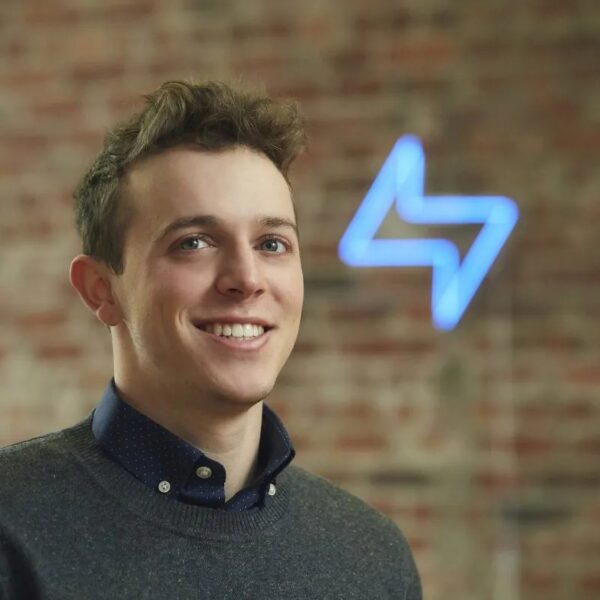

The portrait of Mahatma Gandhi is displayed on Indian rupee banknotes in an organized {photograph} in Bangkok, Thailand, on Wednesday, Sept. 12, 2018.

Brent Lewin | Bloomberg | Getty Pictures

The U.S. Federal Reserve is predicted to chop rates of interest later this 12 months and, whereas that might not be excellent news for the dollar, some Asian currencies stand to profit.

Increased rates of interest increase a rustic’s foreign money, attracting overseas funding and rising demand for the nation’s foreign money. A weak U.S. greenback is usually optimistic for rising markets, which is commonly the case when the Fed cuts rates of interest exterior of an financial disaster.

The Fed shifted to a extra dovish stance in December, with markets now pricing in charge cuts by summer time. The CME FedWatch tool urged the primary 25-basis-point charge lower in 2024 might occur as early as June.

The Fed’s January meeting concluded with the central financial institution holding its benchmark borrowing charge in a spread between 5.25% and 5.5%.

Specialists advised CNBC currencies such because the Chinese yuan, the Korean won and the Indian rupee stand to profit from the Fed loosening financial coverage.

Yuan cannot go any decrease

China has weathered a slew of disappointing headlines which have crushed down investor confidence. However hopes that authorities wouldn’t enable the trade-reliant nation’s foreign money to weaken under a sure stage have restricted yuan pessimism.

China has tried to stabilize the yuan towards the greenback previously and is predicted to proceed doing so, in response to Arun Bharath, chief funding officer at Bel Air Funding Advisors.

“While the exchange rate has weakened to a 7 handle on the USD/CNY rate, reflecting a weaker economic situation in China, further weakening is unlikely as policymakers start to be more aggressive in fiscal stimulus, credit growth, and propping up property values,” Bharath stated.

He famous that the Chinese language foreign money’s alternate charge will doubtless hover in “a narrow band around the current exchange rate of 7.10.”

Not like different main currencies just like the Japanese yen or U.S. greenback which have free floating alternate charges, China retains strict control of the onshore yuan. The foreign money is pegged with a so-called every day midpoint repair to the buck based mostly on the yuan’s earlier closing stage and quotations taken from inter-bank sellers.

Final 12 months, the onshore yuan hit a 16-year low against the dollar at 7.2981.

If the Fed begins reducing charges by summer time, that might doubtless slim the yield differentials between the world’s two largest economies and alleviate some stress off the Chinese language yuan. Yield differentials is a method to examine bonds by way of the variations between how a lot they yield.

The Individuals’s Financial institution of China is a important participant in managing the foreign money, which Simon Harvey, head of FX evaluation at Monex, stated could be carried out by way of its every day fixing, liquidity measures, regulatory channels, and instructing state banks to intervene.

That final technique is probably the most opaque as the whole worth of {dollars} in China’s FX reserves is unknown.

Rupee using excessive

The Indian rupee may benefit from carry trades this 12 months, a method the place merchants borrow low-yielding currencies such because the U.S. greenback so as to purchase high-yielding property like bonds.

“A lot of carry trade against other currencies like the yen or the euro but once interest rates fall in the U.S., we will see the interest rate differential widen to allow carry trade to happen. So those are also positive for the Indian currency,” stated Anindya Banerjee, vice chairman of foreign money and derivatives analysis at Kotak Securities.

The rupee might additionally strengthen amid hopes the Reserve Financial institution of India could loosen financial coverage extra slowly than different central banks.

Banerjee famous that the RBI’s charge lower tempo will probably be “far slower” than the Fed and “will always significantly lag the Fed because India did not have the same inflation problem which Europe or America had.”

“The reason is simple, because fiscal policy is firing on all cylinders, the economy’s doing very well and they don’t want any overheating at this point in time,” Banerjee stated.

The rupee has strengthened to as a lot as 82.82 towards the greenback within the final three months. The foreign money dipped 0.6% in 2023, a a lot smaller weakening towards the greenback in comparison with the prior 12 months’s 11% decline.

Stress off Korea’s gained

South Korea’s gained has been underneath stress for 3 years, however enhancing financial prospects and looser Fed coverage will assist ease that pressure in 2024.

“As a low yielding and highly cyclical currency, we think the Korean won stands to be one of the major beneficiaries of the Fed’s easing cycle in the second half of the year as lower U.S. rates will not only reduce pressure on KRW through the rates channel but will also lead to an uptick in the global growth outlook,” Monex’s Harvey stated.

However Harvey stated the gained’s positive factors can even be decided by the extent of the Fed’s cuts. He predicted the foreign money might acquire anyplace between 5% and 10% if the easing cycle is deep, whereas as little as 3% if the cycle proves to be shallow.

South Korea’s financial prospects are additionally anticipated to enhance this 12 months. The International Monetary Fund predicted 2.3% progress in 2024 and 2025, greater than final 12 months’s progress of 1.4%.