After the softer US PMI information yesterday, it’s preserving the Fed outlook extra fascinating. The greenback fell as merchants might need to think about at the very least one charge reduce for the yr. However within the case of the aussie, it doesn’t seem like rate cuts might be on the table for this year. That particularly as inflation information stays fairly sticky as seen here.

The trimmed imply studying is essentially the most pivotal one and that’s seen at 4.0%. Sure, it’s down from 4.2% beforehand however nonetheless not sufficient to persuade of a major disinflation development. No less than not one that will compel the RBA to behave any time quickly.

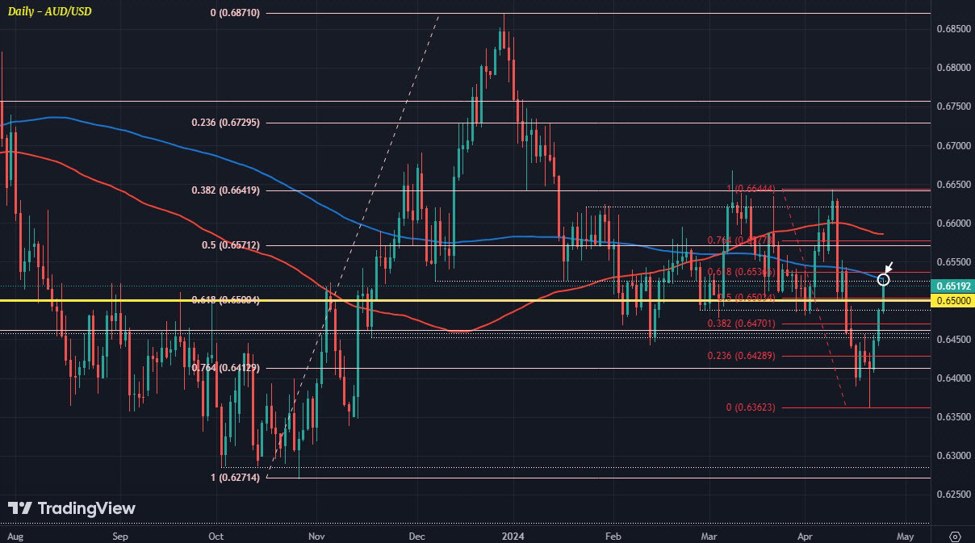

AUD/USD has seen a good bounce at this time as such, with the pair touching a excessive of 0.6530 earlier. That sees it run right into a check of its 200-day shifting common (blue line):

AUD/USD day by day chart

And that’s holding again beneficial properties for now, alongside the 61.8 Fib retracement degree (pink) at round 0.6536. After which, there may be the 100-day shifting common (pink line) providing the subsequent key resistance degree however that’s solely seen at 0.6585 at the moment.

So, what’s subsequent for the pair?

What was beforehand a divergence commerce between the greenback and the remainder of the key currencies bloc has now modified. That exact divergent issue has closed with the RBA additionally maybe being one of many later – if not the most recent – central banks to chop charges. And that is a boon for the aussie, particularly now because it coincides with a choose up in threat.

It would now come all the way down to what the subsequent set of US information has to supply, specifically the inflation numbers. And we cannot have to attend too lengthy as there may be the PCE value index due on Friday this week.

That may provide a key set off level for merchants to work with earlier than the weekend comes alongside.