Within the final three weeks, we have seen market gamers transfer to aggressively worth in price cuts by main central banks. However this week, we lastly get to see policymakers reply again to what they consider the market strikes and whether or not or not they agree with the outlook. In different phrases, will we be seeing central banks push again towards the market pricing?

The largest one to observe is in fact the Fed. The pricing now reveals that the primary price reduce is baked in for Could subsequent 12 months. Sooner or later final week, merchants have been even contemplating pushing that as much as as early as March. However after the US jobs report on Friday, we’ve seen these expectations get tempered down.

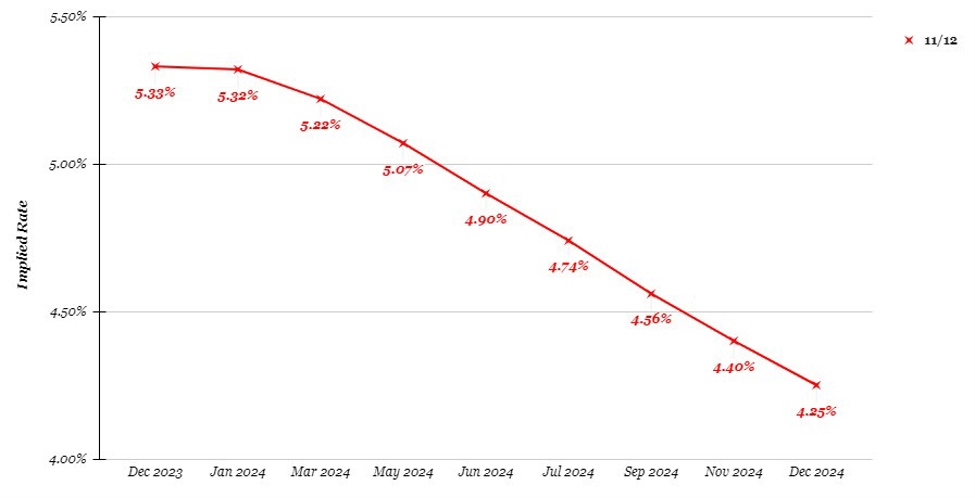

That being stated, there’s nonetheless roughly 108 bps value of price cuts priced in for subsequent 12 months for the Fed. Is that an excessive amount of? Here is a have a look at the Fed funds futures curve.

At this stage, it is secure to say that the Fed is finished with price hikes already. However how shortly are they going to pivot and kick begin the narrative of reducing charges? I’d say this month is one that’s nonetheless to quickly, particularly because the inflation outlook is just simply beginning to look pretty convincing during the last one month or so.

So, it might be a case that market gamers are hoping for central banks to ship a change within the narrative somewhat too early. In that case, they could be arrange for some disappointment this week if policymakers select to stay with the established order to wrap up the 12 months.

That’s not to say that the present pricing is totally unfounded. Nevertheless, maybe there’s a scope for a pullback this week after the overly aggressive strikes currently.