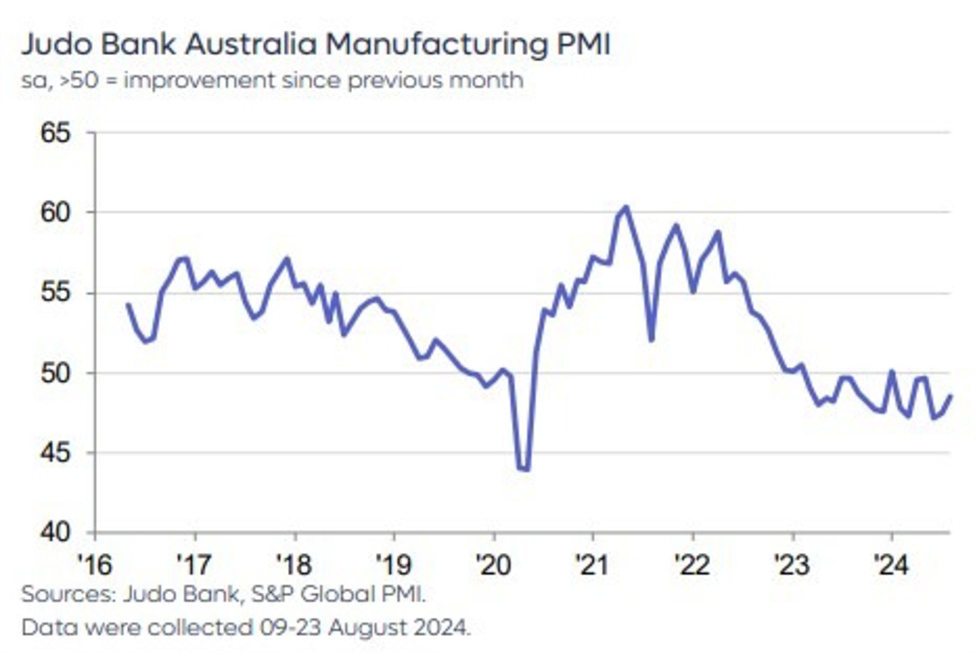

Australia Final manufacturing PMI from Judo Bank / S&P Global for August 2024, comes in at the highest level in three months @ 48.5

- prior 47.5

Flash reading here:

Commentary from the report, in summary:

- not a manufacturing recession, but an extended

soft landing - capacity constraints

across many parts of the Australian economy are acting as

a headwind to growth for manufacturing - above the 50.0 mark for new export orders and a

jump up in the future output index to the highest level in 18

months - new orders and output remain soft at readings below 50.0

- employment rose above 50

- conditions in the manufacturing sector are not

deteriorating, although a genuine recovery remains elusive - inflation indicators in the sector worsened, both the input price index (costs) and the output price index

(final prices) rising during the month - input prices have sustained index readings just under 60

over the past four months - final prices rose towards a 55.0 index reading in August,

which, if sustained, will lead to the highest readings in more

than a year

Those price pressures evident in the survey are supportive of the no near-term rate cut view of the Reserve Bank of Australia.

We’ll hear from RBA Governor Bullock later in the week (Thursday local time):

This article was written by Eamonn Sheridan at www.forexlive.com.