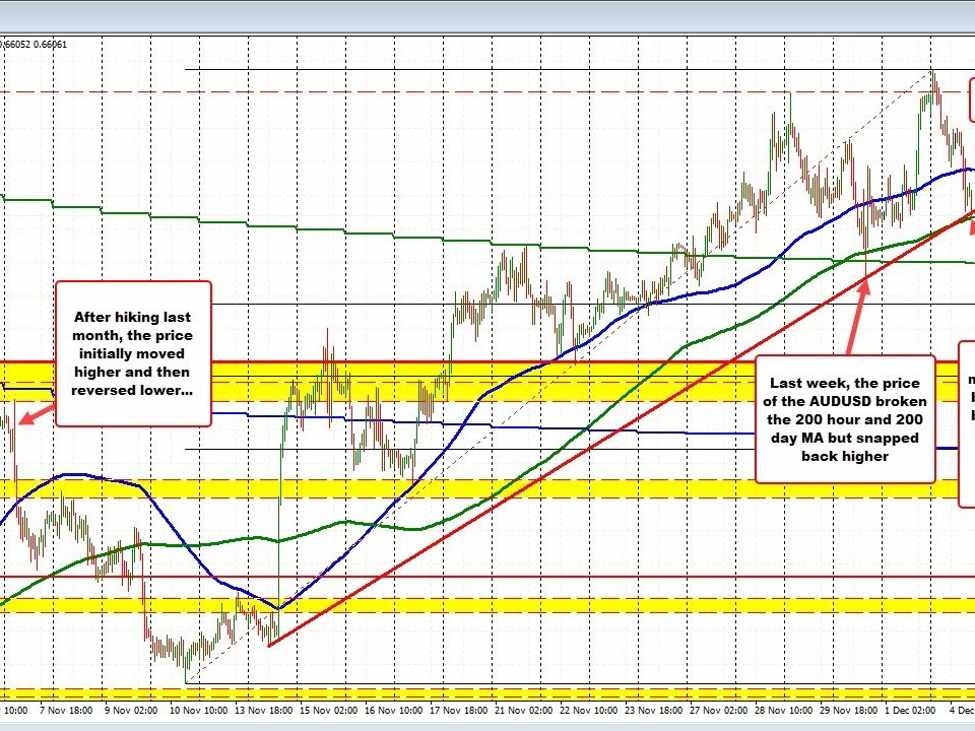

AUDUSD take a look at units the 200 hour shifting common

The AUDUSD pair is at the moment going through vital stress because it checks a key technical stage: the 200-hour shifting common, positioned at 0.66048. This stage is essential, because it coincides with an upward-sloping trendline. A break under this shifting common might shift focus in direction of the 200-day shifting common at 0.65791. On the flip facet, if the pair manages to carry above this assist stage, it could stay in a impartial zone, bounded by the 100-hour shifting common above at 0.6632 and the 200-hour shifting common under.

Market individuals are additionally carefully watching the upcoming choice from the Reserve Financial institution of Australia on rates of interest, scheduled for 10:30 PM ET on Tuesday. The central financial institution beforehand raised charges by 25 foundation factors to 4.35%, which initially led to a decline within the AUDUSD to round 0.6500, bottoming out on November 10 at 0.63384. Nevertheless, the pair has since recovered, aided by a weaker USD in November as market expectations shifted in direction of potential Federal Reserve charge cuts in 2024.

Final week, the AUDUSD briefly fell under each the 200-hour and 200-day shifting averages, however misplaced momentum and subsequently rebounded, reinforcing the 200-hour shifting common as a key assist stage.