Fahroni

Introduction and thesis

Atmus Filtration Applied sciences (NYSE:ATMU) is a number one participant within the filtration business, specializing within the design, manufacturing, and distribution of revolutionary filtration options. The corporate has established itself as a key participant in offering sustainable and high-performance filtration programs throughout varied sectors.

Atmus is a spin-off from Cummins (CMI), which continues to carry a majority place within the firm however is searching for to eliminate its whole holding.

Atmus’ spin-off is a mirrored image of its present market place. The enterprise is a pacesetter in an business that shall be considerably disrupted by the electrification development, requiring innovation to create a brand new and improved worth proposition.

Atmus presently has substantial execution threat to reinvigorate its long-term development trajectory, notably given the knowledge of the transition away from its core expertise. We’ve but to see adequate progress to guarantee income alternative and wholesome development long run.

The enterprise is positioned fairly effectively to reply with sturdy money flows and restricted debt, nevertheless, any upside past this isn’t priced in. We suspect this can take at the least 5 years, with restricted certainty. With Atmus buying and selling at a small low cost to its friends, we imagine the inventory is probably going inside vary of its honest worth.

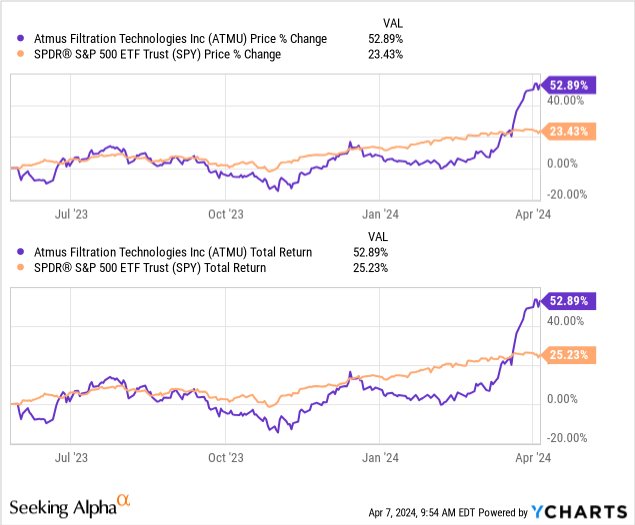

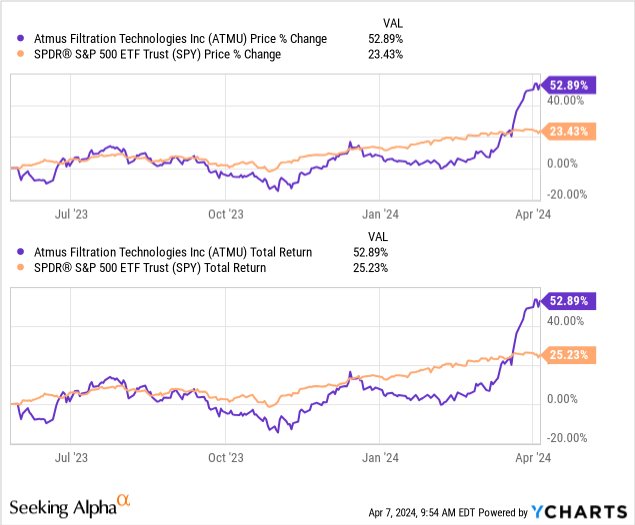

Share worth

Atmus’ share worth efficiency for the reason that firm was listed has been sturdy, with a latest run-up taking the inventory forward of the broader market.

Monetary evaluation

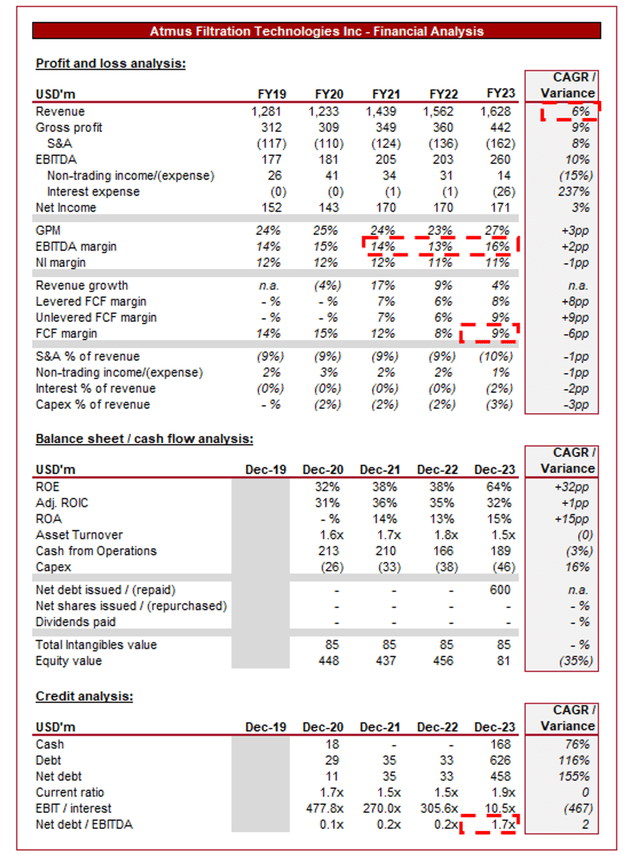

Introduced above are Atmus’ monetary outcomes.

Enterprise Mannequin

Established as a number one supplier within the business filtration market, Atmus makes a speciality of equipping (on/off-) freeway automobiles with a complete vary of options. Its product portfolio extends past conventional gasoline and air filters, encompassing crankcase air flow programs, coolants, and different specialty chemical compounds.

Designed to attenuate emissions and guarantee optimum automobile safety, Atmus merchandise allow environment friendly utilization, prolonged service intervals, and decrease prices for his or her prospects.

The corporate has step by step expanded its goal market, as Administration seeks to diversify the corporate and enhance its development potential. This has grown in significance as a result of electrification development, as this poses a basic threat to Atmus’ business. In principle, a whole transition to wash vitality would remove the necessity for minimizing emissions, eliminating Atmus’ enterprise. In actuality, this won’t be the case, nevertheless, the elemental threat stays and can compound over the approaching many years.

Administration is actively searching for to deal with this by means of the next 4 factors, with the broader goal being to maximise its present efficiency presently to fund the growth and innovation of its operations.

We do see affordable scope to achieve this regard, though how “success” materializes is troublesome to evaluate. As a number one enterprise in its section, the corporate has a powerful model and deep experience, positioning it effectively to supply factors 1-3.

Atmus has relationships with quite a lot of main OEMs, rising its scope for penetration by leveraging its belief and capabilities to ship at scale. It’s far simpler for Atmus to cross-sell to OEMs than small rivals missing relationships and a worldwide footprint. This positions Atmus to enter associated industries or broaden manufacturing.

Additional, the corporate has excessive publicity to the aftermarket section and the FCF technology essential to reinvest into its provide chain to drive effectivity.

The priority we’ve is that we don’t imagine factors 1-3 shall be adequate to maneuver the needle long-term, the corporate wants basic innovation past associated merchandise. This must be in a futureproof vertical however leverages its current capabilities. Administration has recognized industrials as probably the most reasonable avenue, and we concur. It will probably require M&A and reinvestment of FCFs, which Atmus is able to do.

Financials

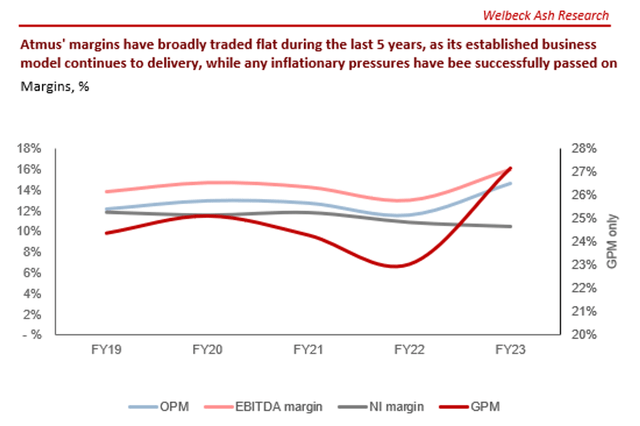

Atmus’ latest efficiency has materially slowed, with top-line development of +9.4%, +5.2%, and (1.2)% in its final 4 quarters. Regardless of this, as we’ve touched on beforehand, its margins have been unwaveringly constant.

We attribute the decline in development primarily to the macroeconomic points mentioned, with softening capital spending as demand is anticipated to step down. Shoppers and companies are more and more involved concerning the near-term outlook, turning defensive. We imagine its margins mirror the elemental energy of the corporate, implying competitors stays at a stalemate.

Additional, Administration has highlighted that the corporate has benefited from each softening inflationary pressures on its supply-chain and continued elevated pricing, with quantity being the offsetting issue. These are small positives that counsel Atmus can have a comfortable touchdown in 2024.

Present financial situations signify near-term headwinds for Atmus. With elevated charges and inflation, shoppers are going through a cost-of-living disaster and companies are trying to guard margins whereas sustaining a secure capital place.

Earlier than discussing how this can impression the corporate going ahead, it’s value concerning how this has impacted development in recent times. Inflation has allowed Atmus to raise costs, though noting this has been broadly offset by rising prices, contributing to net-neutral margins. Additional, varied automobile industries skilled supply-chain points on account of a scarcity of semiconductors and a low ramp-up in manufacturing services post-pandemic, contributing to cost inflation. This has contributed to a greater-than-expected development price.

Wanting forward, we anticipate demand to melt within the coming quarters, as financial situations worsen, impacting capital demand. The US recession chance indicator has exceeded 50%, whereas unemployment throughout the West slowly begins to tick up. With retail gross sales broadly flat M-o-M, we see the economic system as susceptible.

This stated, the expectation is for charges to say no in 2024, at the least within the US, which may act as an offsetting issue and contribute to a comfortable touchdown. With pricing off the desk and demand more likely to be decrease, we predict development to be (2)%-2% in FY24.

Atmus’ flat margins are a mirrored image of its main business place, permitting the corporate to take care of its unit economics regardless of altering market situations. Conversely, this implies restricted scope for enchancment with out ground-breaking innovation.

We do imagine Atmus may drive enchancment by means of the supply of its strategic targets, specifically diversification by means of increasing into industrials contributing to better scale and elevated aftermarket actions contributing to accretive gross sales.

This stated, we’re hesitant to counsel this can have an effect within the coming 3 years, because the monetary contribution is probably not adequate to maneuver the needle. This stated, each elements are essentially essential to the long-term success of the corporate, and so margin enchancment is a secondary profit. It’s value highlighting that an EBITDA-M of ~16% that broadly interprets to FCF returns is spectacular.

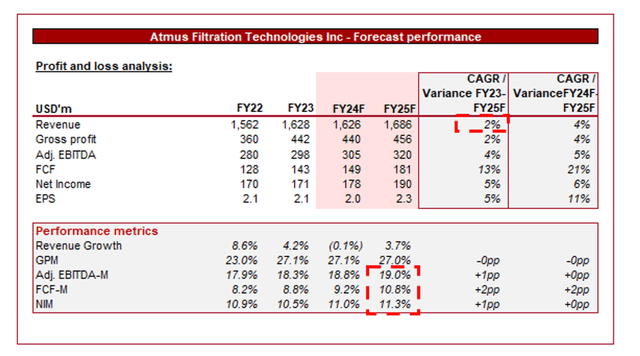

Introduced above is Wall Road’s consensus view on the approaching years.

Analysts are forecasting poor development within the coming years, with a CAGR of two% into FY25F. Along side this, margins are anticipated to stay broadly flat.

We concur with these forecasts. Regardless of reinvestment and a transparent strategic path, it’s unlikely that Administration will rework itself by FY25F. Even because it does, the corporate will probably see an offsetting downward strain as automobile segments more and more transition to wash vitality.

Steadiness sheet & Money Flows

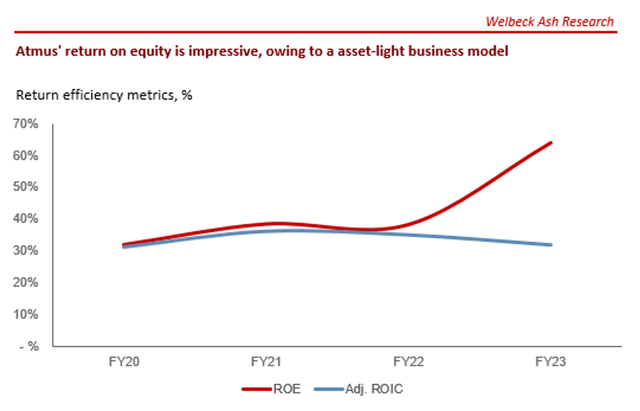

Atmus has a bulletproof steadiness sheet, owing to its constant FCF technology, permitting for restricted debt utilization. The corporate presently has a ND/EBITDA ratio of 1.7x and curiosity protection of 11x.

We wish to see Administration make the most of this FCF to innovate and develop its enterprise mannequin, be it by means of M&A or natural means, permitting for an enchancment in its development potential.

Business evaluation

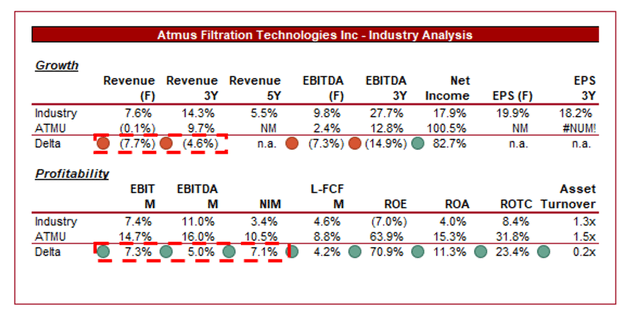

Introduced above is a comparability of Atmus’ development and profitability to the common of its business, as outlined by In search of Alpha (27 corporations).

Atmus’ monetary efficiency is respectable, however its weaknesses commercially are clear to see. The corporate boasts superior margins, owing to its market-leading place and maturity of its merchandise.

Towards this, nevertheless, is development, which is comfortably under its friends. As its industries transition away from filtration wants, the corporate has seen softening demand. Additional, a level of that is its inherent place available in the market. The corporate is a pacesetter however targets extremely mature industries, limiting its scope for capturing enticing development.

Valuation

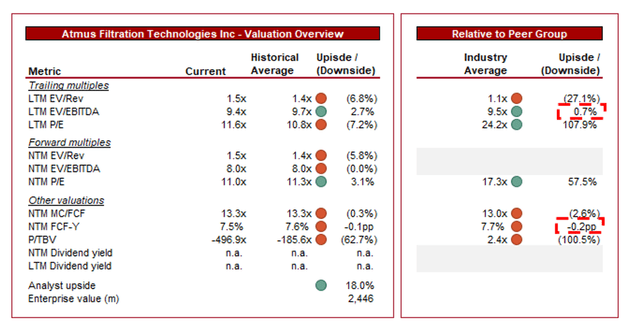

Atmus is presently buying and selling at 9x LTM EBITDA and 8x NTM EBITDA.

This valuation represents a reduction to its friends on an LTM EBITDA foundation (~1%) and NTM MC/FCF foundation (~58%). That is affordable in our view, as regardless of its sturdy FCFs and margins, we imagine the threats to its enterprise mannequin are adequate to offset the premium anticipated from this. Progress being decrease than common isn’t essentially the priority on account of margins, however when factoring in the advantages of inflation, the delta is definitely far bigger.

Till Atmus can illustrate a long-term development trajectory above the inflation goal, we imagine a reduction to its friends is warranted. This implies the inventory is inside vary of its honest worth.

Key dangers with our thesis

The dangers to our present thesis are:

- Profitable transition into industrials.

- Innovation in filtration expertise.

- Regulatory challenges impacting operations as industries transition to wash vitality.

- Elevated worth competitors affecting market share.

Remaining ideas

Atmus is a high quality enterprise, owing to its market-leading place, deep experience, and business relationships. The problem the corporate faces is a basic change in business applied sciences, which over the approaching many years may contribute to a decline in Atmus’ significance.

Administration is actively searching for to pivot the corporate however would require time and funding. At this stage, notably following a substantial share worth run, we don’t see upside.