WASHINGTON — When the Federal Commerce Fee finalized a rule earlier this month banning non-compete clauses, the blowback was swift: Inside 24 hours, the U.S. Chamber of Commerce led a handful of enterprise teams to file a lawsuit looking for to dam the ban. They argued that the FTC lacked the authority to impose it within the first place.

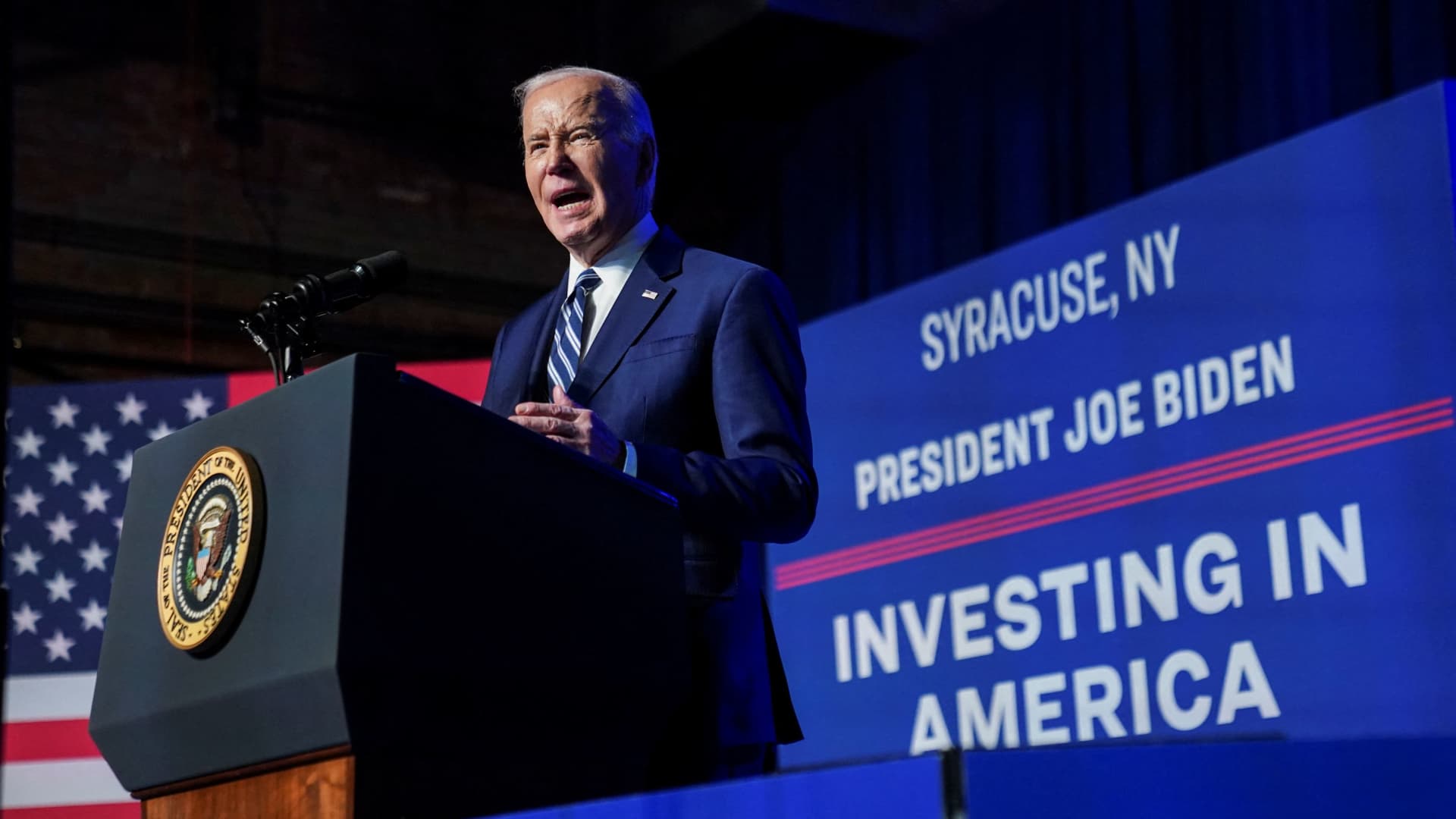

The playbook is turning into a well-recognized one: The Biden administration finalizes a brand new rule regulating enterprise, and the Chamber and trade lobbying teams instantly sue to cease it by arguing that the company has overstepped its authority.

To date this yr, the administration has finalized seven guidelines, addressing every little thing from independent contractors to bank card late fees and climate disclosure requirements, solely to see them met with near-immediate lawsuits by the Chamber and different teams.

In all, the Chamber expects to file at the very least 22 lawsuits towards the Biden administration earlier than the tip of President Joe Biden’s present time period, a dramatic improve from the three fits it filed towards the Trump administration and the 15 it filed throughout Obama’s first time period.

And they aren’t alone. The American Bankers Affiliation, one other influential lobbying group in Washington, has signed on to 4 lawsuits towards banking regulators since Sept. 2022, after not signing on to any authorized challenges to federal coverage for roughly a decade earlier than that.

Officers at each the Chamber and ABA emphasize that litigation is all the time a final resort. However they see it as a obligatory step when companies difficulty rules that go outdoors the scope of their authority.

“It’s not just about a single regulation, right? It’s about the 1,000 regulations that are going to go final this year. It’s about the 200-plus regulations that have an economic impact of more than $200 million a year,” Neil Bradley, government vp on the Chamber, advised CNBC in an interview.

“We went from a time when we would argue about a particular regulation,” Bradley mentioned, “to a period where the concern is about the direction as a whole.”

Whole non-public sector rules have been rising underneath Biden, in response to one metric from George Mason College —particularly in comparison with the Trump administration, throughout which they stayed kind of flat.

However Patrick McLaughlin, director of coverage analytics at George Mason’s free-market, libertarian Mercatus Heart suppose tank, who created the metric, says the character of Biden’s rules is extra notable than the amount of them.

The Biden administration, in McLaughlin’s view, has been “expansive in their interpretation of authorizing statutes.”

“The Chamber and others see an opportunity to push back on regulations that, in their view, are going beyond what Congress authorized,” McLaughlin mentioned.

The precise targets of the lawsuits have been diversified: The Chamber has already sued a dozen companies underneath the Biden administration, as in comparison with simply 4 companies underneath Obama. Regardless of the vary of points at play, the group’s arguments largely middle on the declare that companies are looking for to set guidelines in areas that may solely be addressed by Congress.

Even earlier than the FTC issued its ban on non-compete clauses, for instance, the Chamber pledged to take FTC Chair Lina Khan to court docket over it, whatever the specifics.

Federal Commerce Fee Chair Lina Khan speaks throughout the New York Occasions annual DealBook summit in New York Metropolis, Nov. 29, 2023.

Michael M. Santiago | Getty Photographs

“She might come up with a policy that we would actually agree with on substance,” Bradley mentioned of Khan earlier than the ultimate rule was launched. “But the precedent of that authority is unacceptable.””

Regulation critics also argue that the Biden administration has not been appropriately following the rulemaking process, in part by failing to incorporate viewpoints from stakeholders as part of the final regulation.

“Once they insist on finalizing guidelines that fall outdoors their regulatory purview, and after they ignore constructive suggestions from banks and different stakeholders, litigation is the one remaining device in our toolbox,” ABA President and CEO Rob Nichols said earlier this year. “It isn’t a device we wish to use, but it surely’s one we’ll proceed to strategically wield as wanted.”

The Biden administration says the focus with all of its regulations is on protecting consumers and saving them money. Their estimates show that the FTC’s non-compete ban will boost wages by at least $400 billion over the next decade.

The administration also estimates that the Consumer Financial Protection Bureau’s move to slash credit card late fees will save 45 million Americans $220 per year, and the Environmental Protection Agency’s air-quality rule will yield up to $46 billion in net health benefits in 2032.

“We’re absolutely assured these companies are appearing inside their authorities,” said White House Assistant Press Secretary Michael Kikukawa, in a statement to CNBC. “These guidelines assist American employees and households by rising wages, decreasing prices, saving lives, and constructing a fairer financial system.”

But there can be a cost to complying with regulation, too—especially when each new administration can rewrite the rules of the road.

“If you happen to make an funding in a single factor, are you going to seek out out that there is some obscure regulation that you simply had been unaware of, that will instantly lower the worth of that funding?” asked McLaughlin, of the Mercatus Center. “Or make you cease having the ability to produce it altogether?”