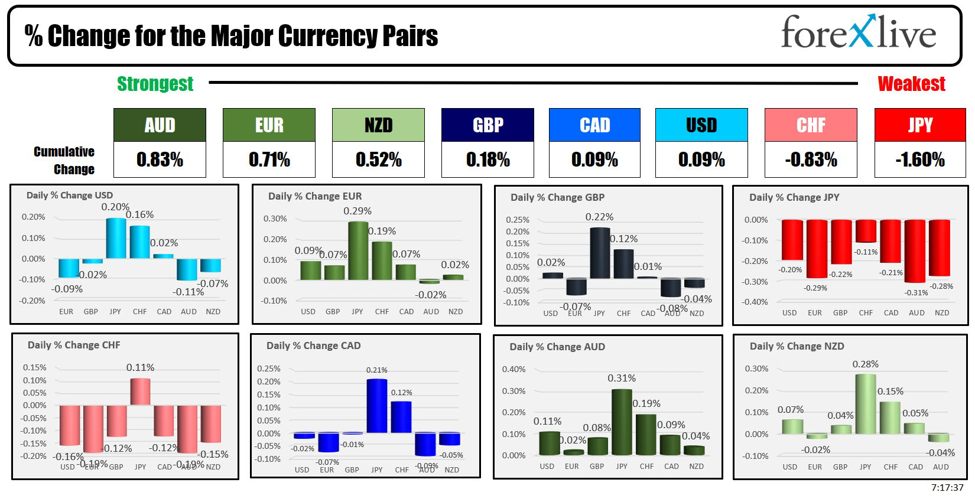

The strongest to the weakest of the key currencies

Because the North American session begins the AUD is the strongest and the JPY is the weakest. The USD is combined/little modified vs the key currencies.

As soon as once more, the low to excessive buying and selling ranges coming into the US session are restricted apart from the JPY which has an 82 pips buying and selling vary and trades close to session highs after dipping earlier within the Asian Pacific session. The EURUSD vary is 22 pips and that was solely resulting from a transfer larger within the final hour of buying and selling. The GBPUSD is 30 pips, USDCHF is 20 pips, USDCAD is barely 13 pips, AUDUSD is eighteen pips and NZDUSD is 25 pips. There’s room to roam.

In Japan, serving to to underscore the JPYs weak spot had been feedback from Financial institution of Japan (BOJ) Governor, Kazuo Ueda, who emphasised the significance of monitoring the emergence of a constructive wage-inflation cycle as a key think about figuring out the timing for phasing out the central financial institution’s stimulus measures. Ueda highlighted this yr’s wage negotiations as a crucial ingredient in deciding when to exit from the stimulus, indicating that the BOJ will carefully scrutinize the outcomes of those talks together with different information earlier than making any coverage choices. He additionally talked about the potential for tweaking unfavorable rates of interest, yield curve management (YCC), and different financial easing instruments if there’s a sustained achievement of the financial institution’s value goal.

Nevertheless, Ueda’s feedback counsel he’s not in a rush to implement main adjustments, stating the necessity for persistence. Moreover, Japanese Prime Minister Kishida expressed his hope that the BOJ’s financial coverage choices will take into account the federal government’s coverage stance, highlighting the alignment between the federal government and the central financial institution as they navigate the transition. The state of affairs now hinges on whether or not the BOJ will make a decisive transfer within the close to time period or delay its resolution. The BOJ subsequent meets subsequent week.

The US and Canada financial calendar at the moment is void of any main financial launch. The weekly oil stock information will probably be launched with crude oil anticipated to point out a:

- Construct of 1.338M.

- Gasoline shares are anticipated a draw of -1.900M, and

- Distilates are anticipated to be little modified with a draw of -0.150M.

The non-public information launched late yesterday confirmed:

At 1 PM ET, the U.S. Treasury will public sale off 30-year bonds. Yesterday the ten yr notice public sale was not too nice with bid to cowl lower than the common, a constructive tail of 0.9 foundation factors, and low worldwide demand. On Monday, the three yr notice public sale was met with stable demand.

Financial information out of the UK and the EU at the moment was combined.

GBP Items Commerce Stability:

- Precise: -£14.5B

- Forecast: -£14.9B

- Earlier: -£14.0B

- Abstract: BETTER (smaller deficit) than the forecast however WORSE (bigger deficit) than the earlier.

GBP Index of Companies 3m/3m:

- Precise: 0.0%

- Forecast: 0.0%

- Earlier: -0.2%

- Abstract: MET the forecast and was HIGHER than the earlier.

GBP Industrial Manufacturing m/m:

- Precise: -0.2%

- Forecast: 0.0%

- Earlier: 0.6%

- Abstract: LOWER than the forecast and LOWER than the earlier.

GBP Manufacturing Manufacturing m/m:

- Precise: 0.0%

- Forecast: 0.0%

- Earlier: 0.8%

- Abstract: MET the forecast however was LOWER than the earlier.

Italian Quarterly Unemployment Fee:

- Precise: 7.4%

- Forecast: 7.3%

- Earlier: 7.6%

- Abstract: HIGHER than the forecast however LOWER than the earlier.

EUR Industrial Manufacturing m/m:

- Precise: -3.2%

- Forecast: -1.8%

- Earlier: 1.6%

- Abstract: LOWER than each the forecast and the earlier.

A snapshot of the markets because the North American session begins at the moment exhibits:

- Crude oil is buying and selling up $1.13 or 1.46% at $78.71. Right now yesterday, the value was at $7.94

- Gold is buying and selling up $5.24 or 0.24% at $2162.90. Right now yesterday, the value was at $2171.81

- Silver is buying and selling up $0.16 or 0.68% at $24.27. Right now yesterday, the value was at $24.37

- Bitcoin at the moment trades at $73,160. The value reached a brand new all-time excessive at $73,679. Right now yesterday, the value was buying and selling at $72,146

Within the premarket, the key indices are buying and selling largely larger. Yesterday the S&P closed at a brand new document excessive. The NASDAQ index closed round 9 factors shy of its all-time excessive closing degree at 16274.94

- Dow Industrial Common futures are implying a acquire of 52.51 factors. Yesterday, the index rose 235.83 factors or 0.61% at 39005.50

- S&P futures are implying a acquire of 4.48 factors. Yesterday, the index rose 57.35 factors or 1.12% at 5.75.28

- Nasdaq futures are unchanged. Yesterday, the index rose 246.36 factors or 1.54% at 16265.64

Within the European fairness markets, the key indices are buying and selling larger.

- German DAX, +0.04%

- France CAC , +0.54%

- UK FTSE 100, unchanged

- Spain’s Ibex, +1.44%

- Italy’s FTSE MIB, +0.57% (delayed by 10 minutes).

Shares within the Asian Pacific markets had been combined:

- Japan’s Nikkei 225, -0.26%

- China’s Shanghai Composite Index, -0.40%

- Hong Kong’s Cling Seng index, -0.07%.

- Australia S&P/ASX index, +0.22%

Trying on the US debt market, yields are marginally larger after rising yesterday submit the US CPI information:

- 2-year yield 4.615%, +1.7 foundation factors. Right now yesterday, the yield was at 4.450%

- 5-year yield 4.175%, +2.1 foundation factors. Right now yesterday, the yield was at 4.088%

- 10-year yield 4.180% +2.5 foundation factors. Right now yesterday, the yield was at 4.086%

- 30-year yield 4.339% +2.8 foundation factors. Right now yesterday, the yield was at 4.244%

- The two-10 yr unfold is at -44 foundation factors. Right now yesterday, the unfold was at -46.6 foundation factors

- The two-30 yr unfold is at -27.8 foundation factors. Right now yesterday, the unfold was at -30.8 foundation factors

European benchmark 10-year yields are minor:

European benchmark 10 yr yields are larger