BlackJack3D

Markets Evaluate

The U.S. fairness market rebounded, because the S&P 500 Index (SP500, SPX) rose 11.69% through the interval. Concurrently, the Bloomberg U.S. Mixture Bond Index rallied, rising 6.82% for the quarter. By way of fashion, the Russell 1000 Worth Index underperformed its development counterpart by 4.66%.

|

Sources: CAPS CompositeHubTM, Bloomberg Previous efficiency will not be indicative of future outcomes. Aristotle Atlantic Focus Progress Composite returns are introduced gross and internet of funding advisory charges and embody the reinvestment of all earnings. Gross returns will likely be lowered by charges and different bills which may be incurred within the administration of the account. Internet returns are introduced internet of precise funding advisory charges and after the deduction of all buying and selling bills. Aristotle Atlantic Composite returns are preliminary pending remaining account reconciliation. Please see necessary disclosures on the finish of this doc. |

Good points have been broad-based, as ten out of the eleven sectors throughout the Russell 1000 Progress Index completed increased. Actual Property, Utilities and Info Expertise have been the best-performing sectors. In the meantime, Vitality was the one sector to complete within the pink, whereas Shopper Staples and Well being Care gained the least.

Knowledge launched through the interval confirmed that the U.S. economic system had accelerated within the third quarter, with actual GDP rising at an annual price of 4.9%-the quickest tempo of development in almost two years. The sturdy outcomes have been pushed by will increase in shopper spending and stock funding. Moreover, single-family housing begins rose 18% month-over-month in November, and the labor market remained tight with 3.7% unemployment. In the meantime, inflation continued its downward pattern, because the annual CPI fell from 3.7% in September to three.1% in November. The drop was primarily pushed by softening vitality costs, as each WTI and Brent fell under $80 a barrel. These developments mixed to ship longer-term rates of interest decrease, with the 10-year U.S. Treasury yield falling over 70 foundation factors through the quarter to complete at 3.88%.

Because of easing inflation, mixed with probably slowing financial exercise and a robust however moderating job market, the Federal Reserve (‘Fed’) held the benchmark federal funds price regular through the quarter. Chair Jerome Powell acknowledged that the central financial institution’s coverage price is probably going at or close to its peak for the present tightening cycle, whereas the Federal Open Market Committee members’ median estimates point out three quarter-point cuts in 2024.

On the company earnings entrance, outcomes have been sturdy, as 82% of S&P 500 firms exceeded EPS estimates, resulting in 4.7% development in earnings for the Index. Trying ahead, analysts anticipate earnings to speed up in 2024, with development of 11.5% year-over-year.

Lastly, in U.S. politics, after backing a bipartisan stopgap funding invoice to stave off a partial authorities shutdown, Congressman Kevin McCarthy was eliminated as speaker of america Home of Representatives. This marked the primary time in American historical past {that a} speaker of the Home was ousted by a movement to vacate. Subsequently, Congressman Mike Johnson was elected as McCarthy’s alternative.

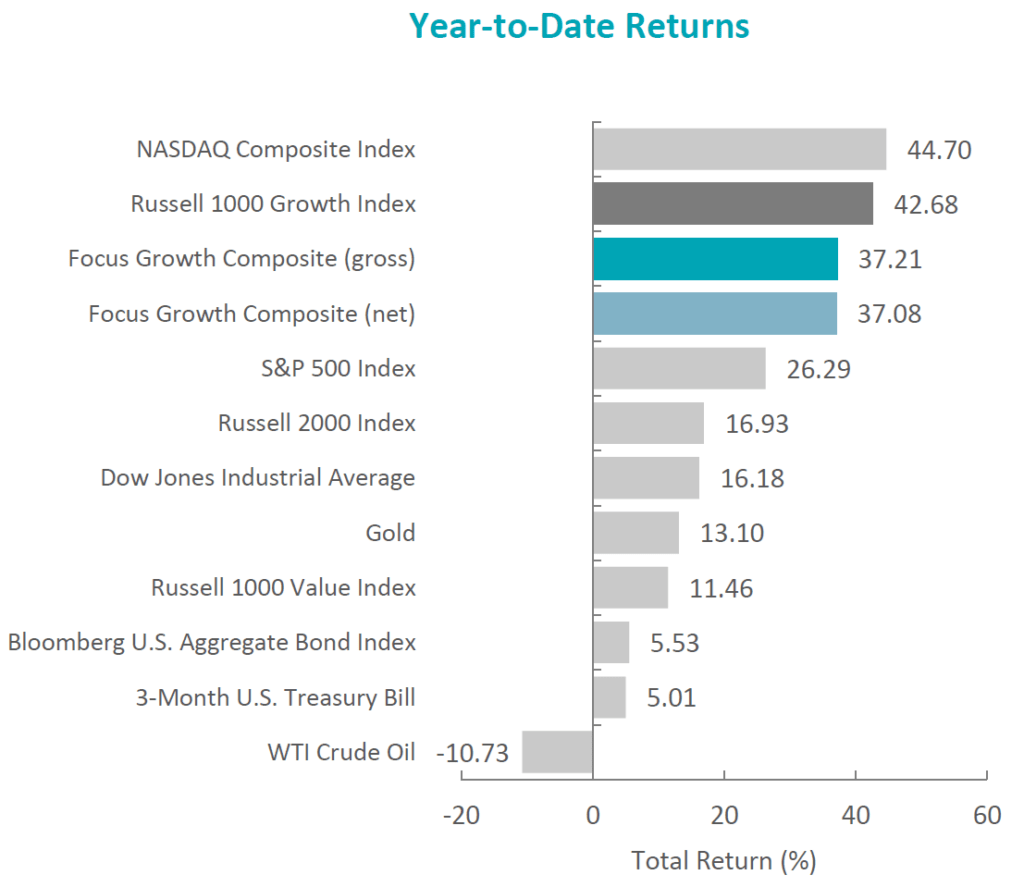

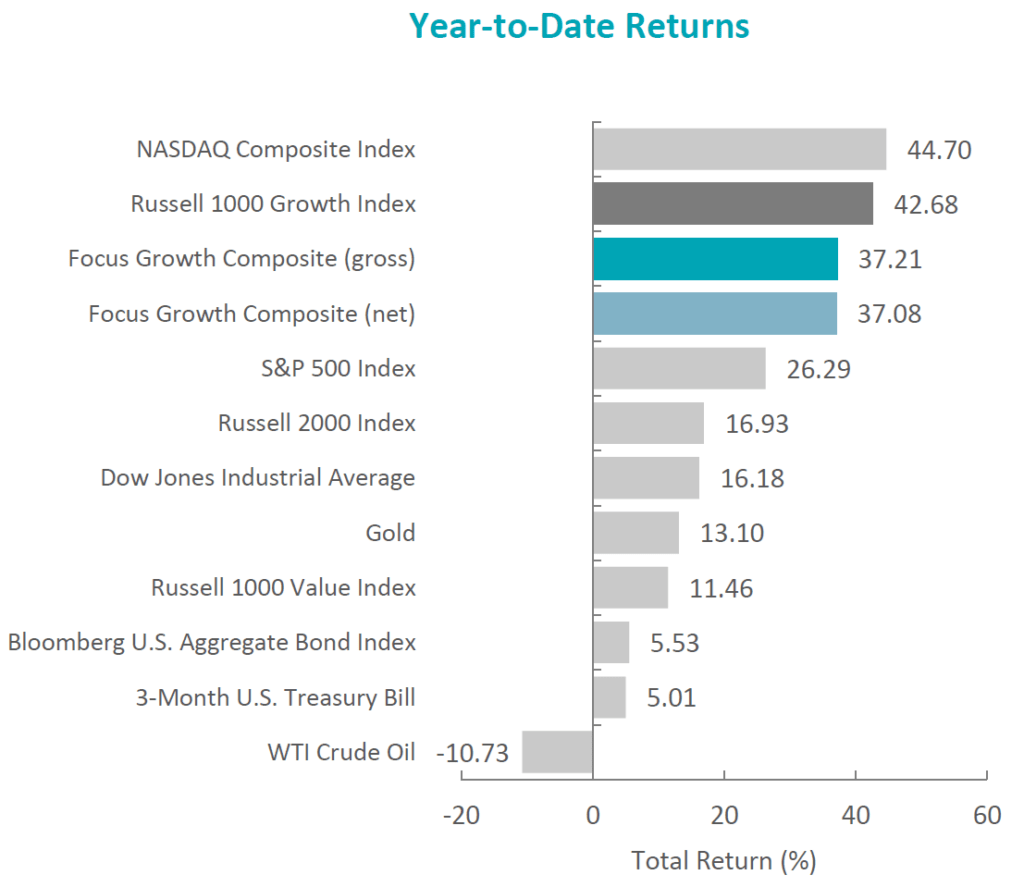

Annual Markets Evaluate

After a tumultuous yr in 2022, the U.S. fairness market rallied in 2023, because the S&P 500 Index posted a full-year return of 26.29%. The rise was primarily pushed by the efficiency of the seven largest firms within the Index, which have been liable for 62% of the S&P 500’s positive factors. Moreover, after underperforming worth final yr by the most important quantity since 2000, development recovered, because the Russell 1000 Progress Index outperformed the Russell 1000 Worth Index by 31.22% for the yr. In the meantime, the mounted earnings market additionally rebounded, because the Bloomberg U.S. Mixture Bond Index rose 5.53% in 2023.

Macroeconomic information was dominated by inflation, central financial institution insurance policies, regional financial institution failures and geopolitical conflicts, whereas different matters, reminiscent of synthetic intelligence and congressional politics, made headlines as properly. Financial knowledge factors have been blended all year long, and company earnings have been simply as unpredictable.

Efficiency and Attribution Abstract

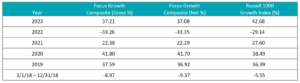

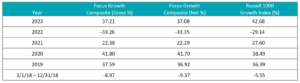

For the fourth quarter of 2023, Aristotle Atlantic’s Focus Progress Composite posted a complete return of 15.02% gross of charges (14.99% internet of charges), outperforming the 14.16% whole return of the Russell 1000 Progress Index.

| Efficiency (%) | 4Q23 | 1 Yr | 3 Years | 5 Years | Since Inception* |

|---|---|---|---|---|---|

| Focus Progress Composite (gross) | 15.02 | 37.21 | 3.87 | 16.93 | 12.52 |

| Focus Progress Composite (‘Internet’) | 14.99 | 37.08 | 3.77 | 16.74 | 12.27 |

| Russell 1000 Progress Index | 14.16 | 42.68 | 8.86 | 19.49 | 15.34 |

|

Sources: FactSet Previous efficiency will not be indicative of future outcomes. Attribution outcomes are based mostly on sector returns that are gross of funding advisory charges. Attribution relies on efficiency that’s gross of funding advisory charges and consists of the reinvestment of earnings. Please see necessary disclosures on the finish of this doc. |

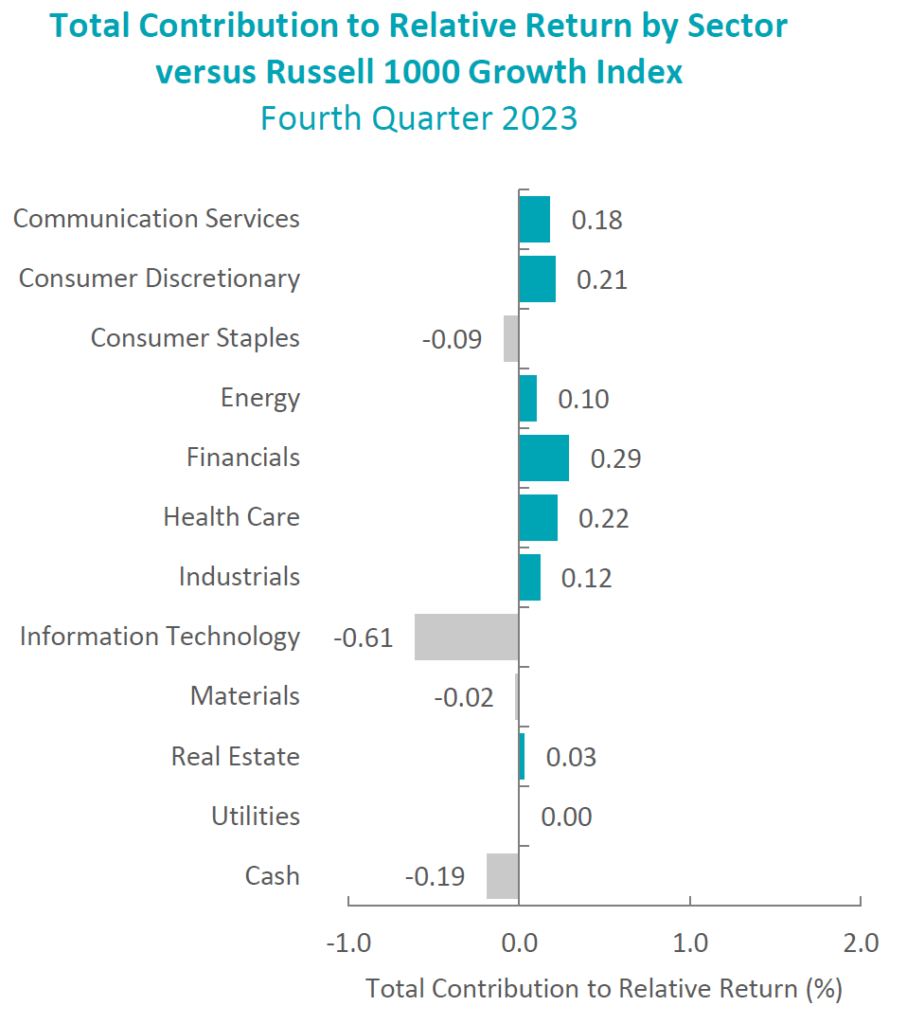

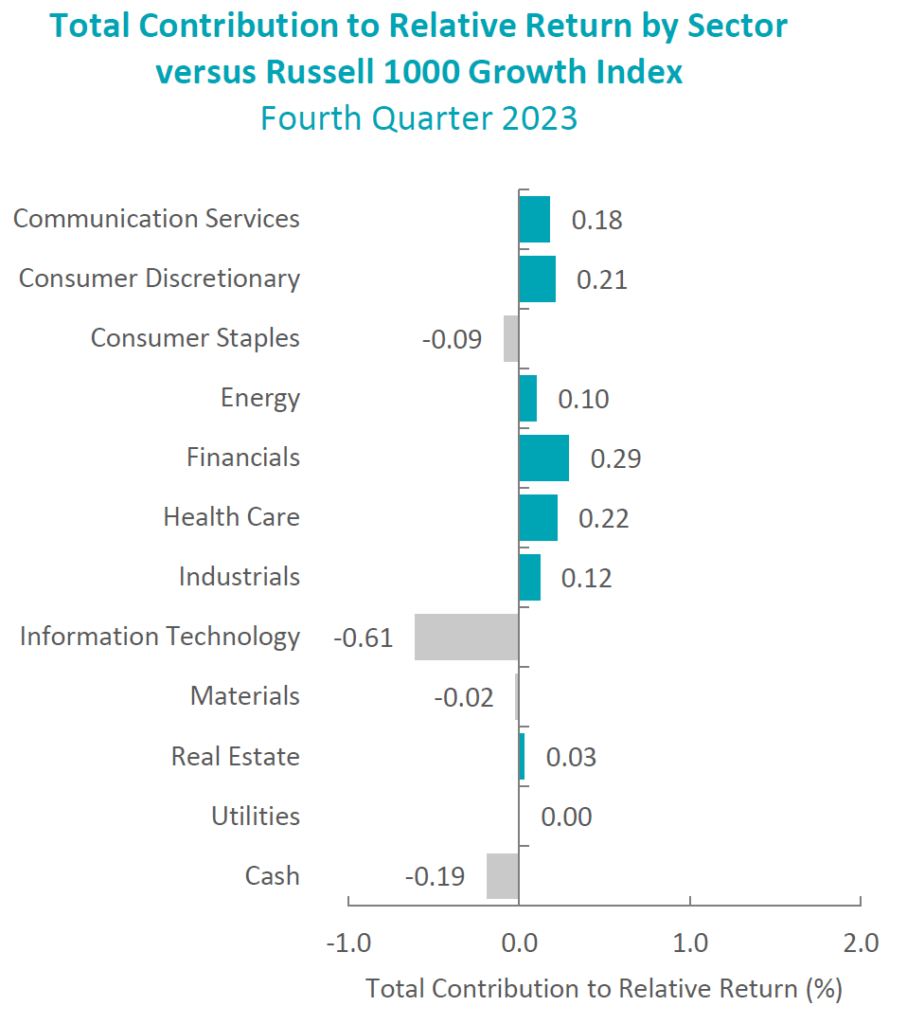

Throughout the fourth quarter, the portfolio’s outperformance relative to the Russell 1000 Progress Index was attributable to each allocation results and safety choice. Safety choice in Financials, Well being Care and Shopper Discretionary contributed probably the most to efficiency. Conversely, safety choice in Info Expertise and Actual Property, in addition to an chubby in Financials, detracted from relative outcomes.

Contributors and Detractors for 4Q 2023

| Relative Contributors | Relative Detractors |

|---|---|

| DexCom (DXCM) | Darling Components (DAR) |

| ServiceNow (NOW) | Adaptive Biotechnologies (ADPT) |

| KLA (KLAC) | ON Semiconductor (ON) |

| S&P International (SPGI) | Guardant Well being (GH) |

| Netflix (NFLX) | Thermo Fisher Scientific (TMO) |

Contributors

DexCom

Dexcom contributed to portfolio efficiency through the quarter, following a better-than-expected earnings report and a rise in full-year steerage. The corporate is benefiting from a brand new product introduction with the G-7 sequence and new Medicare reimbursement for basal insulin customers. Moreover, Dexcom has been below stress most of 2023 on the success of GLP-1 firms and the worry that these novel weight reduction therapies may harm the prospects for firms working in obesity-related comorbidities reminiscent of Diabetes. The shares had a broad reversal of this pattern within the fourth quarter and most of the affected names rebounded, together with Dexcom.

ServiceNow

ServiceNow contributed to portfolio efficiency through the fourth quarter, as buyers targeted on bettering momentum throughout the NOW platform following sturdy third quarter outcomes on the finish of October. As well as, ServiceNow continues to announce new product enhancements to the platform to assist synthetic intelligence (AI) capabilities with early indicators of buyer adoption.

Detractors

Adaptive Biotechnologies

Adaptive Biotechnologies detracted from portfolio efficiency, following a lower-than-expected earnings report and a discount in steerage. The corporate additionally introduced the initiation of a strategic evaluation to guage the separation of the diagnostics and drug-discovery elements of their enterprise. Adaptive Biotechnologies scientific testing quantity was sturdy within the fourth quarter, and common promoting costs started to enhance. We imagine the strategic evaluation has the potential to unlock worth within the identify.

Darling Components

Darling Components detracted from portfolio efficiency within the quarter, as shares have been weak following a lower-than-expected earnings report and a discount in annual steerage. The discount was largely pushed by decrease margins of their Diamond Inexperienced Diesel renewable diesel three way partnership attributable to decrease renewable identification numbers (RINs) and decrease soybean oil costs. We imagine these points ought to show to be short-term headwinds, as margins normalize within the coming quarters.

Latest Portfolio Exercise

There have been no new buys or sells through the quarter.

Outlook

Main fairness markets within the fourth quarter have been positively impacted by a pointy decline in rates of interest. The transfer in rates of interest displays the view that the tightening cycle carried out by the Fed to curb inflation could have run its course. Expectations for 2024 embody price reductions by the Fed and a excessive single-digit enhance in S&P 500 earnings. Together with this constructive view, we additionally anticipate a broadening of efficiency relative to the AI-focused returns in 2023. The sizable transfer in fairness markets within the fourth quarter has left fairness valuations on the higher finish of historic ranges, which may restrict the upside, absent constructive earnings revisions. The elevated geopolitical tensions and a pending U.S. Presidential election might also weigh on markets in 2024. Our focus will proceed to be on the firm stage, with an emphasis on in search of to put money into firms with secular tailwinds or sturdy product-driven cycles.

|

Disclosures The opinions expressed herein are these of Aristotle Atlantic Companions, LLC (Aristotle Atlantic) and are topic to vary with out discover. Previous efficiency will not be a assure or indicator of future outcomes. This materials will not be monetary recommendation or a proposal to buy or promote any product. You shouldn’t assume that any of the securities transactions, sectors or holdings mentioned on this report have been or will likely be worthwhile, or that suggestions Aristotle Atlantic makes sooner or later will likely be worthwhile or equal the efficiency of the listed on this report. The portfolio traits proven relate to the Aristotle Atlantic Focus Progress technique. Not each consumer’s account can have these traits. Aristotle Atlantic reserves the proper to change its present funding methods and strategies based mostly on altering market dynamics or consumer wants. There isn’t any assurance that any securities mentioned herein will stay in an account’s portfolio on the time you obtain this report or that securities bought haven’t been repurchased. The securities mentioned could not signify an account’s whole portfolio and, within the combination, could signify solely a small proportion of an account’s portfolio holdings. The efficiency attribution introduced is of a consultant account from Aristotle Atlantic’s Focus Progress Composite. The consultant account is a discretionary consumer account which was chosen to most intently mirror the funding fashion of the technique. The factors used for consultant account choice relies on the account’s time frame below administration and its similarity of holdings in relation to the technique. Suggestions made within the final 12 months can be found upon request. Returns are introduced gross and internet of funding advisory charges and embody the reinvestment of all earnings. Gross returns will likely be lowered by charges and different bills which may be incurred within the administration of the account. Internet returns are introduced internet of precise funding advisory charges and after the deduction of all buying and selling bills. All investments carry a sure diploma of danger, together with the attainable lack of principal. Investments are additionally topic to political, market, foreign money and regulatory dangers or financial developments. Worldwide investments contain particular dangers that will particularly trigger a loss in principal, together with foreign money fluctuation, decrease liquidity, totally different accounting strategies and financial and political methods, and better transaction prices. These dangers sometimes are higher in rising markets. Securities of small‐ and medium‐sized firms are inclined to have a shorter historical past of operations, be extra risky and fewer liquid. Worth shares can carry out otherwise from the market as an entire and different sorts of shares. The fabric is offered for informational and/or instructional functions solely and isn’t supposed to be and shouldn’t be construed as funding, authorized or tax recommendation and/or a authorized opinion. Traders ought to seek the advice of their monetary and tax adviser earlier than making investments. The opinions referenced are as of the date of publication, could also be modified attributable to adjustments out there or financial circumstances, and will not essentially come to move. Info and knowledge introduced has been developed internally and/or obtained from sources believed to be dependable. Aristotle Atlantic doesn’t assure the accuracy, adequacy or completeness of such info. Aristotle Atlantic Companions, LLC is an impartial registered funding adviser below the Advisers Act of 1940, as amended. Registration doesn’t indicate a sure stage of ability or coaching. Extra details about Aristotle Atlantic, together with our funding methods, charges and targets, will be present in our Type ADV Half 2, which is accessible upon request. AAP-2401-37 Efficiency Disclosures     Sources: CAPS CompositeHubTM, Russell Investments Composite returns for all durations ended December 31, 2023 are preliminary pending remaining account reconciliation. Previous efficiency will not be indicative of future outcomes. Efficiency outcomes for durations higher than one yr have been annualized. Returns are introduced gross and internet of funding advisory charges and embody the reinvestment of all earnings. Gross returns will likely be lowered by charges and different bills which may be incurred within the administration of the account. Internet returns are introduced internet of precise funding advisory charges and after the deduction of all buying and selling bills. Index Disclosures The Russell 1000® Progress Index measures the efficiency of the massive cap development section of the U.S. fairness universe. It consists of these Russell 1000 firms with increased price-to-book ratios and better forecasted development values. This index has been chosen because the benchmark and is used for comparability functions solely. The Russell 1000® Worth Index measures the efficiency of the massive cap worth section of the U.S. fairness universe. It consists of these Russell 1000 firms with decrease price-to-book ratios and decrease anticipated development values. The S&P 500® Index is the Commonplace & Poor’s Composite Index of 500 shares and is a widely known, unmanaged index of widespread inventory costs. The Russell 2000® Index measures the efficiency of the small cap section of the U.S. fairness universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing roughly 10% of the whole market capitalization of that index. It consists of roughly 2,000 of the smallest securities based mostly on a mix of their market cap and present index membership. The Dow Jones Industrial Common® is a price-weighted measure of 30 U.S. blue-chip firms. The Index covers all industries besides transportation and utilities. The NASDAQ Composite Index measures all NASDAQ home and worldwide based mostly widespread sort shares listed on The NASDAQ Inventory Market. The NASDAQ Composite consists of over 3,000 firms, greater than most different inventory market indices. The Bloomberg U.S. Mixture Bond Index is an unmanaged index of home funding grade bonds, together with company, authorities and mortgage-backed securities. The WTI Crude Oil Index is a serious buying and selling classification of candy mild crude oil that serves as a serious benchmark worth for oil consumed in america. The three-Month U.S. Treasury Invoice is a short-term debt obligation backed by the U.S. Treasury Division with a maturity of three months. The Shopper Worth Index (‘CPI’) is a measure of the common change over time within the costs paid by city customers for a market basket of shopper items and companies. Whereas inventory choice will not be ruled by quantitative guidelines, a inventory sometimes is added provided that the corporate has a wonderful repute, demonstrates sustained development and is of curiosity to a lot of buyers. The volatility (beta) of the Composite could also be higher or lower than its respective benchmarks. It isn’t attainable to take a position immediately in these indices. |

Editor’s Observe: The abstract bullets for this text have been chosen by In search of Alpha editors.