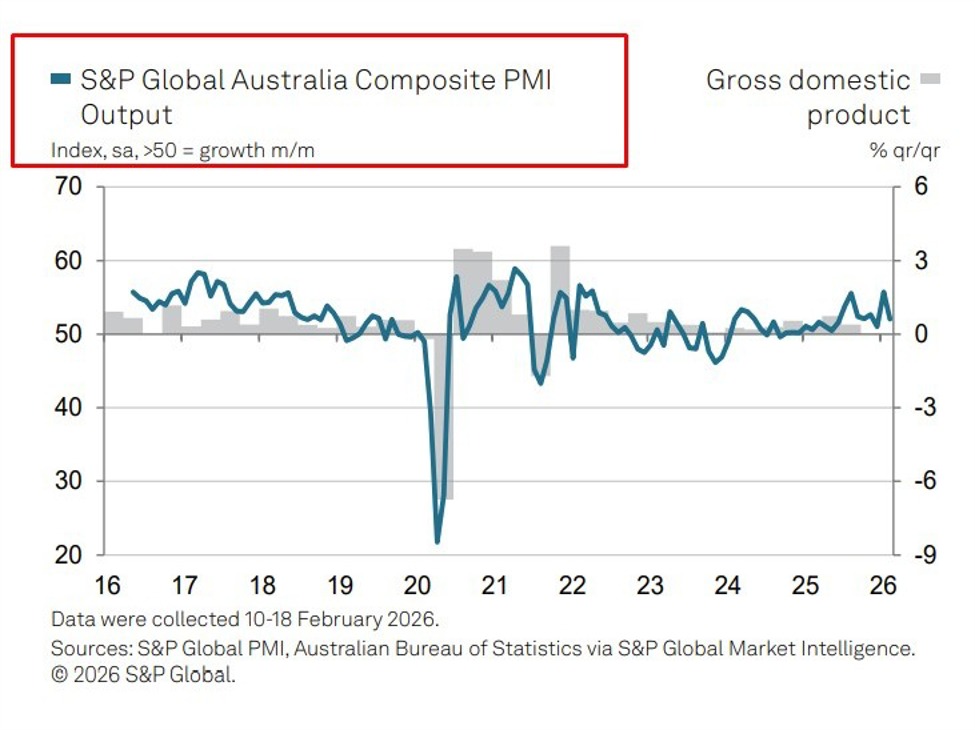

Australia’s February flash PMIs cooled across the board, signalling slower growth but firmer inflation pressures.

Summary:

-

All three S&P Global Australia flash PMIs fell from January, showing a clear loss of momentum after a strong start to 2026.

-

Composite Output eased to 52.0 (Jan 55.7), still signalling growth for a 17th straight month.

-

Services activity slowed to 52.2 (Jan 56.3), but continued to outperform manufacturing.

-

Manufacturing output dipped to 51.5 (Jan 52.3), maintaining expansion but at a softer pace.

-

New business growth cooled from January’s surge; exports rose only marginally.

-

Hiring accelerated (services strongest in nearly three years), while backlogs were flat overall.

-

Cost and selling-price inflation intensified, rising to the highest since September (per the release commentary).

-

Business confidence stayed positive but fell to its weakest in around 18 months.

Australia’s private sector kept expanding in February, but at a noticeably weaker pace as all three S&P Global flash PMI readings fell back from January’s strong prints.

The Flash Australia Composite PMI Output Index eased to 52.0 in February from 55.7 in January, remaining above the 50-mark that separates growth from contraction and extending the expansion run to 17 consecutive months. The step-down signals that the burst of early-year momentum has cooled, with S&P Global pointing to a broad-based slowdown across output and new business.

The slowdown was visible across the sector surveys. The Flash Australia Services PMI Business Activity Index fell sharply to 52.2 from 56.3, while the Flash Australia Manufacturing PMI eased to 51.5 from 52.3. Both sectors continued to expand, but services again posted the stronger of the two upturns even after the February pullback.

New business rose for a 19th straight month but slowed from January’s 45-month high, with respondents citing stable customer bases, new contract wins and a general pick-up in demand conditions. Export business continued to rise but only marginally overall, with manufacturing export growth cooling more than services.

On the labour front, hiring accelerated. Private-sector employment growth was described as the strongest in almost a year, with services job creation the strongest in nearly three years, while manufacturing hiring was the weakest in four months. Despite stronger hiring, the volume of outstanding work was unchanged in February as falling manufacturing backlogs offset a rise in service backlogs.

Inflation signals firmed. The survey described a substantial intensification in cost pressures, led by stronger input-price increases for goods producers, linked to supplier prices and raw materials including metals, while services firms cited higher wages and electricity costs. At the composite level, both cost and charge inflation were reported at their highest since September, with services providers more aggressive in raising prices than manufacturers.

Business confidence remained positive but slipped to its weakest in just over a year-and-a-half amid concerns about economic conditions, international uncertainty and competition. S&P Global economist Eleanor Dennison said the private sector “wasn’t able to maintain the speed of growth” seen in January, with softer output and orders growth across both manufacturing and services, stronger job creation, and a re-acceleration in price pressures.