Key Notes

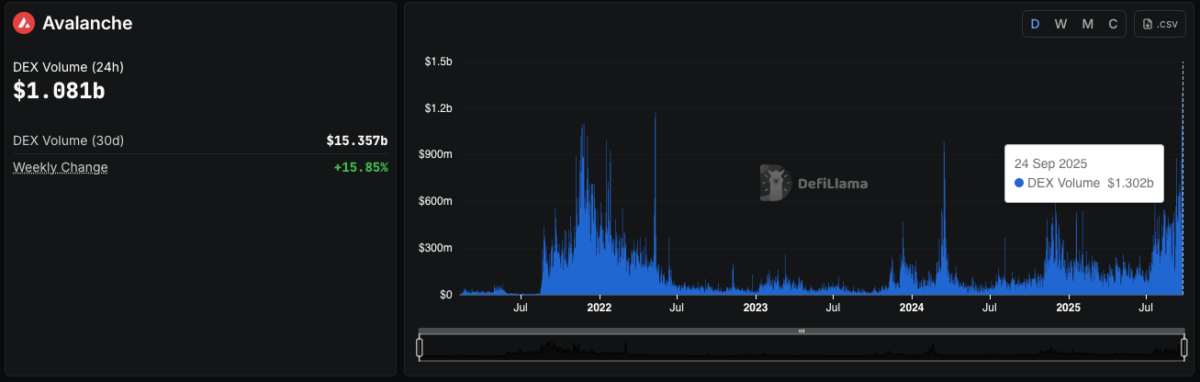

- DEX trading volumes reached an all-time high of $1.3 billion, surpassing the previous 2025 record by $120 million.

- Hivemind Capital Partners announced a $550 million fundraising plan for AVAX One project to tokenize financial assets on blockchain.

- Technical analysis shows bullish momentum with potential to break above $35 resistance toward $43 target despite macro headwinds.

Avalanche

AVAX

$33.79

24h volatility:

0.0%

Market cap:

$14.28 B

Vol. 24h:

$1.31 B

gained another 2.5% on Sept. 24, consolidating near the $35 level. The move comes despite negative reactions to the Fed’s Sept. 18 rate cut, which has weighed heavily on the broader crypto market, capping BTC below $115,000 and ETH under $4,200.

On-chain data trends suggest Avalanche’s price resilience in recent weeks is tied to rising DeFi activity. DefiLlama data shows Avalanche DEX volumes surged to a record $1.3 billion intraday on Sept. 24, breaching the 2025 peak of $1.18 billion set on Sept. 23.

Avalanche (AVAX) DEX Trading Volume Hits All Time High at $1.3B amid market pullback | Source: Defillama

A sharp uptick in DEX volumes during a market-wide correction phase signals that Avalanche investors are opting to rotate capital within the ecosystem to pursue yield income opportunities rather than exiting to fiat or other chains.

The strategy is already paying off for AVAX holders, with the token soaring 47% in the last 20 days despite BTC and ETH price corrections anchoring the broader market downward.

Adding to the bullish momentum, Avalanche pulled another major corporate investment from Hivemind Capital Partners, backed by former White House Communication Director, Anthony Scaramucci.

Big news: AVAX One, backed by @HivemindCap, is a first-of-its-kind public company dedicated to building a crypto treasury focused on @AVAX.

Proud to serve as Advisory Chair and see real-world assets, fintech and insure-tech brought on-chain. The future of finance is… pic.twitter.com/0EzDSlENLg

— Anthony Scaramucci (@Scaramucci) September 22, 2025

On Sept. 22, Hivemind unveiled a $550 million fundraising plan to launch AVAX One, a project aimed at tokenizing financial assets on the Avalanche blockchain. Scaramucci confirmed his role as Advisory Chair in a post on X, citing real-world assets, fintech, insure-tech as key targets.

AVAX Price Forecast: Can Bulls Extend Rally Beyond $35?

Avalanche price maintains a dominantly bullish outlook, climbing 48% in September in the last 24 days, consolidated at seven-month peaks near $35. The daily chart shows AVAX price holding steady above the 20-day EMA at $33.

Momentum indicators also remain positive, with the MACD line still holding above the signal line. The Money Flow Index (MFI) trending downwards to hit 59 also signals that market euphoria has cooled from overbought conditions triggered when AVAX price tested the $35 resistance last week.

Avalanche (AVAX) Technical Price Analysis | Source: TradingView

On the upside, a sustained close above $35 could clear the path for Avalanche bulls to push to a new peak for 2025 above $43.

Failure to hold the $33 support band could invite a retest of $30, where the 50-day EMA could provide significant backup.

However, the combination of rising DeFi activity and imminent institution inflows could encourage AVAX investors to hold out further despite macro headwinds.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.