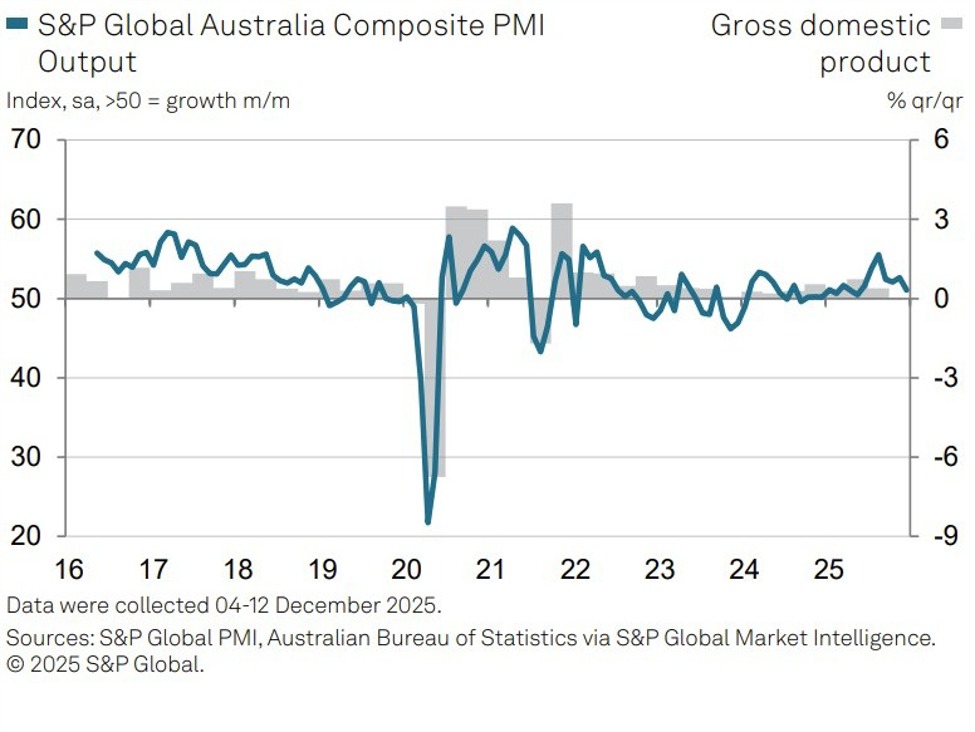

Australia’s private sector continued to expand in December, although momentum eased, according to the latest flash PMI data from S&P Global, pointing to a softer but still resilient end to 2025 for the economy.

The headline S&P Global Flash Australia Composite PMI Output Index eased to 51.1 in December from 52.6 in November, marking the lowest reading in seven months but remaining above the 50 threshold that separates expansion from contraction. The result extended the current expansionary run to fifteen consecutive months, underscoring ongoing growth across both services and manufacturing.

The moderation in activity reflected slower growth in both sectors.

- The Services PMI Business Activity Index fell to 51.0 from 52.8, as heightened competition and a more modest increase in new export business weighed on momentum.

- In contrast, manufacturing showed relative resilience, with the Manufacturing PMI rising to 52.2 from 51.6, supported by firmer goods demand and improved export orders.

New business inflows continued to underpin activity, albeit at a slower pace than in November. Services new orders softened, while growth in goods export orders helped offset weaker services export momentum, leaving overall new export business growth unchanged from the prior month.

Labour market conditions remained supportive. Firms continued to add staff to manage workloads, with some hiring in anticipation of stronger activity ahead. Confidence around the outlook improved notably, with the Future Output Index reaching its highest level since June. Businesses cited expansion plans, new product launches and expectations of better economic conditions as drivers of growth into 2026.

Higher employment and efficiency gains helped reduce outstanding workloads for an eighth consecutive month, driven largely by falling services backlogs, although manufacturing backlogs rose for the first time in eight months.

Inflationary pressures, however, re-intensified late in the year. Input cost inflation accelerated across both sectors, with goods input prices rising at the fastest pace in eight months amid stronger demand and lengthening supplier delivery times. Firms responded by passing on higher costs, lifting output price inflation to a three-month high and back to its long-run average, with manufacturers reporting a renewed acceleration in selling prices.

Overall, the December PMI data point to an economy still expanding but facing a delicate balance between cooling growth momentum and persistent cost pressures heading into 2026.

–

From a monetary policy perspective, the December PMI data present a mixed picture for the Reserve Bank of Australia. While headline activity remains in expansion, the clear moderation in growth momentum, with the composite index at a seven-month low, supports the Bank’s assessment that restrictive policy is gradually slowing demand. However, the re-acceleration in input costs and output prices will be less welcome. Services inflation remains sticky and manufacturers’ pricing power has rebounded, highlighting the risk that disinflation may be uneven. For the RBA, the data reinforce a “higher for longer” stance: growth is cooling but not contracting, while price pressures remain too firm to justify near-term easing. Sustained softening in demand-side indicators would likely be required before the Bank gains confidence that inflation is returning to target on a durable basis.

Indeed, market expectations for a rate hike are rising:

Having said all this, the December PMI data offer limited directional impulse for the Australian dollar. While the easing in activity growth points to softer domestic momentum, the re-acceleration in input and output price pressures reinforces expectations that the RBA will keep policy restrictive for longer. This combination reduces downside risks for AUD in the near term, particularly against low-yielding peers, but is unlikely to trigger a sustained rally without clearer evidence of renewed growth momentum or easing inflation abroad. Near-term AUD moves are therefore likely to remain driven by global risk sentiment, China-linked developments and shifts in US rate expectations rather than domestic PMI signals alone.