The US House of Representatives has not been able to overturn President Joe Biden’s veto of a crypto measure meant to nullify a divisive SEC rule. The vote emphasizes the continuous discussion on how to control the fast changing digital asset scene.

SAB 121: The Controversy’s Crux

Staff Accounting Bulletin 121 (SAB 121) of the Securities and Exchange Commission drives the central focus of this political struggle. Public enterprises are obliged by this rule to be open about the management and any risks connected to safeguarding consumer crypto assets. While detractors claim it causes needless operational difficulties and might inhibit innovation in the crypto sector, supporters say it is absolutely vital for investor security.

Today’s vote in the House to override the President’s veto of the SAB 121 CRA demonstrated bipartisan support, but ultimately fell short of the required 2/3 majority.

The following statement is attributed to @BlockchainAssn CEO @KMSmithDC: pic.twitter.com/NSPOni57Sd

— Blockchain Association (@BlockchainAssn) July 11, 2024

The House vote of 228–184 fell short of the two-thirds majority required to supersede the President’s veto. Especially, twenty-one Democrats broke party lines to help Republicans in overturning SAB 121, therefore proving that the matter transcends simple political boundaries.

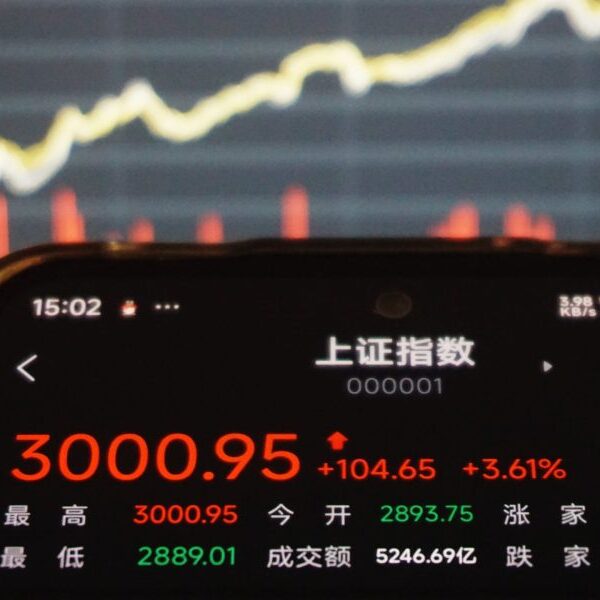

Total crypto market cap at $2.04 trillion on the daily chart: TradingView.com

Landscape Of Regulation Still Unchanged

SAB 121 will stay in place if the veto is not overturned, therefore preserving the present regulatory scene for bitcoin custody and disclosure. This result emphasizes the difficulties the crypto sector has in getting regulatory relief even if reform is supported by both parties.

The vote also shows how the Biden government views crypto legislation, giving financial stability and investor protection top priority over sector worries about constraints of regulation. This strategy fits SEC Chair Gary Gensler’s continuous focus on including cryptocurrencies under the current legal framework.

Looking Ahead: Crypto Regulation’s Evolution

Once the dust settles on this parliamentary struggle, focus now moves to possible future actions. The crypto sector and its advocates in Congress might look for other paths to solve their issues, maybe through fresh laws or ongoing pressure on regulatory authorities.

The result of this vote implies that, in spite of increasing industry interest and investment, major changes to bitcoin control could be difficult to manifest. It also emphasizes how dynamically political processes, financial control, and technical innovation interact in the United States.

The argument on suitable regulation is probably going to remain divisive as the bitcoin market develops. Policymakers and authorities will still have a great difficulty juggling innovation with investor protection in the next years.

Featured image from The Bulwark, chart from TradingView