Rick Kern/Getty Pictures Leisure

We’re almost by means of the primary quarter of 2024, and sure only a few traders would have anticipated the sharp rise within the inventory market for the reason that begin of the 12 months. My urge for food for risk-taking has taken off once more, lifting all the pieces from AI shares to cryptocurrencies. However in opposition to this backdrop, traders ought to concentrate on deploying capital conservatively, and defend for potential draw back as an alternative of getting too grasping.

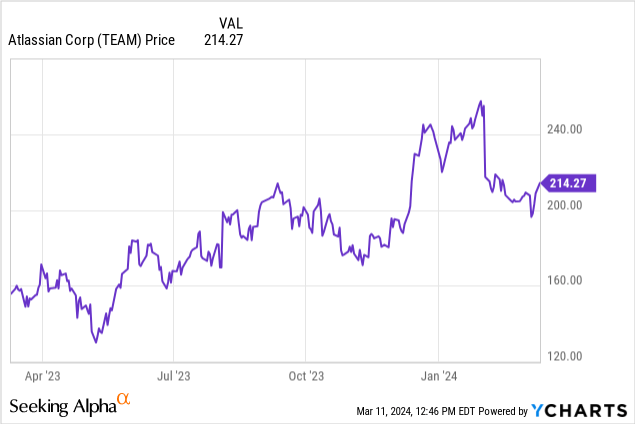

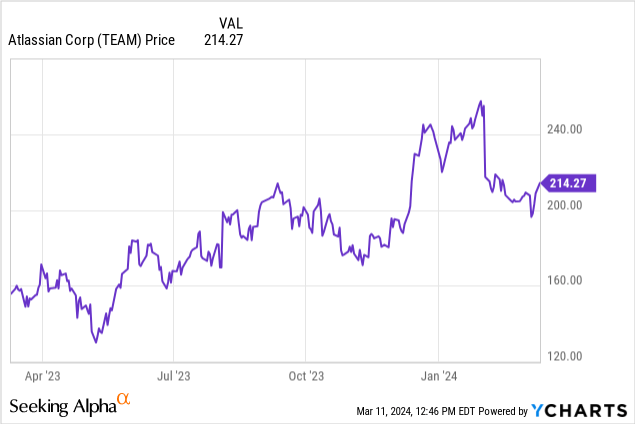

We have seen proof of exhaustion for prime multiples amid lackluster efficiency, particularly in a inventory like Atlassian (NASDAQ:TEAM). The workflow and challenge administration software program vendor has bucked the pattern of its software program friends this 12 months and declined ~5% for the reason that begin of the 12 months, with sharp losses choosing up after the corporate’s fiscal Q2 (December quarter) earnings launch.

I final wrote a neutral opinion on Atlassian in November, when the inventory was buying and selling nearer to $175. On the time, I had argued that the current bull and bear case for the corporate was balanced and that traders can be clever to attend for an extra drop earlier than shopping for in. Now, with the inventory modestly richer than again then (pushed, largely, by Atlassian rising in sympathy with different tech shares slightly than company-specific catalysts), plus the weaknesses uncovered in Atlassian’s most up-to-date earnings quarter, I am dropping my score on the inventory again all the way down to bearish.

Atlassian is within the midst of an enormous enterprise transition. The corporate is killing off its server merchandise and inspiring extra prospects to modify to its cloud choices. This might be a long-term profit to income as the corporate will financial institution on a extra steady, recurring income stream, however there’s a near-term impression on margins as cloud deployments have barely increased embedded prices. On the similar time, Atlassian is dealing with a continued macro headwind as corporations rationalize their IT spending and take an axe to pointless prices. This has manifested in decrease seat enlargement, significantly in small and mid-sized companies which can be feeling quite a lot of the present macro ache.

Listed here are the entire long-term bear dangers for this firm:

- As soon as a progress famous person, Atlassian’s progress has moderated to the 20s. Due each to more durable macro situations plus the burden of Atlassian’s personal scale, Atlassian’s progress charges are lastly beginning to reasonable into the 20s (versus a ~40% progress price throughout the peak of the pandemic period). Arguably, Atlassian’s core merchandise additionally face stiffer competitors as related software program merchandise like Asana (ASAN) proceed to develop from a a lot smaller base. Continued deceleration calls into query Atlassian’s premium valuation a number of.

- Seat enlargement in danger. Atlassian’s core enterprise mannequin entails changing freemium customers to paid customers, after which hoping that these paid customers finally develop utilization and seats over time. In an period of price range rationalization, this enlargement tailwind might lose some steam.

- Margins are additionally dealing with strain, pushed by cloud migration. Equally, as Atlassian continues to see a income combine shift into the cloud (which carries a decrease gross margin profile than its end-of-life server merchandise), its low-80s gross margin is truly fizzling out, which is hindering the corporate’s total bottom-line enlargement.

- Server end-of-life might trigger higher-than-expected churn. Atlassian stopped supporting its server deployments in February 2024, which can alienate many longtime prospects who refuse emigrate to both cloud or knowledge heart deployments, inflicting a income headwind.

We additionally want to think about the truth that, as Atlassian’s inventory has bubbled up with the remainder of the market, it continues to take care of an costly valuation premium relative to its basic prospects. At present share costs close to $215, Atlassian trades at a market cap of $55.55 billion. After we web off the $1.83 billion of money and $987.2 million of debt on Atlassian’s most up-to-date steadiness sheet, the corporate’s ensuing enterprise worth is $54.71 billion.

In the meantime, for the subsequent fiscal 12 months FY25 (the 12 months for Atlassian ending in June 2025), Wall Road analysts have a consensus income goal of $5.10 billion for Atlassian (representing 20% y/y progress) and $3.13 in professional forma EPS. If we apply the corporate’s present YTD FCF margin of twenty-two% in opposition to that income profile, we get a FCF of $1.12 billion.

This places Atlassian’s valuation multiples at:

- 10.7x EV/FY25 income

- 48.8x EV/FY25 FCF

- 68.7x FY25 P/E

Contemplating the variety of dangers stacked in opposition to Atlassian which have partially materialized in latest outcomes, I can not justify paying a heady premium for this inventory presently. Steer clear right here and make investments elsewhere.

Q2 obtain

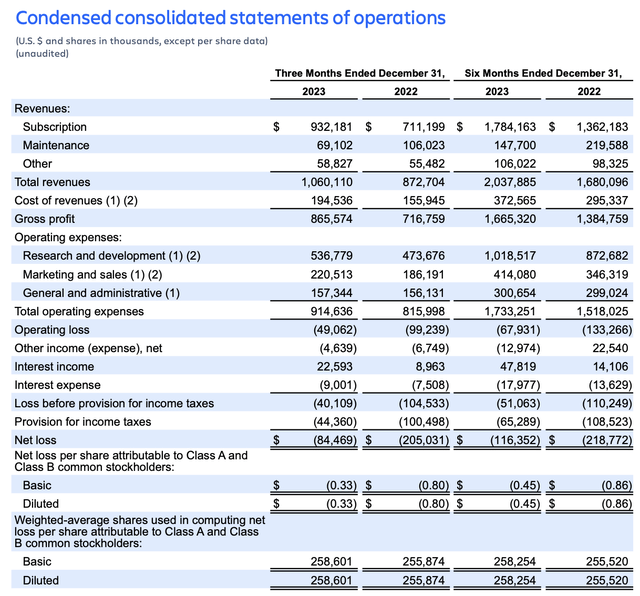

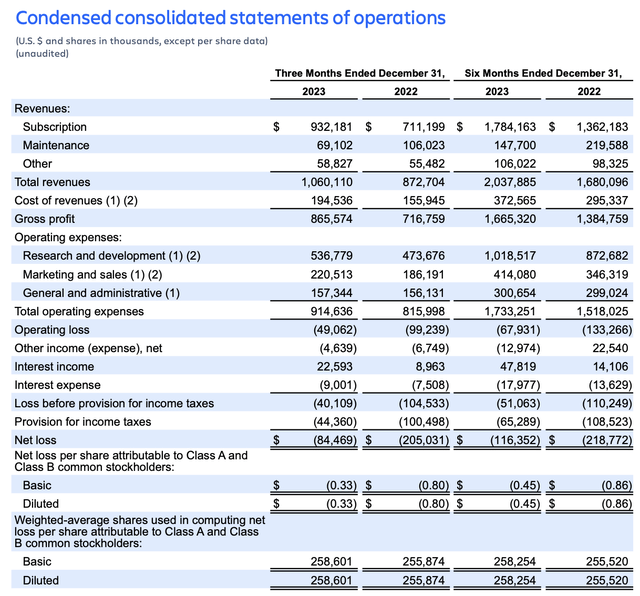

Let’s now undergo Atlassian’s newest quarterly leads to larger element. The Q2 earnings abstract is proven beneath:

Atlassian Q2 outcomes (Atlassian Q2 shareholder letter)

Total income grew 21% y/y to $1.06 billion, forward of Wall Road’s expectations of $1.02 billion (+17% y/y) by a four-point margin. Income progress additionally saved tempo with Q1’s 21% y/y progress tempo.

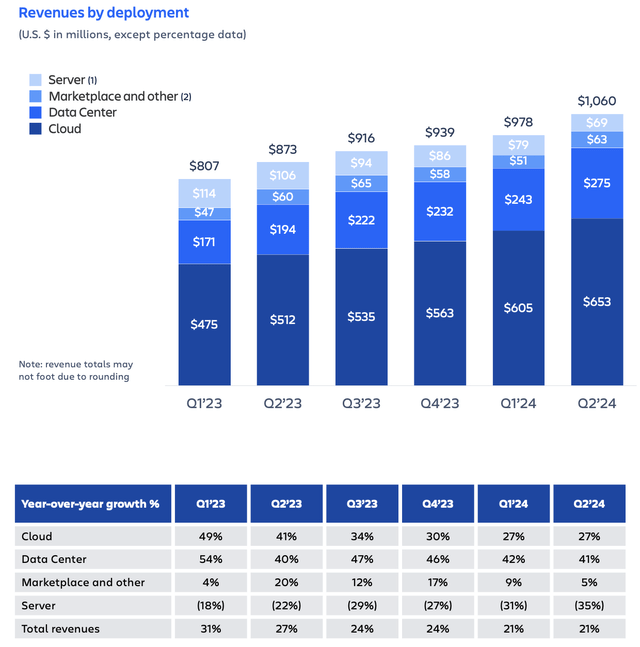

The chart beneath reveals Atlassian’s income damaged out by class:

Atlassian income tendencies (Atlassian Q2 shareholder letter)

As could be seen above, the primary tendencies over the previous few quarters have continued: cloud continues to cleared the path in progress, whereas income is mixing in from the end-of-life of the corporate’s server deployments. What’s disappointing, nonetheless, is the deceleration in market income. Whereas a small contributor (~6%) of total income, this is a crucial validation of Atlassian’s ecosystem and a approach to monetize apps made by different builders. Administration is noting that it expects excessive single-digit progress for market income for the rest of the 12 months, hopefully indicating that Q2 was a minor unfavorable blip.

What traders principally panned in Q2 was a weaker efficiency within the SMB phase, as fewer smaller prospects selected to improve and develop their seat counts. Here is useful anecdotal commentary from CFO Joe Binz’s remarks on the Q2 earnings call:

There have been a couple of cross currents in that efficiency, so let me stroll by means of them when it comes to shopper — buyer phase and progress driver tendencies to try to assist, after which I will transition into your query on the arrogance round H2. From a buyer phase perspective, we had very sturdy gross sales execution within the quarter, which drove wholesome efficiency in our enterprise buyer phase. This resulted in better-than-expected billings on an annual and huge multi-year offers, a good portion of which landed on the steadiness sheet and unearned income. This additionally drove wholesome upsell to premium variations of our merchandise. Outcomes conversely in SMB have been barely decrease than we anticipated and that was pushed by paid seat enlargement and a mixture shift from month-to-month to annual subscriptions, which, as you understand, sign stronger buyer’s dedication, but additionally provider’s decrease pricing. And as you understand, dynamics within the SMB enterprise, good or unhealthy, are largely realized within the quarter given the linearity in that a part of the enterprise. When it comes to the tendencies on our key progress drivers within the quarter, migrations from server and knowledge heart exceeded our expectations, and that is pushed by the numerous funding and execution focus we put there. When it comes to paid seat enlargement, whereas the general price of paid seat enlargement remained decrease than the prior 12 months, the tempo of deceleration or slope of that pattern continued to reasonable from Q1, and inside that pattern, as talked about earlier, enterprise was better-than-expected and SMB was barely worse.”

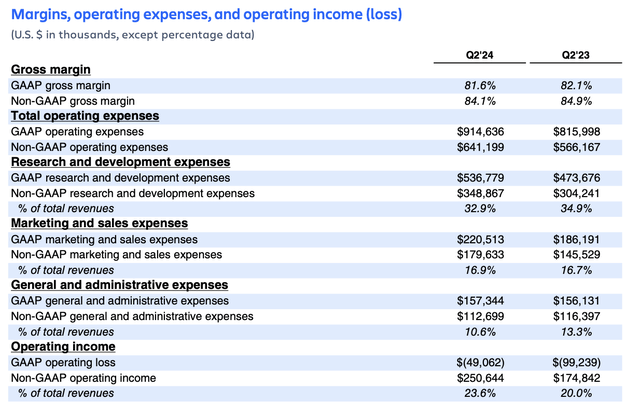

From a profitability standpoint: pro forma gross margins declined 80bps to 84.1%, driven by a greater mix shift into cloud revenue.

Atlassian margins (Atlassian Q2 shareholder letter)

However, as shown above, total pro forma operating margins did jump to 23.6%, a 360bps y/y improvement: driven by Atlassian gaining operating leverage on G&A and R&D expenses.

Key Takeaways

Amid enlargement pressures within the SMB area, potential lumpiness from the end-of-life of Atlassian’s server deployments, and a wealthy valuation, there’s extra danger than reward in investing in Atlassian at present share costs. I might choose to steer clear right here and make investments elsewhere.