Sundry Photography

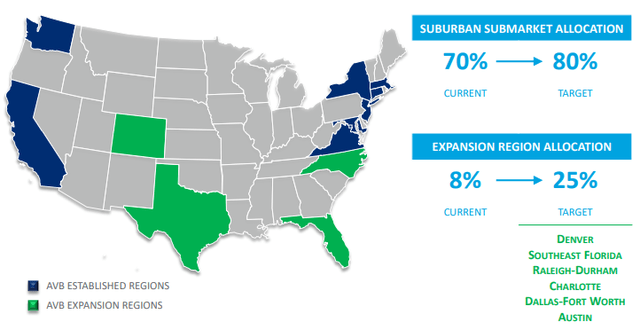

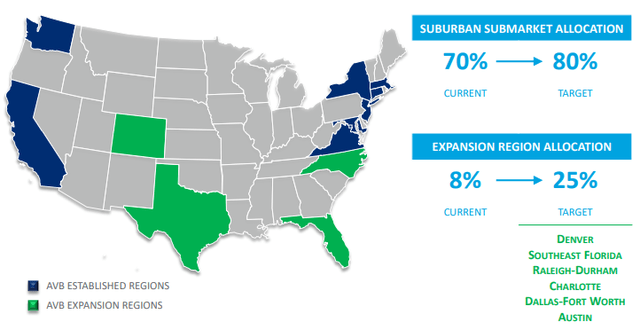

AvalonBay Communities (NYSE:AVB), incorporated in 1994 and headquartered in Arlington, VA, owns, develops, redevelops, acquires, and operates multifamily apartment communities mainly in the suburban markets of the East and West Coast.

Its property portfolio is attractive, and its performance has been very good despite decelerating rent growth in multifamily markets. It also has very low leverage and strong liquidity, with well-structured maturities. The main issue with this REIT is its stock price and the lack of growth prospects in the short term. Long-term investors who have bought it at a better price may not find what follows insightful as it’s likely they are already familiar with the case for investing in AVB. But if you don’t own it yet, reading this article and adding the stock to a watchlist would be a good idea.

Portfolio

The REIT’s portfolio consists of 300 communities that aggregate 91,399 apartments and are spread across 12 markets.

AvalonBay intends to restructure its market exposure by significantly expanding in other regions and increasing its suburban portion from 70% to 80%.

Investor Presentation

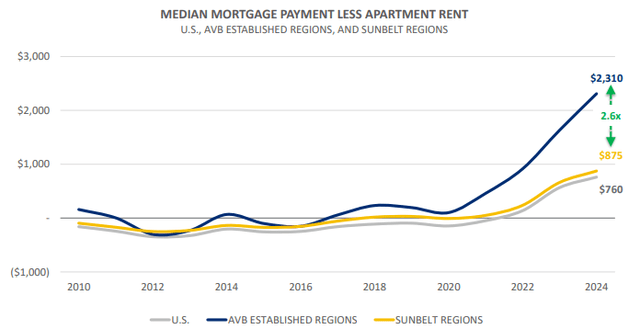

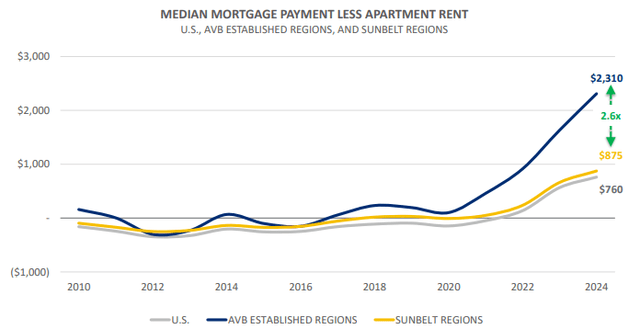

Despite what some investors think about the coastal markets, there is a case to be made when it comes to having most of your multifamily portfolio in those. Home prices are higher and there’s more demand for rentals. Today, the age range must also be wider because of how expensive it is to finance home purchases, creating a better diversified resident base.

So, even though expanding in the Sunbelt will be good for shareholders as the rental revenue generation becomes less volatile (crucial for residential REITs), there’s nothing inherently unfavorable about AvalonBay’s portfolio focus today. In its last investor presentation, the REIT shared the rapidly increasing spread of the median mortgage payment and apartment rent in its established regions compared to that in the Sunbelt. It was mostly higher since 2010, but now it’s so much higher because of the increased interest rate levels.

Investor Presentation

If interest rates decrease by the end of the year, however, this will impact both the favorably wider market for rental apartments and the rental rate growth pace.

Performance

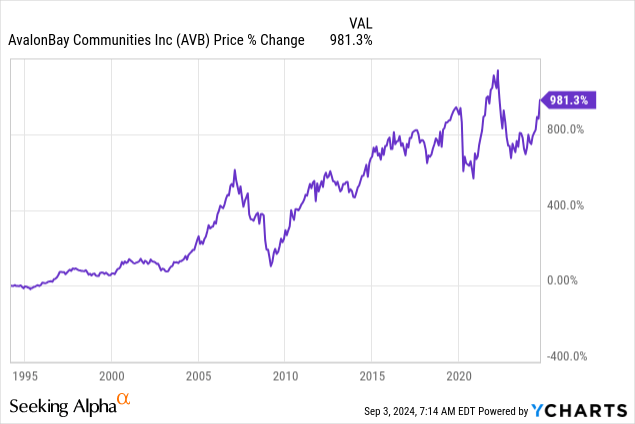

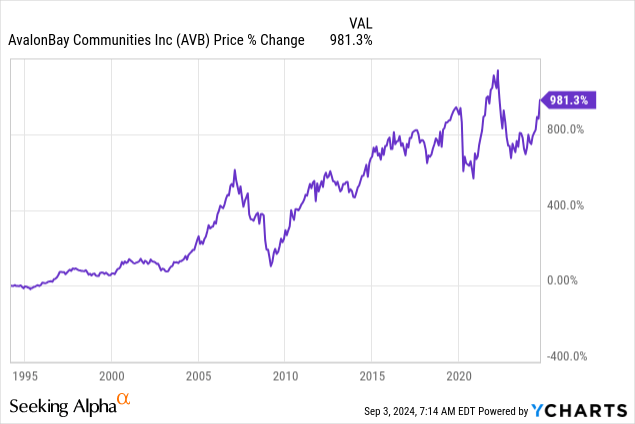

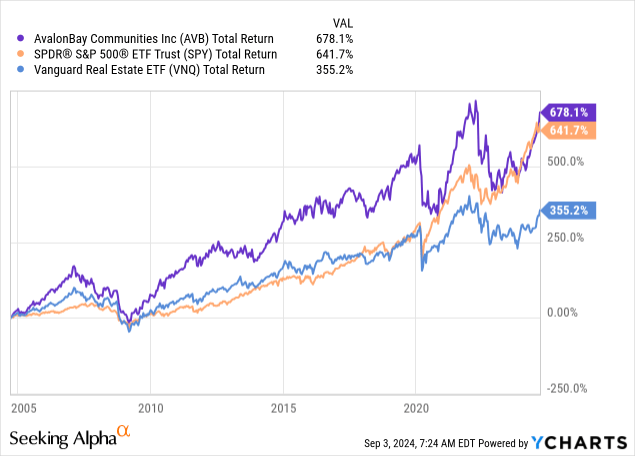

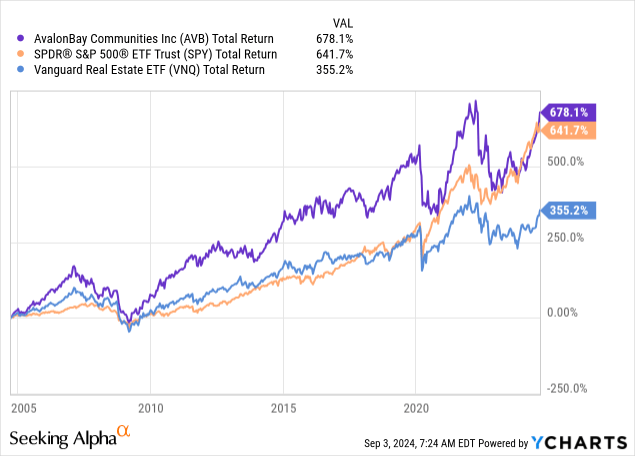

The long-term past price performance of AVB provides us with a quick way to see how fast the company grew to be a $32B market cap REIT in the last 30 years:

Though past growth should never be interpreted as an indication of future results by itself, such a long track record allows us to assess management quality; it’s reasonable that such a large corporation will have fewer opportunities for growth in the future compared to the last 10, 20, and 30 years, but trust in management continuing to efficiently operate the business is also reasonable.

On a total return basis, it has greatly outperformed the real estate public equity market, but the broader market caught up with it as it recovered slower after the COVID-19 drawdown and was later punished more severely by rapidly increasing interest rates. Within this context, however, its growth is admirable, especially after considering the long bull run we experienced.

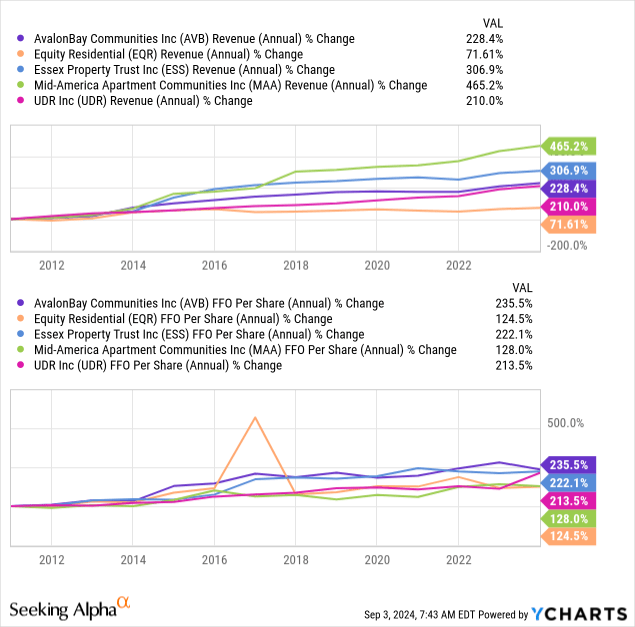

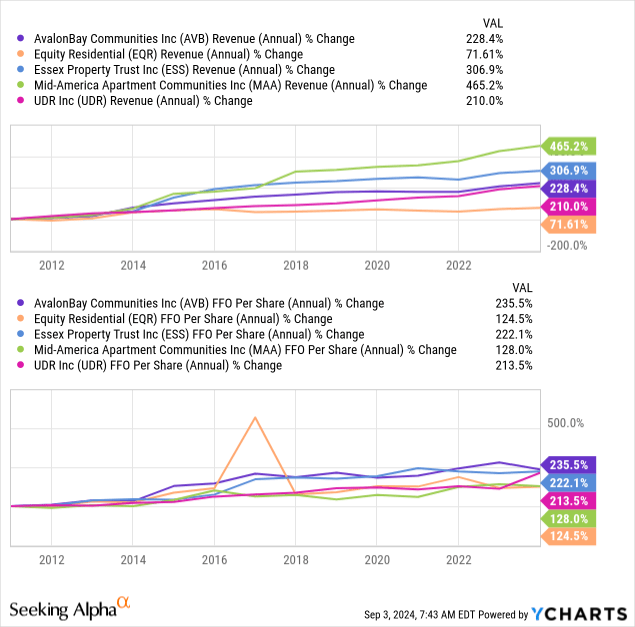

Although some of its peers experienced faster revenue growth, AvalonBay’s FFO growth which has been the greatest among relevant peers could explain its past total return performance:

Coming to more recent results, it’s worth paying attention to some of the REIT-level growth drivers. In 2023, YoY monthly rental rate growth was 6.6% and same-store economic occupancy decreased by 30 bps from 2022. Based on the last quarterly results, the rental rate growth decreased to 3.7%, but occupancy remained at 96% on a YoY basis (10 bps lower than the weighted avg. occupancy in 2023). Rent growth is already decelerating and will probably come back to more modest levels by the end of this year. In the last earnings call, management stated that it expected term effective rent change to be around 3%; based on the call, the REIT has already experienced rent growth moderating in the third quarter and management expects it to further decelerate in H2.

Same-store NOI increased by 6.2% in 2023 over the prior year and AFFO per share increased by 8.58%. In the second quarter of 2024, same-store NOI increased by 3% and AFFO per share increased by 4.13% on a YoY basis. The deceleration here is also consistent with the general slowing of rent growth. Per the last earnings call, same-store NOI and AFFO per share are expected to grow by 2.9% and 3.7%, respectively, in 2024. So the overall picture indicates still attractive future results on an absolute basis, but less attractive than what shareholders recently experienced.

Leverage & Liquidity

The A3 and A- credit ratings received by Moody’s and S&P, respectively, are supported by the overall solvency profile of AvalonBay. The unsecured portion of its debt is 91.41%; plus, 95.24% of that is fixed-rate, averaging a 3.5% interest rate, so no wonder the interest coverage is 7.87x. Additionally, its debt/assets ratio is 39.81% and its debt/EBITDA is only 4.66x.

Moreover, 3.58% of the total debt matures this year and the highest portion matures in 2028 but represents only 10.15% of total debt. Even its cash and cash equivalents alone are more than enough to cover debt coming due for any of the following 3 years if the management wanted to reduce debt. However, its credit facility which is almost completely unused right now makes for enough available liquidity to actually increase leverage.

Dividend & Valuation

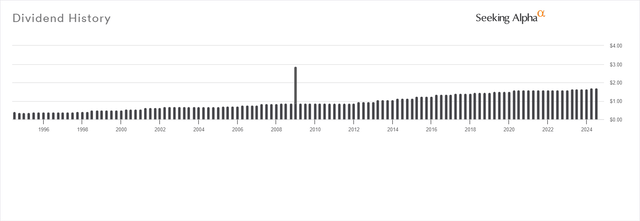

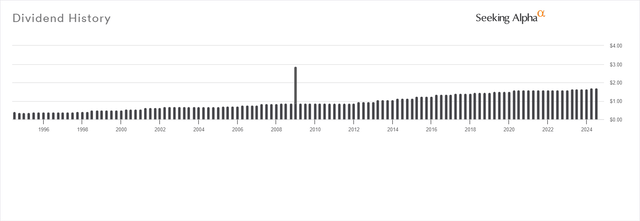

AVB currently pays a quarterly dividend of $1.7 per share, resulting in a forward yield of 3%. A payout ratio of 59.18% makes the dividend relatively safe, especially when you consider that the REIT increased the dividend by 4.9% annualized since 2000.

Seeking Alpha

Regardless, the yield is definitely low in this high-interest environment and probably not attractive for most income investors. The current yield also reflects a high valuation, since it’s lower than its 4-year average yield of 3.39% and the sector median yield of 4.33%. The AFFO yield is also quite low at 5.05%.

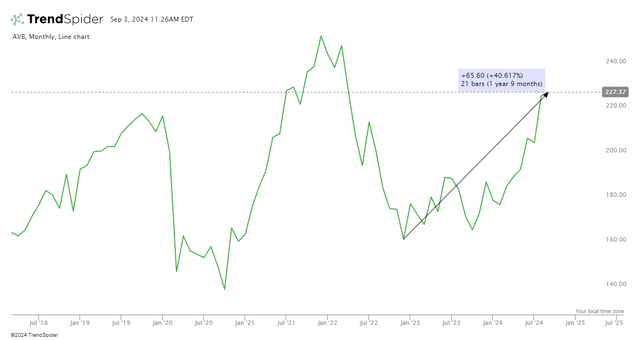

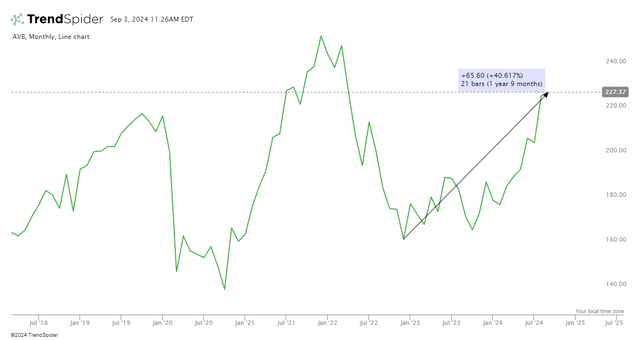

Unfortunately, AVB’s price has recovered for the most part since the 2022 drawdown:

TrendSpider

The REIT is also overvalued on a peer-relative basis, with not only a higher than average FFO multiple but also the highest one among other residential REITs.

| Stock | P/FFO |

| AVB | 20.48 |

| EQR | 19.28 |

| ESS | 19.48 |

| MAA | 18.22 |

| UDR | 18.01 |

| CPT | 18.49 |

| Average | 18.69 |

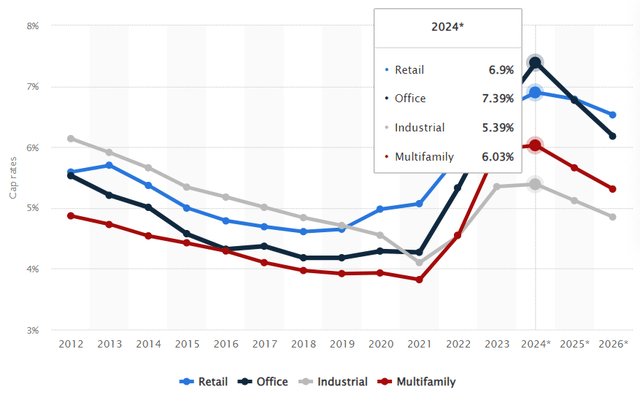

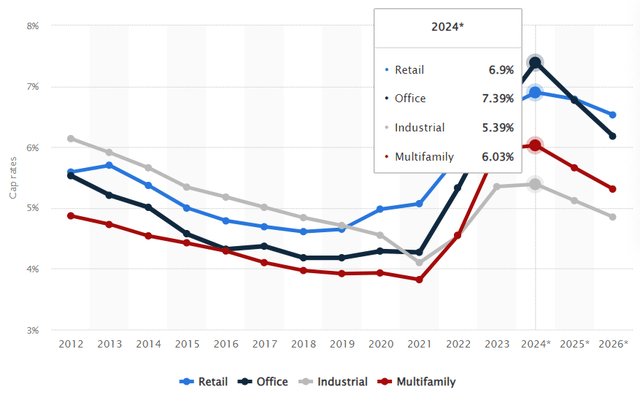

Also, its implied cap rate is 4.72%, which is too low right now, considering that multifamily cap rates have been around 5-6% in the last couple of years.

Statista

Historically, it’s not too low, but the context of the very low interest rates in the last decade should not be ignored when assessing how attractive 4.72% is.

Risks

So, the primary risk is a potential opportunity cost in the short term. There’s little doubt in my mind that the business will continue to grow at an attractive pace, delivering value to shareholders over the long run. It’s just that long-term projects that are going to facilitate such growth carry more uncertainty than the short-term outlook. Management’s expectations and current valuation don’t support a case for short-term outperformance.

Another important but less significant risk is related to the possibility of interest rates staying higher than we anticipate, which could put additional pressure on the share price. At the same time, lower interest rates may be more rewarding to REITs that have a higher cost of debt and don’t depend so much on mortgage rates staying high to make the alternative of owning the property less appealing.

Verdict

Overall, I believe that risks outweigh the prospects even though in the absence of solvency trouble and bad operational results, investing in the REIT is not too risky in my opinion. Therefore, I am rating AVB a hold but will continue to monitor its price.

What do you think? Do you own this stock, or do you favor some other REIT? Also, please leave a comment if you found this post useful; it means a lot! Thank you for reading.