Martin Barraud

Markets Evaluation

(All MSCI index returns are proven internet and in U.S. {dollars} except in any other case famous.)

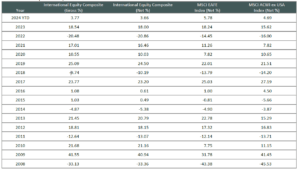

| Sources: CAPS CompositeHubTM, BloombergPast efficiency isn’t indicative of future outcomes. Aristotle Worldwide Fairness Composite returns are offered gross and internet of funding advisory charges and embrace the reinvestment of all earnings. Gross returns shall be decreased by charges and different bills which may be incurred within the administration of the account. Internet returns are offered internet of precise funding advisory charges and after the deduction of all buying and selling bills. Aristotle Capital Composite returns are preliminary pending closing account reconciliation. Please see vital disclosures on the finish of this doc. |

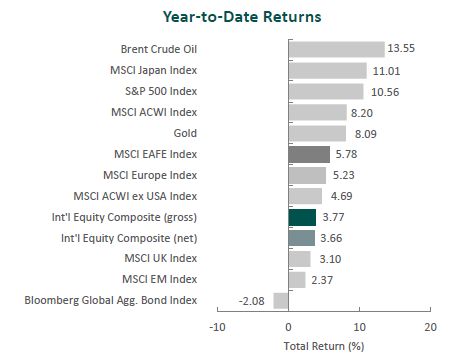

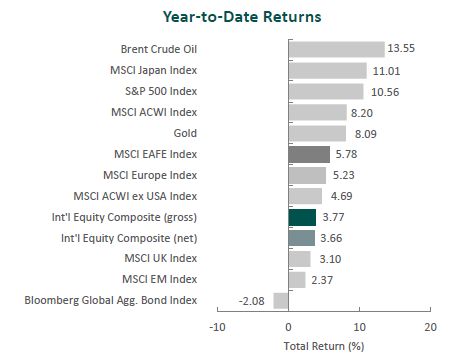

World fairness markets continued to climb in the course of the first quarter. General, the MSCI ACWI Index rose 8.20% in the course of the interval. Concurrently, the Bloomberg World Mixture Bond Index fell 2.08%. By way of type, worth shares underperformed their progress counterparts in the course of the quarter, with the MSCI ACWI Worth Index trailing the MSCI ACWI Development Index by 2.65%.

The MSCI EAFE Index climbed 5.78% in the course of the first quarter, whereas the MSCI ACWI ex USA Index elevated 4.69%. Inside the MSCI EAFE Index, Asia and Europe & Center East have been the strongest performers, whereas the U.Ok. gained the least. On a sector foundation, eight of the eleven sectors inside the MSCI EAFE Index posted constructive returns, with Info Know-how, Client Discretionary and Financials producing the biggest beneficial properties. Conversely, Utilities, Client Staples and Supplies declined.

Financial situations diverse by area, although most developed nations reported slowing inflation. For the month of February, each the U.Ok. and U.S. reported annual inflation descending towards the three% mark, whereas the eurozone recorded an annual fee of two.6%. As such, the respective central banks held financial coverage regular whereas signaling the potential for fee cuts beginning in June because the nations make progress towards the two% goal.

Nevertheless, in Asia, Japan raised rates of interest for the primary time since 2007 to a variety of 0.0% to 0.1%, as each inflation and wage progress have just lately accelerated. This marked a historic shift and ended Japan’s interval of detrimental charges, lastly eradicating the world’s final remaining detrimental charges regime. Conversely, China lowered its five-year mortgage prime fee to bolster its faltering economic system that’s battling deflation and a troubled actual property sector.

In geopolitics, the battle within the Center East continued, with elevated preventing in Lebanon and direct battle within the Crimson Sea between the U.S. and Yemen’s Houthis, which have focused greater than two dozen ships touring to and from the Suez Canal. The heightened exercise in surrounding nations has sparked considerations of additional regional escalation and the potential for a wider battle. In Europe, Russia made small advances in Ukraine, together with the seize of town of Avdiivka, as Ukrainian troops wrestle with provide shortages. The U.S. has just lately partnered with nations comparable to South Korea and Turkey to supply further ammunition and provides to Ukraine.

Efficiency and Attribution Abstract

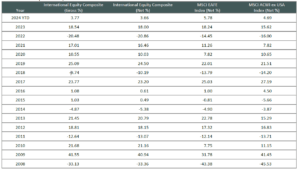

For the primary quarter of 2024, Aristotle Capital’s Worldwide Fairness Composite (MUTF:ARIFX) posted a complete return of three.77% gross of charges (3.66% internet of charges), underperforming the MSCI EAFE Index, which returned 5.78%, and the MSCI ACWI ex USA Index, which returned 4.69%. Please check with the desk under for detailed efficiency.

| Efficiency (%) | 1Q24 | 1 Yr | 3 Years | 5 Years | 10 Years | Since Inception* |

|---|---|---|---|---|---|---|

| Worldwide Fairness Composite (gross) | 3.77 | 14.85 | 3.46 | 7.46 | 5.48 | 5.78 |

| Worldwide Fairness Composite (internet) | 3.66 | 14.33 | 2.97 | 6.95 | 4.98 | 5.28 |

| MSCI EAFE Index (internet) | 5.78 | 15.32 | 4.78 | 7.32 | 4.79 | 3.07 |

| MSCI ACWI ex USA Index (internet) | 4.69 | 13.26 | 1.93 | 5.96 | 4.25 | 2.60 |

| *The inception date for the Worldwide Fairness Composite is January 1, 2008. Previous efficiency isn’t indicative of future outcomes. Aristotle Worldwide Fairness Composite returns are offered gross and internet of funding advisory charges and embrace the reinvestment of all earnings. Gross returns shall be decreased by charges and different bills which may be incurred within the administration of the account. Internet returns are offered internet of precise funding advisory charges and after the deduction of all buying and selling bills. Aristotle Capital Composite returns are preliminary pending closing account reconciliation. Please see vital disclosures on the finish of this doc. |

| Supply: FactSetPast efficiency isn’t indicative of future outcomes. Attribution outcomes are based mostly on sector returns that are gross of funding advisory charges. Attribution is predicated on efficiency that’s gross of funding advisory charges and consists of the reinvestment of earnings. |

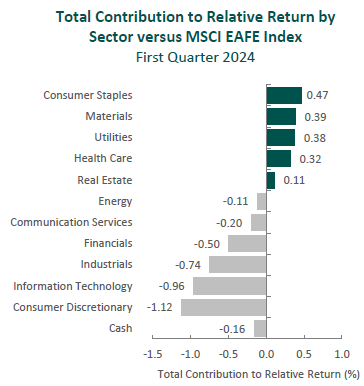

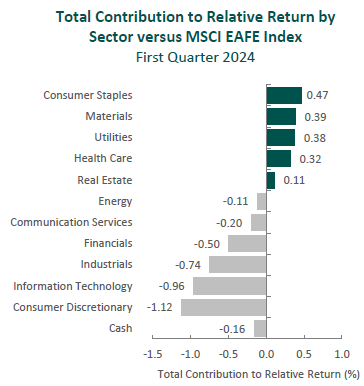

From a sector perspective, the portfolio’s underperformance relative to the MSCI EAFE Index may be attributed to safety choice, whereas allocation results had a constructive affect. Safety choice in Client Discretionary, Info Know-how and Industrials detracted probably the most from the portfolio’s relative efficiency. Conversely, safety choice in Client Staples and Well being Care and an absence of publicity to Utilities contributed to relative return.

Regionally, each safety choice and allocation results have been answerable for the portfolio’s underperformance. Safety choice in Asia and publicity to Canada detracted probably the most from relative efficiency, whereas safety choice within the U.Ok. and Europe & Center East contributed.

Contributors and Detractors for 1Q 2024

Sony, the worldwide supplier of videogames and consoles, picture sensors, music and flicks, was one of many largest detractors for the interval. Sony minimize its steering from 25 million PlayStation 5 (PS5) items offered to 21 million items for the fiscal 12 months. Regardless of the underwhelming {hardware} outcomes, administration has emphasised the significance of balancing profitability and gross sales within the latter stage of the PS5’s life cycle which it expects to realize by means of engagement, with month-to-month energetic customers reaching a document excessive of 123 million accounts. Moreover, we are going to proceed to observe administration’s skill to enhance sport improvement, streamline undertaking administration and management prices, as Sony has already begun to implement structural reforms in its Sport & Community Providers phase. In its Photos phase, Sony terminated its merger with Zee Leisure, as closing situations weren’t met inside the set two-year window. However, administration believes India stays a promising market and can proactively discover alternatives to bolster its place within the nation. We stay assured in Sony’s skill to construct on its {industry} management, and we really feel the corporate’s continued optimization of enterprise operations, together with its plan for a partial spinoff of its Monetary Providers enterprise, positions the corporate to boost long-term worth.

AIA Group, a pan-Asian life insurance coverage firm headquartered in Hong Kong, was one of many largest detractors for the quarter. Whereas macro considerations over the state of the Chinese language economic system could have positioned stress on AIA’s share worth in the course of the quarter, enterprise fundamentals proceed to enhance. As proof, the corporate’s VONB* elevated 33% in 2023. This, in our opinion, displays AIA’s resiliency and the progress it has made throughout Asia, with mainland China, Hong Kong and the ASEAN nations (excluding Vietnam) all reporting double-digit share will increase. The corporate has additionally accomplished a multi-year digital transformation that has not solely decreased prices per transaction by over 30% however has additionally improved buyer expertise. (85% of buyer transactions at the moment are accomplished in a day or much less.) With these technological investments in place, the assist of its extremely productive company gross sales pressure, and additional partnerships with main banks, we stay assured in AIA’s skill to proceed growing its market share in mainland China and increasing throughout Asia.

Safran, the French aerospace propulsion and tools producer, was the highest contributor. Because the main provider of narrow-body plane engines, Safran has benefited from the rise in narrow-body air visitors (above 2019 ranges) and an getting old fleet of plane that has spurred demand for required service. A part of our attraction to Safran is the character of its product classes, which are likely to exhibit pricing energy, and the advantages of higher-margin aftermarket companies, which we count on to increase within the years forward. For instance, the corporate just lately signed a number of multi-year tools contracts with worldwide airline prospects. As well as, deliveries of Safran’s new-generation LEAP engines (which cut back gas consumption and CO2 emissions) elevated 38% in 2023, supporting the corporate’s proposed 63% year-over-year dividend enhance. Long term, we consider Safran will profit from the continued transition to LEAP engines as airways improve their fleets to be extra environment friendly and environmentally pleasant.

Munich Re, the world’s largest reinsurance firm, was a number one contributor for the quarter. The corporate reported sturdy outcomes because it continues to win market share, leverage its international scale and reveal underwriting self-discipline. Maybe counterintuitively, latest international crises, comparable to conflict in each the Center East and Ukraine and pure catastrophe losses that topped $100 billion, in addition to the affect of inflation, showcase Munich Re’s strengths. By means of these crises, the corporate has, we consider, displayed its prudent risk-taking and international diversification. Furthermore, Munich Re (and its friends) have benefited from industry-wide worth will increase, which have contributed to elevated return of capital to shareholders. The corporate raised its dividend by practically 30% in 2023 and introduced a brand new €1.5 billion share buyback program. We proceed to consider Munich Re is attractively positioned to realize market share in quite a lot of areas, together with cybersecurity, specialty insurance coverage and within the fast-growing economies in Asia the place the market is giant, however insurance coverage penetration stays comparatively low.

Current Portfolio Exercise

In line with our long-term horizon and low turnover, there have been no new purchases or gross sales accomplished in the course of the quarter.

Conclusion

Regardless of the U.S. economic system’s continued growth, financial knowledge factors stay blended. Moreover, buyers face uncertainty the remainder of the 12 months, whether or not it’s the trail of central financial institution coverage, the end result of the 2024 U.S. presidential election, or the potential for brand new and/or escalating geopolitical conflicts.

Nevertheless, whereas our evaluation considers long-term developments within the macroeconomy, we focus most of our time and a focus on particular person firms that, in our opinion, possess a mix of qualities which might be sustainable and tough to breed. It’s our perception {that a} diversified portfolio of investments in these firms will thrive over full market cycles.

|

*Worth of New Enterprise (VONB) is an insurance coverage time period for the current worth of latest enterprise written throughout a interval. Disclosures The opinions expressed herein are these of Aristotle Capital Administration, LLC (Aristotle Capital) and are topic to vary with out discover. Previous efficiency isn’t a assure or indicator of future outcomes. This materials isn’t monetary recommendation or a proposal to purchase or promote any product. You shouldn’t assume that any of the securities transactions, sectors or holdings mentioned on this report have been or shall be worthwhile, or that suggestions Aristotle Capital makes sooner or later shall be worthwhile or equal the efficiency of the securities listed on this report. The portfolio traits proven relate to the Aristotle Worldwide Fairness technique. Not each shopper’s account may have these traits. Aristotle Capital reserves the best to change its present funding methods and methods based mostly on altering market dynamics or shopper wants. There isn’t a assurance that any securities mentioned herein will stay in an account’s portfolio on the time you obtain this report or that securities offered haven’t been repurchased. The securities mentioned could not symbolize an account’s complete portfolio and, within the mixture, could symbolize solely a small share of an account’s portfolio holdings. The efficiency attribution offered is of a consultant account from Aristotle Capital’s Worldwide Fairness Composite. The consultant account is a discretionary shopper account which was chosen to most carefully replicate the funding type of the technique. The standards used for consultant account choice is predicated on the account’s time period beneath administration and its similarity of holdings in relation to the technique. Suggestions made within the final 12 months can be found upon request. Returns are offered gross and internet of funding advisory charges and embrace the reinvestment of all earnings. Gross returns shall be decreased by charges and different bills which may be incurred within the administration of the account. Internet returns are offered internet of precise funding advisory charges and after the deduction of all buying and selling bills. All investments carry a sure diploma of threat, together with the attainable lack of principal. Investments are additionally topic to political, market, foreign money and regulatory dangers or financial developments. Worldwide investments contain particular dangers which will specifically trigger a loss in principal, together with foreign money fluctuation, decrease liquidity, completely different accounting strategies and financial and political techniques, and better transaction prices. These dangers sometimes are larger in rising markets. Securities of small‐ and medium‐sized firms are likely to have a shorter historical past of operations, be extra risky and fewer liquid. Worth shares can carry out in a different way from the market as a complete and different varieties of shares. The fabric is offered for informational and/or academic functions solely and isn’t supposed to be and shouldn’t be construed as funding, authorized or tax recommendation and/or a authorized opinion. Buyers ought to seek the advice of their monetary and tax adviser earlier than making investments. The opinions referenced are as of the date of publication, could also be modified resulting from modifications out there or financial situations, and will not essentially come to move. Info and knowledge offered has been developed internally and/or obtained from sources believed to be dependable. Aristotle Capital doesn’t assure the accuracy, adequacy or completeness of such data. Aristotle Capital Administration, LLC is an unbiased registered funding adviser beneath the Advisers Act of 1940, as amended. Registration doesn’t suggest a sure degree of ability or coaching. Extra details about Aristotle Capital, together with our funding methods, charges and goals, may be present in our Type ADV Half 2, which is accessible upon request. ACM-2404-37 Efficiency Disclosures   Sources: CAPS CompositeHubTM, MSCI   Composite returns for all durations ended March 31, 2024 are preliminary pending closing account reconciliation. Previous efficiency isn’t indicative of future outcomes. The knowledge offered shouldn’t be thought of monetary recommendation or a suggestion to buy or promote any specific safety or product. Efficiency outcomes for durations larger than one 12 months have been annualized. Returns are offered gross and internet of funding advisory charges and embrace the reinvestment of all earnings. Gross returns shall be decreased by charges and different bills which may be incurred within the administration of the account. Internet returns are offered internet of precise funding advisory charges and after the deduction of all buying and selling bills. Index Disclosures The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization-weighted index that’s designed to measure the fairness market efficiency of developed markets, excluding the USA and Canada. The MSCI EAFE Index consists of the next 21 developed market nation indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Eire, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the UK. The MSCI ACWI captures giant and mid-cap illustration throughout 23 developed market nations and 24 rising markets nations. With roughly 3,000 constituents, the Index covers roughly 85% of the worldwide investable fairness alternative set. The MSCI ACWI Development Index captures giant and mid-cap securities exhibiting general progress type traits throughout 23 developed markets nations and 24 rising markets nations. The MSCI ACWI Worth Index captures giant and mid-cap securities exhibiting general worth type traits throughout 23 developed markets nations and 24 rising markets nations. The MSCI ACWI ex USA Index captures giant and mid-cap illustration throughout 22 of 23 developed markets nations (excluding the USA) and 24 rising markets nations. With roughly 2,300 constituents, the Index covers roughly 85% of the worldwide fairness alternative set outdoors the USA. The MSCI Rising Markets Index is a free float-adjusted market capitalization-weighted index that’s designed to measure the fairness market efficiency of rising markets. The MSCI Rising Markets Index consists of the next 24 rising market nation indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. The S&P 500® Index is the Customary & Poor’s Composite Index of 500 shares and is a widely known, unmanaged index of frequent inventory costs. The Brent Crude Oil Index is a serious buying and selling classification of candy gentle crude oil that serves as a serious benchmark worth for purchases of oil worldwide. The MSCI Japan Index is designed to measure the efficiency of the massive and mid-cap segments of the Japanese market. With roughly 250 constituents, the Index covers roughly 85% of the free float-adjusted market capitalization in Japan. The Bloomberg World Mixture Bond Index is a flagship measure of world funding grade debt from 28 native foreign money markets. This multi-currency benchmark consists of treasury, government-related, company and securitized fixed-rate bonds from each developed and rising markets issuers. The MSCI United Kingdom Index is designed to measure the efficiency of the massive and mid-cap segments of the U.Ok. market. With practically 100 constituents, the Index covers roughly 85% of the free float-adjusted market capitalization in the UK. The MSCI Europe Index captures giant and mid-cap illustration throughout 15 developed markets nations in Europe. With roughly 430 constituents, the Index covers roughly 85% of the free float-adjusted market capitalization throughout the European developed markets fairness universe. These indexes have been chosen because the benchmarks and are used for comparability functions solely. The volatility (beta) of the Composite could also be larger or lower than the respective benchmarks. It’s not attainable to take a position straight in these indexes. |

Editor’s Notice: The abstract bullets for this text have been chosen by Looking for Alpha editors.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.