primeimages/iStock via Getty Images

|

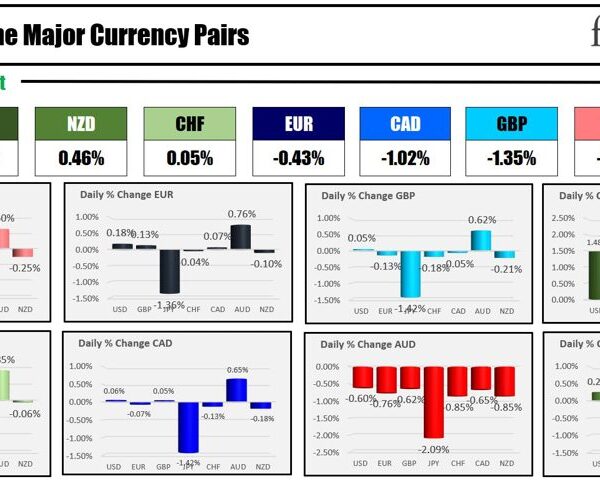

Performance (%) as of March 31, 2024 |

Annualized |

|||||

|

Name |

QTR |

1-Year |

3-Year |

5-Year |

10-Year |

Since Inception |

|

Ariel Fund |

11/06/1986 |

|||||

|

MUTF:ARGFX Investor Class |

6.41 |

15.55 |

2.96 |

8.76 |

8.31 |

10.78 |

|

MUTF:ARAIX Institutional Class |

6.48 |

15.87 |

3.28 |

9.09 |

8.64 |

10.89 |

|

Russell 2500™ Value Index |

6.07 |

21.33 |

5.36 |

9.37 |

7.68 |

10.70 |

|

Russell 2500™ Index |

6.92 |

21.43 |

2.97 |

9.90 |

8.84 |

10.54 |

|

S&P 500® Index |

10.56 |

29.88 |

11.49 |

15.04 |

12.96 |

10.94 |

|

Ariel Appreciation Fund |

12/01/1989 |

|||||

|

MUTF:CAAPX Investor Class |

4.06 |

13.16 |

3.14 |

7.98 |

6.84 |

10.03 |

|

MUTF:CAAIX Institutional Class |

4.13 |

13.51 |

3.45 |

8.32 |

7.18 |

10.16 |

|

Russell Midcap® Value Index |

8.23 |

20.40 |

6.80 |

9.93 |

8.57 |

10.97 |

|

Russell Midcap® Index |

8.60 |

22.35 |

6.06 |

11.09 |

9.95 |

11.16 |

|

S&P 500® Index |

10.56 |

29.88 |

11.49 |

15.04 |

12.96 |

10.46 |

|

Past performance is not indicative of future results. An investment’s return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data as of the most recent month-end may be obtained by visiting our website, Ariel Investments. |

Dear Clients and Friends

Stocks continued the barnburner rally that started last October with the S&P 500 (SP500, SPX) posting its best first quarter in 5 years. In the process, the world-beating tech giants dubbed the Magnificent Seven morphed into the “Fab Four.” (This frenzy is for Artificial Intelligence, not the Beatles.) Amazon.com, Inc. (AMZN), Meta Platforms, Inc. (META), Microsoft Corporation (MSFT) and Nvidia Corporation (NVDA), ultimately accounted for half of the S&P 500’s gains and helped drive the index “to 22 all-time closing highs” in just three months.[1]

Still, it was a broad-based rally, with every sector of the S&P 500 managing positive returns except Real Estate. The backdrop of a solid economy, low unemployment and diminishing inflation put investors in an ebullient mood and stocks showed it. With no signs of a recession in sight, Wall Street cheered a soft economic landing and eagerly awaited a series of interest rate cuts. Although large cap stocks dominated, small- and mid-cap issues rose too-albeit much less dramatically. Despite their more muted returns, smaller companies continue to represent the greatest value in the U.S.

During the quarter, Ariel Fund beat its value peers but slightly underperformed its core benchmark, while Ariel Appreciation Fund fell short on both counts. In physics, Sir Isaac Newton’s First Law of Motion tells us that “an object at rest, stays at rest and an object in motion, stays in motion . . . unless acted upon by an unbalanced force.”[2] Such has been the case with momentum as the most pronounced factor driving stock market returns of late. Simply put, stocks that have gone up, go up more as investors pile in and create a self-fulfilling prophecy. Practically everything else gets less attention while valuation gaps grow, making the most overlooked investment opportunities even more compelling. In the absence of the highly anticipated rate cuts and a stronger than expected economy, higher for longer interest rates could be the “unbalanced force” that suddenly changes this trajectory. In the meantime, we continue to be actively patient as we hold high quality businesses with strong brands and franchises that have low capital reinvestment requirements and trade at discounts to our private market value estimates.

The Troubling Paramount Saga

On occasion, our conviction around one holding runs so high and the value gap becomes so extreme that we buy it across our portfolios. Such is the case with Paramount Global (PARA)-a name that has detracted from our returns-especially in recent weeks. It is increasingly rare to experience something for the first time after investing for more than four decades. The recent dramatic devaluation of Paramount Global shares as a result of market concerns surrounding an unconventional sale process is a situation we have never seen before.

On April 3rd, The Wall Street Journal reported Paramount had entered an exclusive 30-day negotiation with Skydance Media for control of the company. Days later, they also reported this potential combination was predicated on Board Chair, Shari Redstone’s sale of National Amusements, Inc. (NAI) to Skydance and a subsequent merger of Paramount and Skydance-with Skydance assuming control. To put this highly unusual transaction in context, there are approximately 40.7 million Class A shares trading on the open market-most of which are owned by Redstone’s National Amusement. Indeed, through NAI, Shari Redstone controls Paramount, although her shares represent less than 10% of the company’s economic value. Meanwhile, 611.8 million Class B non-voting shares are held by investors like Ariel that would ultimately be diluted if the Paramount/Skydance/NAI transaction is approved. In our view, it is unacceptable for one controlling shareholder to benefit at the expense of all others.

Paramount is a company we have owned in various iterations (i.e., formerly CBS Corporation, formerly Viacom Inc., formerly ViacomCBS Inc.) since 2006. As we were amassing our early positions, we participated in a block trade for shares made available when Shari’s father, the now deceased majority owner, Sumner Redstone, was squeezed by a margin call during the financial crisis.

Since then, as the stock has ebbed and flowed, we traded the name opportunistically and often successfully. We were aggressive buyers when we felt the shares were significantly undervalued; we scaled back when they grew to approach our private market value estimate. Over the years, famed media investor, Mario Gabelli, and other value investing greats have owned this name.

Last year, when discussing our position following a lackluster earnings report and subsequent dividend cut, we wrote, “In our view, Paramount’s long-term opportunity in streaming, joined with the value of its proprietary content, remain meaningfully underappreciated at current trading levels.” That one sentence captured our strong conviction in the underlying fundamentals of the company. Earlier this month, we continued to express a high degree of confidence in that view in both our public comments and in discussions with our investors. When a stock trades down, and our investment outlook has not materially changed, the investment becomes more attractive. As such, we even added to our position.

Based on Paramount’s own statements and representations, we believe its shares are significantly undervalued today. In fact, the company’s comments regarding long-term value potential are squarely at odds with a transaction that would materially dilute all but one shareholder. Prior to recent rumors, management consistently underscored Paramount’s growth trajectory. When the company reported better-than-expected earnings on its February conference call, our confidence in Paramount’s future grew as a direct result of the numbers as well as management’s forward-looking statements. On that call, the company provided guidance “for profitable growth in 2024 and beyond.” They also told investors to expect “domestic Paramount+ profitability in 2025”-which they deemed “a significant milestone.” Toward the end of the call, CEO Bob Bakish said the company was positioned for “significant total company’s earnings growth this year.” Further, when asked for an update on transaction discussions, Mr. Bakish re-affirmed Paramount’s ongoing priority to always seek and create shareholder value, emphatically stating: “And to be clear, that’s for all shareholders.”

Very recently, we have openly expressed our concerns about merger talks, which may be sidestepping competitive bidding in favor of an exclusive discussion, which we view to be averse to the company’s fair market value. Still, we believed the knowledgeable, experienced and independent members of the Paramount board of directors-whom we hold in high regard-would appropriately execute their fiduciary duties by ensuring any transaction would reflect fair market value to the benefit of all shareholders, including our separate account and mutual fund clients.

Instead, we were surprised by the April 11th announcement of a planned reduction in the size of the board and the pending departure of four directors-three of whom are independent. This timing was particularly disturbing given the falling share price. The lack of explanation or context in the company’s proxy filing regarding these changes alarmed us, too. In the absence of any company-issued information regarding the merger, the reasons for the upcoming director departures or the board downsizing, we believed it was our fiduciary duty to publicly share our concerns.

Although we remain troubled by the company’s silence, we never sell into chaos. When we evaluate any name, we consider the investment potential from today-not yesterday, last week, last month or last year. For now, we are comfortable holding Paramount because the underlying value of the company’s content and studio assets are worth far more than its recent share price. Unconfirmed accounts that some substantial bidders have recently surfaced only reinforce our view.

Governance Clarity and Competitive Bidding

Just as we hold ourselves to the highest standards of duty and care, we expect Paramount leadership to do the same. To that end, we have urged Paramount to explain the recent governance changes which will be followed for the evaluation and approval of any strategic transaction. Additionally, the company should ensure the governing body designated to approve any merger is fully and substantively independent and can fulfill its requirements and fiduciary duties in accordance with Delaware law. Not doing so would deeply harm Paramount as well as shareholders like us who firmly believe in the company’s underlying value. We also strongly urged the board to ensure that any transaction is focused on realizing the company’s existing and long-term value and does not merely grant a premium to a single controlling shareholder. If rumors are true, the litigation that will ensue against Paramount and its leadership will be materially detrimental to the value of the company. To this last point, investors should not have to rely on rumors, speculation and the media to consider such serious corporate dealings. Transparent corporate filings and statements would end the obfuscation that is whipsawing the stock.

We have also respectfully requested that the board allow for a competitive bidding process that would maximize the value of all assets for the benefit of all shareholders. Given the diminished Class B share price, it is clear to us that the market does not believe an exclusive deal with the currently proposed party will be good for all shareholders. Usually, when merger transactions are announced, the shares find some equilibrium between the beginning price and the speculated ending price. With the stock having touched new lows, Paramount’s investors are voting with their feet. The lack of disclosures, questions surrounding board governance and company leadership as well as anticipation related to dilution from the rumored transaction have caused a repricing of the stock.

Patient Consideration

At Ariel, our patient investment philosophy resists knee-jerk reactions. Still, we diligently and continually assess changing conditions. We are concerned about the changing conditions at Paramount and do not believe the company should rush any merger, particularly under an exclusivity deal and with a controlling premium.

Instead, the company and board have a fiduciary duty and obligation to take the time needed to seek the right deal with the right partners at a price that will drive long-term success for all.

We will continue to closely monitor this unusual situation. While not activist investors, we will advocate for a good outcome at Paramount for our clients and mutual fund shareholders.

Portfolio Comings and Goings

During the first quarter, Ariel Fund had no new purchases. However, once shares of tool innovator, Snap-on Incorporated (SNA), successfully reached our private market value estimate, we exited the position in Ariel Fund and its sibling, Ariel Appreciation Fund.

In Ariel Appreciation Fund, we bought shares in Bio-Rad Laboratories Inc. (BIO) which manufacturers laboratory equipment and performs biological testing. Bio-Rad has been a long-time holding in other Ariel strategies and is a name we know well. The company offers innovative products in a growing global marketplace and 80% of its sales are derived from products where it leads in market share.

As always, we appreciate your consideration, and welcome any questions you might have.

Sincerely,

John W. Rogers, Chairman and Co-CEO

Jr. Mellody Hobson, Co-CEO and President

P.S. On April 29th, Paramount Global announced its first quarter earnings-which beat expectations as the company stems losses at its Paramount+ streaming platform. It is highly unusual for us to comment on a routine earnings call, but we felt compelled to do so given the information that was provided. While the earnings beat was encouraging, our already serious misgivings were heightened by the announced departure of CEO, Bob Bakish, during such a tumultuous time for the company. In his place, Paramount has formed a three-person Office of the CEO. Without a clearly accountable leader, the haphazard appointment of three divisional CEOs feels like no CEO from our vantage point. Recently, we have written directly to Paramount’s independent directors to express our significant concerns and to impress upon them their responsibilities to uphold their fiduciary duty.

|

Investing in small- and mid-cap companies is riskier and more volatile than investing in large-cap companies. The intrinsic value of the stocks in which the Funds invest may never be recognized by the broader market. The Funds are often concentrated in fewer sectors than their benchmarks, and their performance may suffer if these sectors underperform the overall stock market. Investing in equity stocks is risky and subject to the volatility of the markets. Per the Ariel Fund’s Prospectus as of February 1, 2024, the Investor Class and Institutional Class had an annual expense ratio of 0.99% and 0.68% respectively. Per the Ariel Appreciation Fund’s Prospectus as of February 1, 2024, the Investor Class and Institutional Class had an annual expense ratio of 1.13% and 0.82%, respectively. The opinions expressed are current as of the date of this commentary but are subject to change. The information provided in this commentary does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security. There is no guarantee that any expressed views will come to fruition or any investment will perform as described. As of 3/31/24, Ariel Fund’s position size, if any, in the above holdings was Paramount Global, Class B 3.28%; Paramount Global, Class A 0.00%; Snap-on, Inc. 0.00% and Bio-Rad Laboratories 0.00%. As of 3/31/24, Ariel Appreciation Fund’s position size, if any, in the above holdings was Bio-Rad Laboratories, Inc. 1.10%; Paramount Global, Class B 0.97%; Paramount Global, Class A 0.00% and Snap-on, Inc. 0.00%. Index returns reflect the reinvestment of income and other earnings. Indexes are unmanaged, and investors cannot invest directly in an index. The Russell 2500™ Value Index measures the performance of the small to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500 companies with relatively lower price-to-book ratios, lower forecasted growth values and lower sales per share historical growth. Its inception date is July 1, 1995. The Russell 2500™ Index measures the performance of the small to mid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500 Index is a subset of the Russell 3000® Index. It includes approximately 2500 of the smallest securities based on a combination of their market cap and current index membership. Its inception date is June 1, 1990. The Russell Midcap® Value Index measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap Index companies with lower price-to-book ratios, lower forecasted growth values, and lower sales per share historical growth. Its inception date is February 1, 1995. The Russell Midcap® Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. Its inception date is November 1, 1991. Russell® is a trademark of the London Stock Exchange Group, which is the source and owner of the Russell Indexes’ trademarks, service marks and copyrights. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes or underlying data and no party may rely on any Russell Indexes and/or underlying data contained in this communication. No further distribution of Russell data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. The S&P 500® Index is widely regarded as the best gauge of large-cap U.S. equities. It includes 500 leading companies and covers approximately 80% of available U.S. market capitalization. Its inception date is March 4, 1957. Investors should consider carefully the investment objectives, risks, and charges and expenses before investing. For a current prospectus or summary prospectus which contains this and other information about the funds offered by Ariel Investment Trust, call us at 800- 292-7435 or visit our website, Ariel Investments. Please read the prospectus or summary prospectus carefully before investing. Distributed by Ariel Distributors LLC, a wholly-owned subsidiary of Ariel Investments LLC. Ariel Distributors, LLC is a member of the Securities Investor Protection Corporation. [1] Mao, Hannah. “Wall Street’s Magnificent Seven Narrows to Become the Fab Four.” The Wall Street Journal. April 1, 2024. Page A1. [2] Newton, I., Motte, A. & Chittenden, N.W. (1848) Newton’s Principia: The Mathematical Principles of Natural Philosophy. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.