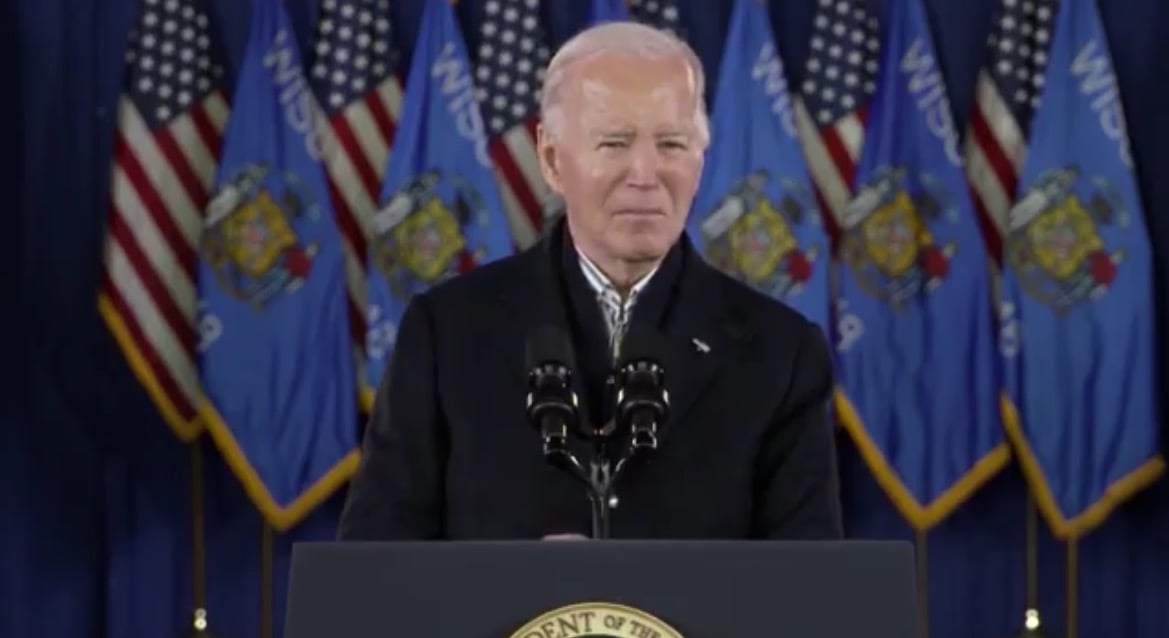

President Joe Biden made a declare Wednesday that even his personal folks most likely aren’t in a position to translate.

“I went to the Supreme Court to eliminate student debt that was out there,” he mentioned, in video shared by RNC Analysis to X. “And guess what? Supreme Court ruled against me, but I still 136 million people[‘s] debt relieved.”

There are such a lot of issues with that assertion, whilst quick as it’s.

Biden claims he bought “136 million peoples’ [student] debt relieved.”

He’s mendacity — once more. pic.twitter.com/e2LLJTyqrg

— RNC Analysis (@RNCResearch) December 20, 2023

Let’s begin with the truth that Biden didn’t go “to the Supreme Court” to do something in any respect. He tried an unconstitutional motion to shift the burden of about $400 billion in student debt away from the individuals who incurred it and onto the shoulders of the American taxpayer.

He wouldn’t describe it that method, in fact — liberals wish to fake that “debt relief” simply makes that debt disappear into the ether. It does no such factor, in fact — debt have to be repaid by somebody. If not by the individuals who really owe it, that by individuals who you don’t.

What really occurred was the Biden tried to drag an unconstitutional quick one, and didn’t go to the Supreme Court however was taken there in opposition to his will by a lawsuit that he ended up losing.

His subsequent assertion gave the impression to be slightly extra problematic, as he basically dismissed the final word arbiter of United States regulation as a minor annoyance when it got here to getting his targets achieved.

However the actual situation with Biden’s feedback is what he claimed to have achieved.

“I still 136 million people[‘s] debt relieved,” you’ll recall he mentioned.

Um, no. He didn’t. Not even shut.

On the one hand, there are solely about 40 million folks within the nation who even have any pupil debt, in accordance with the Washington Examiner.

Alternatively, Biden’s personal White Home mentioned in a statement solely two weeks in the past that the administration had introduced “debt relief” to solely 3.6 million of these, or about 9 p.c of all pupil mortgage holders within the nation.

On the third hand — you’re going to need to lend me one among yours, I suppose — the overall quantity of debt “relieved” has been $132 billion — which would seem, maybe, to be the supply of the “136” quantity Biden cited as plenty of folks, not a greenback quantity, however … I don’t know.

I’m not sure he does, both.

For what it’s value, the White Home assertion from Dec. 6 seems in its entirety beneath. Possibly you can work out what the chief of the free world was speaking about.

At present my Administration is approving one other $4.8 billion in pupil debt cancellation for 80,300 folks. This reduction is because of my Administration’s efforts to repair Public Service Mortgage Forgiveness, so academics, members of the army, nurses, and different public service employees get the reduction they’ve earned. And it’s due to actions my Administration took to guarantee that debtors who’ve been in reimbursement for at the least 20 years – however didn’t precisely get credit score for pupil mortgage funds – get the reduction they’re entitled to. This brings the overall debt cancellation my Administration has accepted to $132 billion for over 3.6 million People by way of varied actions.

At present’s announcement comes on high of all we’ve been in a position to obtain for college kids and pupil mortgage debtors previously few years. This contains: attaining the most important will increase in Pell Grants in over a decade to assist households who earn lower than roughly $60,000 a yr; fixing the Public Service Mortgage Forgiveness program in order that debtors who go into public service get the debt reduction they’re entitled to below the regulation; and creating essentially the most beneficiant Revenue-Pushed Reimbursement plan in historical past – the SAVE plan. Debtors can go to studentaid.gov to use. And, within the wake of the Supreme Courtroom’s resolution on our pupil debt reduction plan, we’re persevering with to pursue an alternate path to ship pupil debt reduction to as many debtors as attainable as shortly as attainable.

From Day One among my Administration, I vowed to enhance the coed mortgage system so {that a} increased schooling gives People with alternative and prosperity – not unmanageable burdens of pupil mortgage debt. I gained’t again down from utilizing each instrument at our disposal to get pupil mortgage debtors the reduction they should attain their desires.

This text appeared initially on The Western Journal.