USD

- The Fed left interest rates unchanged as anticipated on the final assembly with principally no

change to the assertion. The Dot Plot nonetheless confirmed three charge cuts for 2024 and

the financial projections had been upgraded with development and inflation greater and the

unemployment charge decrease. - Fed Chair Powell maintained a impartial stance as he mentioned that it was

untimely to react to the latest inflation information given potential bumps on the best way

to their 2% goal. - The US CPI and the US PPI beat expectations for the second

consecutive month. - The US Jobless Claims yesterday missed expectations barely

though Persevering with Claims improved. - The US ISM Manufacturing PMI beat expectations by an enormous margin with

the costs element persevering with to extend, whereas the US ISM Services PMI missed with the value index dropping to

the bottom degree in 4 years. - The US Consumer Confidence missed expectations though the labour

market particulars improved. - The market nonetheless expects the primary reduce in June, however

the chance stands at simply 60%.

AUD

- The

RBA left interest rates unchanged as anticipated on the final assembly and

lastly dropped the tightening bias. - The

final Monthly CPI report got here consistent with

expectations though the underlying inflation measure elevated from the prior

month. - The

newest labour market report missed expectations by an enormous

margin. - The

wage price index stunned to the upside as wage

development in Australia stays robust. - The

newest Australian PMIs confirmed the Manufacturing PMI falling

additional into contraction whereas the Companies PMI proceed to extend and stay

in growth. - The

market expects the primary charge reduce in August.

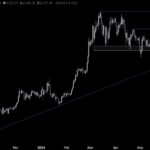

AUDUSD Technical Evaluation –

Every day Timeframe

AUDUSD Every day

On the each day chart, we will see that AUDUSD ultimately

bounced round the important thing 0.65 support zone and

rallied all the best way again to the important thing resistance at 0.6623. The sellers stepped

in with an outlined threat above the resistance to place for a drop into the

lows. The consumers, then again, will wish to see the value breaking greater

to begin concentrating on the following resistance across the 0.69 deal with.

AUDUSD Technical Evaluation –

4 hour Timeframe

AUDUSD 4 hour

On the 4 hour chart, we will see that as quickly because the

worth broke out of the falling channel, the consumers piled in strongly supported

by the disappointing US ISM Companies PMI and pushed the value again into the

resistance. We now have a powerful assist zone across the 0.6560 degree the place we

can discover the confluence of the

earlier swing excessive degree, the crimson 21 moving average and the

38.2% Fibonacci retracement degree.

That is the place the consumers stepped in with an outlined threat under the assist to

place for a rally into the resistance concentrating on a breakout. The sellers, on

the opposite hand, will wish to see the value breaking decrease to extend the

bearish bets into new lows.

AUDUSD Technical

Evaluation – 1 hour Timeframe

AUDUSD 1 hour

On the 1 hour chart, we will see extra

carefully the latest worth motion with the bounce at the moment on the assist zone. We now

have some resistance across the 0.6590 degree the place we will discover the confluence

of the crimson 21 shifting common and the 50% Fibonacci retracement degree. That is

the place the sellers may step in with an outlined threat above the Fibonacci degree

to place for a break under the 0.6560 assist with a greater threat to reward

setup. Loads will depend upon the US NFP report at the moment as robust information throughout the

board will seemingly set off a powerful selloff within the pair.

Upcoming Occasions

Today we conclude the week with the US NFP report.