The Biden administration introduced a rule Tuesday to cap all bank card late charges, the newest effort within the White Home push to finish what it has called junk fees and a transfer that regulators say will save People as much as $10 billion a yr.

The Client Monetary Safety Bureau’s new laws will set a ceiling of $8 for many bank card late charges or require banks to point out why they need to cost greater than $8 for such a payment.

The rule would deliver the common bank card late payment down from $32. The bureau estimates banks introduced in roughly $14 billion in bank card late charges a yr.

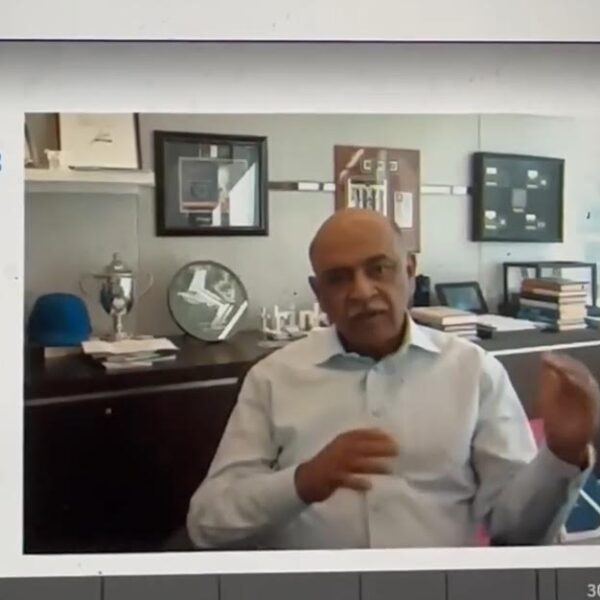

“In credit cards, like so many corners of the economy today, consumers are beset by junk fees and forced to navigate a market dominated by relatively few, powerful players who control the market,” mentioned Rohit Chopra, director of the bureau, in an announcement.

President Joe Biden deliberate to focus on the proposal together with different efforts to scale back prices to People at a gathering of his competitors council on Tuesday. The Democratic president is forming a brand new strike pressure to crack down on unlawful and unfair pricing on issues like groceries, prescribed drugs, well being care, housing and monetary providers.

The strike pressure shall be led by the Justice Division and the Federal Commerce Fee, in keeping with a White Home assertion.

The Biden administration has portrayed the White Home Competitors Council as a strategy to save folks cash and promote better competitors throughout the U.S. economic system.

The White Home Council of Financial Advisers produced an evaluation indicating that the Biden administration’s efforts total will get rid of $20 billion in annual junk charges. The evaluation discovered that buyers pay about $90 billion a yr in junk charges, together with for live shows, residence leases and auto sellers.

The trouble seems to have performed little to assist Biden politically forward of this yr’s presidential election. Simply 34% of U.S. adults approve of Biden’s financial management, in keeping with a brand new survey by The Related Press-NORC Middle for Public Affairs Analysis.

Sen. Tim Scott, R-South Carolina, criticized the CFPB cap on bank card late charges, saying that buyers would in the end face better prices by way of larger rates of interest and fewer entry to credit score.

“It will decrease the availability of credit card products for those who need it most, raise rates for many borrowers who carry a balance but pay on time, and increase the likelihood of late payments across the board,” Scott mentioned.

People held greater than $1.05 trillion on their bank cards within the third quarter of 2023, a file, and a determine sure to develop as soon as the fourth-quarter data is launched by the Federal Deposit Insurance coverage Corp. subsequent month. These balances at the moment are carrying curiosity on them, which is the best it has been for the reason that Federal Reserve began monitoring the info again within the mid-Nineties.

Additional, extra People are falling behind on their credit card debts as properly. Delinquency rates on the main bank card issuers equivalent to American Express, JPMorgan Chase, Citigroup, Capital One and Uncover have been trending upward for a number of quarters. Some analysts have turn out to be involved People, significantly poorer households harm by inflation, is perhaps taking up an excessive amount of debt.

“Overall, the consumer is credit healthy. However, the reality is that there are starting to be some significant signs of stress,” mentioned Silvio Tavares, president and CEO of VantageScore, one of many nation’s two main credit score scoring techniques, in an interview final month.

The expansion of the bank card trade is partly why Capital One announced it would buy Discover Financial final month for $35 billion. The 2 firms, that are two of the biggest bank card issuers, are additionally two firms whose prospects recurrently carry a steadiness on their accounts.

This isn’t the primary time policymakers have weighed in on bank card charges. Congress in 2010 handed the CARD Act, which banned bank card firms from charging extreme penalty charges and established clearer disclosures and client protections.

The Federal Reserve issued a rule in 2010 that capped the primary bank card late payment at $25, and $35 for subsequent late funds, and tied that payment to inflation. The CFPB, which took over the regulation of the bank card trade from the Fed after it was established, is proposing going additional than the Fed.

The bureau’s proposal is analogous in construction to what the bureau introduced in January when it proposed capping overdraft fees to as little as $3. In that proposed regulation, banks can be required to both settle for the bureau’s benchmark or present regulators why they need to cost extra, a technique that few financial institution trade executives anticipate to make use of.

Biden has made the elimination of junk fees one of many cornerstones of his administration’s financial agenda heading into the 2024 election. Charges that banks cost prospects have been on the middle of that marketing campaign, and the White Home directed authorities regulators final yr to do no matter is of their energy to additional curtail the observe.

In one other transfer being highlighted by the White Home, the Agriculture Division mentioned it has finalized a rule to cease what it deems to be misleading contracts by meat processors and to ban retaliation towards small farmers and ranchers that work collectively in associations.

___

Boak reported from Washington.