Gary Yeowell

My previous and first article on Armada Hoffler Properties, Inc. (NYSE:AHH) was issued back in July, before the Q2 2024 data was published. While I recognized the main risks of AHH as elevated leverage and high concentration in the office segment, my investment stance was still bullish. The reason for that lies in several important mitigants to those risks and a very cheap multiple, which in the context of the overall fundamentals seemed to provide an attractive investment case.

The main mitigant besides the P/FFO multiple of ~9.5x was a back-end loaded debt maturity profile, where first material maturities kick in only in 2026. This dynamic allows AHH to avoid unfavorable refinancing moments that would push the weighted average interest rate higher. On top of this, if we look deeper in the data, we will notice that the office exposure is not that bad given that all of AHH’s offices are trophy-like and consistently registering positive leasing spreads, while keeping the occupancy levels high.

My view on AHH was that it offers a compelling dividend case, where the then-current yield of 7.5% was underpinned by strong fundamentals and nice price appreciation potential given the depressed multiple.

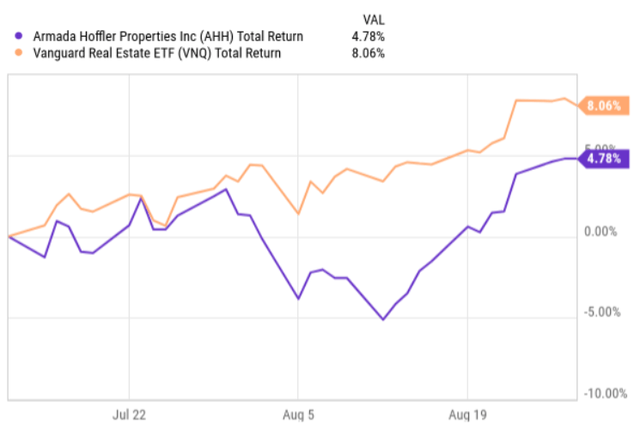

In the chart below, we can see how AHH has delivered relatively decent total returns. Yet, we can also observe a negative alpha and, more importantly, AHH’s return level temporarily falling into negative return territory in early August when the Q2 2024 data was published.

Let’s now review the Q2 2024 earnings deck and see whether the bullish investment case is still valid.

Thesis review

The overall takeaway from the Q2 data points is that AHH has continued to deliver robust performance, sending a clear message to the market that it has a truly high-quality asset base.

In Q2, AHH generated an FFO of $0.25 per share and excluding the extraordinary one-offs, the normalized FFO per share landed at $0.34 per share, which is $0.01 per share above the result achieved in the prior quarter. The reason for these corrections (i.e., normalization) lies in a fair value adjustment of derivatives and the write-off of previously capitalized development costs that did not generate any income. All of these costs are non-cash like and when it comes to the write-off of the development cost base, AHH is set to receive $1.5 million in tenant termination fees during Q3 2024. All in all, these corrections render no meaningful (if any) cash flow impact on AHH. The most important thing to note here is that the normalized FFO per share has continued to tick higher.

Going deeper in the performance metrics, we will see that each operating segment brought very healthy results, allowing AHH to maintain occupancy of 95% across the entire portfolio (the weighted average occupancy moved up by 2 basis points).

The retail segment, which consumes the largest chunk of AHH’s NOI, recorded a cash spread of 2.9%. The multifamily component produced a positive trade-out spread of 2%. In fact, the last month of Q2 looked more impressive, where the trade-out spread landed at 3.4%. The renewal spreads experienced similar momentum, reaching the highest point in July of 4.4%. Even speaking of the construction segment, AHH was able to register $4.3 million in gross profits, marking the highest quarter in AHH’s construction management history.

Speaking of the office segment, which is one of the main drivers behind so depressed multiple here, the Q2 results were rock-solid. In fact, it was the office component of AHH’s business that achieved the best results.

For example, the cash spread landed at 4.4% and, importantly, the cash same-store growth came in at 7.7%, which is one of the highest growth rates I have seen in the office REIT space (in the post COVID-19 period).

Plus, AHH’s office lease expiration profile introduces an additional layer of defense in the system as the leases coming due over the next few years are quite minimal -8.7% until 2026 and no expiries remaining for this year.

In my opinion, the commentary in the recent earnings call by Shawn Tibbetts – President and COO – captures the essence very well:

In addition to the location, quality and amenities, 95% of our office, ABR is located in mixed use ecosystems like Town Center of Virginia Beach and Harbor Point. At Harbor Point, we executed a new 35,000 square foot lease with Stifel and delivered another 46,000 square feet of expansion space to Morgan Stanley. Harbor Point is now firmly entrenched as the destination of choice for financial services. The area is becoming more activated every day and we will see this continue to accelerate when thousands of [indiscernible] price employees are on site. We are witnessing a pronounced flight to quality within the market and Harbor Point is the beneficiary.

Finally, while the office risk is, in my opinion, clearly solved, some concerns on the balance sheet front might still be valid.

As of Q2 2024, the stabilized portfolio debt to adjusted EBITDAre remained relatively high at 6.4x. Plus, the AFFO payout ratio has now increased to 99%, indicating no ability for AHH to redirect part of its internal cash generation towards debt reduction activities.

Having said that, here are several aspects that we have to consider:

- The debt maturity profile remains well-laddered and the first notable refinancings are set to take place in 2026, which leaves a good amount of time for AHH to grow FFO and optimize the structure.

- The AFFO payout has increased to 99% (from ~70%-75%% that could be deemed as a historical range) mostly due to active releasing quarter, whereas explained above the effects will be cash-flow positive as we move forward.

- During the quarter, AHH made a small additional equity issuance, capturing $9 million once the share price started to recover in July. This will help deleverage, while keeping the AFFO per share result stable, given the growing cash generation levels.

- In Q2 AHH took an $85 million term loan in order to pay down more expensive debt. This will not drive the leverage higher, and instead it should provide interest expense savings in Q3.

The bottom line

In my opinion, the results achieved in Q2, 2024 confirm the underlying value of Armada Hoffler Properties. This confirmation stems not only from slightly increased normalized FFO, but also from the overall portfolio dynamics, where the cash spreads and NOI growth have clearly registered positive movements.

Even though the leverage remains high on an absolute basis, given the positive momentum in the financials in combination with high-quality asset base, the current multiple of P/FFO 9.7x still offers investors an enticing opportunity to capture solid total returns (i.e., price appreciation from multiple expansion and a dividend yield of ~6 .9%).