RichLegg/E+ via Getty Images

With the stock market continuing to hover around all-time highs, it has become more prudent than ever to de-risk our portfolios by selling off momentum names and allocating more toward contrarian value plays. Of course, this often means investing in small-cap companies that are not often well-equipped to deal with a macroeconomic slowdown: but in my view, Arlo Technologies (NYSE:ARLO) is one of the best choices here.

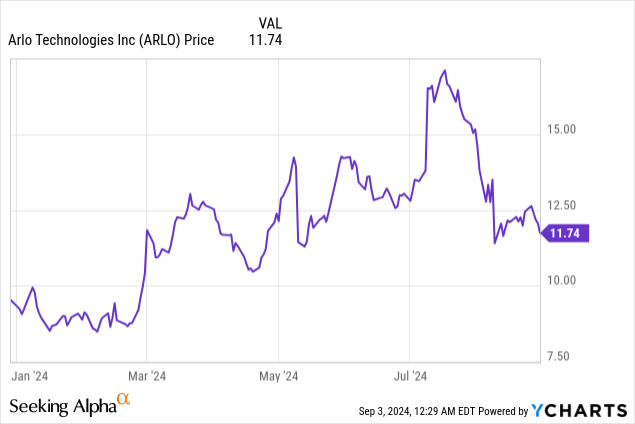

Arlo is a small-cap company that focuses on making home security cameras. Like many of its hardware peers, however, it has quickly adopted a services-first mindset and is selling cameras at just above breakeven in order to encourage subscription revenue growth. Investors have recognized the company’s success in delivering a 25%+ gain to Arlo shares since the start of the year, but the stock is down since reporting Q2 results despite a healthy print.

I last wrote a bullish note on Arlo in June, when the stock was still trading above $13. Since then, shares of Arlo have corrected after posting Q2 results in August, despite strong trends and confident commentary heading into the all-critical year-end holiday season. As a result, I’m reiterating my buy opinion on Arlo.

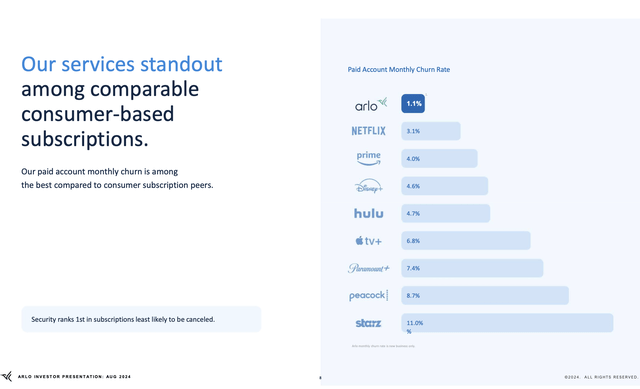

One thing that investors should remember is that Arlo has fiercely high retention rates. While many software and tech companies have reported higher churn rates, particularly from small businesses, Arlo has noted that security is one of the number-one consumer categories for retention. The chart below showcases Arlo’s latest, very low 1.1% churn rate compared to a number of other subscription offerings:

Arlo churn rates (Arlo Q2 shareholder deck)

Meanwhile, the top attraction to Arlo stock remains its cheap valuation. At current share prices near $13, Arlo trades at a market cap of $1.17 billion. After netting off the $144.0 million of cash on Arlo’s most recent balance sheet, the company’s resulting enterprise value is $1.03 billion.

For the next fiscal year FY25, Wall Street analysts are expecting the company to generate $564.8 million in revenue, or 7% y/y growth. And if we conservatively assume a 10% FCF margin on that revenue (equivalent to the company’s 1H’24 actual margins, with no credit given to ongoing margin improvements), FCF would be $56.5 million on that revenue profile.

This puts Arlo’s valuation multiples at:

- 1.8x EV/FY25 revenue

- 18.2x EV/FY25 FCF

On top of this attractive valuation, there are a number of long-term bull case drivers to keep in mind for this stock, including:

-

A category leader in the security camera space with broad positive ratings. Arlo has been highly reviewed by major tech publications like CNET and PCMag and is considered one of the top home smart cameras. In addition to this, Arlo is one of the most prominent security companies to promote DIY installation vs. other cameras that require expensive technicians for installation.

-

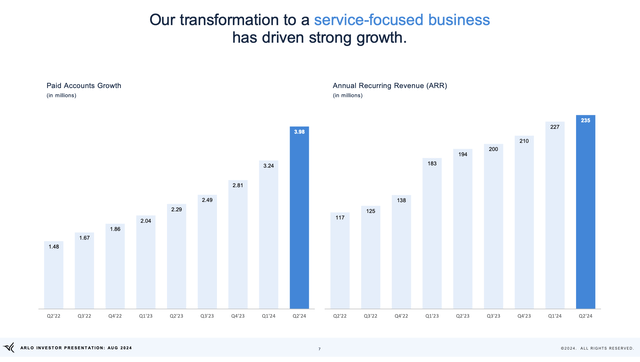

Services revenue is growing quickly and eclipsing hardware revenue. Arlo is moving away from being a pure hardware products company. Paid subscriber accounts, now at 4 million customers, are growing at a ~50% y/y clip. Arlo also notes that ~65% of new hardware customers sign up for Arlo Secure within six months.

-

Favorable unit economics. The company touts an LTV to CAC ratio of 7x, justifying its recent push to reduce hardware prices and get more paid subscribers in the door.

-

Large addressable market. Arlo estimates the market for home security to currently stand at $53 billion, and it also expects a 14% y/y growth CAGR through 2029. With just over ~$500 million in annual revenue, Arlo has plenty of room to expand and innovate in this space. Given that there is no clear leader in the home security camera market, Arlo has a chance to take the crown.

-

Profitability. Unlike many small-caps of its size, Arlo has hit pro forma operating profitability, and its increased revenue indexing into services will further boost its margin profile.

One more major catalyst worth mentioning: On the company’s Q2 earnings call, Arlo’s CEO Matthew McRae noted that the company is actively pursuing a major, inorganic growth opportunity within a 12-18 month timeframe to extend Arlo’s reach into products beyond its existing categories.

The first bucket is something new to Arlo, a new technology, a new product line, a new channel or another area that is not part of our current core business. The second bucket represents possible paths to market consolidation, potentially acquiring an entity in our core market that could accelerate market expansion.

In general, it is clear that some level of inorganic investment could drive additional growth for Arlo and it is likely that you’ll see the company take actions along this path in the next 12 months to 18 months. Irrespective of the opportunity we pursue, we will remain disciplined in our approach, assess the risks of such transactions and ensure that our path to our long-range targets is not compromised.”

While these plans are still far from concrete, it’s an evident signal that Arlo is still looking to greatly expand its presence, and an acquisition would be a great way for the company to leverage its debt-free balance sheet and ongoing FCF.

Stay long here and keep waiting patiently for a broader rally in this stock.

Q2 Download

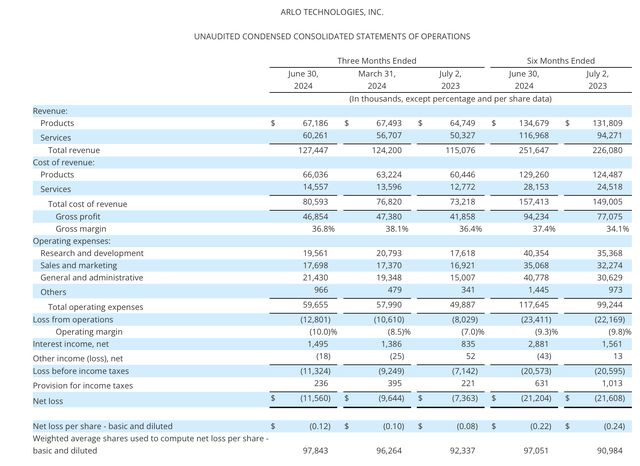

Let’s now go through Arlo’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Arlo Q2 results (Arlo Q2 shareholder deck)

Revenue grew 3% y/y to $127.5 million, while services revenue grew at a faster pace of 6% y/y to $60.3 million. The company beat Wall Street’s consensus expectations of $125.1 million in revenue, or 1% y/y growth, by a two-point margin.

The company’s pace of active account growth continues at a healthy clip. Notably, Arlo added 740k paid subscribers in Q2, ending the quarter at 3.98 million subscribers: up 74% y/y. Sequentially, the company also added $8 million of net new ARR.

Arlo key subscriber metrics (Arlo Q2 shareholder deck)

Arlo is doubling down on its strategy to sell hardware at low margins (GAAP margins for the hardware segment in Q2 were only 2%) in order to incentivize household formation and subscription sign-ups. The company notes that this strategy has helped the company to minimize pressures from a tightening macroeconomy. Arlo is also planning a deep promotional calendar in the back half of this year to capture demand in the critical holiday season. Per CEO McRae’s remarks on the Q2 earnings call on upcoming promotions:

Across our channels, we see the consumer is under some pressure, which often results in a step down in the price segment of the initial hardware purchase. Arlo anticipated this environment with our pricing strategy, where we brought down our initial hardware margins but raised our service pricing, which has driven an expansion of ARR and profitability. This decision has sustained our household formation and coupled with the tailwind in the Security segment, delivered excellent conversion and low churn rates in our subscription business.

Looking ahead to the holiday season, Arlo has worked closely with our channel partners to create an aggressive promotional calendar. The Essential 2 product line is the right product at the right time to drive additional household adoption and address the category shift to mass market. Our current read is the second half of 2024 is going to look very similar to the second half of 2023, and Arlo is extremely well positioned to repeat our success and continue to drive new paid accounts.”

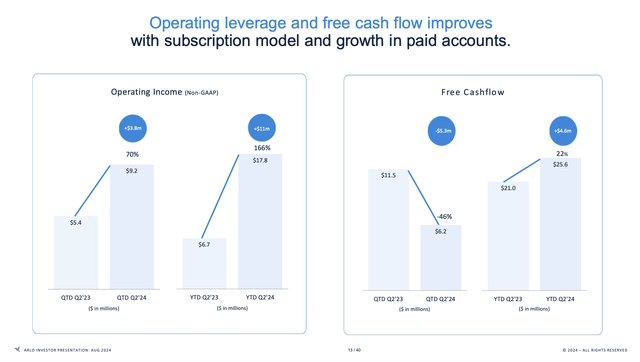

And despite leaning into hardware pricing, we note that the company has still continued to improve its profitability (its sticky subscription base offers a high-70s gross margin, after all). As shown in the chart below, pro forma operating income jumped 70% y/y to $9.2 million, with margins of 7.2% expanding 250bps y/y.

Arlo margin trends (Arlo Q2 shareholder deck)

Risks and Key Takeaways

Of course, Arlo does face risks from a potential decline in consumer spending if the U.S. heads into a recession in the back half of this year. The company’s plan to sink more investment into pricing and promotions may also hurt the company’s current pace of profit margin expansion.

But all of this said, with a consistent pace of subscription sign-ups, ultra-slow churn rates and a bargain-basement valuation, there’s plenty to like about Arlo at ~$12. Buy here and wait for this stock to rally.