The Trump administration’s announcement on Friday of an indefinite pause on the collection of defaulted federal student loan debt, including through the Treasury Offset Program, at least temporarily extends a program that began more than half a decade ago, as a temporary pandemic measure under the first Trump Administration. It has since been extended through both bipartisan legislation and administrative action during the Biden administration.

The student-debt relief will likely come as relief to many members of Gen Z, who, as Fortune‘s Jacqueline Munis recently reported, average $94,000 in student-loan debt, driving them into “disillusionomics.” Other pundits, notably Kyla Scanlon, have riffed on the concept of “financial nihilism,” as coined by entrepreneur Demetri Kofinas, to describe how Gen Z’s crushing anxiety over their own futures—be it artificial intelligence, the $38 trillion national debt, or any other long-running financial emergency—drive them to destructive behaviors.

Trump, for his part, has been scrambling to address voter concerns about “affordability,” and has been reportedly in close contact, even texting back and forth in what the New York Post calls a “bromance,” with the bard of affordability himself: New York City Mayor Zohran Mamdani.

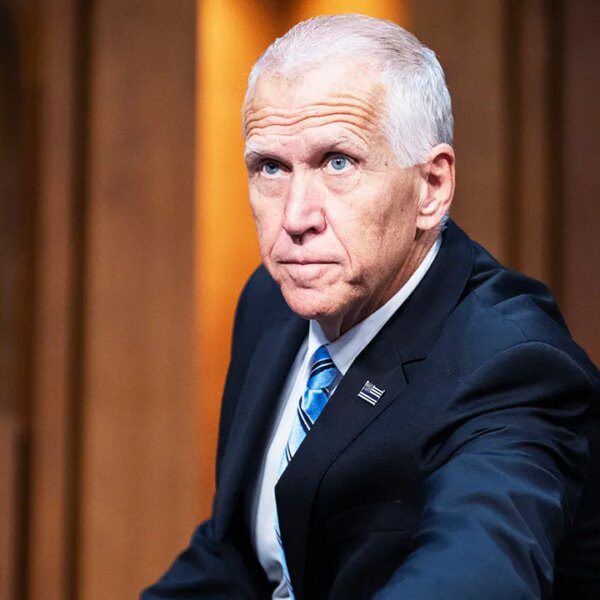

In the opinion of the Committee for a Responsible Federal Budget, though, the nonpartisan watchdog that stresses sustainability in fiscal policy, there is no excuse for this development.

CRFB President Maya MacGuineas called the decision “beyond ridiculous,” coming six years removed from the Covid pandemic that first put a stop to student-debt collections.

“This is an incoherent political giveaway, doubling down on the debt cancelation from the Biden era,” she wrote. “We’re not in a pandemic or financial crisis or deep recession. There’s no justification for emergency action on student debt, and no good reason the for the President to back down on efforts to actually begin collecting debt payments again.”

CRFB estimated that Trump’s pivot away from collections would cost about $5 billion a year in lost revenue.

A new pause, old playbook

Until now, Trump’s second-term team had been moving in the opposite direction, restarting the Treasury Offset Program in May 2025 and preparing to resume wage garnishment for borrowers in default. The new policy abruptly reverses that trajectory by restoring and extending a freeze that critics say was supposed to be temporary and tied to the COVID crisis, not a permanent fixture of higher-education finance.

MacGuineas argued that by blocking collections, the administration risks undermining “historic cost-saving reforms” to the federal student loan program that Congress approved this year to put the system on a more sustainable footing with a “fair repayment system.” She warned that taxpayers will end up paying more while borrowers could ultimately face larger balances, and the wider economy could feel upward pressure on interest rates and inflation.

Clash over Congress’s role

At the heart of the fight is who should shape the future of student lending: Congress or the president acting alone. Lawmakers this year enacted significant reforms meant to trim long-term costs and cement a more predictable repayment framework, and the CRFB credits the Trump administration with implementing those changes “with fiscal costs in mind” until now.

“The student loan program isn’t supposed to be a tool to stimulate the economy or buy votes,” MacGuineas argued, “it’s a way to help millions of students access college.” The White House should work with Congress to reform the collection of defaulted loans if that’s what it really wants to do, “But loans are supposed to be repaid, and the Administration should start collecting,” she added.

The action came just days after Trump took another page out of Mamdani’s democratic socialist playbook, suggesting a 10% cap on credit card interest rates. His former communications director, Anthony Scaramucci, suggested that this “hard-left” move could only have come from one place: his text message bromance with the princeling of Gotham.