Key Notes

- The collaboration launches with Emirates Stadium branding from Arsenal’s August 23 match against Leeds United.

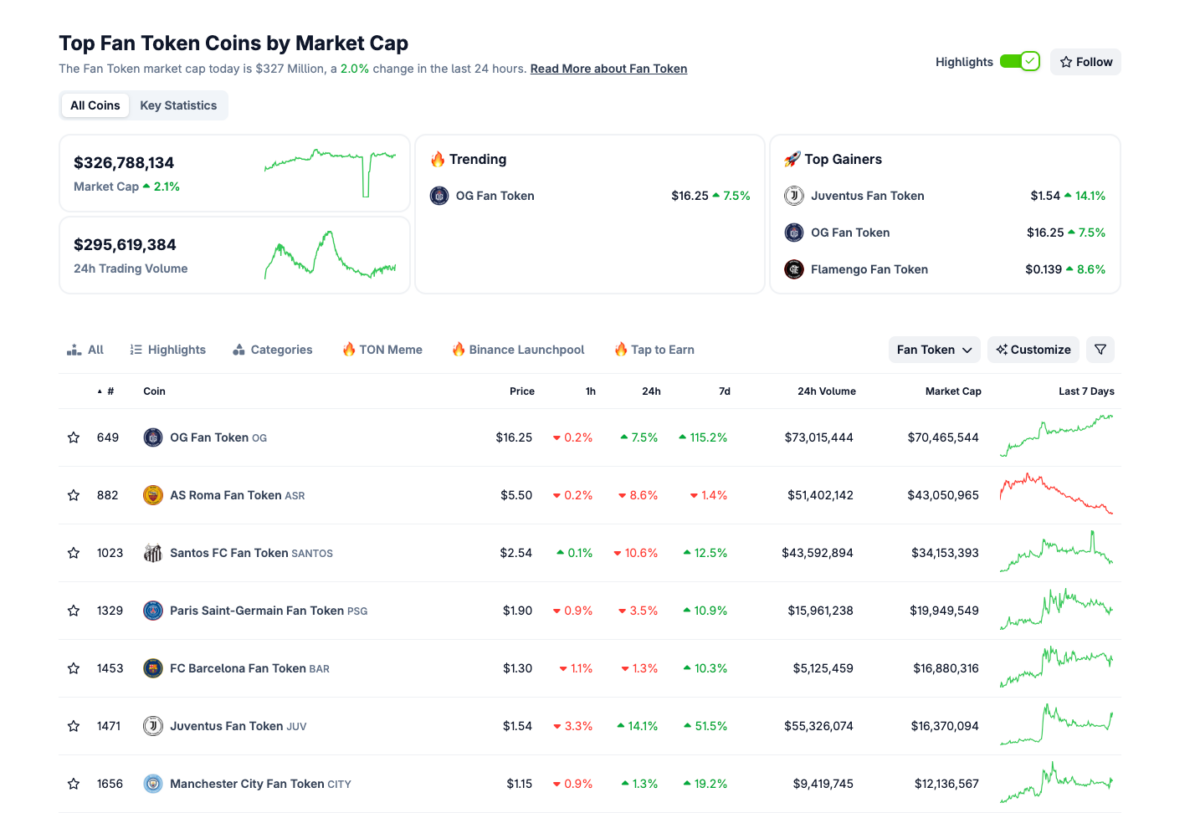

- Fan token markets gained 2.3% following the announcement, with major club tokens leading performance metrics.

- Bitpanda’s UK expansion offers over 600 digital assets while providing Arsenal supporters VIP access and exclusive events.

Bitpanda and Arsenal have officially confirmed a multi-year partnership, naming Europe’s leading crypto platform as the club’s Official Crypto Trading Partner.

The deal coincides with Bitpanda’s UK market debut, offering over 600 digital assets including Bitcoin, Ethereum, stablecoins, and curated crypto indices.

Arsenal’s home turf, the Emirates Stadium, will feature Bitpanda branding starting with Arsenal’s first home match against Leeds United on August 23, complemented by digital activations, player-led content, and exclusive fan experiences.

“We’re excited to welcome Bitpanda to our Arsenal family as the latest global brand to join our diverse stable of partners. They share our ambition and our drive to always move forward. As they launch in the UK for the first time, we’re delighted to be working together to support each other’s growth and sustained success,” said Juliet Slot, Arsenal Chief Commercial Officer.

Bitpanda users will enjoy VIP match access, invites to exclusive events, and opportunities to meet Arsenal legends. The collaboration is poised to leverage Arsenal’s sporting prestige with Bitpanda’s technological infrastructure to drive both crypto adoption and supporter engagement.

Football Fan Tokens Surge 2.3% as Arsenal-Bitpanda Partnership Boosts Market Buzz

The Arsenal–Bitpanda alliance further emphasizes the growing synergy between the world’s most-watched sport and the cryptocurrency sector. Fan token markets reacted positively, with CoinGecko data showing a 2.3% intraday surge following the partnership announcement, just 24 hours before the Premier League 2025/2026 season kicks off on Friday, August 15.

Fan Token Sector Performance | Source: CoinGecko, August 14.

Major football club tokens including Juventus, Barcelona, Inter, Manchester City, PSG, and Santos remain among the top-ranked globally by market cap. According to CoinGecko, the total fan token market cap stands at $327.77 million with a daily trading volume of $298.96 million.

Juventus Fan Token (JUV), Flamengo Fan Token (MENGO), and Santos FC Fan Token (SANTOS) emerged as the top three performers with 12.5%, 10.5% and 9.2% gains respectively.

With the Premier League’s global reach, the collaboration between Arsenal and the newly launched UK subsidiary of Bitpanda exchange could catalyze further crypto adoption, particularly among football supporters seeking fan engagement and investment opportunities.

BTC Hyper Presale Gains Traction as Bitcoin Rally Inspires Layer 2 Interest

As crypto entities enter corporate partnerships amid Bitcoin’s all-time high, bullish traders are looking toward BTC Hyper, a next-generation Bitcoin Layer 2 scaling solution, for the next wave of growth.

BTC Hyper Presale

The BTC Hyper presale has already raised $5.46 million, promising near-instant, low-cost Bitcoin transactions for payments, memecoins, and decentralized apps, along with staking rewards of up to 1,052%.

For traders seeking diversification opportunities amid Bitcoin’s rally, BTC Hyper offers exposure to Bitcoin scalability combined with high-yield staking potential. Visit the official BTC Hyper website to join the presale before the next price tier unlocks.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.