Banco Bilbao Vizcaya Argentaria, S.A. (NYSE:BBVA) is a bank with high exposure to rates, a profile that was quite good during the rising interest rate environment between 2023-24, but as monetary policy changed quite rapidly, both in Europe and in Mexico, which are its two largest markets, I changed my view on BBVA to bearish some months ago.

Moreover, the bank has launched a hostile takeover offer to buy its competitor Banco de Sabadell (OTCPK:BNDSY) in an all-share deal, which will dilute current shareholders and has been a headwind for BBVA’s share price in recent months.

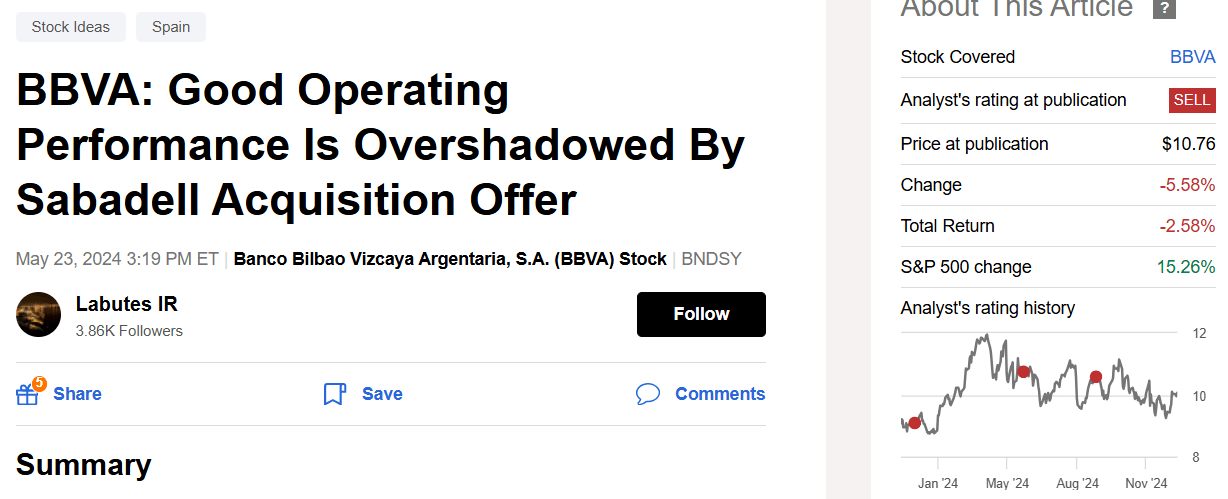

Indeed, since the launch of its offer, BBVA’s share price has traded more or less sideways and has underperformed the market by a significant margin, as shown in the next graph.

More recently, the Spanish competition authority has moved the analysis of this potential deal into a longer review, which means it needs further investigation about the impact of lower competition in the Spanish banking market, and has also raised some concerns about market concentration in some specific regions. Banco Sabadell is a bank with a strong presence in Catalunya and Valencia regions, namely in the SME segment, raising some concerns about BBVA becoming too big and leading to lower choices for banking customers.

This means it’s not certain BBVA will be able to get regulatory approval for this acquisition, as the competition authority is expected to take some months to evaluate more in depth this potential combination, being a headwind for BBVA’s share price for some more time. Additionally, even if BBVA gets regulatory approval, it needs at least more than half of Sabadell’s shareholders to approve the deal, which is also not certain it will happen. This also raises the risk that BBVA may eventually raise its offer and overpay to acquire Sabadell, which would probably not be well received