AI image

Betting markets have boosted Trump’s Presidential odds after the failed assassination attempt on the weekend. In equities, shares of the meme-stock social network $DJT are up 70% premarket and I would expect some others to follow along.

For the broader market, S&P 500 futures are up 22 points and I wonder if that’s underpriced given the political shifts that appear to be coming.

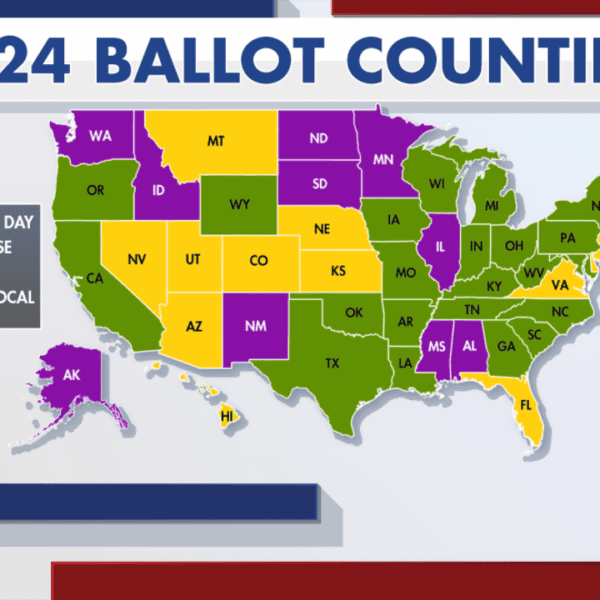

One I’m trying to pin down is the House. Many Democratic districts were running well-ahead of Biden so there had been a good chance that Democrats would control the House. A Trump Presidency with a Democratic House is very different than a Republican sweep (I’m assuming Republicans take the Senate).

Polymarket makes a market on House control and you can see a shift to 45% for Dems but that seems high and the market is thin.

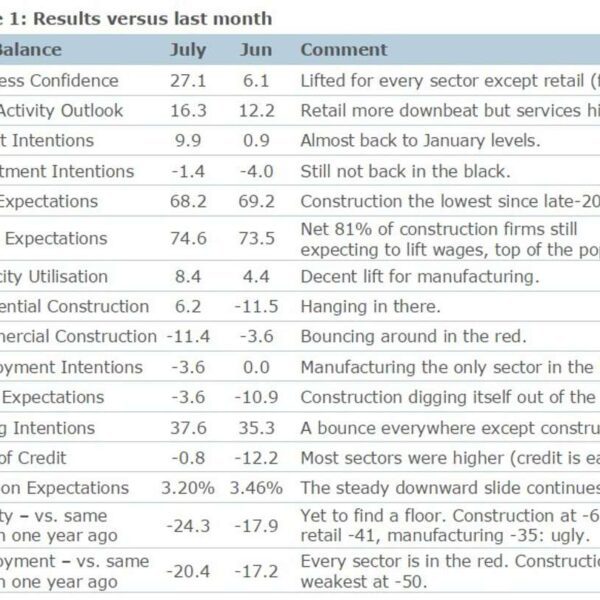

A clearer signal may be in bonds where there is a bear steepener unfolding today, similar to after Biden’s debate performance. The short end is flat today while the long end is up 6 bps. That has 2s30s uninverted for the first time since January.

US 2s30s daily

If you translate that to FX, the message here is a Republican sweep running larger deficits and cutting taxes. That would be good for equities and the US dollar as interest rates are kept higher. At some point, you run into supply worries in Treasuries and that’s tough to gauge but in FX, I could see a scenario unfolding where material USD outperformance continues.

Then again, politics are tough to predict and it’s still a long way to November.