Sakorn Sukkasemsakorn/iStock through Getty Photos

Investing Atmosphere

US fairness markets reached new all-time highs in Q1 supported by a resilient US financial system, a basic pattern of disinflation and an acceleration in company income development. Given principally benign financial knowledge providing little indication {that a} recession is close to, rate of interest markets pared again the variety of anticipated Federal Reserve fee cuts in 2024. The S&P 500® Index (SP500, SPX) rose 10.56%, persevering with the sturdy rally that started in late October of final yr. There was broad-based power throughout sectors. Communication companies, financials, vitality, industrials and know-how shares have been every up double-digit percentages. Greater yielding sectors (actual property, utilities and client staples) trailed.

The market’s transfer greater has been an unusually clean one. In Q1, the S&P 500® Index skilled solely three down days of 1 % or better. Over the five-year interval from 2019 to 2023, the typical quarter had 9 such days. There are many dangers that would upset the apple cart, whether or not geopolitical or macroeconomic. The continued conflicts within the Center East and Ukraine proceed to rage, and inflation—although trending decrease—stays above the Federal Reserve’s 2% goal. Markets in the course of the first three months of the yr confirmed comparatively little concern, nonetheless. Earnings—the bedrock of enterprise values—are rising soundly as soon as once more, and the recession that many predicted would have began by now has but to emerge. Nonetheless, volatility has picked up in April as we write this letter.

Efficiency Dialogue

In Q1, the portfolio carried out in step with our whole return expectations—delivering a robust whole return comprised of premium earnings (a portfolio present yield that’s better than or equal to 2X the typical present yield for shares within the S&P 500® Index) and stable capital appreciation. Our Core Worth, Dividend Restoration and Dividend Progress holdings drove our general return as bond proxies and glued earnings securities trailed the broad fairness market.

Our high contributors have been nVent Electrical (NVT), Corebridge Monetary (CRBG) and Lamar Promoting (LAMR). nVent Electrical offers electrical connections and safety options. These are mission-critical components in industrial electrical and mechanical techniques and civil infrastructure. nVent has proven constant and regular development for the reason that pandemic, having reported 12 consecutive quarters of year-over-year gross sales development supported by the secular tailwinds of electrification, sustainability and digitalization. Progress has come from a mix of volumes and pricing, with the corporate efficiently offsetting inflation with pricing. As a result of low price of its merchandise relative to a undertaking and excessive failure prices for patrons, nVent has good pricing energy and sustainable margins. Within the latest quarter, the corporate’s knowledge facilities enterprise (~14% of gross sales) was a standout, rising 20% yr over yr, because the acceleration in synthetic intelligence infrastructure investments has created elevated demand for the corporate’s liquid cooling options. Although nVent is now not promoting as cheaply as when it first drew our curiosity, the inventory nonetheless sells at a decrease P/E a number of than the S&P 500® Index regardless of higher earnings development.

Corebridge, a life insurance coverage and retirement options firm, was beforehand a unit of AIG and a September 2022 IPO. AIG nonetheless owns ~51% of the corporate following its latest secondary sale in November 2023, equaling 9.1% of shares excellent. Since including Corebridge to the portfolio in Q1 2023, it’s been amongst our high performers because the “higher for longer” rate of interest surroundings has pushed a rise in unfold earnings. Our funding thesis has been that Corebridge would profit from the present rate of interest surroundings following ZIRP (zero rate of interest coverage) and would even have loads of room to enhance its aggressive place and wring out efficiencies to enhance ROE now that it’s a standalone entity that’s now not half of a big inefficient and capital-constrained dad or mum. Even after latest inventory value beneficial properties, Corebridge yields 3.2% on its dividend, with a double-digit free money circulation yield. Along with Corebridge’s common dividend, the corporate paid two particular dividends in 2023 totaling $1.78, which is 7.6% on the March quarterending inventory value. In addition to dividends, we anticipate free money circulation shall be used to make sure holding firm liquidity, retire diluted shares and assist modest development expectations.

Lamar Promoting—our largest place—operates outside promoting constructions equivalent to billboards, digital billboards and transit advertisements. Outcomes have been comparatively regular, with power in native/regional gross sales lifting the highest line, whereas margin enchancment drove better-than-expected earnings development. Along with returning money to shareholders (the dividend yields 4.7%), administration is concentrated on delevering the steadiness sheet given restricted M&A alternatives. Whereas the corporate’s development can ebb and circulation, over the long run, the corporate has skilled common annualized natural development within the excessive single digits, supplemented by small tuckin acquisitions. With a report of constantly producing free money circulation and prudent capital allocation that features excessive return of capital to shareholders, this inventory suits our course of.

Our backside contributors have been Cable One (CABO), Philips (PHG) and Common Well being Realty Earnings Belief (UHT). Cable One, a small cable firm working in rural US markets, was our greatest detractor in Q1. Shares have remained weak as a result of issues about competitors from wi-fi suppliers and depressed subscriber development, pushed partially by fewer residential strikes in a frozen US housing market. Broadband subscriber additions picked up within the newest quarter, however elevated promotions and discounting decreased common income per subscriber, and an finish to the ACP (Reasonably priced Connectivity Program) accepting new enrollees creates a further headwind to rising subscribers. Whereas wi-fi firms are getting into new markets, 5G just isn’t presently aggressive with cable’s obtain speeds, and based mostly on the physics of wi-fi knowledge supply, 5G is unlikely to be aggressive with cable for a few years, if ever. Cable continues to have a aggressive benefit with respect to community speeds, reliability and capital depth. Regardless of latest development challenges, free money circulation conversion stays stable, and the valuation is extremely engaging, having a free money circulation yield of ~12% and promoting beneath our estimate of 8X normalized earnings. We just like the cable enterprise typically as a result of its excessive recurring income, pricing energy and wholesome working leverage.

Since Philips, a well being care know-how firm, initiated a voluntary recall of its first-generation CPAP machine greater than two years in the past, buyers have shunned the inventory as a result of uncertainty associated to potential litigation liabilities. That has left the inventory extraordinarily undervalued. In January, Philips agreed with the US authorities on a proposed consent decree offering a roadmap of required actions and prohibitions—a course of prone to take three years to conclude. As a part of the consent decree, Philips is prohibited from promoting CPAP or BiPAP sleep gadgets within the US. Nonetheless, Philips should still service sleep and respiratory care gadgets already with well being care supplier and sufferers and should proceed to promote different merchandise within the US. Additional, it doesn’t influence the corporate’s gross sales exterior the US. The general phrases are as anticipated, and there’s now a path ahead for Philips to ultimately return to the market. We recognize that till there’s better readability on the entire settlement price, the inventory might stay underneath stress, however on the present asking value, shares promote at a big low cost to our estimates of intrinsic worth.

Common Realty Earnings Belief (UHT) is a well being care REIT (actual property funding belief) specializing in well being care services, together with acute care hospitals, behavioral well being facilities and medical workplace buildings. Our preliminary buy was in June 2023. Like different excessive earnings producing shares, UHT has been out of favor given greater rates of interest. In addition to the inventory promoting at low ranges relative to its historic valuation and different REITs, we appreciated UHT’s monitor report of execution, low leverage, decreased cyclicality and constant annual dividend development. It presently yields almost 8%. Current outcomes have been sturdy, with income development up over 5% pushed by annual lease value escalators, a greater mixture of belongings, elevated occupancy and M&A. Nonetheless, UHT was down in Q1 together with the broader actual property sector as interest-rate delicate areas badly lagged the remainder of the market.

Portfolio Exercise

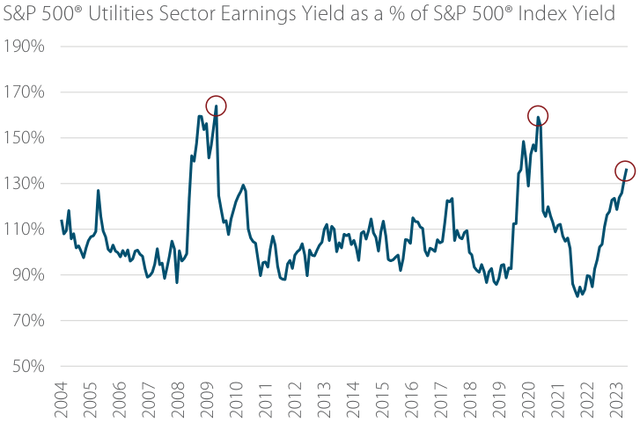

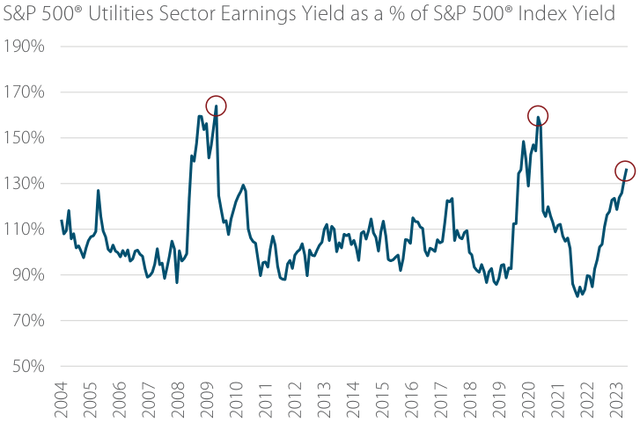

In Q1, we added two utilities to the portfolio: Alliant Vitality (LNT) and Evergy (EVRG). Alliant Vitality is a US-regulated electrical energy and pure fuel utility working within the Midwest. Evergy is a Kansas-based, absolutely built-in, absolutely electrical utility. Because the sector has lagged considerably over the previous yr, resulting in an above-average earnings yield relative to the broader market (Exhibit 1), we’re discovering extra alternative.

Exhibit 1: Utilities Sector: Mispriced Yield

Supply: Artisan Companions/FactSet. As of 31 Mar 2024. Previous efficiency doesn’t assure and isn’t a dependable indicator of future outcomes.

As a gaggle, utilities have been out of favor for a couple of causes. The rate of interest surroundings has made bonds extra interesting, and better inflation has elevated labor, gear and commodities prices whereas additionally elevating utilities’ prices of capital. Utility firms can cross on quite a lot of their prices to clients; nonetheless, charges are regulated, and regulators have strived to restrict the rise in clients’ utility payments, which have already skilled massive will increase within the post-COVID inflationary interval. Consequently, utilities haven’t been in a position to enhance their ROEs as latest charges instances have gone in opposition to them.

Alliant Vitality serves roughly 995,000 electrical and 425,000 pure fuel clients by means of two public utility subsidiaries, Interstate Energy and Mild (operates in Iowa) and Wisconsin Energy and Mild. Regardless of little change within the firm’s regulatory or working environments, the inventory has retrenched over the previous yr, and it now trades for about 16X P/E in comparison with a median of 18X over the previous 10 years and has a 3.6% dividend yield. The corporate continues to spend money on fee base, and a optimistic end result on its present fee case in September might give it a lift.

Evergy serves greater than 1.7 million clients in Kansas and Missouri. Along with the aforementioned dynamics weighing on utilities share costs, Evergy had two key fee instances in 2023, one in Kansas and the opposite in Missouri, that offered danger for buyers. The Missouri case went higher than anticipated, however the returns allowed by the Kansas regulator have been punishingly low. Although Evergy operates in a subpar regulatory surroundings, the utility is an efficient operator, with sturdy buyer satisfaction scores, below-average capex wants and a clear steadiness sheet. The regulatory surroundings might enhance in some unspecified time in the future, however even when it doesn’t, Evergy trades for simply 13X 2024 earnings, which is beneath common relative to its historical past and friends— and pays a dividend yielding 4.7%.

We additionally added Ryanair Holdings (RYAAY), an Eire-based low-cost airline targeted on the European market. The airline’s low-cost, excessive on-time, high-efficiency mannequin has helped it to take share from inefficient legacy and state-sponsored carriers over the previous 20 years. Ryanair retains a internet money steadiness sheet to opportunistically buy plane countercyclically when it could possibly accomplish that at cheaper costs. Moreover, the corporate’s economics are favorable. It has pricing energy as a result of business consolidation, capability development that’s beneath demand development and an absence of overlap on key routes. This results in sturdy returns on fairness and margins. Ryanair not too long ago initiated its first dividend coverage, and we estimate the dividend might yield 2%–3%. Along with the dividend, Ryanair is predicted to repurchase inventory. Over the past decade, the corporate has retired 20% of its share rely. That is exceptional contemplating it was a growth-focused airline and nonetheless had internet money after a pandemic. The inventory sells at a beautiful low-doubledigit P/E, however we don’t want a number of enlargement for this funding to contribute effectively to our portfolio earnings and capital appreciation aims. We consider merely continued execution of the enterprise ought to result in stable returns.

Perspective

With market-cap weighted indices hitting new highs and the S&P 500® Index promoting for 23X (FY1) earnings, value-conscious buyers—a gaggle during which we proudly admit to being members—might really feel some trepidation concerning ahead return expectations for the asset class. Nonetheless, we consider it could be a mistake to focus solely on the S&P 500® Index, which has turn out to be more and more concentrated amongst a couple of mega-cap shares, and in our view, now not represents the various alternative set that exists inside our worth funding universe. As we’ve famous in prior letters and on our weblog Artisancanvas.com, worth is traditionally low cost. Other than the pandemic years of 2020 to 2021, large-cap worth hasn’t been this low cost relative to large-cap development for the reason that aftermath of the tech bubble. The Russell 1000® Worth Index trades for 16.5X FY1 estimated earnings. The Russell 1000® Progress Index trades at 28.8X FY1 estimates. The typical and median valuation spreads between these indices have been 7.8 and 6.1 share factors over the previous 26 years. At the moment, it’s 12.2 share factors. We don’t know if the valuation premium for development shares will revert in a yr or over the subsequent 10, however we do know that the present unfold positions worth shares favorably from right here.

|

Fastidiously take into account the Fund’s funding goal, dangers and costs and bills. This and different essential info is contained within the Fund’s prospectus and abstract prospectus, which could be obtained by calling 800.344.1770. Learn rigorously earlier than investing. Present and future portfolio holdings are topic to danger. The worth of portfolio securities chosen by the funding group might rise or fall in response to firm, market, financial, political, regulatory or different information, at instances better than the market or benchmark index. A portfolio’s environmental, social and governance (“ESG”) concerns might restrict the funding alternatives out there and, consequently, the portfolio might forgo sure funding alternatives and underperform portfolios that don’t take into account ESG elements. There is no such thing as a assure that the businesses during which the portfolio invests will declare dividends sooner or later or that dividends, if declared, will stay at present ranges or enhance over time. The fairness, fastened earnings and by-product safety varieties referenced every comprise inherent dangers, together with the chance of loss like all investments, and capital appreciation and earnings just isn’t assured. Worldwide investments contain particular dangers, together with forex fluctuation, decrease liquidity, completely different accounting strategies and financial and political techniques, and better transaction prices. These dangers usually are better in rising and fewer developed markets, together with frontier markets. Worth securities might underperform different asset varieties throughout a given interval. Securities of small- and medium-sized firms are inclined to have a shorter historical past of operations, be extra risky and fewer liquid and should have underperformed securities of enormous firms throughout some durations. S&P 500® Index measures the efficiency of 500 US firms targeted on the large-cap sector of the market. Russell 1000® Progress Index measures the efficiency of US large-cap firms with greater value/e book ratios and forecasted development values. Russell 1000® Worth Index measures the efficiency of US large-cap firms with cheaper price/e book ratios and forecasted development values. The Dow Jones US Choose Dividend Index measures the efficiency of the US’s main shares by dividend yield. The index(es) are unmanaged; embody internet reinvested dividends; don’t mirror charges or bills; and should not out there for direct funding. This abstract represents the views of the portfolio managers as of 31 Mar 2024. These views might change, and the Fund disclaims any obligation to advise buyers of such modifications. For the aim of figuring out the Fund’s holdings, securities of the identical issuer are aggregated to find out the burden within the Fund. The holdings talked about above comprise the next percentages of the Fund’s whole internet belongings as of 31 Mar 2024: nVent Electrical PLC 2.1%, Corebridge Monetary Inc 1.8%, Lamar Promoting Co 3.7%, Cable One Inc 3.4%, Koninklijke Philips NV 1.1%, Common Well being Realty Earnings Belief 1.3%, Alliant Vitality Corp 1.7%, Evergy Inc 1.5%, Ryanair Holdings PLC 1.5%. Securities named within the Commentary, however not listed below are not held within the Fund as of the date of this report. Portfolio holdings are topic to vary with out discover and should not meant as suggestions of particular person securities. All info on this report, except in any other case indicated, consists of all lessons of shares (besides efficiency and expense ratio info) and is as of the date proven within the higher proper hand nook. This materials doesn’t represent funding recommendation. Portfolio safety yields are topic to market situations and should not assured. The International Trade Classification Commonplace (GICS®) is the unique mental property of MSCI Inc. (MSCI) and Commonplace & Poor’s Monetary Companies, LLC (S&P). Neither MSCI, S&P, their associates, nor any of their third social gathering suppliers (“GICS Parties”) makes any representations or warranties, categorical or implied, with respect to GICS or the outcomes to be obtained by the use thereof, and expressly disclaim all warranties, together with warranties of accuracy, completeness, merchantability and health for a selected function. The GICS Events shall not have any legal responsibility for any direct, oblique, particular, punitive, consequential or every other damages (together with misplaced income) even when notified of such damages. The S&P 500® and Dow Jones US Choose Dividend (“Indices”) are merchandise of S&P Dow Jones Indices LLC (“S&P DJI”) and/or its associates and has been licensed to be used. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P International, Inc. All rights reserved. Redistribution or copy in complete or partially are prohibited with out written permission of S&P Dow Jones Indices LLC. S&P® is a registered trademark of S&P International and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). None of S&P DJI, Dow Jones, their associates or third social gathering licensors makes any illustration or guarantee, categorical or implied, as to the flexibility of any index to precisely signify the asset class or market sector that it purports to signify and none shall have any legal responsibility for any errors, omissions, or interruptions of any index or the info included therein. Frank Russell Firm (“Russell”) is the supply and proprietor of the emblems, service marks and copyrights associated to the Russell Indexes. Russell® is a trademark of Frank Russell Firm. Neither Russell nor its licensors settle for any legal responsibility for any errors or omissions within the Russell Indexes and/or Russell rankings or underlying knowledge and no social gathering might depend on any Russell Indexes and/or Russell rankings and/or underlying knowledge contained on this communication. No additional distribution of Russell Knowledge is permitted with out Russell’s categorical written consent. Russell doesn’t promote, sponsor or endorse the content material of this communication. Attribution is used to judge the funding administration choices which affected the portfolio’s efficiency when in comparison with a benchmark index. Attribution just isn’t actual, however ought to be thought-about an approximation of the relative contribution of every of the elements thought-about. Portfolio holdings are categorised into 5 earnings classes: Core Worth, Dividend Restoration, Dividend Progress, Bond Proxy and Capital Construction. Core Worth holdings are investments in keeping with the group’s worth investing method that even have an earnings part. Dividend Restoration holdings are investments the place the present yield doesn’t mirror the longer term payout. Dividend Progress holdings are investments the place the dividend payout is predicted to develop over a multiyear interval. Bond Proxy holdings are investments in companies that are much less economically delicate and have regular dividend polices. Capital Construction holdings are devices that comprise non-equity elements of the capital construction (e.g., most well-liked securities, convertibles and bonds). This materials is supplied for informational functions with out regard to your specific funding wants and shall not be construed as funding or tax recommendation on which you’ll rely on your funding choices. Traders ought to seek the advice of their monetary and tax adviser earlier than making investments with the intention to decide the appropriateness of any funding product mentioned herein. Free Money Move is a measure of economic efficiency calculated as working money circulation minus capital expenditures. Free Money Move Yield is an general return analysis ratio of a inventory, which standardizes the free money circulation per share an organization is predicted to earn in opposition to its market value per share. The ratio is calculated by taking the free money circulation per share divided by the share value. Worth-to-Earnings (P/E) is a valuation ratio of an organization’s present share value in comparison with its per-share earnings. Dividend Yield is a monetary ratio that exhibits how a lot an organization pays out in dividends annually relative to its share value. Normalized Earnings are earnings which can be adjusted for the cyclical ups and downs over a enterprise cycle. Earnings Yield (which is the inverse of the P/E ratio) is the corporate’s per-share earnings divided by its present share value. Unfold is the distinction in yield between two bonds of comparable maturity however completely different credit score high quality. Artisan Companions Funds provided by means of Artisan Companions Distributors LLC (APDLLC), member FINRA. APDLLC is an entirely owned dealer/supplier subsidiary of Artisan Companions Holdings LP. Artisan Companions Restricted Partnership, an funding advisory agency and adviser to Artisan Companions Funds, is wholly owned by Artisan Companions Holdings LP. © 2024 Artisan Companions. All rights reserved. |

Editor’s Be aware: The abstract bullets for this text have been chosen by In search of Alpha editors.