BreatheFitness

Investment Thesis

I recommend selling Banco Santander (Brasil) S.A. (NYSE:BSBR) shares. In the last two years, Santander adopted a conservative strategy, focusing on safe segments after the rise in interest rates in Brazil, due to worsening macroeconomic conditions. The fact is that in recent quarters, the bank has been adjusting its route and starting to be bolder.

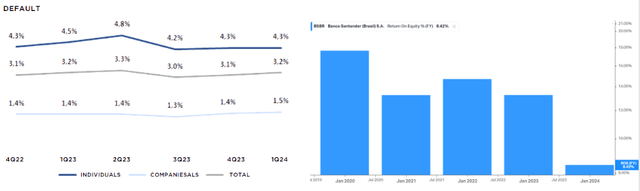

As a result, its ROE, which had been growing slowly, reached 14.1% in 1Q24, but still below its peers. Furthermore, by adjusting the strategy to more daring segments (with higher margins), the company will face competition and high default rates in my opinion. Given these difficulties, the bank’s valuation appears overvalued by the P/E multiple, not offering a good risk-return ratio.

Introduction

The evolution of the Brazilian banking sector brought an oligopoly characteristic, creating large private conglomerates that share leadership with two large state banks.

The sector’s oligopolistic bias has unique characteristics. Unlike other countries, large Brazilian banks concentrate several services in their portfolio, such as cards, accounts, investments, insurance, and financing.

However, technological developments have brought competition to the sector. Currently, digital banks such as Nu (NU) and Inter (INTR) are beginning to compete for customers and services against private banks such as Itaú (ITUB), Santander Brasil, Bradesco (BBD), and against public banks such as Banco do Brasil (OTCPK:BDORY) and Caixa.

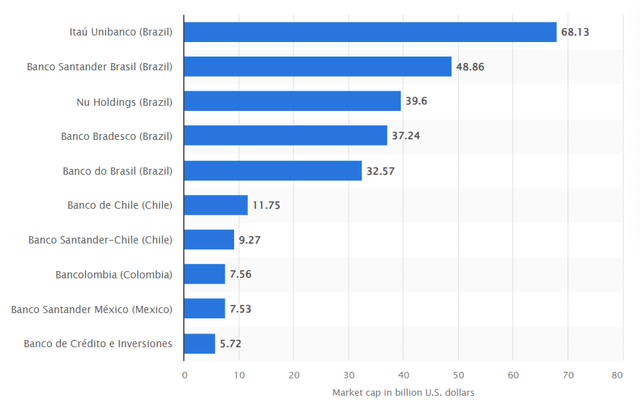

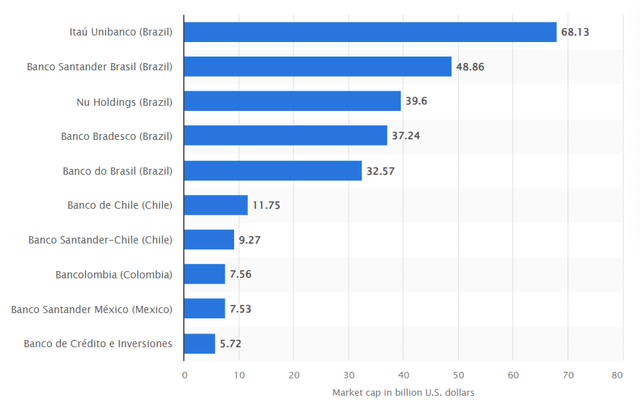

Another characteristic is that only 3% of the Brazilian population does not have a bank account. We can see that the Brazilian banking sector is very relevant in Latin America from the graph below:

Largest Banks In Latin America (Statista)

Now let’s understand the history of Santander Brasil, its business model, as well as its role in the competitive scenario.

History and Business Model

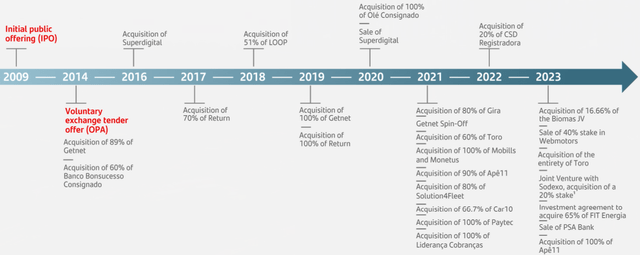

Santander is among the largest private banks in Brazil. The bank is part of the Santander Group (SAN), founded in Spain in 1857. The institution came to Brazil in 1957, but began to gain scale with the purchases of banks Banespa and Real in 2000 and 2008. Let’s look at the timeline of Banco Santander Brasil:

According to the institutional presentation, Santander Brasil has:

- Domestic market shares of around 8% in loans and 9% in deposits

- Leader in vehicle financing for individuals, with a market share of 22%

- Total Assets: $230B

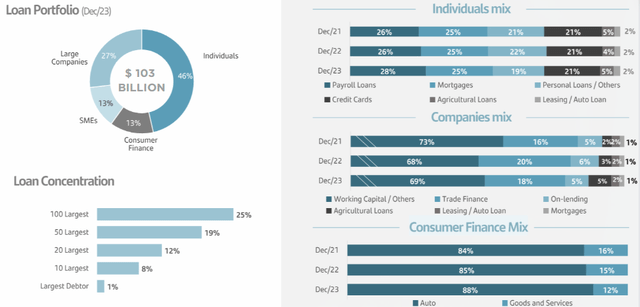

- Loan Portfolio: $103B

- Funding: $125B

- Branches and PABs: 2677

- Employees: 55611

- Total costumers: 66 million

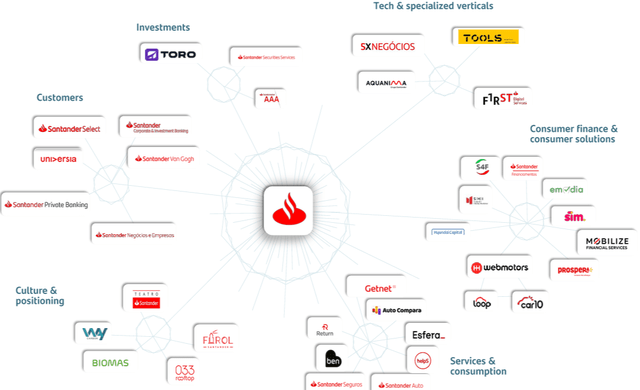

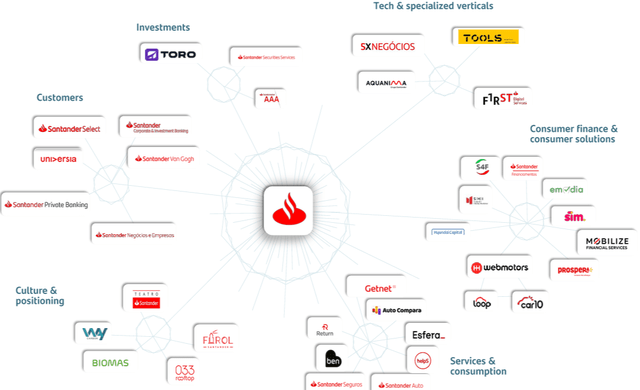

This robustness together with the characteristics of the Brazilian banking sector means that Santander Brasil has a wide range of services:

Service Ecosystem (IR Company)

Now let’s go deeper into the thesis because as I mentioned, Santander Brasil adopted a conservative strategy in its loan portfolio amid the complex Brazilian macroeconomic scenario.

Loan Portfolio – Conservative Approach

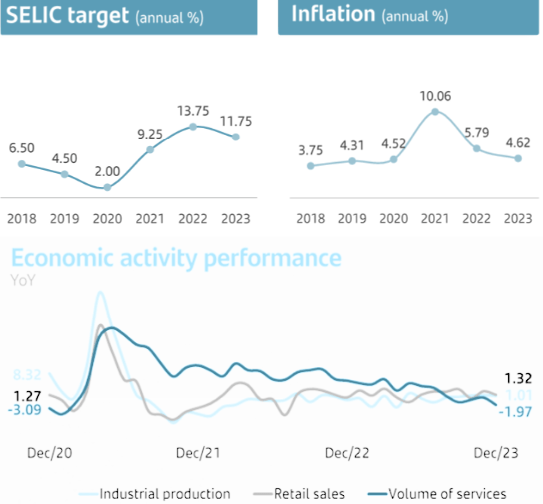

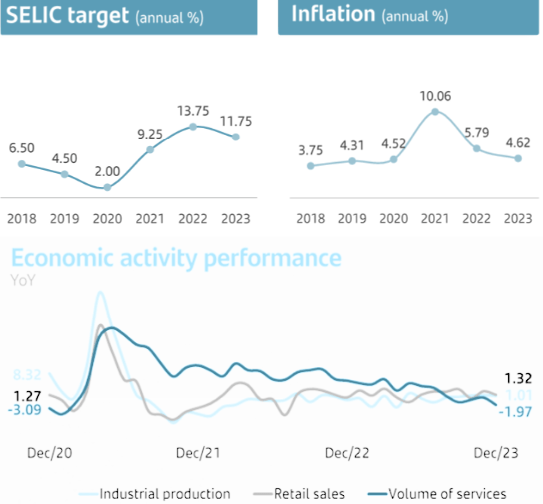

One of the effects of the pandemic and the use of expansionary fiscal policies was an increase in interest rates around the world. Unlike the USA, Brazil suffered a serious economic downturn that caused all local banks to rethink their strategies.

Interest Rates, Inflation And Economic Activity (IR Company)

Santander Brasil has a long history of good loan risk management, maintaining controlled delinquency levels. With the uncertainties demonstrated by the graphs, Santander adopted a cautious strategy.

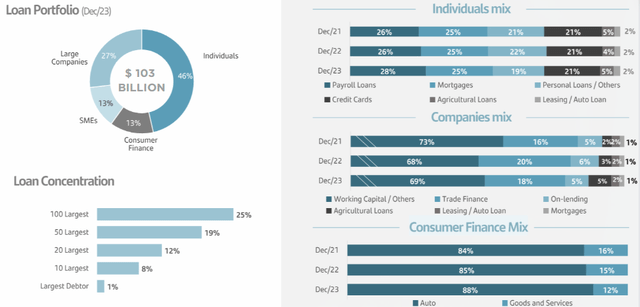

Its focus was redirected to customers with a better risk profile, products with guarantees and greater exposure to agribusiness. The dispersion of the loan portfolio itself contributed to a reduction in systemic risks:

Loan Portfolio (Adapted from IR Company)

However, by opting for a more conservative strategy that results in lower delinquency rate, the company’s ROE also fell considerably.

But to better understand the numbers, let’s do a comparative analysis of Santander Brasil with its private peers Itaú and Banco Bradesco, and see how this analysis corroborates my thesis of selling the company’s shares.

Santander Brasil Fundamentals

Next, I will use Seeking Alpha to do a comparative financial analysis of Santander Brasil with its private peers Itaú and Bradesco:

| Name | Itaú | Bradesco |

Santander |

| Ticker | (ITUB) | (BBD) | (BSBR) |

| Market Cap | $55B | $27B | $20.7B |

| Net Income TTM | $6.8B | $2.9B | $1.9B |

| Net Income Margin | 26.6% | 20.8% | 23.1% |

| Net Income CAGR 3Y | 20.5% | -3.4% | -11% |

| Loan Portfolio | $181B | $177B | $103B |

| ROE FWD | 20.7% | 11.1% | 14.75% |

| Dividend Yield | 3.87% | 6.81% | 5.35% |

Well, when we carried out the financial analysis, we found that Itaú has the best financial indicators. The only caveat we could make is its dividend of 5.35%, but that has little relevance when we are faced with an ROE below 15%. But is Santander cheap compared to its competitors?

The Valuation Is Not Attractive

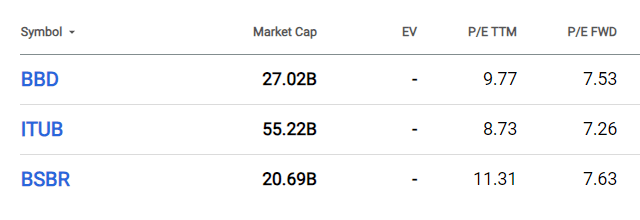

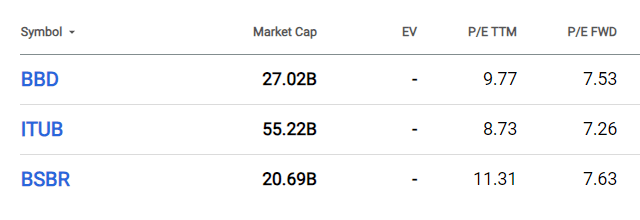

Since we are analyzing the banking sector, characterized by stable profits, a good comparison multiple is Price/Earnings. Let’s look at Santander Brasil versus its peers:

P/E FWD (Seeking Alpha)

I was impressed when I came across the comparative evaluation (P/E FWD), it is clear that Santander Brasil has a premium due to its high business diversification and strict cost control. However, the valuation seems overvalued when compared to Itaú, which I have a recommendation.

Due to this disparity between valuation and financial indicators, my recommendation is to sell Santander Brasil shares. In my opinion, Santander Brasil should trade at a discount to Itaú’s multiples due to its size, type of client, and prospects. Now, let’s check whether SA’s Quant Rating and Factor Grades tools corroborate the thesis.

Santander Brasil According To The Seeking Alpha Quant & Factor Grades

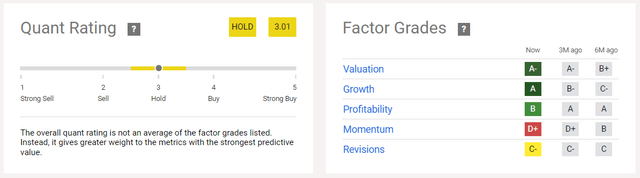

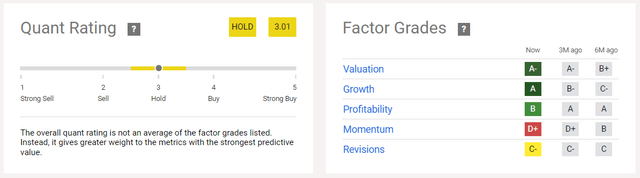

The Quant Rating tool gives a recommendation to hold the shares:

Quant Rating and Factor Grades (Seeking Alpha)

However, I was curious about the A- rating for valuation and went to examine it. The tool considers Price/Earnings to be 7x cheaper versus global competitors, and it is right; however, it seems more valid to compare with local peers.

Operating in the same competitive environment would bring a more skeptical assessment and possibly corroborate my thesis of selling the shares. Anyway, we need to check expectations for future results and what strategies the company will use to understand whether market pricing makes sense.

Latest Earnings Results

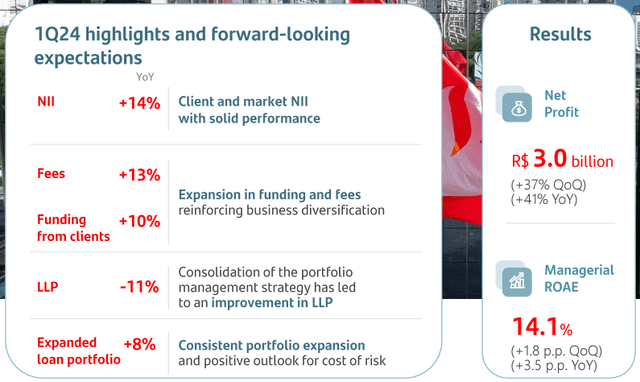

Santander Brasil delivered decent numbers in 1Q24, with a managerial recurring net profit of $600 million, equivalent to an ROE of 14.1%. The positive highlights are the growth of the loan portfolio and financial margin. As for the expanded loan portfolio, the annual growth of 8.1% marks a return to the market’s growth rate.

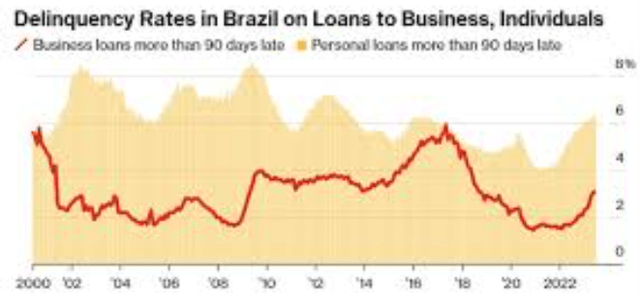

This growth has come with greater momentum in the personal retail segments. The bank sees a lot of competition ahead in this segment. The negative highlights were delinquency and commissions. As for delinquency, it was predominantly pressure on companies, but stability in individuals.

And as Santander is expected to have a bolder approach with a higher spread mix, it is possible that we will see a deterioration in delinquency rates, which are currently under control. But the big question is: Will its strategy to face competition be enough?

Will Its Strategy To Face Competition Be Enough?

Santander is undergoing a complete reformulation of its retail offer and branch model, with emphasis on a new offer initially aimed at individuals. The offer targets the 30 million non-active customers. Currently, the bank has 65.8 million customers, but only 31.1 million of them are active.

But will it be enough? Despite recognizing that some players are suffering from cyclical factors, I believe that the drop in profitability is structural, as the detractors should not be mitigated.

There is an increase in competition, which started in the acquiring segment, and has now extended to investments, cards, current accounts, such as Nu, which already has more than half of Brazil’s adults as customers.

When we look at regulation, there is a ceiling on credit card interchange, a ceiling on interest on special checks and PIX. In the past, there was a belief that difficulties were resolved by increasing fees and spreads.

However, currently the challengers have competitive characteristics, creating difficulties in increasing prices. That’s why I’m skeptical about Santander’s ability to modernize to the point of fighting its agile competition.

Another point is that segments with higher margins and greater competition bring greater operational difficulties, such as delinquency:

In any case, before buying or selling a share, it is necessary to understand the risks to the thesis, let’s look at them.

Potential Threats To The Bearish Thesis

Despite profitability still being low in relation to peers that managed the post-pandemic period in a less turbulent manner, Santander’s 1Q24 results showed improvements compared to previous results. The ROE of 14.1% signals a clearer trend towards a return to profitability. If the company is successful in modernizing, the indicator should continue to improve.

The company’s management shows a great impetus for growth in more profitable lines, made possible by quality levels under their control. There is also the intention to optimize costs through a new digital service model and a possible increase in customers. All of these factors would be contrary to my thesis of selling the shares.

It is also important to highlight that in 4Q23, the bank strengthened its balance sheet with credit provisions, which could help mitigate the need for future provisions and, probably, contribute to a better result in this quarter and the next. The risks to Santander’s thesis are diverse, and investors must understand them well before investing.

The Bottom Line

Santander Brasil has the same Price/Earnings multiple as Itaú Unibanco, which makes no sense given that Itaú has a more resilient audience (high income) and better financial indicators.

In addition to overvalued pricing, the company is moving away from a more conservative strategy to enter segments with greater competition, such as loans for companies and individuals. In this scenario, competition and delinquency are not being priced in my opinion.

Based on this analysis, I recommend selling Santander Brasil shares. Investors must analyze the difficulties that the company will face and its valuation with a small margin of safety. The risk-return ratio does not seem attractive in this case.