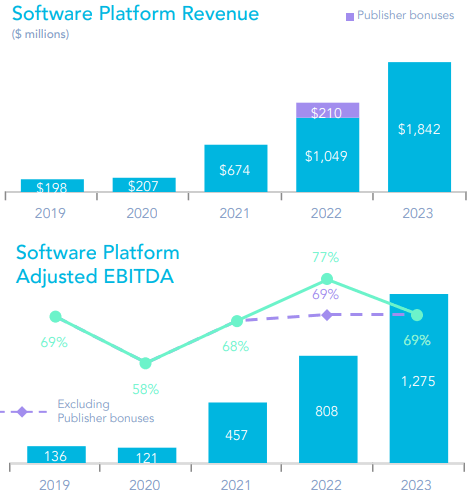

AppLovin has a historical past of manufacturing sturdy Software program Platform phase income development. It grew the Software program Platform phase’s annual income over 9 occasions over the previous 5 years. On the similar time, the phase maintained an approximate 70% Adjusted EBITDA (Earnings Earlier than Curiosity, Taxes, Depreciation, and Amortization) margin throughout that interval. The next picture exhibits AppLovin’s Software program Platform’s historic annual income and adjusted EBITDA over the past 5 years.

AppLovin Fourth Quarter 2023 Shareholder Letter.

In distinction, the corporate’s 2023 Apps phase income declined 18% from the earlier 12 months’s comparable quarter to $1.4 billion. The poor financial system and a downturn within the gaming phase have been partially chargeable for the decline. The opposite purpose for the income decline is that the corporate modified its focus from development within the App phase to sustaining profitability. Consequently, administration lowered its studio footprint and consumer acquisition spending in 2023.

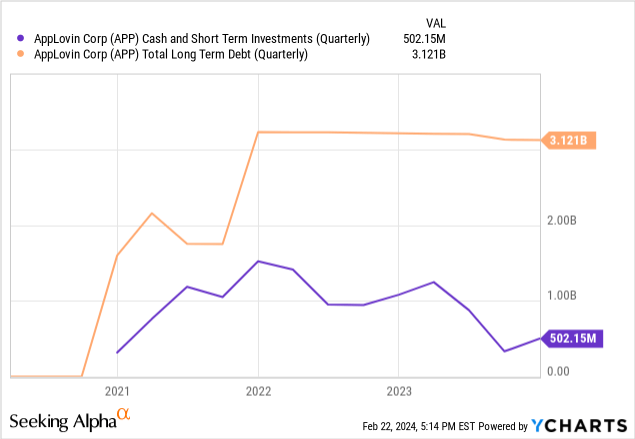

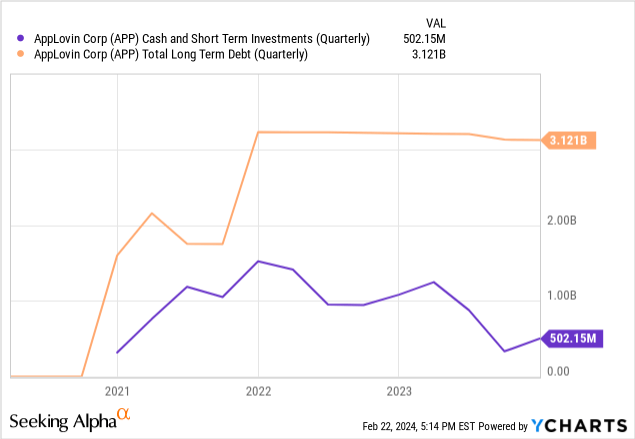

Let us take a look at the corporate’s monetary well being. AppLovin has $502 million in money versus $3.1 billion. It has a debt-to-equity (D/E) ratio of two.48. An organization with a D/E over 2.0 means over two-thirds of its capital financing comes from debt — an organization with excessive leverage. Though a D/E of over 2.0 doesn’t suggest the corporate is in monetary hazard, the corporate’s total monetary situation warrants shut monitoring in future quarters. AppLovin has a fast ratio of 1.71, that means the corporate pays its short-term obligations. It has a debt-to-EBITDA ratio of two.15, indicating the corporate has reasonable threat in its potential to repay its money owed. The corporate’s curiosity protection within the fourth quarter was 3.77, indicating it may pay the curiosity on its debt.

The corporate’s Chief Monetary Officer (CFO) Matt Stumpf stated through the fourth quarter earnings name about its debt:

Through the 12 months, we prolonged the maturity of our time period mortgage to 2030. On the similar time, decreasing our rate of interest to proceed to handle our ongoing prices.

Supply: AppLovin Fourth Quarter 2023 Earnings Name Transcript.

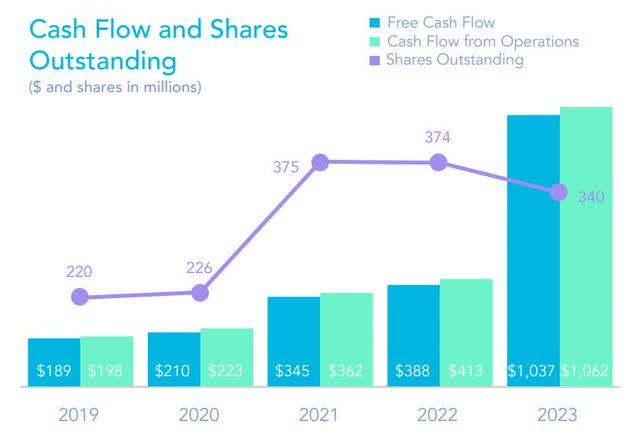

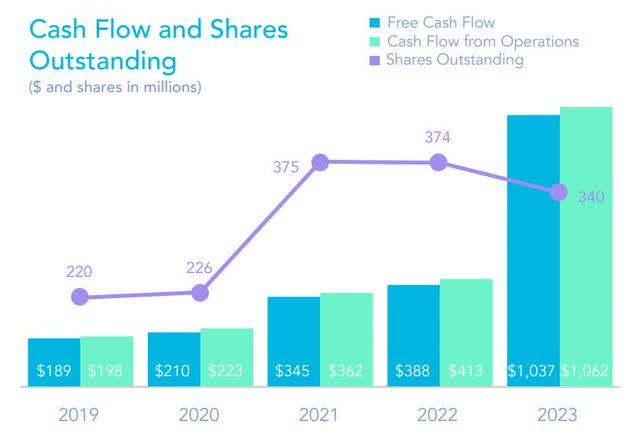

AppLovin exhibits the advantages of getting an asset-light enterprise mannequin and scale by producing a sturdy 2023 FCF of $1.06 billion, 69% of its adjusted EBITDA of $1.5 billion. The corporate’s objective is to retain 70% of adjusted EBITDA as FCF yearly, with the qualification that the quarterly proportion could differ on account of adjustments in working capital and tax funds. FCF margin was a strong 32.6%.

AppLovin Fourth Quarter 2023 Shareholder Letter.

AppLovin CEO Adam Foroughi stated concerning the firm’s EBITDA margin and FCF on the fourth quarter earnings name:

And as you take a look at that software program phase, there’s not lots of software program companies with 70% plus EBITDA margin rising on the price that’s, I imply, rule of 140, 150 or no matter. And so, it is simply an astounding quantity. After which we convert a really excessive proportion of that EBITDA to money movement as properly. So we predict as a result of the applied sciences are new, it’s going to take some time for traders to grasp what we already see, which isn’t solely is that this very highly effective expertise in our core market, we have been in a position to develop a lot better than the market is rising as a result of this expertise is environment friendly.

Supply: AppLovin Fourth Quarter 2023 Earnings Name Transcript.

In 2023, the corporate repurchased 54.3 million shares, decreasing the whole shares excellent by 10%. AppLovin plans to proceed to make use of a few of its FCF to repurchase shares transferring ahead. CFO Matt Stumpf stated through the earnings name:

Via the mixture of free money movement technology and share administration, we hope to proceed to generate important long-term worth for our current and our new shareholders. Our Board has additionally permitted a rise in our share repurchase authorization by $1.25 billion. We plan to make use of this to proceed to handle our excellent shares.

Supply: AppLovin Fourth Quarter 2023 Earnings Name Transcript.

Administration gave first-quarter 2024 income steering for $955 million and $975 million, above analysts’ consensus estimates of $923.8 million. The corporate forecasts that the primary quarter of 2024 adjusted EBITDA shall be within the vary of $475 million to $495 million, implying an adjusted EBITDA margin of between 50% and 51%.

Dangers

The corporate faces fierce competitors from different firms specializing in serving to sport builders monetize their apps. Based on the corporate 6Sense, AppLovin solely has a 6.04% market share in cellular advert applied sciences and is just the fourth largest cellular advert community.

| Know-how | Market Share (Est.) | Prospects |

| URX | 50.75% | 3,204 |

| Alphabet’s (GOOGL) (GOOG) Google AdMob | 10.87% | 686 |

| Mobusi | 7.32% | 462 |

| AppLovin | 6.04% | 381 |

| Chartboost | 4.06% | 256 |

| Others | 20.97% | 1,324 |

Supply: Information from 6Sense

Nonetheless, the above checklist solely encompasses cellular advert community market share. The checklist fails to incorporate many different issues that AppLovin focuses on, similar to programmatic advert bidding software program, analytics, consumer acquisition providers, and Lion Studios, which helps builders publish and market their video games. The corporate’s most direct competitor with comparable providers is perhaps Unity Software program (U), particularly after Unity bought ironSource in November 2022. Different important rivals embrace Meta Platform (META) and Amazon (AMZN). The corporate additionally competes towards SSPs with broader focuses exterior of gaming, like Magnite (MGNI) and PubMatic (PUBM). If AppLovin fails to innovate quick sufficient and sustain with the technological improvements of its rivals, its market share and profitability might shrink.

One other threat traders should take note of is administration’s potential to seek out and retain certified expertise. The cellular app business is quickly increasing, with quite a few firms looking for staff with comparable talent units in areas like AI, promoting expertise, and information evaluation. AppLovin faces a ton of competitors to seek out certified staff in the identical expertise pool that bigger firms like Google, Meta, and Amazon may also be fishing in, making discovering and hiring the most effective candidates difficult. As an example, there’s a talent shortage for AI builders and engineers. AppLovin wants to rent sufficient certified individuals with AI experience, or it could ultimately be unable to compete successfully.

Subsequent, AppLovin’s enterprise fortunes rely extremely on entry to the 2 most dominant cellular platforms: Android and iOS. Adjustments to the Apple App Retailer or the Google Play Retailer’s insurance policies and practices, together with insurance policies surrounding Apple’s Identifier for Advertisers (“IDFA”), might limit AppLovin’s entry to these platforms, making it more durable to promote or distribute merchandise — a major threat. Moreover, governmental businesses have a say about what occurs on Android and iOS and will create laws that assist or harm AppLovin. It could be in traders’ greatest pursuits to concentrate to this threat.

Lastly, this firm is within the early levels. AppLovin grew annual FCF 168% year-over-year with 32% FCF margins in 2023. Moreover, it has spectacular EBITDA margins. Current rivals and potential adversaries have doubtless seen the corporate’s efficiency. The corporate’s sturdy margins and FCF development over the past 12 months might entice much more competitors to the area. For my part, the corporate does not have a lot of a moat, and it’s unsure if its superior AI can present a differentiating think about serving to it keep market share.

Valuation

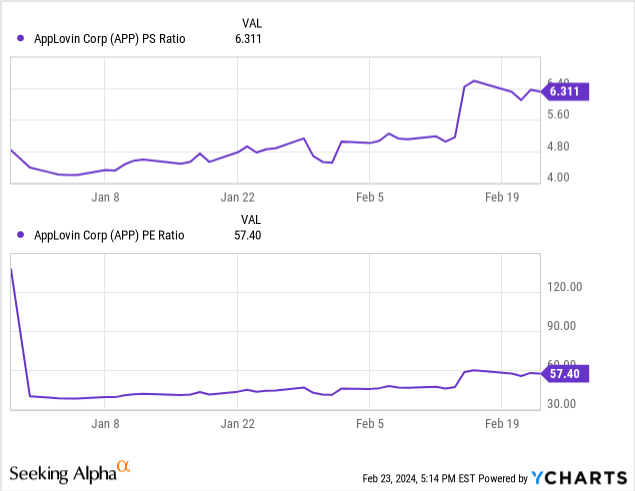

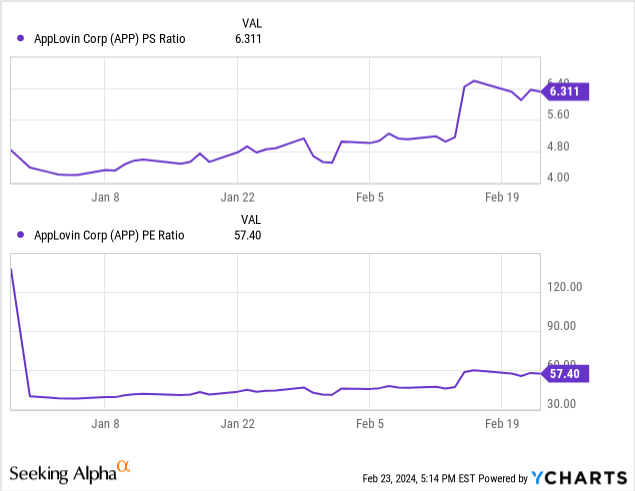

By traditional price-to-sales (P/S) and price-to-earnings (P/E) ratios, the market seems to be prefer it overvalues AppLovin’s inventory. The inventory trades at a P/S ratio of 6.31 versus a sector median P/S ratio of two.93 and a P/E ratio of 57.40 versus a sector median P/E ratio of 29.18. The market could overvalue the corporate’s gross sales and earnings-per-share (“EPS”) over the trailing 12 months.

Nonetheless, the above valuation metrics are backwards-looking. Let us take a look at a number of forward-looking valuation metrics. The inventory trades at a ahead P/E ratio of 23.67, beneath the sector median ahead P/E ratio of 27.70. Suppose the inventory have been to promote at its sector median P/E ratio; the implied inventory worth could be $67, round 17% upside. The typical analyst worth goal for AppLovin shares is $62.38, with solely an 8.7% upside, in keeping with Seeking Alpha. Due to this fact, you could possibly make the case that the market undervalues the inventory by wherever from 9% to 17% as of the closing inventory worth on February 24, 2024. Based on Yahoo Finance, its 5-year ahead price-to-earnings-to-Progress (PEG) Ratio is 0.76 — an indication that the market probably undervalues AppLovin’s anticipated EPS development over the following 5 years. Additionally, traders have historically thought-about PEG valuations underneath 1.0 an indication of an undervalued inventory.

Let us take a look at AppLovin’s reverse DCF to find out what FCF development price the present inventory worth assumes.

Reverse DCF

|

The third quarter of FY 2024 reported Free Money Circulation TTM (Trailing 12 months in tens of millions) |

$1037 |

| Terminal development price | 2% |

| Low cost Price | 11.5% |

| Years 1 – 10 development price | 10% |

| Present Inventory Value (February 23, 2024, closing worth) | $57.39 |

| Terminal FCF worth | $2.744 billion |

| Discounted Terminal Worth | $9.724 billion |

Often, I give most shares a reduction price of ten. Nonetheless, due to the corporate’s excessive D/E ratio, debt might turn out to be a difficulty if development stalls for any purpose (poor execution, competitors, macro financial system). The corporate at the moment engages in inventory buybacks, and administration could also be wiser to spend that FCF paying down debt or investing in Analysis and Improvement at this stage of the corporate’s development. Due to this fact, I give this inventory a reduction price of 11.5% to mirror some debt threat. With the above figures, AppLovin would solely should develop FCF by 10% over the following ten years. An FCF development price of 10% over the following ten years might be greater than achievable should you imagine the corporate is an rising FCF machine. The market could also be undervaluing AppLovin’s potential FCF development over the following ten years in my view.

Why AppLovin is a purchase

Though AppLovin won’t have a transparent reduce moat right now, its diversified product portfolio, international attain, rising scale, and deal with innovation make it a formidable firm that rivals could discover difficult to take share from or dent its margins.

This inventory is a high-risk, high-reward funding. You could need to keep away from the inventory in case you are a risk-averse investor. Nonetheless, in case you are an investor prepared to simply accept some threat for an opportunity to attain a probably excessive upside, take into account an funding in AppLovin. I price the inventory a purchase for aggressive development traders.