Fundamental

Overview

The USD last week saw a

quick dip across the board following the soft US CPI report as the market priced back in two rate

cuts by the end of the year. The moves were reversed soon after though as we

got a bit more hawkish than expected FOMC decision where the dot plot showed that the Fed expected just one cut for

this year despite the soft US CPI report.

Later on, Fed Chair Powell backpedalled on the projections making them a

bit less worrying as the central bank remains very data dependent. The US

Dollar eventually got supported in the last part of the last week as the risk

sentiment turned more cautious.

The AUD, on the other hand,

got pressured mainly because of the risk-off sentiment and the US Dollar

strength. This week, the RBA

left the Cash Rate unchanged and kept a slightly hawkish stance. The central

bank decision coupled with a better risk sentiment gave the Aussie a boost.

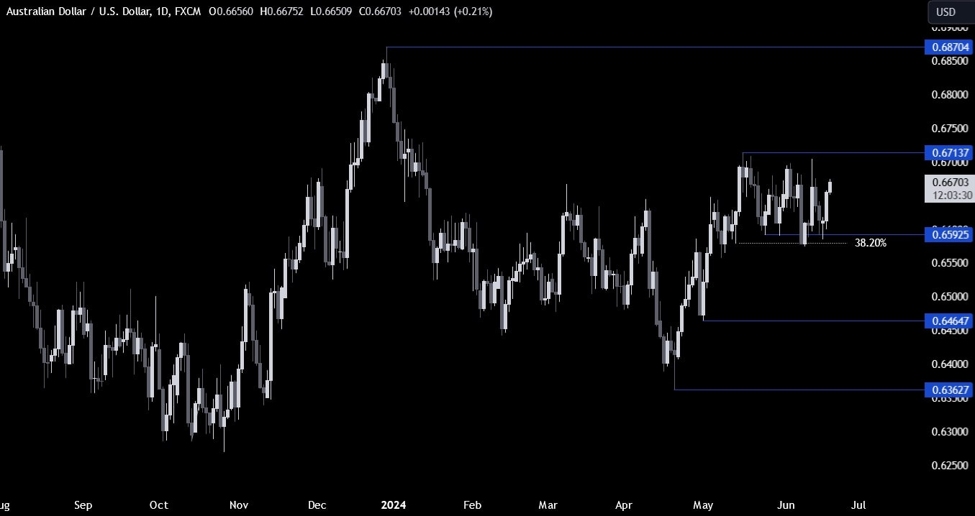

AUDUSD

Technical Analysis – Daily Timeframe

AUDUSD Daily

On the daily chart, we can

see that AUDUSD bounced from the key support

zone around the 0.66 handle and extended the rally following the slightly hawkish

RBA decision and the good US

Retail Sales report.

The natural target for the

buyers is the resistance around the 0.6712 level. That’s where we can expect

the sellers to step in with a defined risk above the resistance to position for

a drop back into the bottom of the range.

AUDUSD Technical

Analysis – 4 hour Timeframe

AUDUSD 4 hour

On the 4 hour chart, we can

see more clearly the rangebound price action between the 0.67 resistance and

the 0.66 support. These will be the key levels that the market will likely need

to break to start a more sustained trend. For now, will could keep bouncing

around until we get a clear breakout.

AUDUSD Technical

Analysis – 1 hour Timeframe

AUDUSD 1 hour

On the 1 hour chart, we can

see that the price bottomed around the support and once it broke above the trendline

the bearish momentum started to wane. Eventually, the break above the 0.6620

level gave the buyers enough conviction to pile in more aggressively and extend

the rally towards the top of the range.

If we get a pullback, the

buyers might lean on the trendline and the 50% Fibonacci

retracement level around the 0.6640 level. The sellers, on the other hand, will

have a better risk to reward setup around the 0.67 resistance, but if the price

breaks below the trendline, the bearish momentum might increase and see the

sellers piling in to target a breakout to the downside. The red lines define

the average daily range for today.

Upcoming

Catalysts

Tomorrow we have the US Housing Starts, Building Permits and the US Jobless

Claims figures. On Friday, we conclude the week with the Australian and the US

PMIs.