Flipping homes shouldn’t be for the faint of coronary heart, irrespective of how enjoyable or simple HGTV would possibly make it appear.

One startup needs to make the method simpler by providing a unique strategy to borrow cash to fund such a purchase order. Based in late 2020, Backflip gives a service to actual property buyers for securing short-term loans. Past serving to customers safe financing, Backflip’s tech additionally helps buyers supply, observe, comp and consider potential investments. Consider it as a cross between Zillow and Shopify.

Backflip originates loans via its subsidiary, Double Backflip, LLC. Curiously, amongst its processing staff are former workers of Higher.com, a digital mortgage lender that has had its shares of ups and downs principally associated to its administration and market situations, however was lauded for its know-how.

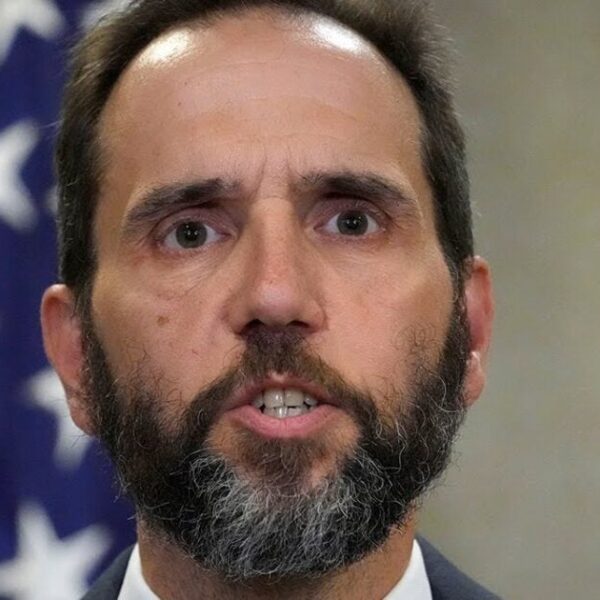

“We help investors source properties and curate their pipeline, analyze the deals that they might want to invest in, and hopefully make lower risk, better buying decisions,” CEO and co-founder Josh Ernst informed TechCrunch in an interview.

Backflip launched a stealth non-public beta in 2021 that ran via the primary half of 2022. Coming into the market at a time when rates of interest started to surge was difficult, mentioned Ernst, who’s a former funding banker and enterprise capitalist (he’s backed the likes of Polychain Capital). But the corporate managed to develop its income almost 5x in 2023 and attain an annualized income of $10 million. It additionally claims to be “near profitability.”

And at this time, the corporate is asserting it has raised $15 million in a Collection A funding spherical led by FirstMark Capital, a agency which invested early within the likes of Airbnb, Shopify and Pinterest, it has informed TechCrunch solely.

Current backers Vertical Enterprise Companions, LiveOak Enterprise Companions, Revel Companions, ECMC and the actual property firm Crow Holdings additionally participated within the spherical, as did angel buyers. In whole, Backflip has raised $28 million in fairness — and $67 million in debt financing.

To provide some context on how a lot enterprise has been performed on the Backflip platform to this point, Ernst mentioned that customers analyze a mean of $5 billion in properties every month on the platform and that the startup has funded greater than 900 properties since its mid-2022 launch. Customers have realized a mean gross revenue of $82,000 per property on the platform, and sometimes repay their loans in six months.

Most of Backflip’s loans are for 12 months (known as a bridge mortgage) however are offered at a 2% to 4% larger rate of interest than a typical residential mortgage, in keeping with Ernst.

Buyers can both promote the property and pay again Backflip or refinance and transfer right into a longer-term mortgage via one other lender.

“Our interest rates are higher than a retail bank, so our customer pays more for our loans than a bank,” Ernst mentioned. “But what we’re doing is giving them money, underwriting the asset, underwriting the business plan and underwriting the person.”

The standard (and cheaper) mortgage course of, he mentioned, is slower. And with Backflip, prospects don’t want a W-2 to qualify for a mortgage. Plus, the corporate bundles within the rehab and development mortgage so it’s simpler and quicker for an investor to maneuver shortly via all these transactions.

“We underwrite business plans, assets and people, not just W-2 income… and we provide capital for home renovation and give credit for post-repair valuation,” Ernst mentioned.

The corporate doesn’t presently cost subscription charges. Its enterprise mannequin is to function a market for the monetary merchandise. It makes cash through take charge on the loans on the lending origination enterprise, which it operates by partnering with capital suppliers.

“We’re helping to underwrite the properties and all the while, we’re getting more and more data that can then be used to make a quick and accurate underwriting decision on a specific loan product, which our members use to buy the property and renovate the property,” Ernst mentioned.

So the buyers get the cash from Backflip, which originates the loans after which in flip sells the loans.

Adam Nelson, managing director at FirstMark, informed TechCrunch that the chance for flipping is big. Within the U.S., greater than 50% of properties are over 40 years outdated, in keeping with 2023 research from the Nationwide Affiliation of Dwelling Builders and “not up to the standard of new homeowners and institutional single-family residential buyers,” he mentioned.

“The entrepreneurs in the ‘fix and flip’ industry provide an important service to bring the existing housing stock up to spec and put their own capital and sweat equity on the line to do it in both bull/bear housing markets,” he mentioned.

Nelson has been impressed by the corporate’s capacity to develop almost 5x 12 months over 12 months “with an efficient <1x burn multiple,” he added.

”We view Backflip because the working system for this $100 billion+ annual transaction market, with the potential so as to add worth and monetize a number of completely different elements of the repair and flip transaction and finally institutionalize the asset class,” Nelson added.

Presently, the startup has 47 workers with headquarters in Dallas and Denver.

Need extra fintech information in your inbox? Join TechCrunch Fintech here.

Need to attain out with a tip? Electronic mail me at [email protected] or ship me a message on Sign at 408.204.3036. You can too ship a word to the entire TechCrunch crew at [email protected]. For safer communications, click here to contact us, which incorporates SecureDrop (instructions here) and hyperlinks to encrypted messaging apps.