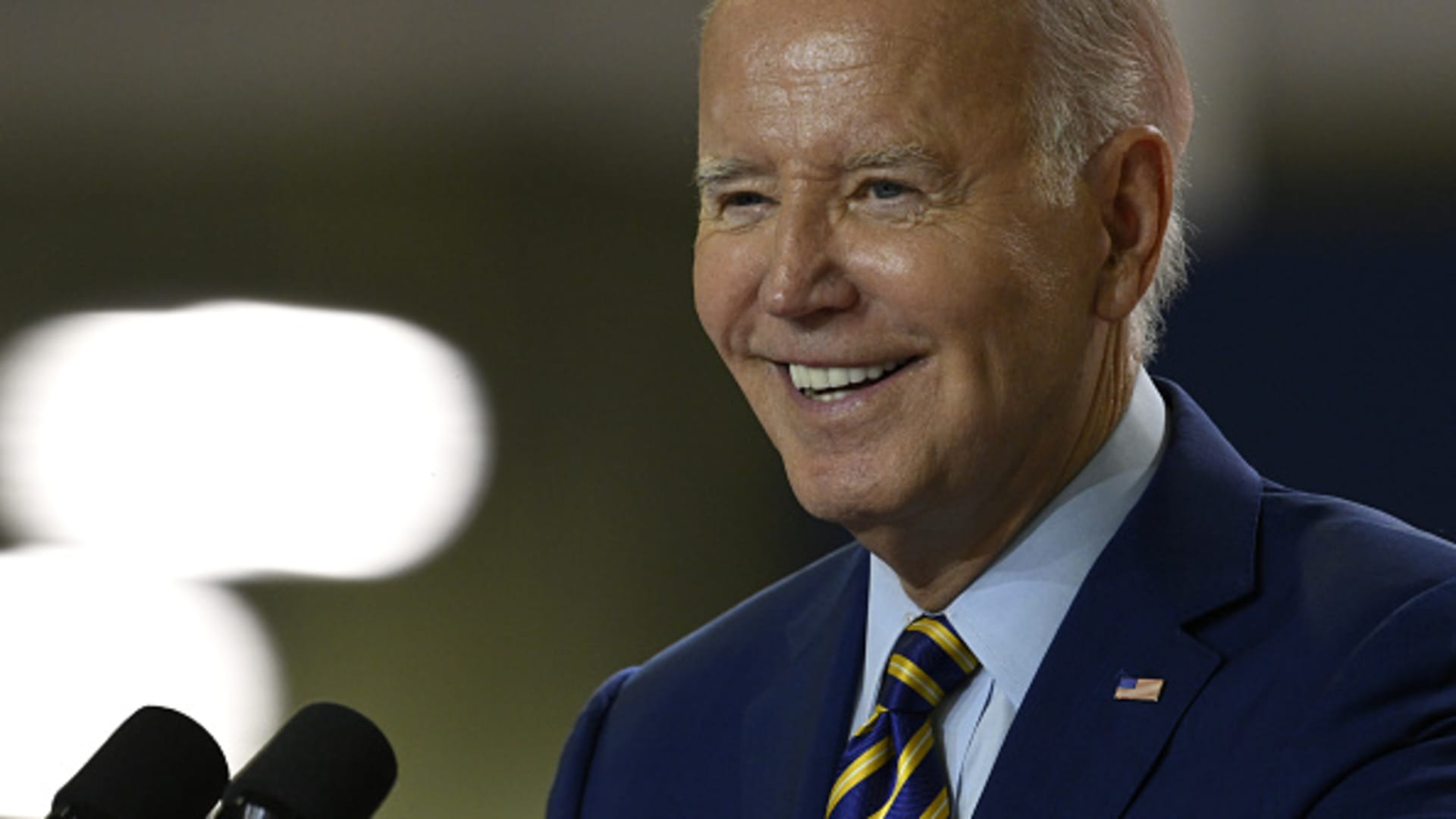

President Joe Biden highlights a brand new manufacturing partnership between Enphase Vitality and Flex LTD in West Columbia SC, on July 06, 2023.

Peter Zay | Anadolu Company | Getty Pictures

The Biden administration has launched its proposal for which struggling borrowers ought to qualify for its new scholar mortgage forgiveness plan.

The Supreme Courtroom’s conservative majority blocked President Joe Biden’s first help package deal final yr. In an effort to create a mortgage forgiveness program that’s legally viable, the Biden administration is working to slender the aid by specializing in sure teams of debtors, together with these with balances better than what they initially borrowed and college students from colleges of questionable high quality.

Its new proposal issues debtors experiencing financial hardship, the class that has remained essentially the most imprecise.

The U.S. Division of Training outlined on Thursday a set of things that might establish struggling debtors, comparable to these with scholar mortgage balances and required funds which are unreasonable relative to their family earnings, and folks with excessive childcare and healthcare bills. It additionally stated that monetary hardship could possibly be primarily based on different debt obligations, incapacity, or age, amongst different elements.

Extra from Private Finance:

Why the ‘last mile’ of inflation fight may be tough

Why disinflation is ‘more ideal’ than deflation

Workers may be unfairly sour on the job market

“The ideas we are outlining today will allow us to help struggling borrowers who are experiencing hardships in their lives, and they are part of President Biden’s overall plan to give breathing room to as many student loan borrowers as possible,” Division of Training Undersecretary James Kvaal stated in a press release.

At one level, it appeared potential that the “financial hardship” class had been dropped from what has change into often called Biden’s Plan B for student loan forgiveness. Whereas Biden first tried to cancel scholar debt by way of an government order, he has now turned to the rulemaking course of.

Over three rulemaking classes, the negotiators tasked with figuring out who might be eligible for the president’s revised aid plan recognized a number of categories that might sign hardship. These embody debtors who acquired a Pell Grant or certified for a medical insurance subsidy on the Reasonably priced Care Act’s market.

However the Training Division didn’t embody language on borrowers in hardship in its aid proposal, and the negotiators did not get to vote on the class.

Shortly after the rulemaking classes, lawmakers together with Sen. Elizabeth Warren, D-Mass. and Rep. James Clyburn, D-S.C., wrote to U.S. Secretary of Training Miguel Cardona on Jan. 24., pressuring him to nonetheless think about struggling debtors for aid.

“We are concerned that, without full consideration of cancellation targeted toward borrowers facing financial hardship, the rule will not provide adequate debt relief for the most vulnerable borrowers,” the lawmakers stated.

The Biden administration appears to have heard these worries. The Training Dept. stated it is going to maintain an extra rulemaking session on Feb. 22 and Feb. 23, throughout which the negotiating committee will focus completely on financially strapped debtors. Its personal proposal suggests the class might cowl thousands and thousands of People.

That is breaking information. Please examine again for updates.