Bank of America is cracking down on managers who pressured junior bankers to hide the number of hours they worked to avoid triggering a policy that would give them time off.

On Monday, several managers told junior bankers to report instances in which they were instructed to underreport their hours in order to avoid having to notify the human resources department, according to the Wall Street Journal. The issue is front and center because it raises concerns about corporate culture at the $300 billion bank, and whether it is pushing junior staff to limits that harm their physical and mental health, in the name of paying dues.

The new directive at Bank of America comes after an earlier investigation from the Journal found that junior bankers across the company reported being regularly told to misrepresent the number of hours their bosses told them to work. BofA currently has rules in place that limit junior employees to 100-hour workweeks and guarantee they have at least one weekend day off. Employees are only allowed to exceed those limits with approval from human resources.

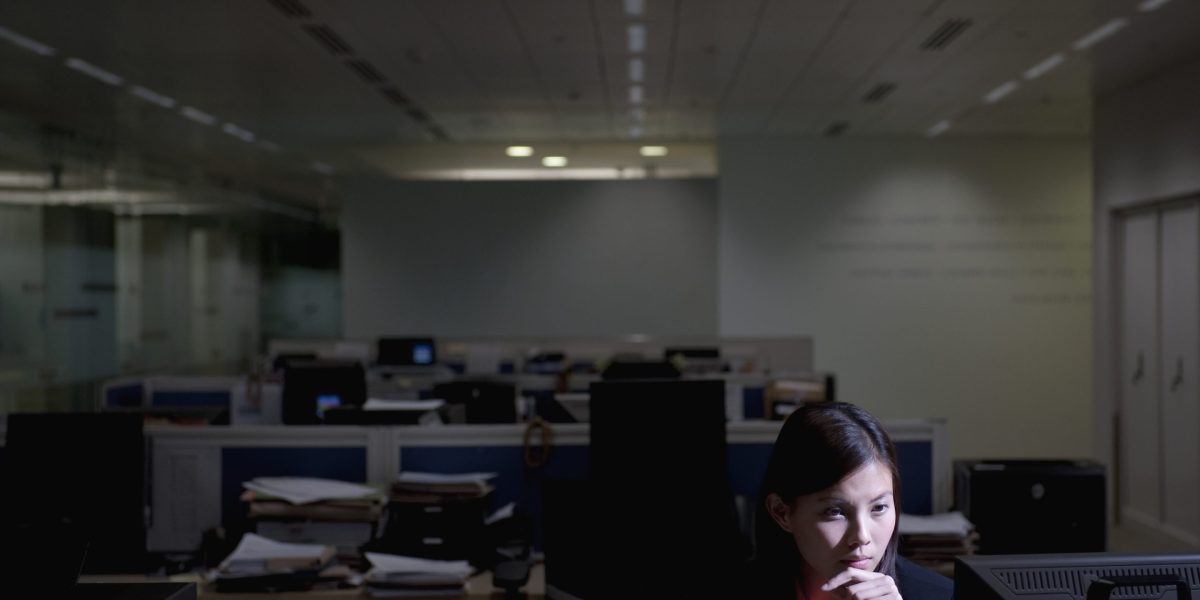

However, junior bankers in divisions across the company said they often worked more than was allowed and were told to say otherwise when reporting their hours. One former employee told the Journal she was regularly held at the office until 5 a.m. and asked to say otherwise. Another said they were instructed to only report the allowed number of hours, even though they worked at least one all-nighter a week. Bank of America did not respond to a request for comment.

Banking is known for long hours, often seen as the price ambitious young people have to pay in order to pocket the mammoth entry level salaries. Pay regularly tops $100,00 a year for entry-level roles and can stretch as close to $200,000. That’s to say nothing of the annual bonuses that can come on top of salaries. A recent report from compensation consultancy Johnson Associates found that bankers’ bonuses were expected to rise across the board this year, some as high as 35%.

Such paydays can be especially enticing for summer interns, who are vying to earn a full-time role. Bank of America’s 100-hour cap became a company norm in 2014, after a 21-year-old intern in the London office named Moritz Erhardt died on the job a year earlier. Erhardt died of an epileptic seizure after working three all-nighters in a row.

When the bank is in the thick of a deal, it often requires an all-hands-on-deck approach that can mean extraordinarily long hours. It’s during these periods that younger employees, eager to please and prove themselves, were pushed to circumvent the policies, the Journal reported.

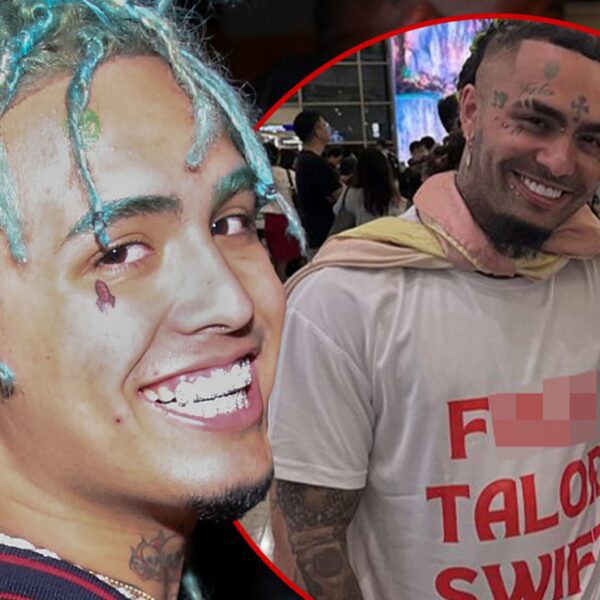

The demanding work environment of Wall Street bank’s was thrust back into sharp relief, after a Bank of America employee died in May. Leo Lukenas III, who was a former Green Beret, had been working on a deal that was in its final stages when he died of a blood clot. Lukenas worked 100-hour weeks for the previous month as the deal closed.

Much of the grunt work—building PowerPoint decks, scouring Excel spreadsheets—that required junior bankers to work such punishingly long hours could be coming to an end with the advent of AI. The belief is that this crop of new productivity tools will do away with the need to have entry level employees toil away at such tasks.