Few people think Trump will actually follow through with 25% across-the-board tariffs on Canada and Mexico, at least not for any length of time.

But with Trump you need to prepare for anything and that’s what Deutsche Bank has done today with forecast scenarios that illustrate where US inflation will lad with tariffs.

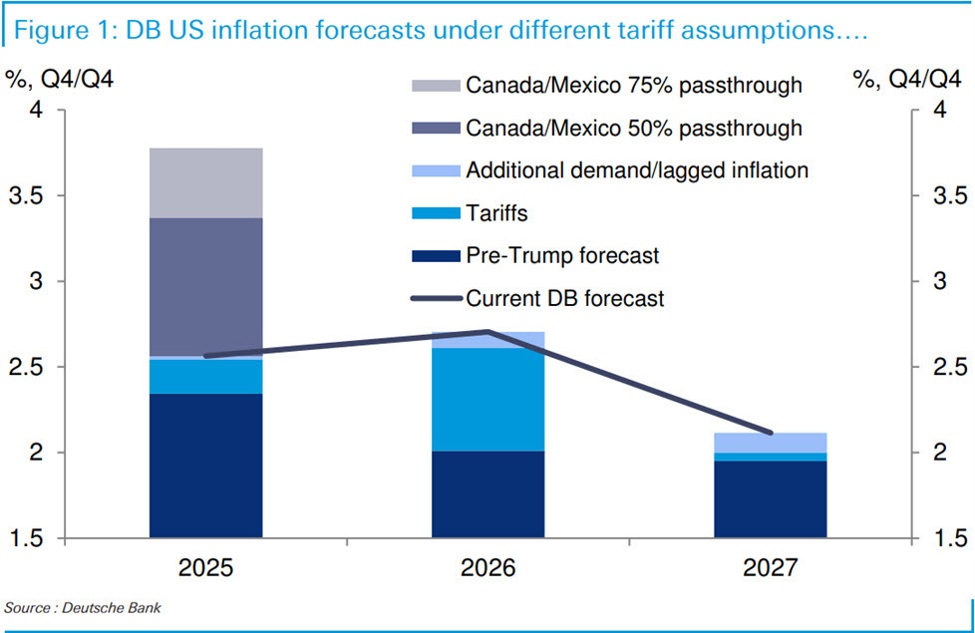

This chart shows how US inflation could develop in scenarios where half or three-quarters of the costs of the tariffs are passed on to end users.

“US imports from Canada and Mexico represent

about 4.7% of headline personal consumption expenditures and 5.4% of core.

Should that extra 25pp tariff be passed along through all stages of production,

that would be expected to increase the core PCE price level by 1.4% (5.4% times

25pp),” they write. “So a strong potential boost that would be

a further headache for the Fed. For now, the team assume no further increases

in the price level in 2026 but it is of course complicated and the risk would

be other tariffs cause a general reset of price expectations higher.”

The kicker here is that this is just Canada and Mexico. If that pair were to be hit by tariffs that high, then China, Europe and the rest of the world would surely be stung as well.