© Reuters.

Investing.com– Most Asian currencies superior on Tuesday amid rising conviction that the Federal Reserve was performed elevating rates of interest, which in flip put the greenback at a three-month low.

Nonetheless, positive aspects in most regional currencies had been restricted as merchants remained cautious earlier than a string of key financial readings this week. – the Fed’s most popular inflation gauge- will likely be a serious level of focus this week.

The was among the many higher performers for the day, rising 0.3% as merchants guess that the Financial institution of Japan will pivot away from its ultra-dovish stance in 2024. Sticky Japanese inflation knowledge launched final week furthered this notion.

Easing fears of the Fed helped the yen recuperate farther from the 150 degree. Focus is now on and readings from Japan, due later within the week.

The rose 0.3%, whereas the added 0.2% monitoring some energy in commodity costs. Information confirmed on Tuesday that Australian unexpectedly shrank in October, spurring some bets that inflation will pattern decrease within the coming months.

However Reserve Financial institution of Australia Governor Michele Bullock warned that Australian inflation was monitoring world developments, and that the financial institution wanted to be cautious in elevating rates of interest additional.

The was flat round document lows, whereas the and additionally tread water.

Greenback at 3-mth low on bets of no extra Fed hikes

The and fell barely in Asian commerce, extending in a single day losses after sinking to three-month lows at the beginning of the week.

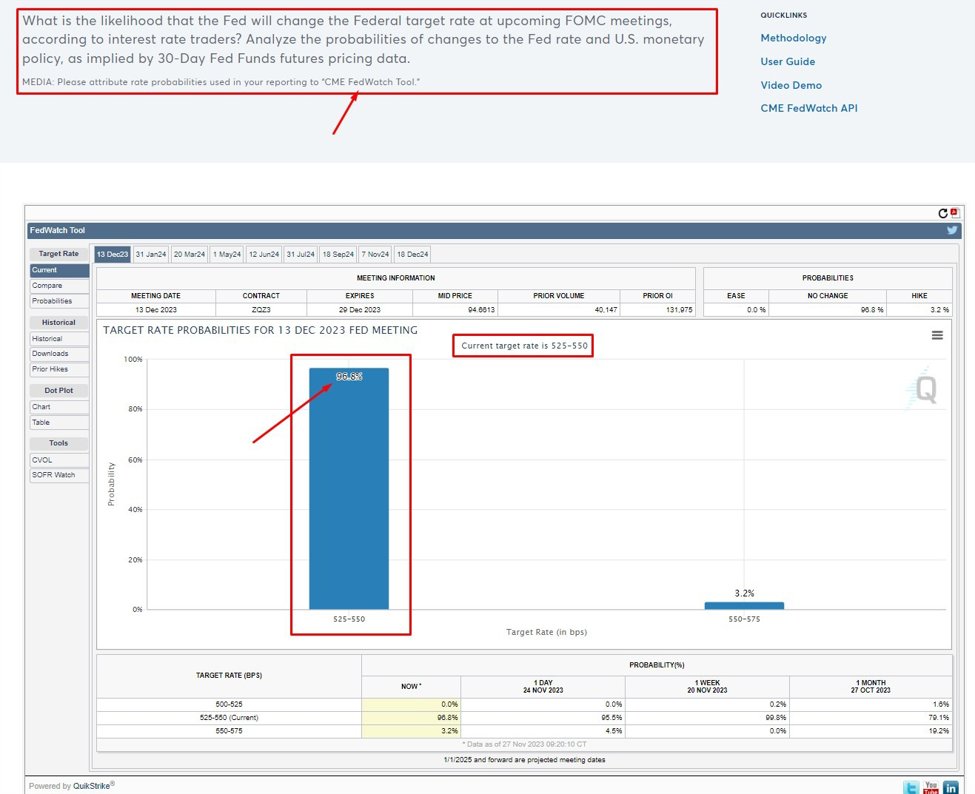

The buck was walloped by rising bets that the , and is more likely to start trimming charges in 2024.

However markets had been now awaiting extra financial cues to gauge simply when the Fed may start loosening coverage. Other than the PCE knowledge, U.S. (PMI) readings for November are additionally due this week, as is a revised .

Any indicators of resilience within the U.S. financial system is probably going to provide the Fed extra headroom to maintain charges increased for longer. However the reverse may occur if knowledge reveals the financial system cooling sooner than anticipated.

Asian markets have been largely delicate to the trail of U.S. charges, and are more likely to see extra positive aspects on the prospect of a much less hawkish Fed.

Chinese language yuan flat, key PMIs in focus

The moved little on Tuesday following a touch stronger each day midpoint repair by the Folks’s Financial institution of China. However persistent issues over a slowing Chinese language financial rebound and laggard stimulus measures restricted any energy within the forex.

Focus this week is squarely on for November, due on Thursday. The readings are anticipated to point out continued weak spot in enterprise exercise after a swathe of disappointing readings for October.

Issues over China have additionally weighed on Asian markets in latest months, given the nation’s dominance as a buying and selling hub within the area. Beijing has additionally remained largely conservative in rolling out extra coverage help for the financial system.

![Web Design Glossary: 38 Terms & Definitions You Need to Know [Infographic]](https://whizbuddy.com/wp-content/uploads/2024/05/bG9jYWw6Ly8vZGl2ZWltYWdlLzM4X3dlYl9kZXNpZ25fdGVybXMxLnBuZw.webp.webp)