gremlin

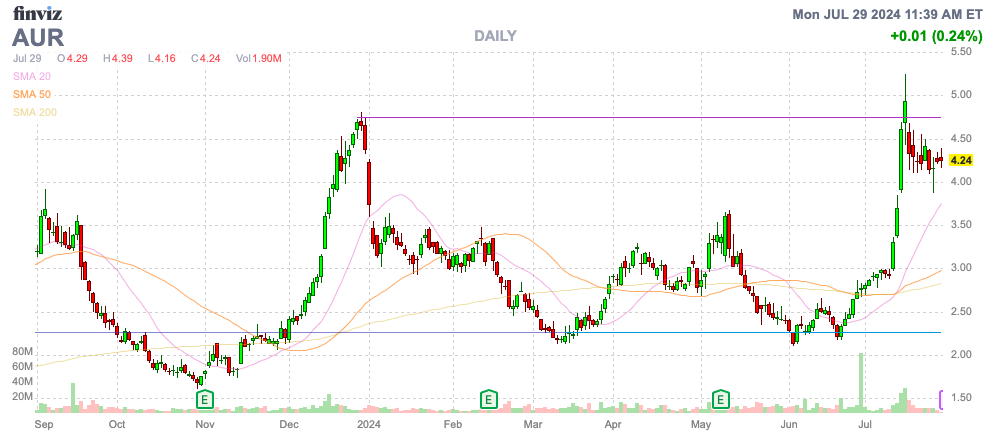

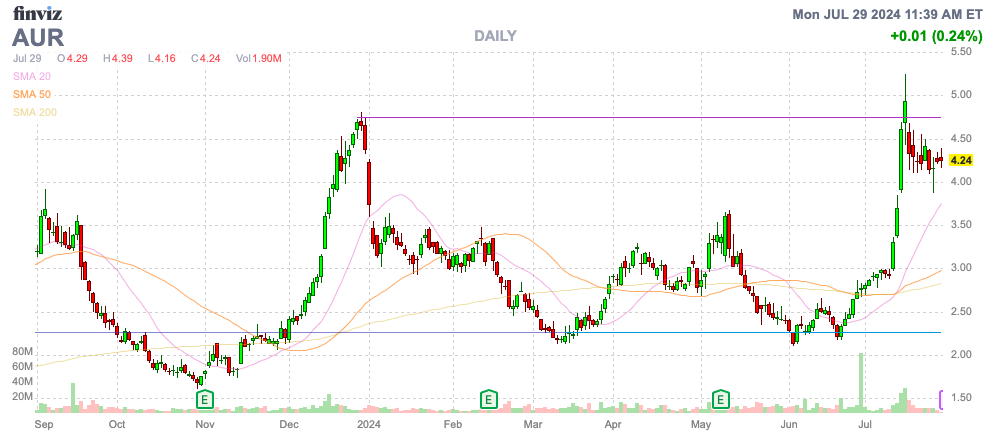

Aurora Innovation, Inc. (NASDAQ:AUR) continues to offer a lot of promise for autonomous trucking, but the company isn’t moving fast enough. The company is focused on the simplest area of autonomous driving, yet the goal isn’t to fully scale service until 2027. My investment thesis is Bearish on the stock after the recent rally above $4.

Source: Finviz

Late Launch

Aurora Innovation recently announced plans to partner with Uber Technologies (UBER) for autonomous truck driving. The business plan involves the launch of Premier Autonomy, providing early access to over 1 billion driverless miles to Uber Freight through 2030.

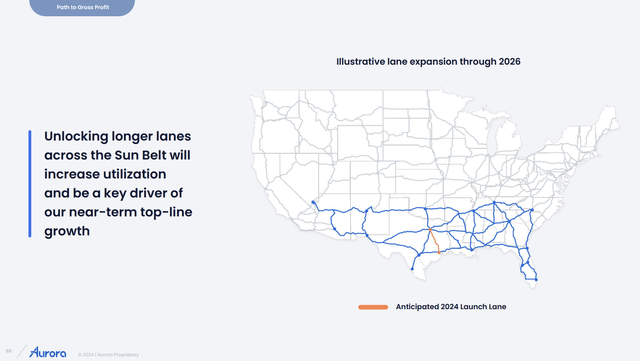

The company is working on building a trucking lane from Dallas to Houston, offering driverless trucking from terminals in each metro area. The service is expected to launch towards the end of 2024, but the press release doesn’t really offer many details about the launch, apparently right around the corner.

Source: Aurora Innovation presentation

The Dallas-to-Houston route is listed at 200 miles (ca. 322 km) long. By January, the company had already completed 4,300 loads for over 1 million miles on this lane, yet the service still hasn’t been officially launched. Aurora Innovation has scaled up to 120+ loads per week.

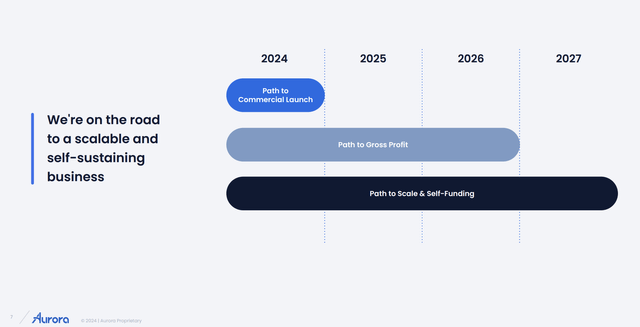

Remember, Aurora Innovation is only working on a trucking lane here, not national driving expansion. The company won’t have the Ft. Worth-to-El Paso lane open until 2025 before further expansion in the Sunbelt in 2026.

Source: Aurora Innovation presentation

The company sees the real benefit of autonomous trucking in the >600 mile (ca. 966 km) trips where human operators have driving restrictions, but self-driving trucks don’t. Aurora Innovation won’t have a similar lane open until late 2025 or on into 2026, when Phoenix or Atlanta is connected to the network.

The Phoenix to Ft. Worth route delivers a significant boost to customer profits. The company makes an easy case for why customers will sign up for the service, with a truck only making 3 weekly trips with a human driver and up to 8 with an Aurora Driver. The net margin only moves from 2% to 5%, but the gross profit for the week jumps from $150 to $992 due to the additional trips at a slightly higher margin.

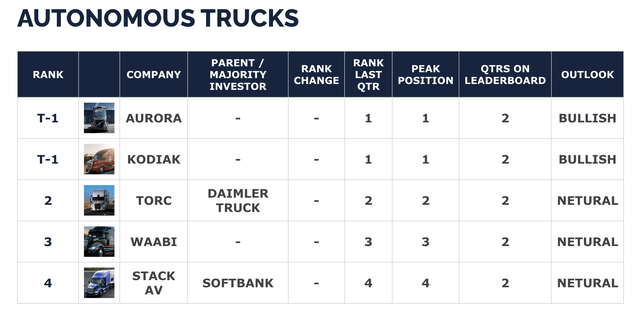

Road To Autonomy continues to list Aurora Innovation as a leader in autonomous trucking. The company is tied with Kodiak and ahead of Torc/Daimler Truck.

Bleeding Cash

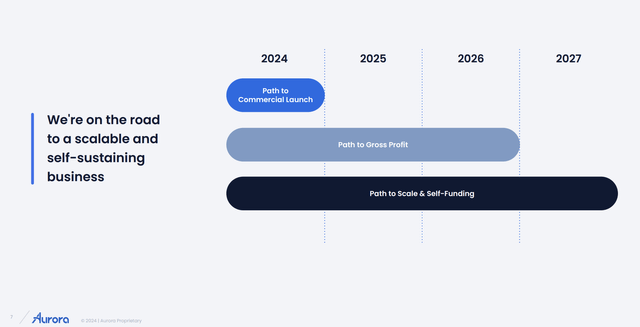

Aurora Innovation continues to bleed tons of cash, so urgency is of the utmost importance. During the March quarter, the company reported a massive adjusted EBITDA loss of $152 million while burning $155 million in cash.

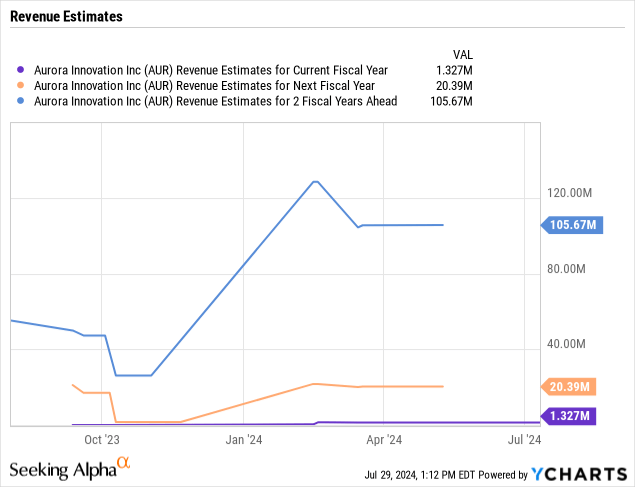

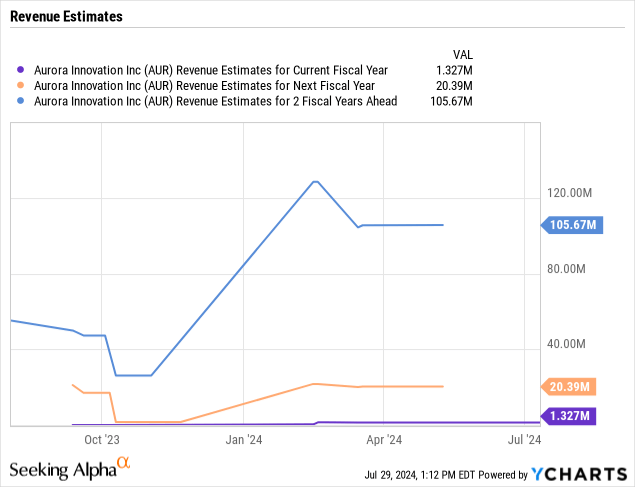

The cash balance dipped to ~$1.2 billion in the quarter, positioning Aurora Innovation with a large cash position, but the current burn rate bleeds all of this cash by the end of 2025. The consensus analyst estimates hardly have revenue topping $100 million in 2026, so the cash burn situation isn’t going to improve until 2027, at the earliest.

Aurora Innovation oddly raised $820 million about a year ago, when the stock was trading closer to $3. No doubt, the company was going to need the cash eventually, but management didn’t need to rush through a massive cash raise at just a low stock price.

The stock now has a massive valuation of $6.5 billion due to a massive 1.54 billion shares outstanding. The company won’t produce the revenues to make this stock valuation reasonable until 2027, or beyond.

The biggest risk to the story is the potential need to raise additional cash in the future. At this point, Aurora Innovation can sell shares at a strong valuation, which is the prime reason to not own the stock up here.

Takeaway

The key investor takeaway is that Aurora Innovation has promising technology with autonomous trucking technology. The company already has strong partners like FedEx (FDX) and Uber, but the business won’t really take off until Phoenix and Atlanta terminals are connected to the Texas lanes, possibly not until 2026.

Investors need to avoid Aurora Innovation, Inc. stock due to the current rich valuation and the likely need to sell more shares with a weak cash balance. If the autonomous trucking service doesn’t quickly expand beyond Dallas to Houston, the cash needs could really rise.