Whereas the know-how world breathlessly awaits Reddit’s public debut, one other firm you may by no means have heard of is about to go public: Astera Labs. And it could be a extra necessary take a look at of buyers’ returning urge for food for tech IPOs.

Astera this week introduced in a public filing that it’s public debut could be larger than it initially deliberate in each approach: It’ll promote extra shares — 19.8 million vs. the earlier plan of 17.8 million — and at the next value, anticipating to promote at $32 to $34 per share, vs. the earlier $27 to $30 vary. Astera expects to lift $517.6 million on the center of its raised vary, it stated, up from $392.4 million. IPO watchers anticipate it to debut this week.

Whereas Reddit’s IPO might do effectively from buyers trying to purchase a widely known social media firm that has an attention-grabbing, burgeoning AI data business, Astera Labs is an AI {hardware} story. And no, it’s not taking on Nvidia, the American chip giant that created the world’s most in-demand AI chip.

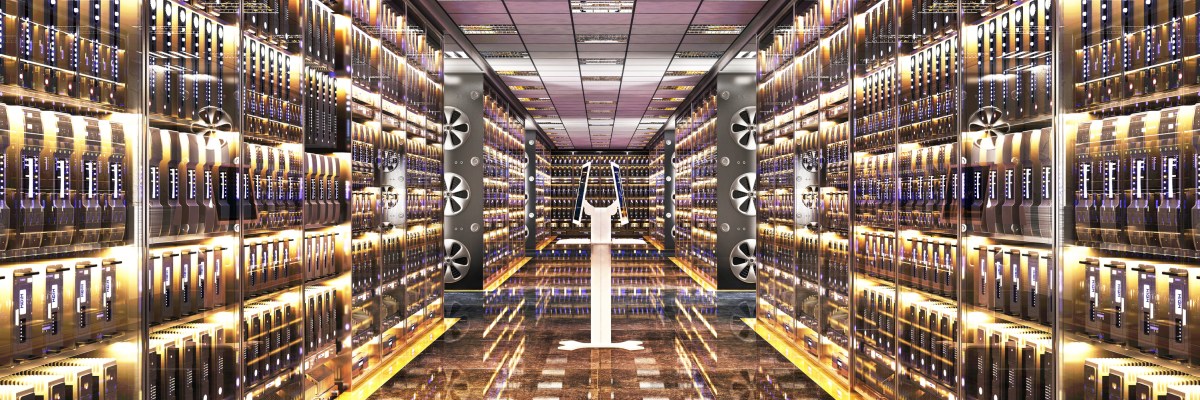

Astera Labs makes connectivity {hardware} for cloud computing information facilities. As a result of AI requires huge quantities of knowledge transferring into, out of and round information facilities, Astera has seen current its revenues bloom. After producing $79.9 million in 2022, income swelled 45% in 2023 to $115.8 million.

With 271 mentions of “AI” in its most up-to-date SEC submitting, the corporate is working exhausting to persuade buyers that it’s a part of the bigger synthetic intelligence increase.

Simply how a lot AI-juice Astera actually has for long-term success is up for debate. Nick Einhorn, vice chairman of analysis at Renaissance Capital, an organization that tracks the IPO market and provides public-offering targeted ETFs, is a contact skeptical. Astera is “not an AI company” Einghorn instructed TechCrunch. The corporate, is, nevertheless, “benefiting from the trend,” in his view, significantly information heart spending driven by AI. A lot so, that in 2022, Amazon signed a warrant settlement that enables it to purchase simply shy of 1.5 million shares, which isn’t proof that Amazon Net Companies is a buyer, however does trace at it.

Then once more, whereas the corporate does have an AI story to inform, its fast current development and demonstrated early profitability could possibly be the important thing drivers to its public-market investor curiosity.

Firms can develop and earn money on the similar time

In startup-land, development and losses usually stroll hand-in-hand. Startups increase capital from private-market buyers, investing the funds into their operations to develop headcount in order that they’ll construct, and promote extra shortly. Usually by the point {that a} startup reaches the required scale to file for a public providing, it’s nonetheless unprofitable and never prone to begin producing adjusted earnings, not to mention revenue based on extra stringent accounting requirements, within the close to future

Up till the fourth quarter of 2023, Astera Labs gave the impression to be simply that type of firm. It’s enterprise grew quickly final 12 months, with sticky losses to match.

On its 2022 $79.9 million in income, it posted a internet lack of $58.3 million; on its 2023 $115.8 million in income, internet loss tallied $26.3 million. So, on an annual foundation, that is far from the kind of profitable company IPO experts say this harsh market requires. Even when the corporate eliminated the non-cash prices of paying its staff partially in shares, the corporate’s adjusted earnings have been nonetheless destructive in 2023.

However after we dig in, its monetary success turns into extra nuanced. Within the third quarter of 2023, Astera Labs’ income started rising dramatically: from $10.7 million in Q2 2023 to $36.9 million in Q3, and $50.5 million in This fall.

And whereas that spike in development is spectacular by itself, the corporate’s profitability image has additionally radically improved as 2023 got here to a detailed. After posting a internet lack of $20.0 million in Q2 2023, internet loss evaporated to a mere $3.1 million in Q3 2023.

And for This fall, Astera Labs swung to a revenue: $14.3 million value of internet revenue.

Einhorn warned that the corporate’s This fall 2023 outcomes might not augur the corporate’s new regular. “One of the challenges for companies like this,” he defined, “is that you tend to have a lot of customer concentration and customer buying patterns can be very lumpy.” Good current quarters don’t at all times indicate related future quarters. One other weak point: in 2023, its largest three clients represented about 70% of its income, Astera disclosed.

Placing all of it collectively: Astera Labs has caught a wave because of AI information heart spending. Its ensuing monetary glow-up is spectacular, and helps clarify why its IPO is is about to happen at a valuation of around $5.2 billion, a wholesome raise from of its closing private-market value of $3.15 billion.

If the corporate is ready to entice a robust following after its first day of buying and selling, it might wedge the IPO door open for different companies seeing newfound development as a by-product of AI. And maybe that might be sufficient for extra know-how choices to sneak out this 12 months.